0% found this document useful (0 votes)

309 views8 pagesCalculation of Forward Rate

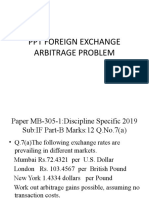

The document calculates forward rates, bid/ask prices, and premiums or discounts for the Indian rupee against the US dollar for 1, 3, and 6 month periods. Spot rates are provided and used to determine the forward rates. Bid and ask prices are calculated from the spot rates and forward rates. Premiums or discounts are then determined by comparing the bid and ask prices, with a positive value indicating a premium and negative value a discount. A 1 month period results in a small premium, a 3 month period a small discount, and a 6 month period an even smaller discount.

Uploaded by

Chintakunta PreethiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

309 views8 pagesCalculation of Forward Rate

The document calculates forward rates, bid/ask prices, and premiums or discounts for the Indian rupee against the US dollar for 1, 3, and 6 month periods. Spot rates are provided and used to determine the forward rates. Bid and ask prices are calculated from the spot rates and forward rates. Premiums or discounts are then determined by comparing the bid and ask prices, with a positive value indicating a premium and negative value a discount. A 1 month period results in a small premium, a 3 month period a small discount, and a 6 month period an even smaller discount.

Uploaded by

Chintakunta PreethiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd