Professional Documents

Culture Documents

Cash Management

Uploaded by

Dhananjay SinghalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Management

Uploaded by

Dhananjay SinghalCopyright:

Available Formats

Cash Management in MNEs

(Working Capital)

This is something to do with both Transaction and operating

exposure risk management in MNEs

Sept 11, 2009 14.30 to 18.40 hours Slide 1

Cash Management Practices in a MNC

Decentralised operations Vs. Centralised operations

Disadvantages of decentralised operations (Advantages of centralised cash Management)

• Multiple cash holding practices – loss of SOPs

• Management oversight over distributed cash is high

• Cash is dangerous cannon let loose

• Multiple and ineffective hedging

• Larger cash balances lying all over the place

Positive advantages of centralisation

• Possibilities of exploiting currency movement correlations

Payables & receivables in different currencies having positive correlations

Payables/Receivables of different currencies having negative correlations

Pooling of funds allows for reduced holding – the variance of the total cash flows for the entire group

will be smaller than the sum of the individual variances

Sept 11, 2009 14.30 to 18.40 hours Slide 2

Cash Management Practices

There is a need to strike the right balance in framing a cash holding policy across the group

Accounting and financing efficiencies can never replace operating efficiencies of the business – do

not restructure the business to help accounting and finance – it is always the other way around

Subsidiaries individually netting vs. centralised netting center

Sept 11, 2009 14.30 to 18.40 hours Slide 3

Enablers and Impediments

Facilitators for integration

• Globalised village with expanded connectivity infrastructure

• Expanding capabilities of the banking system

Government restrictions (eg. withholding taxes)

• Prohibition on netting

• Prohibition on remittances

• Restrictions on remittances without payment of withholding taxes

• Unknown new tax imposts

Ineffective Banking systems

• Multiple banking relationships

• Level of automation

• Capabilities and inclinations

Sept 11, 2009 14.30 to 18.40 hours Slide 4

Wire Transfers

Until 1973, all inter bank communications were by telephone, telex, courier, or mail (what we now refer to

snailmail).

Presently, one of the most used messaging system by the banking world for wire transfer of funds is ‘SWIFT’

SWIFT expands to Society for Worldwide Interbank Financial Telecommunication.

It is a non-profit organization comprised of member financial institutions.

Established in Belgium in 1973 by 7 European bankers who needed a more efficient and secure system for inter

bank communications and transfer of funds and securities. SWIFT has offices in 19 countries and operates in

209 countries now

SWIFT handles more than 40 …. messages everyday today.

SWIFT is a messaging service. It is NOT a funds transfer system. Each type of message is a condition of wire

transfer. Can be used by trained banking personnel only

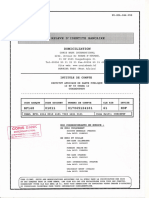

What does a SWIFT look like?

A SWIFT consists of a one-page document containing the name and code of the originating bank, the date and time, the

address and code of the receiving bank, the name and internal code of the officer initiating the transmission, the names and

numbers of the accounts involved in the transfer, a description of the asset being transferred, category of the transmission,

