Professional Documents

Culture Documents

Activity Based Costing

Uploaded by

Saumya0 ratings0% found this document useful (0 votes)

9 views8 pagesOriginal Title

Activity-Based-Costing.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views8 pagesActivity Based Costing

Uploaded by

SaumyaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 8

Activity Based Costing

Dr. M.V.S. Kameshwar Rao

Associate Professor, IBS, Hyderabad

Activity Based Costing – ABC – What is it?

• A method of costing where the overhead costs are allocated to the

product or service based on the activities involved in producing the

product or service

• Need for this technique arised when

• Companies started manufacturing more than 1 product

• The Overhead Costs started occupying the major share of the cost of a product

• The products or services are not similar and there is customisation

• Overheads become a function of the complexity and uniqueness of the product

• It is the Cause and Effect principle that is used to cost a product or

service.

• The cost of a product or services is function of all the various activities

that go in to produce it

Merits and Limitations

• Merits:

• A more reliable basis for cost plus pricing

• Helps identify over priced and under priced products and services

• Helps Identify hidden cross subsidisation of products and services

• Does not load unutilised capacity costs onto the product or service

• Provides visibility to managers to manage and control costs

• Limitations:

• Time Consuming and expensive to lay down Activity Based Costing

• Identifying Cost Drivers for some costs like Insurance, Supervisor Salary,

Depreciation of Buildings etc

Steps in Establishing Activity Based Costing

• Identify the various activities undertaken in an organisation

• An activity is an event or unit or work with a purpose

• Create “Cost Pool” for each major Activity

• Allocate and Apportion all Indirect Expenses (Overhead Expenses) to

these Cost Pools and also direct costs attributable to the activity

• Determine “Cost Drivers” for each Activity

• Compute the Activity Cost Rate as “Activity Cost / The Intensity of the

Activity Cost Driver” Eg: Inspection Cost / No. of Inspections done

• Identify the activities required to product each product or service

• Identify the intensity of consumption of the activity by each product

• Absorb the cost of an activity into the final cost of the product or service

Traditional Costing (TC) Vs ABC

• TC – Aggregate Indirect Costs or Overheads are allocated to products or

services based on Volume production or number of service instances

• ABC – Computes costs of product or services by cumulating the cost of

activities that are consumed by each product or service

• TC - To a large extent all the products and services are treated

homogeneous for allocation of overheads.

• ABC – Each product or service is treated unique to absorb the overheads

• TC – Service Centre costs are allocated to production centres and finally

these costs are absorbed as production overheads

• ABC – Each product or service is mapped to the kind of service centre

tasks it consumes and the cost of service centre are directly assigned to

the cost of product without re-routing

Illustration Traditional Costing

• A company manufactures and sells two products A (25000 units) and B

(5000 units)

• Time required to produce each unit of A or B is 1 Hour

• Labour Cost for each unit of A or B is Rs.12 per unit. So Rs. 12 per hour

• Material Cost for A Rs.40 per unit and B is Rs.30 per unit

• Overheads total to Rs.9,00,000 for the entire year of operations.

• Overheads need to be absorbed based on the Direct Labour Cost i.e.

Rs.25,000 and Rs.5,000 = Rs.30,000

• Each unit of product produced will absorb Rs.30 as overheads

• So product A would Cost Rs.40 + Rs.12 + Rs.30 = Rs.82

• And product B would Cost Rs.30 + Rs.12 + Rs.30 = Rs.72

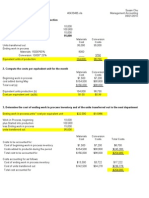

Illustration Contd....A B Costing

• Rs.9,00,000 of overheads are actuall incurred due to three activities

• Setting up Machines - Rs.3,00,000 – with 1500 set ups

• Machining – Rs. 5,00,000 – with 50,000 machine hours

• Inspecting – Rs.1,00,000 – with 2000 inspections

• Therefore the cost rate for each unit of activity can be arrived at as

• Setting Up = 3,00,000 / 1500 = Rs.200 per set up

• Machining = 5,00,000 / 50,000 = Rs.10 per machine hour

• Inspecting = 1,00,000 / 2000 = Rs.50 per inspection

• Product A requires 500 setups, 30,000 machine hours, and 500

inspections to produce 25,000 units

• Product B requires 1000 setups, 20,000 machine hours, and 1500

inspections to produce 5000 units

Illustration Contd....A B Costing

Cost of Product A Activity Activity Total Annual Cost of Product B Activity Activity Total Annual

