Professional Documents

Culture Documents

Chap 004

Chap 004

Uploaded by

ahmed hilles0 ratings0% found this document useful (0 votes)

3 views24 pagesinvestment theory

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentinvestment theory

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views24 pagesChap 004

Chap 004

Uploaded by

ahmed hillesinvestment theory

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 24

CHAPTER 4

Mutual Funds and Other

Investment Companies

INVESTMENTS | BODIE, KANE, MARCUS

McGraw-Hill/Irwin Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

4-2

Investment Companies

• Pool funds of individual investors and invest

in a wide range of securities or other assets.

• Services provided:

– Administration & record keeping

– Diversification & divisibility

– Professional management

– Reduced transaction costs

INVESTMENTS | BODIE, KANE, MARCUS

4-3

Net Asset Value

Calculation:

Market Value of Assets - Liabilities

Shares Outstanding

INVESTMENTS | BODIE, KANE, MARCUS

4-4

Types of Investment Companies

• Unit Trusts

– Fixed portfolio of uniform assets

– Unmanaged

– Total assets have declined from

$105 billion in 1990 to $29 billion in

2009

INVESTMENTS | BODIE, KANE, MARCUS

4-5

Types of Investment Companies

• Managed Investment Companies

– Open-End

• Fund issues new shares when

investors buy in and redeems

shares when investors cash out

• Priced at Net Asset Value (NAV)

INVESTMENTS | BODIE, KANE, MARCUS

4-6

Types of Investment Companies

• Managed Investment Companies

– Closed-End

• no change in shares outstanding;

old investors cash out by selling

to new investors

• Priced at premium or discount to

NAV

INVESTMENTS | BODIE, KANE, MARCUS

4-7

Types of Investment Companies

• Other investment organizations

– Commingled funds

– REITs

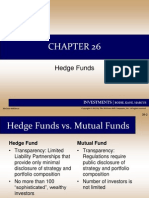

– Hedge Funds

INVESTMENTS | BODIE, KANE, MARCUS

4-8

Mutual Funds: Open-End Investment

Companies

• Money Market

• Equity

• Sector

• Bond

• Balanced

• Asset Allocation and Flexible

• Index

• International

INVESTMENTS | BODIE, KANE, MARCUS

4-9

Table 4.1 U.S. Mutual Funds by Investment

Classification

INVESTMENTS | BODIE, KANE, MARCUS

9

4-10

How Funds Are Sold

• Direct-marketed funds

• Sales force distributed

– Revenue sharing on sales force

distributed

– Potential conflicts of interest

• Financial Supermarkets

INVESTMENTS | BODIE, KANE, MARCUS

4-11

Costs of Investing in Mutual Funds

• Fee Structure: Four types

1. Operating expenses

2. Front-end load

3. Back-end load

4. 12 b-1 charge

• Fees must be disclosed in the prospectus

• Share classes with different fee

combinations

INVESTMENTS | BODIE, KANE, MARCUS

4-12

Example 4.2: Fees for Various Classes

(Dreyfus Worldwide Growth Fund)

INVESTMENTS | BODIE, KANE, MARCUS

4-13

Fees and Mutual Fund Returns:

An Example

Initial NAV = $20

Income distributions of $.15

Capital gain distributions of $.05

Ending NAV = $20.10:

NAV1 NAV0 Income and capital gain distributions

Rate of return =

NAV0

$20.10 - $20.00 + $.15 + $.05

Rate of Return = 1.5%

$20.00

INVESTMENTS | BODIE, KANE, MARCUS

4-14

Table 4.2 Impacts of Costs on Investment

Performance

INVESTMENTS | BODIE, KANE, MARCUS

4-15

Late Trading and Market Timing

• Late trading – accepting buy or sell orders

after the market closes and NAV is determined

• Market timing – rapid in-and-out trading on

stale net asset values

• Net effect is to transfer value from ordinary

shareholders to privileged traders

• Mutual funds penalized for improper

trading. New rules to prevent these

practices

INVESTMENTS | BODIE, KANE, MARCUS

4-16

Taxation of Mutual Fund Income

• Pass-through status under the U.S. tax

code

– Taxes are paid only by the investor

– Fund investors do not control the timing

of the sales of securities from the

portfolio

• High portfolio turnover leads to tax

inefficiency

– Average turnover = 60%

INVESTMENTS | BODIE, KANE, MARCUS

4-17

Exchange Traded Funds

• Examples: “spiders”, “diamonds” and “cubes”

