Professional Documents

Culture Documents

International Banking-Euro Bank, Types of Banking Offices, Correspondent Bank, Representative Bank 5

Uploaded by

Chintakunta Preethi0 ratings0% found this document useful (0 votes)

35 views20 pagesOriginal Title

PPT INTERNATIONAL BANKING-EURO BANK, TYPES OF BANKING OFFICES, CORRESPONDENT BANK, REPRESENTATIVE BANK 5 - Copy.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views20 pagesInternational Banking-Euro Bank, Types of Banking Offices, Correspondent Bank, Representative Bank 5

Uploaded by

Chintakunta PreethiCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 20

INTERNATIONAL BANKING

EURO BANK, TYPES OF BANKING OFFICES,

CORRESPONDENT BANK REPRESENTATIVE

OFFICE, FOREIGN BRANCH , SUBSIDIARY

BANK, OFFSHORE BANK

• International banking provides accessibility

and ease of doing business to the companies

from different countries. An individual or

MNC can use their money anywhere around

the world. This gives them a freedom to

transact and use their money to meet any

requirement of funds in any part of the world.

What Is a Eurobank?

• A eurobank is a financial institution that

accepts deposits and makes loanslin foreign

currencies. It is not necessary for a eurobank to be

located in Europe; it can in fact be located anywhere

in the world. For example, an American bank located

in New York which holds deposits and issues loans in

Japanese Yes (JPY) would be considered a eurobank.

• Eurobanks may operate in their own country, such as

the American bank in the example above, or they may

operate in a country outside their home.

• KEY TAKEAWAYS

• Eurobanks are financial institutions that accept

foreign currencies for deposits and loans.

• Because they handle multiple currencies

transactions, these institutions play a key role in

facilitating global trade.

• Eurobanks cater mainly to governmental and

institutional clients, and will often form syndicates

to facilitate especially large transactions.

• Working of Eurobanks

• Eurobanks play an important role in the global

economy because they facilitate international

trade. Following World War II, this model of

banking became popular due to demand

from communist countries which wished to

remove their holdings from U.S. banks in order

to hedge against political risks stemming from

the then-nascent Cold War.

• Since then, the emergence of eurobanks has done

much to facilitate trade and investment between

countries. In the past, cross-border trade was

hampered by a lack of international intermediaries

capable of accommodating transactions involving

multiple foreign currencies. The substantial

growth in international trade which we have

witnessed since the 1980s is due in part to the

proliferation of eurobanks throughout the world.

• This growth was further propelled by the development of

large and dynamic economies such as those of China,

India, and other emerging economies. As these nations

have pursued policies of economic development

and industrialization through export-led growth the

demand for eurobanking has grown accordingly. This is

especially true because, despite the growing importance of

these economies, some of the currencies of these nations

are still not widely traded on global currency markets. As

such, emerging economies often find it necessary to

conduct international trade using foreign currencies.

• Real World Example of a Eurobank

• The currencies held and lent by eurobanks are

known as eurocurrencies, although it is

important to note that the term “eurocurrency”

is used even if the currency in question is not

the euro. Today, the most widely used

eurocurrencies are the U.S(USD), JPY,British

Pound (BP), and the euro (EUR).

• When eurobanks issue loans denominated in

eurocurrencies, these are referred to as eurocredits.

More specifically, a eurocredit is any loan given by

a eurobank which is not denominated in that

eurobank’s domestic currency. Typically, eurocredits

are issued to sovereign governments, corporations,

international organizations, and commercial banks.

In this respect, eurobanks are mainly oriented

toward facilitating commerce at the international

and institutional level.

• If an especially large loan is required,

eurobanks will typically work together in

a syndicate, in order to spread their respective

risks. The loans themselves often have short or

medium-term durations, with the outstanding

balances rolled over at the end of the term. As

in many banking transactions, the interest

rate used on eurocredits is typically based on

the London Interbank Offered Rate.

• Types of International Banking Offices

• The services and operations which an international bank

undertakes is a function of the regulatory environment in

which the bank operates and the type of banking facility

established.

• A correspondent bank relationship- Established when two

banks maintain a correspondent bank account with one

another. The correspondent banking system provides a

means for a bank’s MNC clients to conduct business

worldwide through his local bank or its contacts.