Consumed Cost Cost Consumed Cost Cost

Setting Up Machines 500 200 1,00,000 Setting Up Machines 1000 200 2,00,000

Machining 30000 10 3,00,000 Machining 20000 10 2,00,000

Inspection 500 50 25,000 Inspection 1500 50 75,000

Total Overhead 4,25,000 Total Overhead 4,75,000

Units Produced 25,000 Units Produced 5,000

Overhead Per Unit 17 Overhead Per Unit 95

Cost Component Product A Product B Product A Product B

ABC ABC TC TC

Raw Material per Unit 40 30 40 30

Labour per Unit 12 12 12 12

Overheads per Unit 17 95 30 30

Total Cost per Unit 69 137 82 72

You might also like

- Exercise 4-2 Group WorkDocument6 pagesExercise 4-2 Group Worksesegar_nailofar100% (4)

- Group 8Document20 pagesGroup 8nirajNo ratings yet

- Assignment Accounting 12 - 13Document10 pagesAssignment Accounting 12 - 13cecilia angel100% (1)

- Pricing Decisions and Cost ManagementDocument18 pagesPricing Decisions and Cost ManagementAmrit PrasadNo ratings yet

- Activity Based Costing (ABC) SystemDocument16 pagesActivity Based Costing (ABC) SystemPoint BlankNo ratings yet

- Activity Based CostingDocument50 pagesActivity Based CostingParamjit Sharma97% (65)

- Activity Based CostingDocument49 pagesActivity Based CostingEdson EdwardNo ratings yet

- Chapter 5 ABC - ABM PDFDocument31 pagesChapter 5 ABC - ABM PDFdiky supriadiNo ratings yet

- City Buildings Business PowerPoint TemplateDocument15 pagesCity Buildings Business PowerPoint TemplateSalman SajidNo ratings yet

- BudgetingDocument11 pagesBudgetingTanuj LalchandaniNo ratings yet

- Activity Based Costing: Presented By: Anurag Garg Himanshu Sumit Garg AnjliDocument17 pagesActivity Based Costing: Presented By: Anurag Garg Himanshu Sumit Garg AnjliSumit GargNo ratings yet

- Activity Based Costing PractiseDocument23 pagesActivity Based Costing PractiseAR KuvadiyaNo ratings yet

- Costing ProblemsDocument26 pagesCosting ProblemsNikhil PrasannaNo ratings yet

- 2.2 PM - Activity Based Costing - 250622Document26 pages2.2 PM - Activity Based Costing - 250622abhijit tikekarNo ratings yet

- ABC Model For A UniversityDocument20 pagesABC Model For A UniversityrahulNo ratings yet

- Final Managerial 2016 SolutionDocument10 pagesFinal Managerial 2016 SolutionRanim HfaidhiaNo ratings yet

- FIDM 2019-20 - L3 CompleteDocument55 pagesFIDM 2019-20 - L3 CompleteAdam StożekNo ratings yet

- Managerial Accounting, Fourth EditionDocument48 pagesManagerial Accounting, Fourth EditionSpider177No ratings yet

- Activity Based Costing and Service Cost Allocation MethodsDocument40 pagesActivity Based Costing and Service Cost Allocation MethodsrhearomefranciscoNo ratings yet

- Activity Based CostingDocument52 pagesActivity Based CostingAfrina AfsarNo ratings yet

- Chapter 10 Activity Based CostingDocument10 pagesChapter 10 Activity Based CostingRuby P. MadejaNo ratings yet

- Activity Based Costing: By: Kasahun N. (M.SC.)Document20 pagesActivity Based Costing: By: Kasahun N. (M.SC.)Mulugeta WoldeNo ratings yet

- Strategic Cost ManagementDocument7 pagesStrategic Cost Managementjayesh jhaNo ratings yet

- Ch04 Activity Based CostingDocument52 pagesCh04 Activity Based CostingDaniel John Cañares LegaspiNo ratings yet

- ABC - Sem-IV - 10 MarksDocument5 pagesABC - Sem-IV - 10 MarksTechboy RahulNo ratings yet

