Professional Documents

Culture Documents

Presentation 1

Uploaded by

Melli M0 ratings0% found this document useful (0 votes)

1 views5 pagesOriginal Title

Presentation1

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views5 pagesPresentation 1

Uploaded by

Melli MCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

NATIONAL REGULATION PART-2

GOODBODY & CO. FAILURE, 1970

• Top-five Brokerage firm Goodbody &Co. ran into financial

difficulties, trouble maintaining SEC capital requirements.

• Fears for the accounts of their 225,000 retail clients.

• At the request of the New York Stock Exchange, Merrill Lynch took

over company 1970.

• New York Stock Exchange pledged $30 million to cover losses

Merrill might incur.

• None of Goodbody’s retail customers lost anything, because of the

“heroism” of Merrill, NYSE.

SECURITIES INVESTOR PROTECTION

CORPORATION (SIPC)

• To plan for such events in the future, SIPC was created by US

Congress 1970 (Sen. Ed Muskie).

• SIPC much criticized. Very defensive, pays more to the lawyers than

to claimants.

• “Not blanket protection that returns your money in all cases”,

“doesn’t cover fraud claims” (SIPC web site)

THE 2008 FINANCIAL CRISIS AS RESULT

OF REGULATORY FAILURE BEFORE

CRISIS

• Many home buyers were put into unsuitable mortgages, later to default.

• Leverage ratio of the financial sector was allowed to reach historically

high levels.

• Banks ad governments used off-balance-sheet accounting to conceal

liabilities.

• Home appraisers were in effect bribed.

• Rating shopping compromised security valuation process.

INTERNATIONAL REGULATION

BANK FOR INTERNATIONAL

SETTLEMENTS

• Created 1930 by Hague Agreements

• Has 57 member central banks, who are in turn national regulators.

• Basel Switzerland.

BASEL COMMITTEE

• Created by the G10 1974 to coordinate banking regulation.

• Basel I 1988.

• Basel II 2004.

• Basel III 2009 Adopted by G20 at the Seoul Korea summit in 2010.

You might also like

- Investment BankingDocument158 pagesInvestment BankingUsha Sailaja D.No ratings yet

- The Economics of Money, Banking, and Financial Markets, Tenth Edition CH 12 NotesDocument7 pagesThe Economics of Money, Banking, and Financial Markets, Tenth Edition CH 12 Notessilva921No ratings yet

- BCCI BankDocument8 pagesBCCI BankShaurya Pratap SinghNo ratings yet

- Types of BankingDocument123 pagesTypes of BankingSuvankar Nandi100% (1)

- BCCI FraudDocument34 pagesBCCI FraudAnkush Bahri100% (2)

- Corporate Failure: Bank of Credit and Commerce InternationalDocument15 pagesCorporate Failure: Bank of Credit and Commerce InternationalHussain Amin100% (1)

- Financial Markets and Institutions: Lecture 1: IntroductionDocument41 pagesFinancial Markets and Institutions: Lecture 1: IntroductionGaurav007No ratings yet

- FinTech Rising: Navigating the maze of US & EU regulationsFrom EverandFinTech Rising: Navigating the maze of US & EU regulationsRating: 5 out of 5 stars5/5 (1)

- US Banking StructureDocument40 pagesUS Banking Structureswati_rathourNo ratings yet

- Inside JobDocument12 pagesInside JobAbhilash KurupNo ratings yet

- Major Corporate Governance Failures: Chapter OutlineDocument5 pagesMajor Corporate Governance Failures: Chapter OutlineKurnool LionsNo ratings yet

- Corporate GovernanceDocument17 pagesCorporate GovernanceBhavy GandhiNo ratings yet

- BCCIDocument8 pagesBCCIPriyanshuNo ratings yet

- Bcci Scandal 1Document19 pagesBcci Scandal 1Ali HaiderNo ratings yet

- Banking & Finance Basics Class 8Document39 pagesBanking & Finance Basics Class 8Anèse mabouanaNo ratings yet

- The Global Financial CrisisDocument35 pagesThe Global Financial CrisisSamya MittalNo ratings yet

- Wykład V.L.SmithDocument20 pagesWykład V.L.SmithprnoxxxNo ratings yet

- Baring Failure FINAL-1Document19 pagesBaring Failure FINAL-1Nodtaporn ChaichoochaiNo ratings yet

- FIN560ARes016 PDFDocument33 pagesFIN560ARes016 PDFAli TahtahNo ratings yet

- Economic RecessionDocument22 pagesEconomic Recessionasadkhanbu89No ratings yet

- Presented By: Vinod Panigrahi Rupesh Mahyavanshi Presented To: Ashwin SirDocument11 pagesPresented By: Vinod Panigrahi Rupesh Mahyavanshi Presented To: Ashwin Siranon_738641101No ratings yet

- Basel AccordDocument11 pagesBasel AccordleojosephkiNo ratings yet

- HS 449 3Document34 pagesHS 449 3Ram Phal SutharNo ratings yet

- Credit Crunch What Went WrongDocument32 pagesCredit Crunch What Went WrongGautam ChapagainNo ratings yet

- Lehman Brothers and LIBOR ScandalDocument16 pagesLehman Brothers and LIBOR Scandalkartikaybansal8825No ratings yet

- Banking and The Financial Services IndustryDocument42 pagesBanking and The Financial Services IndustryJeric Justin LudyawanNo ratings yet

- Market RiskPractice QuestionDocument99 pagesMarket RiskPractice QuestionRajivManochaNo ratings yet

- Latin America's Debt Crisis 1980's: Franko, Chapter 4Document18 pagesLatin America's Debt Crisis 1980's: Franko, Chapter 4Arpana ChandraNo ratings yet