• A representative office- A small service facility

staffed by parent bank personnel that is

designed to assist MNC clients of the parent

bank in its dealings with the bank’s

correspondents. It is a way for the parent bank

to provide its MNC clients with a level of

service greater than that provided through

merely a correspondent relationship.

• A foreign branch bank- Operates like a local

bank, but legally it is a part of the parent bank.

As such, a branch bank is subject to the banking

regulations of its home country and the country

in which it operates. The primary reason a parent

bank would establish a foreign branch is that it

can provide a much fuller range of services for

its MNC customers through a branch office than

it can through a representative office.

• A subsidiary bank- is a locally incorporated

bank that is either wholly owned or owned in

major part by a foreign subsidiary. An affiliate

bank is one that is only partially owned, but

not controlled by its foreign parent. Both

subsidiary and affiliate banks operate under

the banking laws of the country in which they

are incorporated.

• Edge Act Banks

• This designation applies to certain U.S. banks,

and is based on a 1919 constitutional

amendment. While physically located in the

United States, Edge Act banks conduct

business internationally under a federal

charter.

• Offshore Banking Unit (OBU)

• An offshore banking unit (OBU) is a bank shell branch, located in

another international financial center. For instance, a London-based

bank with a branch located in Delhi. Offshore banking units make

loans in the Eurocurrency market when they accept deposits from

foreign banks and other OBUs. Eurocurrency simply refers to money

held in banks located outside of the country which issues the

currency.

• Local monetary authorities and governments do not restrict OBUs'

activities; however, they are not allowed to accept domestic deposits

or make loans to residents of the country, in which they are physically

situated. Overall OBUs can enjoy significantly more flexibility

regarding national regulations.

• KEY TAKEAWAYS

• Offshore banking units (OBUs) refer to bank branches located

outside of its home country, and handling transactions made in

foreign currency (known generically as "eurocurrency")

• OBUs make it easier for individuals and businesses to bank

internationally and establish offshore accounts.

• Individuals may choose to keep their money offshore if there is

instability in their own country, and they fear losing their

investments.

• Offshore bank accounts must be declared to the holder's home

country for tax reasons; however, some countries allow foreigners

to earn capital gains tax-free.

• Working Offshore Banking Units

• OBUs have proliferated across the globe since the 1970s. They

are found throughout Europe, as well as in the Middle East,

Asia, and the Caribbean. U.S. OBUs are concentrated in the

Bahamas, the Cayman Islands, Hong Kong, Panama, and

Singapore. In some cases, offshore banking units may be

branches of resident and/or nonresident banks; while in other

cases an OBU may be an independent establishment. In the first

case, the OBU is within the direct control of a parent company;

in the second, even though an OBU may take the name of the

parent company, the entity’s management and accounts are

separate.

• Some investors may, at times, consider moving money

into OBUs to avoid taxation and/or retain privacy.

More specifically, tax exemptions on withholding tax

and other relief packages on activities, such as

offshore borrowing, are occasionally available. In

some cases, it is possible to obtain better interest

rates from OBUs. Offshore banking units also often

do not have currency restrictions. This enables them to

make loans and payments in multiple currencies, often

opening more flexible international trade options.

• History of Offshore Banking Units

• The euro market allowed the first application of an offshore

banking unit. Shortly afterward Singapore, Hong Kong,

India, and other nations followed suit as the option allowed

them to become more viable financial centers. While it took

Australia longer to join, given less favorable tax policies, in

1990, the nation established more supportive legislation.

• In the United States, the International Banking Facility

(IBF)acts as an in-house shell branch. Its function serves to

make loans to foreign customers. As with other OBUs, IBF

deposits are limited to non-U.S applicants.

