Professional Documents

Culture Documents

Closing Remarks - Dr. Deepali Pant Joshi

Uploaded by

Kavitha0 ratings0% found this document useful (0 votes)

28 views14 pagesThis document summarizes the India-OECD-World Bank Regional Conference on Financial Education.

[1] Speakers discussed developing national strategies for financial education using OECD/INFE principles and sharing experiences from Asia, Europe, and other regions. Surveys to measure financial literacy and capability were also addressed.

[2] Presentations provided insights into effective financial education programs and evaluation, including for youth and women. Innovative methods like comics, doorstep banking, and lotteries were also discussed.

[3] Building financial capability through financial literacy is key to inclusive growth and development. National strategies are needed, engaging various stakeholders. While progress has been made, more work remains to empower people

Original Description:

Original Title

Closing remarks - Dr. Deepali Pant Joshi

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the India-OECD-World Bank Regional Conference on Financial Education.

[1] Speakers discussed developing national strategies for financial education using OECD/INFE principles and sharing experiences from Asia, Europe, and other regions. Surveys to measure financial literacy and capability were also addressed.

[2] Presentations provided insights into effective financial education programs and evaluation, including for youth and women. Innovative methods like comics, doorstep banking, and lotteries were also discussed.

[3] Building financial capability through financial literacy is key to inclusive growth and development. National strategies are needed, engaging various stakeholders. While progress has been made, more work remains to empower people

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views14 pagesClosing Remarks - Dr. Deepali Pant Joshi

Uploaded by

KavithaThis document summarizes the India-OECD-World Bank Regional Conference on Financial Education.

[1] Speakers discussed developing national strategies for financial education using OECD/INFE principles and sharing experiences from Asia, Europe, and other regions. Surveys to measure financial literacy and capability were also addressed.

[2] Presentations provided insights into effective financial education programs and evaluation, including for youth and women. Innovative methods like comics, doorstep banking, and lotteries were also discussed.

[3] Building financial capability through financial literacy is key to inclusive growth and development. National strategies are needed, engaging various stakeholders. While progress has been made, more work remains to empower people

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

INDIA-OECD-WORLD BANK REGIONAL

CONFERENCE ON FINANCIAL

EDUCATION

Dr. Deepali Pant Joshi

Executive Director

Reserve Bank of India

RBI Governor Dr Subbarao set the tone for this conference

by providing us the analytical framework.

He explained how in the wake of the financial crisis our

efforts had gathered greater salience .

He also explained how the equation of financial literacy

from the demand side and financial inclusion from the

supply side work in tandem He pointed to the numerous

challenges, in the Indian context, liberalised Know Your

Customer norms with a unique identity number would help

spur financial inclusion .Banks however must treat it as a

business opportunity and not an obligation thrust on them.

Dr .K.C. Chakrabarty brought into very sharp focus how

financial literacy, financial education and financial

stability are inextricably linked and form part of a

continuum.

Mr. Onno Ruhl ,India country director of the World

Bank explained the seminal work of the World Bank in

addressing issues of building financial capability

through financial education and also referred to the

work of the RBI in this regard.

Ambassador Boucher expressed how In October 2011, G

20 finance Ministers agreed to new principles on

financial consumer protection developed by an OECD

led task Force integrated with financial inclusion and

financial education policies.

During the Financial crisis, people who did not know any better

borrowed beyond their means ,not in Africa, not in Nigeria ,Papua

New Guinea ,Japan ,India but in the USA because appraisers

inflated the value of properties that prospective buyers were

interested in.

Borrowers were led to believe that they had undertaken a standard

fixed rate mortgage only to learn later that their mortgage was a

complicated variable rate contract which with their income streams

they could not honour .

Brokers, mortgage companies etc., took the financially illiterate

borrower for a ride risky lending practices proliferated.

There was no CONSUMER PROTECTION different jurisdictions

had their own sets of lending policies

A large part the financial crisis was a result of financial

illiteracy and lack of financial capability. We are

meeting to ensure that this does not happen again this is

the first commitment we must make and pledge ourselves

to.

Appropriately our introductory session dwelt on

developing National Strategies for Financial education

OECD/INFE principles and practical examples from Asia

and the Pacific.