- Newwrldcomppt 110723061054 Phpapp02Document13 pagesNewwrldcomppt 110723061054 Phpapp02Taimoor ShabeerNo ratings yet

- Capstone Week1 Group 1Document9 pagesCapstone Week1 Group 1VeritaserumNo ratings yet

- Basel I and Basel Ii: History of An EvolutionDocument39 pagesBasel I and Basel Ii: History of An EvolutionFarida RasiwalaNo ratings yet

- The Housing Market Collapse of 2008Document22 pagesThe Housing Market Collapse of 2008Muhammad WasifNo ratings yet

- Finance: Thursday, October 2Document56 pagesFinance: Thursday, October 2CA Varun TulsyanNo ratings yet

- BUSC51F20R010Document4 pagesBUSC51F20R010Munaj AzharNo ratings yet

- The Subprime CrisisDocument14 pagesThe Subprime CrisisSimranjit KohliNo ratings yet

- Lecture 1 PG 1Document47 pagesLecture 1 PG 1carinaNo ratings yet

- Final PPT On US BANKING and Bank of AmericaDocument74 pagesFinal PPT On US BANKING and Bank of AmericaSahil GuptaNo ratings yet

- Merrill Lynch CaseDocument12 pagesMerrill Lynch CaseDamir Pejić0% (1)

- Basel I and Basel Ii: History of An EvolutionDocument48 pagesBasel I and Basel Ii: History of An EvolutionamritNo ratings yet

- BankingDocument25 pagesBankingjayashree_jothivelNo ratings yet

- FD Lecture XVIIDocument38 pagesFD Lecture XVIIVineet RanjanNo ratings yet

- Economic Factors - The Financial Markets: Financial Opportunities and Risks For International BusinessDocument32 pagesEconomic Factors - The Financial Markets: Financial Opportunities and Risks For International BusinessProtazz AndcoNo ratings yet

- Accounting Fundamentals - Session 1 - For ClassDocument13 pagesAccounting Fundamentals - Session 1 - For ClassPawani ShuklaNo ratings yet

- The BCCI Scandal-A Tale of Fraud, Intrigue and ConspiracyDocument5 pagesThe BCCI Scandal-A Tale of Fraud, Intrigue and ConspiracyAkshita PradhanNo ratings yet

- Sub Prime Crises: CitibankDocument31 pagesSub Prime Crises: Citibankjibran_jogezaiNo ratings yet

- Overview of The 2007-2009 Financial Crisis - The Panic Vitoria SaddiDocument61 pagesOverview of The 2007-2009 Financial Crisis - The Panic Vitoria SaddiVic SaddiNo ratings yet

- The Collapse of Lehman BrothersDocument14 pagesThe Collapse of Lehman BrothersAhmed Magdy Aly HegazyNo ratings yet

- Chap. 5. Banking Industry Structure and CompetitionDocument52 pagesChap. 5. Banking Industry Structure and CompetitionMichaelAngeloBattungNo ratings yet

- Investment Banking: 2021 BatchDocument135 pagesInvestment Banking: 2021 Batchaditya.babarNo ratings yet

- Amit Dewadiga: - Neelesh Singh - Ravin Kapadia - Satish Mohite - Shivkumar Verma - Trushali Gaikar - Vineet NadkarniDocument12 pagesAmit Dewadiga: - Neelesh Singh - Ravin Kapadia - Satish Mohite - Shivkumar Verma - Trushali Gaikar - Vineet NadkarnisiddhimaniyarNo ratings yet

- Financial Regulation PPT 1Document19 pagesFinancial Regulation PPT 1Tania GhoshNo ratings yet

- Presentation On Bank RegulationDocument19 pagesPresentation On Bank RegulationIshat NijhumNo ratings yet

- 28 Financial System and IPOsDocument30 pages28 Financial System and IPOsSINGH GITIKA JAINARAIN IPM 2019-24 BatchNo ratings yet

- What Causes RecessionDocument23 pagesWhat Causes Recessionashwini_anaredyNo ratings yet

- Subprime Crisis: Presented byDocument11 pagesSubprime Crisis: Presented bysampadaNo ratings yet

- Banking in Other CountriesDocument37 pagesBanking in Other CountriesSudhansuSekharNo ratings yet

- An Introduction To The Subprime Crisis in The U.SDocument25 pagesAn Introduction To The Subprime Crisis in The U.SAdeel RanaNo ratings yet

- IB Chapter # 12Document22 pagesIB Chapter # 12Ma Quang ThinhNo ratings yet

- International Debt Crisis/ Latin American Debt Crisis: - Arpana Chandra - Santosh SarateDocument29 pagesInternational Debt Crisis/ Latin American Debt Crisis: - Arpana Chandra - Santosh Saratesweetsep8No ratings yet

- Asset Liability Management: by S.ClementDocument91 pagesAsset Liability Management: by S.ClementshrniksNo ratings yet

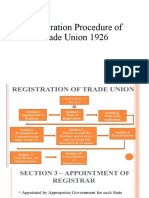

- Registration Procedure of Trade Union 1926Document14 pagesRegistration Procedure of Trade Union 1926Melli MNo ratings yet

- Offer LetterDocument2 pagesOffer LetterMelli MNo ratings yet

- Offer Letter 1Document2 pagesOffer Letter 1Melli MNo ratings yet

- A Study On Organizational Performance and Job Satisfaction Among Employees in Manufacturing Sector at Shakthi Tech Manufacturing India Private LTDDocument12 pagesA Study On Organizational Performance and Job Satisfaction Among Employees in Manufacturing Sector at Shakthi Tech Manufacturing India Private LTDMelli MNo ratings yet