purpose of remittance, from whom to whom, beneficiary address……

Sept 11, 2009 14.30 to 18.40 hours Slide 5

DETAILS OF NOSTRO ACCOUNTS MAINTAINED BY CANARA BANK

OFFICE NAME OF THE

MAINTAINING CORRESPONDENT BANK

CURRENCY ACCOUNT NO

THE NOSTRO

ACCOUNTS

TREASURY, JP MORGAN CHASE, NEW YORK

MUMBAI SWIFT: USD SWIFT: CHASUS33 001-1395969

CNRBINBB

BANK OF AMERICA, 6550791917 UID-

-DO- USD

NEW YORK SWIFT: BOFAUS3N 396491//CP 0959

CITI BANK, 36053796 UID-

-DO- USD

NEW YORK SWIFT:CITIUS33 259486//CP 0008

COMMERZ BANK,

-DO- EURO 400875020001

FRANKFURT SWIFT:COBADEFF

DEUTCHE BANK AG

-DO- EURO 100-9534587-1000

FRANKFURT SWIFT: DEUTDEFF

SOCIETE GENERALE,

-DO- EURO 001016201860

PARIS SIWFT: SOGEFRPP

GBP (BRITISH POUND) CANARA BANK,

-DO- 0001-120001-001

LONDON SWIFT: CNRBGB2L

CHF (SIWISS FRANC) CREDIT SUISSE, 0835-891216-43-

-DO-

SWITZERLAND SWIFT: CSFBCHZZ 003

CAD (CAN. BANK OF MONTREAL,

-DO- 3169 1035 502

DOLLAR) CANADA SWIFT: BOFMCAMZ

SEK (SWEDISK SKANDINAVISKA

-DO- ENSKILDA BANKEN, SWEDEN 5201-85-282-97

KRONER)

SWIFT:ESSESSESS

AUD (AUS. ANZ BANKING GROUP

-DO- 212894/00 001

DOLLAR0 MELBOURNE SWIFT: ANZBAU3M

SGD (SING. OCBC.,

-DO- 501-071575-001

DOLLAR) SINGAPORE SWIFT:OCBCSGSG

YEN (JAPAJESE YEN) BANK OF AMERICA,

-DO- 6064-18411019

JAPAN SWIFT: BOFAJPJX

DKK (DANISH KRONER) DANSKE BANK

-DO- 3007530811

COPENHAGEN SWIFT: DABADKKK

HKD (HK CANARA BANK,

-DO- 100 - 200054

DOLLAR) HONG KONG SWIFT IHIFHKHH

Sept 11, 2009 14.30 to 18.40 hours Slide 6

Other Transfer Systems

CHIPS: Clearing House Interbank Payments System: Private ownership of US Banks. An interbank

payment system related to international trade, CHIPS is used for the transfer of international trade

dollars. It is a netting engine and mainly used for high value, low time sensitive fund movements.

CHAPS: Clearing House Automated Payments System. Operated by the Bankers Clearing House of

London, CHAPS is used for interbank messaging and wire transfer involving British Pounds.

BOJNET: Electronic wire transfer system overseen by the Bank of Japan.

FUNDS WIRING SERVICES: Although there are many wire transfer services, they must each use the

basic services such as Fedwire, S.W.I.F.T, or BOJNET. Examples of wire money transfer services are

Western Union, Moneygram, Eurigro, Sterling Draft Service, and the various payment services

available on the Internet.

Sept 11, 2009 14.30 to 18.40 hours Slide 7

Precautions while transferring funds

Read application for wire-transfer document completely, especially the small letters

Give clear instructions to the Bank

Write legibly (preferably in capital letters)

• The guy on the other side will never be able to decipher the names of persons, companies and corporates

Every transfer should state the purpose of transfer clearly

Take adequate care in writing the bank account number of the beneficiary – you cannot expect the

banker on the other side to exercise any reasonableness in your favour – the amount could be lying in

‘nostro/vostro accounts’ under ‘suspense’

Inform the other party immediately on transfer of funds. Always instruct the remitting party to advise

you on remittance of funds

Always try to understand from your banker the route along which the funds will move – it helps

Sept 11, 2009 14.30 to 18.40 hours Slide 8

Nostro, Vostro and Loro Accounts

“Ours”, “Yours” and “Theirs”

Domestic Bank maintains a foreign currency account with a foreign bank in a foreign country

SBI Mumbai, maintains a USD account with Philadelphia branch of Citibank

SBI remits USD into its account – SBI would say “Credit our Nostro Account with you”

If Citibank Philadelphia wants SBI Mumbai to pay INR 50 million to Indian PM’s Relief Fund, it

would instruct “Pay PM’s Relief Fund and debit Nostro Account No. …..”. To this, SBI would

respond as “Your Vostro Account Debited for INR Rs.50 mn”