Ms. Flore-Anne of the OECD set the tone. Country

experiences were shared by Mr G.P.Garg, Mr. Pungky

Purnomo from Indonesia, Ryoko Okazaki from Japan

shared the South, South East Asian and Asian experiences

and as Dr. KCC explained Helena Kolmanova balanced

the picture through the European perspective.

It is a truism that whatever gets measured gets done that

statistics and empirical experience alone hold certitudes

the rest are platitudes so fittingly Dr. Urjit Patel capably

steered the session on developing surveys to measure

Financial literacy and Capability. Surveys as a

diagnostic tool can inform policy.

Valeria Perotti, social protection specialist of the World

Bank spoke on Measuring Financial Capability in Low

and Middle Income settings and Adele Atkinson

competently walked us through International

Comparative measures of Financial literacy and evidence

from the OECD/INFE Measurement pilot.

Douglas Randall of the World Bank expounded on the

FINDEX in which several of our countries have

participated.

The third fascinating session was on financial literacy and

financial inclusion Findings and experience from - Asia and the

Pacific region.

Flore Anne Messy OECD capably moderated the session where

Ryoko Okazaki, Director head of Promotion of Financial

Education Group Central Bank of Japan Ms Rufina Peter, Senior

research officer Papua New Guinea made her presentation .

She explained how difficult it was to run the questionnaire in two

languages Tok Pisin and Hirin Motu in Papua New Guinea

imagine how in India we manage with 22 official languages and

398 living languages the mind boggles but we need to do this.

The last engaging presentation of the day was from Temitayo

Adebiyi, Principal Statistics officer National Statistics office,

Nigeria.

This morning we have had a series of hands on sessions Richard

Hinz and Flore Anne Messy provided us a valuable and insightful

Introduction to the program Knowledge products and website of

the Financial Literacy and Education Trust fund.

There is currently limited evidence and little consensus on the types of

programs which are effective in raising the capacity for and level of

financial capability.

Effective impact evaluation is essential but often serves as a forgotten

half in this context the presentations made by Richard Hinz, Trust Fund

Program Manager ,World Bank OECD High level Principles for

evaluation of financial education programs were particularly valuable.

Adele Atkinson Policy analyst of the OECD presented the OECD High

Level Principles for the evaluation of financial education programs and

Joanne Yoong from the National University of Singapore presented a

toolkit for evaluation of financial capability Programs in Middle and

Low Income countries.

This was followed by the session on Youth Developing financial skills

and Competencies OECD /INFE guidelines on Financial Education in

schools and PISA financial literacy.

Financial education in schools, innovative tools, examples and

evaluation findings was presented by Ms Amara Sriphayak ,Bank

of Thailand, Ms. Luciana, Consultant ,World Bank gave us

extremely valuable insights.

The session on Women empowerment through Financial

Education, especially close to the heart was moderated by Mr.

Prashant Saran, whole time member, SEBI and there was valuable

experience sharing through presentations by Ms.Chiara,

Consultant, OECD and Ms.Sushma Kapoor of the UNWOMEN.

The session on Innovative methods for financial capability

enhancement ,in which Doorstep banking and financial

education in India were presented by Mr.Leopold Sarr of World

Bank was very useful. We all enjoyed Prof. Billy Jack, Associate

Professor, Georgetown University presentation on Comic Books.

We thank Florentina Mulaj of the World Bank for the serial

melodrama to improve debt management of South Africa

and Martin Kanz of the Economic Development Research

Group of the World Bank for sharing the experience on

Lotteries and Savings in Nigeria.

We thank all the speakers for acquainting us with the range

of evaluation of new methods and tools to enhance

financial awareness and capability evidence suggests that

innovative methods can bring positive outcomes on the

target audience .The hardcore and asset less poor who are

hard to reach due to low literacy levels and Geographical

Locations . In sum, through the cross country experience

sharing of the conference we have learnt a lot.

Some of you may also have visited our stalls and picked up

some comics to take back .

We have covered a lot of ground but with distance still to go.

Building financial capability through financial literacy is a key

component of the financial Inclusion process. On this we are

all agreed Every country has to tread its own path to financial

inclusion and literacy depending on its particular situation

literacy levels, per capita income, levels of financialization of

the economy.

