Professional Documents

Culture Documents

International Financial Management: Pavani Raju

International Financial Management: Pavani Raju

Uploaded by

Nithyananda Patel R MBA0 ratings0% found this document useful (0 votes)

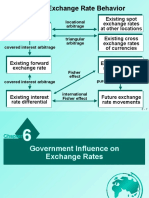

2 views5 pagesThe European monetary system linked most European economic community currencies through a multilateral adjustable exchange rate agreement. Under a fixed exchange rate, governments set and maintain currency values to provide trade and investment confidence and certainty, while avoiding speculation, but require large foreign reserves and can discourage free markets through under or overvaluation. A flexible exchange rate varies by market forces to remove external instability without reserves, and avoids under or overvaluation, but discourages trade and investment with uncertainty from currency fluctuations and encourages speculation.

Original Description:

Original Title

IFM

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe European monetary system linked most European economic community currencies through a multilateral adjustable exchange rate agreement. Under a fixed exchange rate, governments set and maintain currency values to provide trade and investment confidence and certainty, while avoiding speculation, but require large foreign reserves and can discourage free markets through under or overvaluation. A flexible exchange rate varies by market forces to remove external instability without reserves, and avoids under or overvaluation, but discourages trade and investment with uncertainty from currency fluctuations and encourages speculation.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views5 pagesInternational Financial Management: Pavani Raju

International Financial Management: Pavani Raju

Uploaded by

Nithyananda Patel R MBAThe European monetary system linked most European economic community currencies through a multilateral adjustable exchange rate agreement. Under a fixed exchange rate, governments set and maintain currency values to provide trade and investment confidence and certainty, while avoiding speculation, but require large foreign reserves and can discourage free markets through under or overvaluation. A flexible exchange rate varies by market forces to remove external instability without reserves, and avoids under or overvaluation, but discourages trade and investment with uncertainty from currency fluctuations and encourages speculation.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

International

Financial

Management

Pavani Raju

Mba 4th sem

European Monetary System

The European monetary system is a multilateral adjustable

exchange rate agreement in which most of the nations of the

European economic community linked their currencies.

Fixed Exchange Rate

It is a rate which the government sets and maintains at the same level.

-Confidence and certainty for trade and investment decisions.

-Avoids speculation in forex market

-Helps government to check inflation

-Need to maintain a large foreign exchange reserve

-Discouraging the objectives of having free markets

-May result in undervaluation or overvaluation of currencies

Flexible Exchange Rate

It is a rate that varies according to the market forces

-Operates to remove external instability by change in forex rate

-No need to maintain gold reserves

-Eliminates problem of undervaluation and overvaluation of currency

-International trade and investment is discouraged due to the uncertainty caused

by currency fluctuations

-Encourages Speculation

Thank You

You might also like

- Exchange Rates JBDocument9 pagesExchange Rates JBboss9921No ratings yet

- What Are The Main Advantages and Disadvantages of Fixed Exchange RatesDocument4 pagesWhat Are The Main Advantages and Disadvantages of Fixed Exchange RatesGaurav Sikdar0% (1)

- Economics ProjectDocument27 pagesEconomics ProjectKashish AgrawalNo ratings yet

- How International Currency Excharge Rate WorksDocument6 pagesHow International Currency Excharge Rate Worksggi2022.1928No ratings yet

- International Monetary SystemDocument16 pagesInternational Monetary Systemriyaskalpetta100% (2)

- Exchange Rate 1Document9 pagesExchange Rate 1Pule JackobNo ratings yet

- ProjectDocument7 pagesProjectRajeshwari ShuklaNo ratings yet

- International Monetary System Term PaperDocument18 pagesInternational Monetary System Term PaperDarshan GaragNo ratings yet

- The Exchange Rate - A-Level EconomicsDocument13 pagesThe Exchange Rate - A-Level EconomicsjannerickNo ratings yet

- Currency Regimes TheoryDocument7 pagesCurrency Regimes TheoryTimea DemeterNo ratings yet

- Module 2 RMDocument12 pagesModule 2 RMksheerodshriNo ratings yet

- The International Monetary SystemDocument4 pagesThe International Monetary SystemAnalou LopezNo ratings yet

- Forex Currency Forex Market Liquid Market Trillions of DollarsDocument5 pagesForex Currency Forex Market Liquid Market Trillions of DollarsTimothy 328No ratings yet

- Advantages N Disadvantages of Fixed Xchange RateDocument3 pagesAdvantages N Disadvantages of Fixed Xchange RateMohammad FaizanNo ratings yet

- Tutorial 5-SolutionsDocument4 pagesTutorial 5-SolutionsSruenNo ratings yet

- Exchange Rate Movements: Changes in ExportsDocument11 pagesExchange Rate Movements: Changes in ExportsamitNo ratings yet

- International Monetary SystemDocument3 pagesInternational Monetary SystemOrea DonnanNo ratings yet

- Float: Fear of FloatingDocument8 pagesFloat: Fear of FloatingPRIYANKNo ratings yet

- Government Influence On Exchange Rates: Resume Chapter 6Document3 pagesGovernment Influence On Exchange Rates: Resume Chapter 6Elsa RahmaNo ratings yet

- Floating Exchange RateDocument2 pagesFloating Exchange RateMuhammad FaizanNo ratings yet

- IMS (Last)Document29 pagesIMS (Last)Mehdi SamNo ratings yet

- Exchange Rate Regimes of The WorldDocument14 pagesExchange Rate Regimes of The WorldPaavni SharmaNo ratings yet