You might also like

- International Banking and Money MarketDocument37 pagesInternational Banking and Money MarketBeer g[upiN100% (1)

- Treasury and International BankingDocument23 pagesTreasury and International BankingMohammad DabiriNo ratings yet

- International Banking (Assignment)Document18 pagesInternational Banking (Assignment)JILPA76% (17)

- International BankingDocument21 pagesInternational BankingVarun Rauthan50% (2)

- Global Financing Decisions May 19Document39 pagesGlobal Financing Decisions May 19Venance NDALICHAKONo ratings yet

- MergedDocument42 pagesMergedUrvashi RNo ratings yet

- The Euromarkets1Document22 pagesThe Euromarkets1Shruti AshokNo ratings yet

- International Banks: Preyanth T KDocument8 pagesInternational Banks: Preyanth T KnofaNo ratings yet

- Types of BanksDocument23 pagesTypes of BankscrazysidzNo ratings yet

- International BanksDocument15 pagesInternational BanksPrince KaliaNo ratings yet

- International Banking: Globalisation and Liberalisation, Brief History of International BankingDocument18 pagesInternational Banking: Globalisation and Liberalisation, Brief History of International BankingBalaji KalyanNo ratings yet

- Resident Representative:: International Banking Section - A Introduction To International BankingDocument3 pagesResident Representative:: International Banking Section - A Introduction To International BankingNimisha BhararaNo ratings yet

- Report On International Banking and Money MarketDocument16 pagesReport On International Banking and Money Marketruchit sherathiyaNo ratings yet

- BankingDocument15 pagesBankingJyoti BhardwajNo ratings yet

- International BankingDocument20 pagesInternational Bankingamit098765432150% (6)

- Financial Globalization Lecture 10Document5 pagesFinancial Globalization Lecture 10nihadsamir2002No ratings yet

- International Banking and Money MarketDocument28 pagesInternational Banking and Money MarketNiharika Satyadev JaiswalNo ratings yet

- IB-International Banking Trends & ServicesDocument30 pagesIB-International Banking Trends & ServicesKarissa Jun MustachoNo ratings yet

- International Banking: Course Code: FIN-684 4 Semester Instructor: Hira Manzoor Lecture # 01Document11 pagesInternational Banking: Course Code: FIN-684 4 Semester Instructor: Hira Manzoor Lecture # 01Monika RehmanNo ratings yet

- Offshore CurrencyDocument16 pagesOffshore Currencypriya_1234563236980% (5)

- IFS International BankingDocument39 pagesIFS International BankingVrinda GargNo ratings yet

- International Banking Functions GuideDocument22 pagesInternational Banking Functions GuideMayankTayalNo ratings yet

- Project On IbDocument81 pagesProject On Ibtushar_holeyNo ratings yet

- FE Chapter 3Document36 pagesFE Chapter 3dehinnetagimasNo ratings yet

- International Banking LawDocument10 pagesInternational Banking LawMir ArastooNo ratings yet

- International BankingDocument28 pagesInternational BankingVijay KumarNo ratings yet

- Inbound 2983251778108401687Document3 pagesInbound 2983251778108401687atenanlheyNo ratings yet

- International BankingDocument46 pagesInternational BankingPARMANANDNo ratings yet

- Role of Commercial Banks in Lending and Financial ServicesDocument47 pagesRole of Commercial Banks in Lending and Financial ServicesMubashir QureshiNo ratings yet

- Euro MarketDocument12 pagesEuro MarketNishi SharmaNo ratings yet

- Lec 14 Int'l Fin MarketsDocument19 pagesLec 14 Int'l Fin MarketsLaiba TufailNo ratings yet

- Structure of International BankingDocument1 pageStructure of International BankingAnkur Saxena0% (1)

- Major Functions of International BankingDocument7 pagesMajor Functions of International BankingSandra Clem SandyNo ratings yet

- M. B. A. Ii: International Financial ManagementDocument8 pagesM. B. A. Ii: International Financial ManagementSolankiPriyankaNo ratings yet

- Eun Resnick 8e Chapter 11Document18 pagesEun Resnick 8e Chapter 11Wai Man NgNo ratings yet

- International BankingDocument50 pagesInternational Bankingkevalcool250100% (1)

- Offshore BankingDocument39 pagesOffshore Banking971991No ratings yet

- Chapter 1 - International Banking & Money MarketDocument21 pagesChapter 1 - International Banking & Money MarketFaiz FahmiNo ratings yet

- International Banking, Money MarketDocument42 pagesInternational Banking, Money MarketranusnNo ratings yet

- International Financial SystemDocument19 pagesInternational Financial SystemSachinGoel100% (2)