• Potential advantages:

– Trade continuously like stocks

– Can be sold short or purchased on margin

– Lower costs

– Tax efficient

• Potential disadvantages:

– Prices can depart by small amounts from NAV

– Must be purchased from a broker

INVESTMENTS | BODIE, KANE, MARCUS

4-18

Figure 4.2 Growth of U.S. ETFs over

time

INVESTMENTS | BODIE, KANE, MARCUS

4-19

Table 4.3 ETF Sponsors and Products

INVESTMENTS | BODIE, KANE, MARCUS

4-20

Mutual Fund Investment Performance:

A First Look

• Performance of actively managed funds:

– below the return on the Wilshire index in

23 of the 39 years from 1971 to 2009

– Evidence for persistent superior

performance (due to skill and not just

good luck) is weak, but suggestive

– Bad performance more likely to persist

INVESTMENTS | BODIE, KANE, MARCUS

4-21

Figure 4.3 Diversified Equity Funds versus

Wilshire 5000 Index

INVESTMENTS | BODIE, KANE, MARCUS

4-22

Table 4.4 Consistency of

Investment Results

INVESTMENTS | BODIE, KANE, MARCUS

4-23

Information on Mutual Funds

• Fund’s prospectus describes:

– investment objectives

– Fund investment adviser and portfolio

manager

– Fees and costs

• Statement of Additional Information

(SAI)

• Fund’s annual report

INVESTMENTS | BODIE, KANE, MARCUS

4-24

Information on Mutual Funds

• Wiesenberger’s Investment Companies

• Morningstar (www.morningstar.com)

• Yahoo (biz.yahoo.com/funds)

• Investment Company Institute (www.ici.org)

• Directory of Mutual Funds

INVESTMENTS | BODIE, KANE, MARCUS

You might also like

- Topic G ExercisesDocument8 pagesTopic G ExercisesAustin Joseph100% (1)

- Bodie Investments 12e PPT CH03Document32 pagesBodie Investments 12e PPT CH03kaylakshmi8314100% (2)

- Bodie Investments 12e PPT CH16Document46 pagesBodie Investments 12e PPT CH16RajonNo ratings yet

- MMA Business PlanDocument18 pagesMMA Business PlanLetmeseethis100% (1)

- Bodie Investments 12e PPT CH10Document18 pagesBodie Investments 12e PPT CH10黃浩瑋No ratings yet

- 2nd - Amend.third Party - Cmpt.kazenercom - Turan.03.15Document117 pages2nd - Amend.third Party - Cmpt.kazenercom - Turan.03.15bels15443No ratings yet

- Chapter One: The Investment EnvironmentDocument67 pagesChapter One: The Investment EnvironmentZhi Hwang100% (2)

- Chap 026sddDocument33 pagesChap 026sddsatishiitrNo ratings yet

- Chapter Twenty-Four: Portfolio Performance EvaluationDocument33 pagesChapter Twenty-Four: Portfolio Performance EvaluationAreej AlGhamdi100% (2)

- Chapter Seven: Efficient DiversificationDocument35 pagesChapter Seven: Efficient DiversificationAreej AlGhamdi100% (2)

- Bodie Kane Marcus InvestmentsDocument38 pagesBodie Kane Marcus InvestmentsZaindi Zidane100% (2)

- Chapter One: The Investment EnvironmentDocument30 pagesChapter One: The Investment Environmentkaylakshmi8314100% (1)

- Chapter Two: Asset Classes and Financial InstrumentsDocument28 pagesChapter Two: Asset Classes and Financial Instrumentskaylakshmi831450% (2)

- W6 - ANALYTICAL TOOLS AND TECHNIQUES FOR FINANCIAL ANALYSIS - 2020 - Final PDFDocument158 pagesW6 - ANALYTICAL TOOLS AND TECHNIQUES FOR FINANCIAL ANALYSIS - 2020 - Final PDFjeremy AntoninNo ratings yet

- Singer Sri Lanka PLCDocument24 pagesSinger Sri Lanka PLCSANDUN KAVINDANo ratings yet

- Capitalism and Accounting in The Dutch East-India Company 1602-16Document538 pagesCapitalism and Accounting in The Dutch East-India Company 1602-16Saarvin சர்வின் 李在山 سرفينNo ratings yet

- Mutual Funds and Other Investment Companies: Bodie, Kane and MarcusDocument20 pagesMutual Funds and Other Investment Companies: Bodie, Kane and MarcusMd TowkikNo ratings yet

- IAE Chap 24 Portfolio Performance EvaluationDocument34 pagesIAE Chap 24 Portfolio Performance EvaluationAlfaRahmatMaulanaNo ratings yet

- Managing Bond Portfolios: InvestmentsDocument39 pagesManaging Bond Portfolios: InvestmentsPepper CorianderNo ratings yet

- Introduction To Risk, Return, and The Historical Record: InvestmentsDocument44 pagesIntroduction To Risk, Return, and The Historical Record: InvestmentsSaurav SinghNo ratings yet

- The Term Structure of Interest Rates: Investments - Bodie, Kane, MarcusDocument37 pagesThe Term Structure of Interest Rates: Investments - Bodie, Kane, MarcusMohammed Al-YagoobNo ratings yet

- BKM Chapter 3 SlidesDocument41 pagesBKM Chapter 3 SlidesIshaNo ratings yet

- Chap 018Document38 pagesChap 018MaryNo ratings yet

- Risk Aversion and Capital AllocationDocument38 pagesRisk Aversion and Capital AllocationVishwak SubramaniamNo ratings yet

- Class 1 Investments BKM Chapter9Document19 pagesClass 1 Investments BKM Chapter9Daniel PortellaNo ratings yet

- The Term Structure of Interest Rates: Denitsa StefanovaDocument41 pagesThe Term Structure of Interest Rates: Denitsa StefanovathofkampNo ratings yet

- Chapter 24 PDFDocument50 pagesChapter 24 PDFAreej AlGhamdi100% (1)

- Bodie Investments CH04Document28 pagesBodie Investments CH04rafat.jalladNo ratings yet

- Chapter Four: Mutual Funds and Other Investment CompaniesDocument24 pagesChapter Four: Mutual Funds and Other Investment CompaniesnouraNo ratings yet

- Chap 008Document27 pagesChap 008Chajar Matari Fath MalaNo ratings yet

- Investments. Lecture Notes 2Document34 pagesInvestments. Lecture Notes 2Oona NiallNo ratings yet

- Chap 02 Asset Class and Financial InstrumentsDocument29 pagesChap 02 Asset Class and Financial Instrumentsall friendsNo ratings yet

- Chapter Five: Risk, Return, and The Historical RecordDocument27 pagesChapter Five: Risk, Return, and The Historical RecordAreej AlGhamdiNo ratings yet

- Chapter Eleven: The Efficient Market HypothesisDocument33 pagesChapter Eleven: The Efficient Market HypothesisAreej AlGhamdi100% (2)

- Chapter Two: Asset Classes and Financial InstrumentsDocument27 pagesChapter Two: Asset Classes and Financial Instrumentsbilly93100% (1)

- Bodie 11e PPT Ch09Document22 pagesBodie 11e PPT Ch09Fatimah Alashour100% (1)

- Chapter Six: Capital Allocation To Risky AssetsDocument32 pagesChapter Six: Capital Allocation To Risky AssetsSUNLINo ratings yet

- FINA0804 Assignment 4 PDFDocument2 pagesFINA0804 Assignment 4 PDFHarry KwongNo ratings yet

- Bodie Investments Ch06Document35 pagesBodie Investments Ch06rafat.jalladNo ratings yet

- Asset Classes and Financial InstrumentsDocument33 pagesAsset Classes and Financial Instrumentskaylakshmi8314No ratings yet

- Portfolio Management: Lecturer: Th.S. Le Phuoc Thanh (NCS)Document47 pagesPortfolio Management: Lecturer: Th.S. Le Phuoc Thanh (NCS)Eli ZabethNo ratings yet

- Financial ServicesDocument77 pagesFinancial ServicesGiridhara Raju80% (5)