If Hyundai wants to pay USD 5 mn to its parent company in Seoul, it would instruct its bank SBI

Mumbai to remit the amount and debit its local INR Account. In turn, SBI will remit the funds to

Citibank, Seoul with an instruction to credit the amount to “Loro Account No. XXXXX”

Thus, Nostro Account is “Our Account with You”

Vostro Account is “Your Account with us”

Loro Account is “Their Account with You”

(Note: Loro Account is a current account maintained by one bank with another)

Sept 11, 2009 14.30 to 18.40 hours Slide 9

THE

END OF

CLASS

Sept 11, 2009 14.30 to 18.40 hours Slide 10

You might also like

- Transferring Funds : International Personal BankDocument4 pagesTransferring Funds : International Personal BankGarbo BentleyNo ratings yet

- 26.inward RemittancesDocument4 pages26.inward RemittancesanilkumarosmeNo ratings yet

- Barclays Bank Payment Confirmation of £2.5 MillionDocument1 pageBarclays Bank Payment Confirmation of £2.5 Millionpravins93No ratings yet

- Transfer of USD 100,000 to China manufacturerDocument2 pagesTransfer of USD 100,000 to China manufacturerRasha AbdullahNo ratings yet

- John Sebabi Bosco REPSSDocument26 pagesJohn Sebabi Bosco REPSSaNo ratings yet

- QuotesDocument2 pagesQuotesnefurtaNo ratings yet

- Dokumen - Tips - MT 103 500m0003pdf PDFDocument1 pageDokumen - Tips - MT 103 500m0003pdf PDFswift adminNo ratings yet

- Atelier Ouaga RIB IASPDocument1 pageAtelier Ouaga RIB IASPDip ShootsNo ratings yet

- 000445952482_FT22199XC6MSDocument2 pages000445952482_FT22199XC6MSElodie Lorreta DinanNo ratings yet

- Uzbekistan Mobile Money Market AnalysisDocument20 pagesUzbekistan Mobile Money Market Analysisميرنا ميرناNo ratings yet

- Swift CodeDocument2 pagesSwift CodeEmmarold OdwongosNo ratings yet

- PGL DTC 47 Tri Db-Strong - 11 August 2023Document8 pagesPGL DTC 47 Tri Db-Strong - 11 August 2023Joel MURILLONo ratings yet

- Financial Institutions SSI List v2Document1 pageFinancial Institutions SSI List v2nextleve.test1No ratings yet

- 000445952482_FT22199G129YDocument2 pages000445952482_FT22199G129YElodie Lorreta DinanNo ratings yet

- Consolidated Trial Balance: Summery/Details: DDocument37 pagesConsolidated Trial Balance: Summery/Details: Djasim khanNo ratings yet

- Dynamics of Foreign Remittance Management SystemDocument27 pagesDynamics of Foreign Remittance Management SystemAsaduzzaman AsadNo ratings yet

- Swift BCG Paper-Internationalpayments PDFDocument13 pagesSwift BCG Paper-Internationalpayments PDFThu Phương DươngNo ratings yet

- Server Swift Abbygb2l-1Document3 pagesServer Swift Abbygb2l-1planetamundo2017No ratings yet

- Transfer Advice ةلاوح راعشإ: JO09 UBSI 1010 0000 1020 7720 9151 01Document2 pagesTransfer Advice ةلاوح راعشإ: JO09 UBSI 1010 0000 1020 7720 9151 01Rasha AbdullahNo ratings yet

- Materi Remittance Presentasi BNTT - 14 Okt 23Document167 pagesMateri Remittance Presentasi BNTT - 14 Okt 23Selfiana GoethaNo ratings yet

- Mt103-Zhejiang Chouzhou Commercial Bank-EuroDocument2 pagesMt103-Zhejiang Chouzhou Commercial Bank-Eurorasool mehrjoo50% (2)