- What is a EurobondDocument4 pagesWhat is a EurobondmissconfusedNo ratings yet

- Unit 1 Introduction To BankingDocument34 pagesUnit 1 Introduction To BankingLalit AyerNo ratings yet

- International Banking and Money Market: Chapter ObjectiveDocument21 pagesInternational Banking and Money Market: Chapter ObjectiveElla Marie WicoNo ratings yet

- 7-Global Capital MarketsDocument8 pages7-Global Capital MarketsAnonymous f7wV1lQKRNo ratings yet

- International Banking ServicesDocument38 pagesInternational Banking ServicesMuhammad HanifNo ratings yet

- Lecture # 15: Role of Commercial BanksDocument46 pagesLecture # 15: Role of Commercial BanksMudassar NawazNo ratings yet

- Euro-Currency Market DNCDocument44 pagesEuro-Currency Market DNCmadhurakhanganNo ratings yet

- Offshore BankingDocument28 pagesOffshore Bankingshonz2468No ratings yet

- International Bank: Working CapitalDocument10 pagesInternational Bank: Working CapitalVinod AroraNo ratings yet

- International BankingDocument19 pagesInternational BankingAshishBhardwajNo ratings yet

- What Is An International Bank?: AnswerDocument22 pagesWhat Is An International Bank?: AnswerSonetAsrafulNo ratings yet

- MCB - Offshore Banking Unit (OBU)Document8 pagesMCB - Offshore Banking Unit (OBU)BaazingaFeedsNo ratings yet

- Banks Finanl PresentationDocument31 pagesBanks Finanl PresentationADNANE OULKHAJNo ratings yet

- International Banking: Banking and Financial Institutions Semi-Final PeriodDocument24 pagesInternational Banking: Banking and Financial Institutions Semi-Final PeriodJane AtendidoNo ratings yet

- International Financial InstrumentsDocument25 pagesInternational Financial InstrumentsChintakunta Preethi100% (1)

- Structure of Foreign Exchange Market in India, Exchange Rate Mexchanism-Quotes in Spot Market and Forward MarketDocument7 pagesStructure of Foreign Exchange Market in India, Exchange Rate Mexchanism-Quotes in Spot Market and Forward MarketChintakunta PreethiNo ratings yet

- Unit-Ii Foreign ExchangeDocument55 pagesUnit-Ii Foreign ExchangeChintakunta PreethiNo ratings yet

- Tarapore Committee ReportDocument14 pagesTarapore Committee ReportChintakunta PreethiNo ratings yet

- IF Problems Arbitrage OpportunityDocument11 pagesIF Problems Arbitrage OpportunityChintakunta PreethiNo ratings yet

- Q.8b IF 2019Document7 pagesQ.8b IF 2019Chintakunta PreethiNo ratings yet

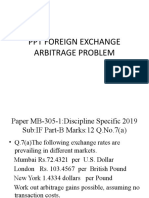

- Foreign Exchange Arbitrage ProblemDocument7 pagesForeign Exchange Arbitrage ProblemChintakunta PreethiNo ratings yet

- Calculation of Forward RateDocument8 pagesCalculation of Forward RateChintakunta PreethiNo ratings yet

- Gold Standard and Bretton Woods SystemsDocument39 pagesGold Standard and Bretton Woods SystemsChintakunta PreethiNo ratings yet

- Bop in IndiaDocument54 pagesBop in IndiaChintakunta PreethiNo ratings yet

- Curency Derivatives - Forwards, Futures, Forward Rate Agreement, Options, Swaps - Foreign Exchange Management ActDocument34 pagesCurency Derivatives - Forwards, Futures, Forward Rate Agreement, Options, Swaps - Foreign Exchange Management ActChintakunta PreethiNo ratings yet

- BOP Trends in IndiaDocument29 pagesBOP Trends in IndiaChintakunta PreethiNo ratings yet

- Kathmandu University: Q.No. Marks Obtained Q.No. Marks Ob-Tained 1. 6. 2. 7. 3. 8. 4. 9. 5. 10Document12 pagesKathmandu University: Q.No. Marks Obtained Q.No. Marks Ob-Tained 1. 6. 2. 7. 3. 8. 4. 9. 5. 10Snehaja RL ThapaNo ratings yet