We have all reached consensus on the need for financial

literacy and on National strategies engaging all stakeholders

including Central and State Governments, financial regulators

civil society public private partnerships etc.,

We have agreed that financial literacy, financial education

lead to customer protection which leads to financial stability.

You have come to India to the mystic East so I will give you a mantra,

Our collective global goal is higher growth leading to inclusive and

sustainable development. Our Finance Minister terms this the ‘mool

mantra’ of Growth.

Economic growth is essential but growth with equity is an

imperative.

Ladies and gentlemen, We must unhesitatingly embrace the need to

build financial capability which leads to growth as the highest goal.

It is growth that will lead to inclusive development without growth

there will be neither development nor inclusiveness.

The finance minister, presenting the Indian Budget quoted Stiglitz

said “There is a compelling moral case for equity but it is also

necessary if there is to be sustained growth. A country’s most

important resource are its people”. You will all agree it is financially

literate, financially educated and financially included people.

At the end of the day ,there will be no dissent that it has been a

great conference .We have indeed covered a lot of ground but

several challenges remain, with distance still to go.

Our first Prime minister Jawaharlal Nehru often recalled the

words of Robert Frost

“The woods are lovely dark and deep

but I have promises to keep

and miles to go before I sleep

and miles to go before I sleep”.

As Dr. Subbarao explained “A part, indeed an important part ,of

the mandate of Central Banks is financial stability and an

essential prerequisite for financial stability is financial literacy

and the central bank has unique leverage in providing financial

literacy”.

We all agree on the need to build financial capability of our

people. We need to empower people. Now it is the time to get

down to do it and together we know we can.

THANK YOU

deepalipantjoshi@rbi.org.in

You might also like

- Economic and Financial Learning Program (EFLP) : A Reflection PaperDocument2 pagesEconomic and Financial Learning Program (EFLP) : A Reflection Paperjanrei agudosNo ratings yet

- Research Paper On Financial InclusionDocument36 pagesResearch Paper On Financial Inclusionimsarfrazkhan96% (28)

- A STUDY On Financial Literacy Among Youths in MumbaiDocument57 pagesA STUDY On Financial Literacy Among Youths in Mumbaibhanushalidhruv59No ratings yet

- Ey Educate To EmpowerDocument52 pagesEy Educate To Empowersidthefreak809No ratings yet

- Enterprenurial Skill and Youth Development by Ndubuisi KaluDocument6 pagesEnterprenurial Skill and Youth Development by Ndubuisi KalundubissiNo ratings yet

- Maverick Workbook CompanionDocument169 pagesMaverick Workbook CompanionUlrik Aabye Hansen0% (1)

- Informed Choices 2016 PDFDocument35 pagesInformed Choices 2016 PDFRamshaNo ratings yet

- Alg 2 Resource Ws CH 5 PDFDocument119 pagesAlg 2 Resource Ws CH 5 PDFAnoop Sreedhar100% (1)

- Welcome Address K. C. ChakrabartyDocument5 pagesWelcome Address K. C. Chakrabarty2deepak12No ratings yet

- Bangkok Bank BBDocument41 pagesBangkok Bank BBkukuhNo ratings yet

- Black BookDocument23 pagesBlack BookRISHABH KHANDELWALNo ratings yet

- Opening Remarks FinLitThailand2014Document11 pagesOpening Remarks FinLitThailand2014noydoshoNo ratings yet

- Fic Cir 14102011Document12 pagesFic Cir 14102011bindulijuNo ratings yet

- Finance ProjectDocument6 pagesFinance ProjectPradeep Mib2022No ratings yet

- K C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesDocument9 pagesK C Chakrabarty: Financial Inclusion and Banks - Issues and PerspectivesAnamika Rai PandeyNo ratings yet

- A Study On Financial Literacy of Women in Hyderabad City (Telangana)Document9 pagesA Study On Financial Literacy of Women in Hyderabad City (Telangana)Editor IJTSRDNo ratings yet

- Financial Literacy As A Tool For Financial Inclusion and ClientDocument163 pagesFinancial Literacy As A Tool For Financial Inclusion and ClientSambasivarao MallempatiNo ratings yet

- EduFin Position PaperDocument88 pagesEduFin Position PaperComunicarSe-ArchivoNo ratings yet