- IBTDocument2 pagesIBTAmethyst NocelladoNo ratings yet

- Cash LogisticsDocument40 pagesCash LogisticsKalpesh ChouhanNo ratings yet

- Caltech Swift2Document3 pagesCaltech Swift2SERIGNE MBACKE THIELELE SY MBOWNo ratings yet

- Funding Instructions - AMP FuturesDocument1 pageFunding Instructions - AMP Futuressuon ongbakNo ratings yet

- 102 202 5B 17 2020 Malaysia PDFDocument3 pages102 202 5B 17 2020 Malaysia PDFismail saltan0% (2)

- Risk Fraud and Operational Efficiency of Swift Payment NetworkDocument28 pagesRisk Fraud and Operational Efficiency of Swift Payment Networkludovic kueteNo ratings yet

- HSBC HK Inward-PaymentsDocument2 pagesHSBC HK Inward-PaymentsBenedict Wong Cheng WaiNo ratings yet

- E Money PDFDocument41 pagesE Money PDFCPMMNo ratings yet

- E Money PDFDocument41 pagesE Money PDFCPMMNo ratings yet

- RTGSDocument14 pagesRTGSHarshUpadhyayNo ratings yet

- Uf1 - 2 - Medios de Pago Internacionales en InglésDocument9 pagesUf1 - 2 - Medios de Pago Internacionales en InglésJosemi CastellóNo ratings yet

- MT103 Netkom Solutions LTDDocument2 pagesMT103 Netkom Solutions LTDrasool mehrjoo100% (2)

- Incoming Payment InstructionDocument2 pagesIncoming Payment InstructionCapitol CONo ratings yet

- ECB Virtualcurrencyschemes201210enDocument55 pagesECB Virtualcurrencyschemes201210enmichelerovattiNo ratings yet

- Mt103 Idbi Bank 100,000 EuroDocument2 pagesMt103 Idbi Bank 100,000 Eurohaleighcrissy49387No ratings yet

- The Evolving Landscape of Cross Border PaymentsDocument18 pagesThe Evolving Landscape of Cross Border Paymentsanurag kumarNo ratings yet

- Mobile Remittance Trends and M-Banking Cost ReductionsDocument3 pagesMobile Remittance Trends and M-Banking Cost ReductionsaqsarshadNo ratings yet

- Central Bank Digital CurrenciesDocument46 pagesCentral Bank Digital CurrenciesluisNo ratings yet

- MT103 MD Swift. Com Fix (147B) Bumi JAlur KumiteDocument19 pagesMT103 MD Swift. Com Fix (147B) Bumi JAlur Kumitekanchan samudrawar100% (3)

- International Banking Congress, The Payment IndustryDocument15 pagesInternational Banking Congress, The Payment IndustryMarcoNo ratings yet

- International Remittances: Business Process Outsourcing Consulting System Integration Universal Banking SolutionDocument11 pagesInternational Remittances: Business Process Outsourcing Consulting System Integration Universal Banking Solutionakther_aisNo ratings yet

- Swift MT 760 & MT 799Document2 pagesSwift MT 760 & MT 799Lincoln Reserve Group Inc.No ratings yet

- Mt103 Qonto Bank 100 e EuroDocument2 pagesMt103 Qonto Bank 100 e Eurohaleighcrissy49387No ratings yet

- AI-powered Digital PaymentsDocument5 pagesAI-powered Digital PaymentsNeha LodheNo ratings yet

- MT 760 Bank InstrumentsDocument1 pageMT 760 Bank InstrumentskdelaozNo ratings yet

- SWIFT Transactions - Cause, Effects, Risks & AuditDocument58 pagesSWIFT Transactions - Cause, Effects, Risks & AuditLokesh MahajanNo ratings yet

- SWIFT Operations Mr. KunduDocument58 pagesSWIFT Operations Mr. KunduLokesh MahajanNo ratings yet