- Lecture 6 - ABC Costing RevisedDocument22 pagesLecture 6 - ABC Costing RevisedMJ jNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- Process CostingDocument43 pagesProcess CostingbortycanNo ratings yet

- ABC Costing Autumn 19Document15 pagesABC Costing Autumn 19Tory IslamNo ratings yet

- Chapter 5 ABC System For StudentsDocument14 pagesChapter 5 ABC System For StudentsNour Al Kaddah100% (1)

- Chapter 6 PRODUCT AND SERVICE COSTINGDocument40 pagesChapter 6 PRODUCT AND SERVICE COSTINGsalsa azzahraNo ratings yet

- S Iv CC 402 ScmaDocument60 pagesS Iv CC 402 ScmaRajnish DubeyNo ratings yet

- Activity Based Costing 1st Sem 2023 24Document38 pagesActivity Based Costing 1st Sem 2023 24Jessy Mae FlorentinoNo ratings yet

- Group 6 PPT CaseDocument33 pagesGroup 6 PPT CaseRavNeet KaUr100% (1)

- Activity Based CostingDocument49 pagesActivity Based CostingAries Gonzales CaraganNo ratings yet

- PPC Ch. 4Document20 pagesPPC Ch. 4Mulugeta WoldeNo ratings yet

- Universidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesDocument5 pagesUniversidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesAqib LatifNo ratings yet

- Questions and Answers For MGT 3 000 Level 23Document15 pagesQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNo ratings yet

- Compute The Equivalent Units of ProductionDocument1 pageCompute The Equivalent Units of Productionsb73_817No ratings yet

- Process Costing: This Is On The Other Side of The Continuum From Job CostingDocument28 pagesProcess Costing: This Is On The Other Side of The Continuum From Job CostingRajeev NairNo ratings yet

- Managerial AccountingDocument11 pagesManagerial Accountingmiljane perdizoNo ratings yet

- Cost CH 3Document40 pagesCost CH 3tewodrosbayisaNo ratings yet

- ABC - Suggested Answer - 0Document8 pagesABC - Suggested Answer - 0pam pamNo ratings yet

- ABC Sample ProblemsDocument16 pagesABC Sample ProblemsrsalicsicNo ratings yet

- Activity Based CostingDocument20 pagesActivity Based CostingArpit SahaiNo ratings yet

- Upload Week 4Document7 pagesUpload Week 4Suman PreetNo ratings yet

- COST ALLOCATION and ACTIVITY-BASED COSTINGDocument5 pagesCOST ALLOCATION and ACTIVITY-BASED COSTINGBeverly Claire Lescano-MacagalingNo ratings yet

- Abc PDFDocument55 pagesAbc PDFPawan PoynauthNo ratings yet

- ABC Hansen & Mowen ch4 P ('t':'3', 'I':'669594619') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Document22 pagesABC Hansen & Mowen ch4 P ('t':'3', 'I':'669594619') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Aziza AmranNo ratings yet

- Standard Costing and Basic VariancesDocument9 pagesStandard Costing and Basic Variancesbrian bolloNo ratings yet

- Activity-Based Costing: Activity-Based Costing Is The Best Functional-Based Costing Is Good For UsDocument32 pagesActivity-Based Costing: Activity-Based Costing Is The Best Functional-Based Costing Is Good For UsRichardNo ratings yet

- ABC and CashFlow QuestionDocument11 pagesABC and CashFlow QuestionTerryDemetrioCesarNo ratings yet

- Activity Based CostingDocument10 pagesActivity Based CostingEdi Kristanta PelawiNo ratings yet

- Wk4 Seminar Abc & Overhead Absorption Methods Q Workshop Problems Example 1Document6 pagesWk4 Seminar Abc & Overhead Absorption Methods Q Workshop Problems Example 1FungaiNo ratings yet

- Chapter 4Document15 pagesChapter 4Arun Kumar SatapathyNo ratings yet

- Process Costing, RAMAN ROYDocument109 pagesProcess Costing, RAMAN ROYramanroy0% (1)

- Wilkerson Case Study Final1Document5 pagesWilkerson Case Study Final1Swapan Kumar Saha100% (1)

- MFA - Assessment - 2 - SolutionDocument12 pagesMFA - Assessment - 2 - Solutionvishnu kanthNo ratings yet

- Break Even AnalysisDocument33 pagesBreak Even AnalysisArunraj ArumugamNo ratings yet