- A Study On The Growth and Challenges of Development Banking in IndiaDocument81 pagesA Study On The Growth and Challenges of Development Banking in IndiaRajan KashyapNo ratings yet

- Financial Literacy For Developing Countries in AfricaDocument12 pagesFinancial Literacy For Developing Countries in AfricaJuped JunNo ratings yet

- Citi Center For Financial LiteracyDocument60 pagesCiti Center For Financial LiteracyShankar JhaNo ratings yet

- Chapter1 SynthesisDocument16 pagesChapter1 SynthesisPrincess Engreso100% (2)

- World B PDFDocument202 pagesWorld B PDFAnur WakhidNo ratings yet

- September 2020 NewsletterDocument30 pagesSeptember 2020 NewsletterAnonymous FnM14a0No ratings yet

- Financial Literacy and Investor AwarenessDocument3 pagesFinancial Literacy and Investor AwarenessRishabh KhichiNo ratings yet

- Ifcb 38Document492 pagesIfcb 38Ivy BernardoNo ratings yet

- Finacial LiterncyDocument48 pagesFinacial LiterncyKiranNo ratings yet

- Financial Literacy & Importance of Financial Education: 4 April 2016Document60 pagesFinancial Literacy & Importance of Financial Education: 4 April 2016Huei ChunNo ratings yet

- Final Research ProposalDocument9 pagesFinal Research ProposalSunil Rawat100% (1)

- Aman-Mrinal Financial Management AssignmentDocument24 pagesAman-Mrinal Financial Management AssignmentAman KumarNo ratings yet

- Financial Literacy Initiatives by Various Regulatory InstitutionsDocument5 pagesFinancial Literacy Initiatives by Various Regulatory InstitutionsarcherselevatorsNo ratings yet

- Booklet Financial Inclusion English Version Bank Indonesia 2014Document16 pagesBooklet Financial Inclusion English Version Bank Indonesia 2014hkurniawan2009No ratings yet

- CCCCCCCCC C C C CCC C: C C C C CDocument50 pagesCCCCCCCCC C C C CCC C: C C C C Cpinkeshparvani100% (2)

- Fin. LiteracyDocument9 pagesFin. LiteracyX YNo ratings yet

- Chapter 07 - Financial Literacy RBI InitiativesDocument4 pagesChapter 07 - Financial Literacy RBI Initiativesshubhram2014No ratings yet

- National Strategy - Final Document - Report EnglishDocument57 pagesNational Strategy - Final Document - Report EnglishMoh SaadNo ratings yet

- Financial Literacy The Case of PolandDocument17 pagesFinancial Literacy The Case of PolandCarlo CalmaNo ratings yet

- Financial Inclusion - RBI - S InitiativesDocument12 pagesFinancial Inclusion - RBI - S Initiativessahil_saini298No ratings yet

- A Study On Awareness of Financial Literacy Among College Students in ChennaiDocument83 pagesA Study On Awareness of Financial Literacy Among College Students in ChennaiGunavathi.S 016100% (1)

- The Importance of Financial Literacy in A Global Economic EraDocument7 pagesThe Importance of Financial Literacy in A Global Economic EraJuped JunNo ratings yet

- National Plan For Financial EducationDocument24 pagesNational Plan For Financial Educationdiana_vaduvaNo ratings yet

- Research Paper On Financial InclusionDocument57 pagesResearch Paper On Financial InclusionChilaka Pappala0% (1)

- Using Evidence to Inform Policy: Report of Impact and Policy Conference: Evidence in Governance, Financial Inclusion, and EntrepreneurshipFrom EverandUsing Evidence to Inform Policy: Report of Impact and Policy Conference: Evidence in Governance, Financial Inclusion, and EntrepreneurshipNo ratings yet

- BENEFITS OF FINANCIAL LITERACY - Valencia, Jamaica - BSED1Document12 pagesBENEFITS OF FINANCIAL LITERACY - Valencia, Jamaica - BSED1MaeNo ratings yet

- Financial Literacy Improvement Strategies in Supporting Financial Inclusion Policy in Gorontalo DistrictDocument11 pagesFinancial Literacy Improvement Strategies in Supporting Financial Inclusion Policy in Gorontalo DistrictInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Reaction Paper To Financial Literacy LectureDocument1 pageReaction Paper To Financial Literacy LecturePatricia Bianca ArceoNo ratings yet