- Black Slip Deutsche Bank Ag-99euroDocument3 pagesBlack Slip Deutsche Bank Ag-99eurohaleighcrissy49387No ratings yet

- Basic concepts of cash and securities settlementDocument12 pagesBasic concepts of cash and securities settlementcrajanikNo ratings yet

- 2006 ATM Deployer Study 082506 - CO-OP - ExecSummaryDocument30 pages2006 ATM Deployer Study 082506 - CO-OP - ExecSummaryDavid SwaiNo ratings yet

- Payments SyllabusDocument5 pagesPayments SyllabuspritamkguinNo ratings yet

- SyllabusDocument5 pagesSyllabuskhuranayogeshNo ratings yet

- Transfer Receipt JP Morgan Bank Theo de Vos.Document1 pageTransfer Receipt JP Morgan Bank Theo de Vos.Hervé LowellNo ratings yet

- Mt103-Ziraatbankasi-100 E-EuroDocument2 pagesMt103-Ziraatbankasi-100 E-Eurohaleighcrissy49387No ratings yet

- MT103 Zheshang 100BDocument3 pagesMT103 Zheshang 100Brasool mehrjooNo ratings yet

- Payments NationalBankofSerbiaDocument20 pagesPayments NationalBankofSerbiaarijit00No ratings yet

- Mt103 Ziraatbankasi 150e EuroDocument2 pagesMt103 Ziraatbankasi 150e Eurohaleighcrissy49387No ratings yet

- EBS Session1Document12 pagesEBS Session1Dhananjay SinghalNo ratings yet

- Key Elements and Focus Areas for Careem's Operating SystemDocument1 pageKey Elements and Focus Areas for Careem's Operating SystemDhananjay SinghalNo ratings yet

- Financing International Trade with Letters of CreditDocument40 pagesFinancing International Trade with Letters of CreditDhananjay SinghalNo ratings yet

- The New Labour CodesDocument15 pagesThe New Labour CodesDhananjay SinghalNo ratings yet

- RolloversDocument6 pagesRolloversDhananjay SinghalNo ratings yet

- Capital Budgeting For MNCDocument21 pagesCapital Budgeting For MNCDhananjay SinghalNo ratings yet

- FRAs and Interest Rate OptionsDocument8 pagesFRAs and Interest Rate OptionsDhananjay SinghalNo ratings yet

- Hedging With FuturesDocument22 pagesHedging With FuturesDhananjay SinghalNo ratings yet

- Balance of Payments-Final For KreaDocument25 pagesBalance of Payments-Final For KreaDhananjay SinghalNo ratings yet

- Interest Rate Swaps and Currency SwapsDocument21 pagesInterest Rate Swaps and Currency SwapsDhananjay SinghalNo ratings yet

- Understanding Economic ExposureDocument10 pagesUnderstanding Economic ExposureDhananjay SinghalNo ratings yet

- International Financial Markets OverviewDocument27 pagesInternational Financial Markets OverviewDhananjay SinghalNo ratings yet

- International Capital Budgeting - Raja Rani Scooters - Template For Students-1Document12 pagesInternational Capital Budgeting - Raja Rani Scooters - Template For Students-1Dhananjay SinghalNo ratings yet

- SwotDocument7 pagesSwotDrRitesh PatelNo ratings yet

- Yonas AtomsaDocument48 pagesYonas Atomsaberhanu seyoumNo ratings yet

- Crypto Is New CurrencyDocument1 pageCrypto Is New CurrencyCM-A-12-Aditya BhopalbadeNo ratings yet

- MM Cia 1Document7 pagesMM Cia 1debarati majiNo ratings yet

- Crespo Logistics QuestionerDocument21 pagesCrespo Logistics QuestionerJulie CrespoNo ratings yet

- AR #02: Inspection and Maintenance of Steam Traps: Recommended ActionDocument4 pagesAR #02: Inspection and Maintenance of Steam Traps: Recommended ActionJUAN CAMILO EspindolaNo ratings yet