- Business Risks ExplainedDocument15 pagesBusiness Risks Explainedvz clash royaleNo ratings yet

- Essential Mathematics 4th Edition Lial Solutions ManualDocument26 pagesEssential Mathematics 4th Edition Lial Solutions ManualChristinaBurketrfd100% (58)

- Consolidation Strategy GuideDocument5 pagesConsolidation Strategy GuideChristopher McManusNo ratings yet

- Enhanced 05Document48 pagesEnhanced 05Abu SufyanNo ratings yet

- Astse-782378 - Techno Image LTDDocument2 pagesAstse-782378 - Techno Image LTDahmedghassanyNo ratings yet

- Banking Chapter QuestionsDocument5 pagesBanking Chapter QuestionsRohan MehtaNo ratings yet

- Billing Statement SampleDocument6 pagesBilling Statement SampleamitNo ratings yet

- Money, Banking and Finance (ACFN-341)Document120 pagesMoney, Banking and Finance (ACFN-341)Addis InfoNo ratings yet

- Bharat Heavy Electricals Balance Sheet Data for 5 YearsDocument2 pagesBharat Heavy Electricals Balance Sheet Data for 5 YearsTaksh DhamiNo ratings yet

- Business Presentation PPTDocument21 pagesBusiness Presentation PPTRagav ArchiNo ratings yet

- Chapter 4 - Checking AccountsDocument7 pagesChapter 4 - Checking AccountsChristian Paul CayagoNo ratings yet

- Money and BankingDocument17 pagesMoney and Bankingmuzzammil4422No ratings yet

- Staf Pengajar Fakultas Ekonomi Dan Bisnis Universitas Pembangunan Panca Budi MedanDocument9 pagesStaf Pengajar Fakultas Ekonomi Dan Bisnis Universitas Pembangunan Panca Budi MedanCamelia HamidahNo ratings yet

- Course: Understanding Economic Policymaking by IE Business School Week-2: Fiscal Policy Tool QuizDocument6 pagesCourse: Understanding Economic Policymaking by IE Business School Week-2: Fiscal Policy Tool QuizSofia Yurina100% (1)

- Financial Markets: Submitted byDocument12 pagesFinancial Markets: Submitted byrjay manaloNo ratings yet

- The Philippine Peso and The Foreign Currency 12Document36 pagesThe Philippine Peso and The Foreign Currency 12CHRISTIAN PAUL ALPECHENo ratings yet

- A2 en N AGui MDTAW SE MOD Prbblty and DCSN MKNGDocument2 pagesA2 en N AGui MDTAW SE MOD Prbblty and DCSN MKNGmark davidNo ratings yet

- Chapter 11 Tugas DosenDocument11 pagesChapter 11 Tugas DosenElsa Siregar100% (1)

- Balance of Payment Position of IndiaDocument15 pagesBalance of Payment Position of Indiavinodsurendran100% (3)

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheShahzad techNo ratings yet

- 2019 Mock Exam A - Morning SessionDocument23 pages2019 Mock Exam A - Morning SessionDan ChanNo ratings yet

- Ratio-2 20230913012137Document105 pagesRatio-2 20230913012137Dilpreet SinghNo ratings yet

- How To Trade Crypto A Complete Guide Aluna - SocialDocument69 pagesHow To Trade Crypto A Complete Guide Aluna - SocialJim McLaughlin100% (6)

- Eefc Queries - FedaiDocument4 pagesEefc Queries - FedaicallvkNo ratings yet

- Demonetization: Impact On Indian Economy: Edited byDocument213 pagesDemonetization: Impact On Indian Economy: Edited bySripriya ColaNo ratings yet

- Portfolio Tracker (Public Version) V - 2.4Document181 pagesPortfolio Tracker (Public Version) V - 2.4john08sanNo ratings yet

- The Foreign Exchange MarketDocument29 pagesThe Foreign Exchange MarketChamiNo ratings yet

- The Money MastersDocument41 pagesThe Money Mastersjoan marie supsup100% (1)

- St. K.C. Memorial English School: Unit Test 2 - (2020-2021) Class - 4 Subject - MathematicsDocument2 pagesSt. K.C. Memorial English School: Unit Test 2 - (2020-2021) Class - 4 Subject - MathematicsAshwaniNo ratings yet