- Creating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowFrom EverandCreating a One-Piece Flow and Production Cell: Just-in-time Production with Toyota’s Single Piece FlowRating: 4 out of 5 stars4/5 (1)

- Microeconomics 19th Edition Samuelson Test BankDocument25 pagesMicroeconomics 19th Edition Samuelson Test BankRobertFordicwr100% (55)

- Excel Modeling in Investments 4th Edition Holden Solutions ManualDocument87 pagesExcel Modeling in Investments 4th Edition Holden Solutions Manualvictoriawaterswkdxafcioq100% (16)

- Notes - PartnershipDocument56 pagesNotes - PartnershipsudhirbazzeNo ratings yet

- Inventories, Biological Assets, Etc.Document3 pagesInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNo ratings yet

- Carbonaro SeminarDocument50 pagesCarbonaro SeminarernycueaNo ratings yet

- Main Project of SHGDocument27 pagesMain Project of SHGMinal DalviNo ratings yet

- Rogue Trader Profit FactorDocument9 pagesRogue Trader Profit FactorMorkizgaNo ratings yet

- Ban 500, 1000 Notes - Corruption Uprooted or Just Changing Clothes!Document35 pagesBan 500, 1000 Notes - Corruption Uprooted or Just Changing Clothes!Arun JagaNo ratings yet

- Addresses of AMC Branches 160711Document40 pagesAddresses of AMC Branches 160711kimsrNo ratings yet

- Environmental Impact Assessment (Eia)Document9 pagesEnvironmental Impact Assessment (Eia)kashyap jyoti gohainNo ratings yet

- CHAPTER 1 ENTREPRENEURIAL PROCESS NewDocument16 pagesCHAPTER 1 ENTREPRENEURIAL PROCESS NewNurul Wahida Binti Safiyudin C19A0696No ratings yet

- Bookmap Presentation (BMT)Document29 pagesBookmap Presentation (BMT)Second KonieNo ratings yet

- Corporate Social Responsibility and Tax AggressivenessDocument28 pagesCorporate Social Responsibility and Tax AggressivenessAdella WulandariNo ratings yet

- PDFDocument2 pagesPDFRodrigo Uribe BravoNo ratings yet

- College Admission Essay Format ExampleDocument5 pagesCollege Admission Essay Format Examplefz68tmb4100% (2)

- Insurance ContractsDocument19 pagesInsurance Contractsstarstarstar100% (1)

- PipDocument199 pagesPipShrinivasa RaoNo ratings yet

- IDT MCQ's - June 21 & Dec 21 ExamsDocument99 pagesIDT MCQ's - June 21 & Dec 21 ExamsDinesh GadkariNo ratings yet

- S. Akbar ZaidiDocument19 pagesS. Akbar Zaidifaiz100% (1)

- Macro and Micro Economics of MalaysiaDocument13 pagesMacro and Micro Economics of MalaysiaGreyGordonNo ratings yet

- Tutorial 3 QuestionsDocument3 pagesTutorial 3 Questionsguan junyanNo ratings yet

- Payment Orchestration Guide 1703514938942Document55 pagesPayment Orchestration Guide 1703514938942Roger OlivieiraNo ratings yet

- Voltas Annual Report 2009-2010Document120 pagesVoltas Annual Report 2009-2010L R SADHASIVAMNo ratings yet

- How To Start Investing in Philippine Stock MarketDocument53 pagesHow To Start Investing in Philippine Stock MarketAlbert Aromin100% (1)

- Ee Roadinfra Tend 01Document3 pagesEe Roadinfra Tend 01Prasanna VswamyNo ratings yet

- BSP Interim Org ChartDocument2 pagesBSP Interim Org ChartJerah Marie PepitoNo ratings yet

- 1995 NAFTA and Mexico's Maize ProducersDocument14 pages1995 NAFTA and Mexico's Maize ProducersJose Manuel FloresNo ratings yet

- Toate Subiectele Sunt Obligatorii. Se Acord Timpul Efectiv de Lucru Este de 3 OreDocument2 pagesToate Subiectele Sunt Obligatorii. Se Acord Timpul Efectiv de Lucru Este de 3 OreOliviu ArsenieNo ratings yet

- Marketing Plan Group 5Document29 pagesMarketing Plan Group 5Neri La Luna100% (1)