- Financial Literacy Strategy 2019Document32 pagesFinancial Literacy Strategy 2019sompasongNo ratings yet

- The Provincial Performance Improvement Initiative: Papua New Guinea: A Case Study on Subnational Capacity DevelopmentFrom EverandThe Provincial Performance Improvement Initiative: Papua New Guinea: A Case Study on Subnational Capacity DevelopmentNo ratings yet

- Department of Education: Pagturian/Sipit Saburan Mangyan SchoolDocument6 pagesDepartment of Education: Pagturian/Sipit Saburan Mangyan SchoolDorothea Lou PeliñoNo ratings yet

- Microfinance in Myanmar Sector Assessment (Jan 2013) - 1 PDFDocument54 pagesMicrofinance in Myanmar Sector Assessment (Jan 2013) - 1 PDFliftfundNo ratings yet

- SynopsisDocument36 pagesSynopsisjaiNo ratings yet

- Igi 2Document15 pagesIgi 2Claire Ann LorenzoNo ratings yet

- Charting A Course To Prosperity: The Importance of Financial LiteracyDocument7 pagesCharting A Course To Prosperity: The Importance of Financial LiteracySubodh BansalNo ratings yet

- Building Inclusive Financial Sectors The Blue BookDocument195 pagesBuilding Inclusive Financial Sectors The Blue BookHoang Thi ChuongNo ratings yet

- SSRN Id2934855Document18 pagesSSRN Id2934855YogashiniNo ratings yet

- MSME Financing Bangladesh - 10 May 2021 - Share - 0Document61 pagesMSME Financing Bangladesh - 10 May 2021 - Share - 0Ayman MustakimNo ratings yet

- Publication On Financial LiteracyDocument162 pagesPublication On Financial LiteracyAsghar AliNo ratings yet

- Financial Literacy & Investment Decisions of Indian InvestorsDocument15 pagesFinancial Literacy & Investment Decisions of Indian InvestorsSnow Gem100% (1)

- 156-Article Text-297-2-10-20191012Document12 pages156-Article Text-297-2-10-20191012Hải VũNo ratings yet

- Low Public Awareness of The Finansial Literacy: Qurrota A'yunin - University of Muhammadiyah YogyakartaDocument3 pagesLow Public Awareness of The Finansial Literacy: Qurrota A'yunin - University of Muhammadiyah YogyakartaFadiyah NasNo ratings yet

- Project ReportDocument79 pagesProject ReportNigin K Abraham100% (1)

- How To Face Interview - Sarat PadhihariDocument17 pagesHow To Face Interview - Sarat PadhihariKavithaNo ratings yet

- FASTAGDocument5 pagesFASTAGKavithaNo ratings yet

- Train Yourself - R K SinghDocument21 pagesTrain Yourself - R K SinghKavithaNo ratings yet

- PPIs (PREPAID PAYMENT INSTRUMENTS)Document10 pagesPPIs (PREPAID PAYMENT INSTRUMENTS)KavithaNo ratings yet

- RTGS (Real Time Gross Settlement)Document4 pagesRTGS (Real Time Gross Settlement)KavithaNo ratings yet

- E RupiDocument5 pagesE RupiKavithaNo ratings yet

- NEFT (National Electronic Fund Transfer)Document9 pagesNEFT (National Electronic Fund Transfer)KavithaNo ratings yet

- Bhim UpiDocument6 pagesBhim UpiKavithaNo ratings yet

- Imps (Immediate Payment Service)Document5 pagesImps (Immediate Payment Service)KavithaNo ratings yet

- NUUPDocument3 pagesNUUPKavithaNo ratings yet

- PlaceDocument1 pagePlaceKavithaNo ratings yet

- BankDocument1 pageBankKavithaNo ratings yet

- Audit Functions in BankDocument23 pagesAudit Functions in BankKavithaNo ratings yet

- Cash ComplianceDocument74 pagesCash ComplianceKavithaNo ratings yet

- Recent Technological Developments in Indian Banking: Vepa Kamesam Deputy Governor Reserve Bank of IndiaDocument44 pagesRecent Technological Developments in Indian Banking: Vepa Kamesam Deputy Governor Reserve Bank of IndiaRanvijay SinghNo ratings yet