- Alaya-Ay, Regine MDocument3 pagesAlaya-Ay, Regine MMae Ann AvenidoNo ratings yet

- Point72 ApplicationDocument2 pagesPoint72 ApplicationNima AttarNo ratings yet

- Bobot Lahir Bobot Sapih Dan Ukuran Statistik Vital Pada Dua Kelompok Paritas Sapi Peranakan Ongole PDFDocument5 pagesBobot Lahir Bobot Sapih Dan Ukuran Statistik Vital Pada Dua Kelompok Paritas Sapi Peranakan Ongole PDFAndi KurniawanNo ratings yet

- Patanjali CaseDocument3 pagesPatanjali CaseRohit S ThattilNo ratings yet

- Tutorial 1Document3 pagesTutorial 1Chun Yeen NgaiNo ratings yet

- Richard M. Bird, Francois Vaillancourt-Fiscal Decentralization in Developing Countries (Trade and Development) (1999) PDFDocument314 pagesRichard M. Bird, Francois Vaillancourt-Fiscal Decentralization in Developing Countries (Trade and Development) (1999) PDFryu2550% (1)

- Top 30 MCQ - Banking Reform & NationalizationDocument4 pagesTop 30 MCQ - Banking Reform & NationalizationEthan HuntNo ratings yet

- 3 Marks Q 11 1STDocument6 pages3 Marks Q 11 1STDINESH KUMAR SENNo ratings yet

- FINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSDocument9 pagesFINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSPau Santos76% (29)

- Beijing Review - March 05, 2020Document54 pagesBeijing Review - March 05, 2020NISHANT SRIVASTAVANo ratings yet

- Interest Rates Determinants and TheoriesDocument11 pagesInterest Rates Determinants and TheoriesEugene AlipioNo ratings yet

- ELEM-District: - Particular Amount: Actual MOOE Expenses 2015 For The Month ofDocument1 pageELEM-District: - Particular Amount: Actual MOOE Expenses 2015 For The Month ofCHANIELOU MARTINEZNo ratings yet

- Polymers of Styrene, in Primary FormsDocument1 pagePolymers of Styrene, in Primary FormslyesNo ratings yet

- Regulating Initial Public Offerings in EthiopiaDocument17 pagesRegulating Initial Public Offerings in EthiopiaAbnet BeleteNo ratings yet

- Notes From PT 365 2022Document1 pageNotes From PT 365 2022Atul KumarNo ratings yet

- Annual Public Debt Report 2018-2019Document55 pagesAnnual Public Debt Report 2018-2019Olympus MonsNo ratings yet

- Hakeem Ullah 0xutxhDocument5 pagesHakeem Ullah 0xutxhHakeem UllahNo ratings yet

- Claude Diebolt, Michael Haupert (Eds.) - Handbook of Cliometrics (2016, Springer References)Document597 pagesClaude Diebolt, Michael Haupert (Eds.) - Handbook of Cliometrics (2016, Springer References)André Martins100% (1)

- PDFViewerDocument2 pagesPDFViewerKunal GiriNo ratings yet

- Assignment No 2Document5 pagesAssignment No 2Ghulam Awais SaeedNo ratings yet

- 2019 H2 Y5 CT 1 - Examiner - S Report (Final)Document20 pages2019 H2 Y5 CT 1 - Examiner - S Report (Final)19Y5C12 ZHANG YIXIANGNo ratings yet

- Annex 6 - RCB - CabangtalanDocument15 pagesAnnex 6 - RCB - CabangtalanLikey PromiseNo ratings yet

- Attachments Amaia Land Corp.Document4 pagesAttachments Amaia Land Corp.AbbaNo ratings yet

- Koleksi CSR100 by JGV100Document17 pagesKoleksi CSR100 by JGV100Pra nowoNo ratings yet