- Free FloatDocument5 pagesFree FloatHinaJhambNo ratings yet

- Exchange Rates: Quick ReviseDocument8 pagesExchange Rates: Quick ReviseScorpions StingNo ratings yet

- Ibt Rev PDFDocument4 pagesIbt Rev PDFRose Vanessa BurceNo ratings yet

- Exchange Rate Regime Currency Foreign Exchange Market Floating CurrencyDocument6 pagesExchange Rate Regime Currency Foreign Exchange Market Floating Currencypradeep3673100% (1)

- Unit ViDocument13 pagesUnit VisudhanshuNo ratings yet

- Presentation PreparationDocument6 pagesPresentation PreparationShahtaj BakhtNo ratings yet

- The Determination of Exchange RatesDocument33 pagesThe Determination of Exchange RatesInshadRT NomanNo ratings yet

- Chpter 6 INTERNATIONAL TRANSACTIONS AND PAYMENTSDocument20 pagesChpter 6 INTERNATIONAL TRANSACTIONS AND PAYMENTSJOHN MICO AMIGONo ratings yet

- Part ofDocument5 pagesPart ofdagimNo ratings yet

- ForexDocument9 pagesForexAshish MhatreNo ratings yet

- Currency PeggingDocument15 pagesCurrency PegginghimanilapasiaNo ratings yet

- How Would You Classify The Exchange Rate Regime Used by Russia For The Ruble Over The 1991Document4 pagesHow Would You Classify The Exchange Rate Regime Used by Russia For The Ruble Over The 1991Angela Lim Jia YingNo ratings yet

- An Assignment On: D.Pradeep KumarDocument4 pagesAn Assignment On: D.Pradeep Kumarpradeep3673No ratings yet

- Exchange Rate RegimesDocument12 pagesExchange Rate RegimesSachinGoel100% (1)

- Chapter 11Document23 pagesChapter 11Fazila AzharNo ratings yet

- Foreign ExchangeDocument2 pagesForeign Exchangesurinderkumar02No ratings yet

- International Monetary SystemsDocument23 pagesInternational Monetary SystemsTharshiNo ratings yet

- UNIT-6: International Trade and Institutions: What Is A 'Closed Economy?'Document13 pagesUNIT-6: International Trade and Institutions: What Is A 'Closed Economy?'anushreeNo ratings yet

- Government Influence On Exchange Rates Presented by (1) 11111111111111Document16 pagesGovernment Influence On Exchange Rates Presented by (1) 11111111111111Faizan AbidNo ratings yet

- Foreign ExchangeDocument3 pagesForeign Exchangeatharva1760No ratings yet

- Exchange Rate Regimes of The WorldDocument14 pagesExchange Rate Regimes of The WorldKajal Chaudhary100% (1)

- Unit 10 Merits and Demerits of Fixed and Flexible Foreign Exchange Rates. Merits of Fixed Exchange RateDocument2 pagesUnit 10 Merits and Demerits of Fixed and Flexible Foreign Exchange Rates. Merits of Fixed Exchange RateSenthil Kumar GanesanNo ratings yet

- History/ Stages On International Monetary SystemDocument9 pagesHistory/ Stages On International Monetary SystemsivakaranNo ratings yet

- The Determination of Exchange RatesDocument33 pagesThe Determination of Exchange RatesBorn HyperNo ratings yet

- Chapter 6Document6 pagesChapter 6jon doeeNo ratings yet

- PGP13013 - Exchange RatesDocument1 pagePGP13013 - Exchange RatesMayank BhattNo ratings yet

- Tutor2u - Fixed and Floating Exchange RatesDocument4 pagesTutor2u - Fixed and Floating Exchange RatesSumanth KumarNo ratings yet

- International Financial Management: by Jeff MaduraDocument32 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- Dwnload Full Multinational Business Finance 14th Edition Eiteman Solutions Manual PDFDocument36 pagesDwnload Full Multinational Business Finance 14th Edition Eiteman Solutions Manual PDFkerdonjawfarm100% (12)

- Tài Chính CôngDocument3 pagesTài Chính CôngMinh AnhNo ratings yet

- Lesson 6 - Labor Migration in The Philippines: Content of The ModuleDocument7 pagesLesson 6 - Labor Migration in The Philippines: Content of The ModuleClaire TumulakNo ratings yet

- International Financial Management: Resume Chapter 6Document6 pagesInternational Financial Management: Resume Chapter 6Wida KusmayanaNo ratings yet

- International Finance ManagementDocument30 pagesInternational Finance ManagementClaudia ChavarriaNo ratings yet

- Floating (Flexible) Exchange Rate SystemDocument2 pagesFloating (Flexible) Exchange Rate SystemBalasingam PrahalathanNo ratings yet

- Big Picture C UlocDocument5 pagesBig Picture C UlocAnvi Rose CuyosNo ratings yet

- Project ForexDocument63 pagesProject ForexRitesh koliNo ratings yet

- Lecture 2 (1) - Chapter 6Document5 pagesLecture 2 (1) - Chapter 6indapantsNo ratings yet

- JMP ResourcesDocument11 pagesJMP ResourcesNithyananda Patel R MBANo ratings yet

- 1ST Mba AssignmentDocument10 pages1ST Mba AssignmentNithyananda Patel R MBANo ratings yet

- Option and Swap Valuation On Bloomberg: Chris Lamoureux, PHDDocument15 pagesOption and Swap Valuation On Bloomberg: Chris Lamoureux, PHDNithyananda Patel R MBANo ratings yet

- CF 2Document3 pagesCF 2Nithyananda Patel R MBANo ratings yet