- BaselDocument28 pagesBaselKavithaNo ratings yet

- Conflict Management: Presented byDocument63 pagesConflict Management: Presented byAhmed_Saya_9006No ratings yet

- 12 Psychology Chapter 1 Intelligence and Aptitude - Learn CBSEDocument7 pages12 Psychology Chapter 1 Intelligence and Aptitude - Learn CBSEMohit RajpootNo ratings yet

- Resume GerminDocument4 pagesResume Germinlingesh1892No ratings yet

- SDETDocument4 pagesSDETjaniNo ratings yet

- CBLM Work in A Team EnvironmentDocument64 pagesCBLM Work in A Team EnvironmentJessa Airam LigutomNo ratings yet

- Toeic Preparation PDFDocument3 pagesToeic Preparation PDFputri0% (1)

- ANNA ROSE D. ALFARO - The Prepared Environment (Montessori)Document12 pagesANNA ROSE D. ALFARO - The Prepared Environment (Montessori)Princess CruzNo ratings yet

- 2013volume6 PDFDocument170 pages2013volume6 PDFPaolita del CampoNo ratings yet

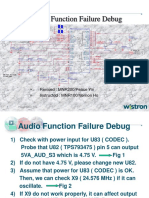

- Audio Function Failure DebugDocument11 pagesAudio Function Failure Debugbeppino_andoNo ratings yet

- Contoh Percakapan Present Continuous Tense Antara 2 Orang Tentang UjianDocument2 pagesContoh Percakapan Present Continuous Tense Antara 2 Orang Tentang Ujianbumdes kamaseNo ratings yet

- Accommodative Insufficiency A Literature and Record ReviewDocument6 pagesAccommodative Insufficiency A Literature and Record ReviewPierre A. RodulfoNo ratings yet

- P. C. Deshmukh - Foundations of Classical Mechanics-Cambridge University Press (2019)Document590 pagesP. C. Deshmukh - Foundations of Classical Mechanics-Cambridge University Press (2019)RatoDorimeNo ratings yet

- Impromptu SpeechDocument13 pagesImpromptu Speechapi-327193447No ratings yet

- Elementary - Test 4BDocument7 pagesElementary - Test 4BConstanza SalazarNo ratings yet

- 3 3 Performing Underchassis Preventive Converted RecoveredDocument126 pages3 3 Performing Underchassis Preventive Converted RecoveredEDEN JIMENEZNo ratings yet

- Professional Education Pointers To ReviewDocument5 pagesProfessional Education Pointers To ReviewJuden LaxamanaNo ratings yet

- Sample Lesson Plan-Elements of Poetry (Ubd) : That's What FriendsDocument1 pageSample Lesson Plan-Elements of Poetry (Ubd) : That's What FriendsAlphaa RevecheNo ratings yet

- A Delayed Choice Quantum EraserDocument4 pagesA Delayed Choice Quantum EraserDavide Morgante100% (1)

- Cici, Devi, Ayu, IvanDocument2 pagesCici, Devi, Ayu, Ivanayu suhestiNo ratings yet

- Deadlock Condition System Programming & Operating System PDFDocument41 pagesDeadlock Condition System Programming & Operating System PDFwww.entcengg.comNo ratings yet

- WidaDocument20 pagesWidaapi-448096857No ratings yet

- OCR GCSE Computer Science EPQ Pack Sample ChapterDocument7 pagesOCR GCSE Computer Science EPQ Pack Sample Chapteromotayoomotola485No ratings yet

- IEM Professional Interview Guidelines: For Applicants and CandidatesDocument22 pagesIEM Professional Interview Guidelines: For Applicants and CandidatesMatthew WongNo ratings yet

- Nurse Practioner Syllabus RegulationsDocument69 pagesNurse Practioner Syllabus RegulationsSanthu SuNo ratings yet

- Body Parts Lesson Plan FinalDocument5 pagesBody Parts Lesson Plan FinalCristina Stepan0% (1)

- Teachers' Retreat Program ScheduleDocument6 pagesTeachers' Retreat Program ScheduleMrs MataNo ratings yet

- Antiquarian LDocument60 pagesAntiquarian LSoumyajit DasNo ratings yet