- Alternative Investment FundsDocument10 pagesAlternative Investment Fundskrishna sharmaNo ratings yet

- Sapm - Fifth (5) Sem BBIDocument156 pagesSapm - Fifth (5) Sem BBIRasesh ShahNo ratings yet

- Foreign Currency Derivatives: Futures and OptionsDocument35 pagesForeign Currency Derivatives: Futures and OptionsMinerva Education100% (1)

- Bab 9 MIPDocument24 pagesBab 9 MIPAprilia MarshyaNo ratings yet

- Man - Invest Chap 006Document34 pagesMan - Invest Chap 006yolaNo ratings yet

- Types of Mutual FundDocument3 pagesTypes of Mutual FundKhunt DadhichiNo ratings yet

- Chapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinDocument21 pagesChapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinmaheraldamatiNo ratings yet

- Portfolio Management Through Mutual FundsDocument14 pagesPortfolio Management Through Mutual FundsMedha SinghNo ratings yet

- Capital Allocation To Risky Assets: Investments - Bodie, Kane, MarcusDocument22 pagesCapital Allocation To Risky Assets: Investments - Bodie, Kane, MarcussaharNo ratings yet

- Secondary Market: Sanjo K Sunil S3, KicmaDocument21 pagesSecondary Market: Sanjo K Sunil S3, KicmaSANJO K SUNILNo ratings yet

- Bodie Investments 12e PPT CH13Document33 pagesBodie Investments 12e PPT CH13黃浩瑋No ratings yet

- Mutual Funds: By: Dr. Neelam TandonDocument28 pagesMutual Funds: By: Dr. Neelam TandonSuresh RaghavNo ratings yet

- Zeus Asset Management Inc. - Team 1 - Investment ManagementDocument4 pagesZeus Asset Management Inc. - Team 1 - Investment ManagementVvb SatyanarayanaNo ratings yet

- Chapter 1 The Investment EnvironmentDocument32 pagesChapter 1 The Investment EnvironmentNguyễn VânNo ratings yet

- 9 Mutual FundsDocument32 pages9 Mutual FundsarmailgmNo ratings yet

- BKM PPT Ch24 10eDocument43 pagesBKM PPT Ch24 10eSaurabh Chauhan100% (1)

- Chap 004Document25 pagesChap 004K59 Le Nhat ThanhNo ratings yet

- FNCE4030 Fall 2014 ch04 Handout PDFDocument29 pagesFNCE4030 Fall 2014 ch04 Handout PDFabdul mateenNo ratings yet

- Week 1FDocument23 pagesWeek 1FJessicaNo ratings yet

- CH - 04 Mutual Funds and Other Investment CompaniesDocument27 pagesCH - 04 Mutual Funds and Other Investment CompaniesshomudrokothaNo ratings yet

- Mutual Funds and Other Investment CompaniesDocument19 pagesMutual Funds and Other Investment Companiesliyjb2No ratings yet

- Mutual Funds and Other Investment CompaniesDocument10 pagesMutual Funds and Other Investment Companiesz_k_j_vNo ratings yet

- Dividend Investing: Passive Income and Growth Investing for BeginnersFrom EverandDividend Investing: Passive Income and Growth Investing for BeginnersNo ratings yet

- Appendix 9ADocument9 pagesAppendix 9AAndreea Ioana100% (1)

- RushilDocument382 pagesRushilReetika KashivNo ratings yet

- 4.budgetory ControlDocument66 pages4.budgetory ControlSrinivas ReddyNo ratings yet

- Healthsouth ScandalDocument11 pagesHealthsouth ScandalAnshak KumarNo ratings yet

- Future Worth Analysis + Capitalized CostDocument19 pagesFuture Worth Analysis + Capitalized CostjefftboiNo ratings yet

- Redrawing The Lines Fintechs Growing Influence On Financial Services PDFDocument18 pagesRedrawing The Lines Fintechs Growing Influence On Financial Services PDFRajyaLakshmiNo ratings yet

- Bid Proposal TemplateDocument3 pagesBid Proposal TemplateGunawan Budi SantosaNo ratings yet

- BM AssignmentDocument4 pagesBM AssignmentafridaNo ratings yet

- Duties of Directors Under Company LawDocument6 pagesDuties of Directors Under Company LawManasvi ThaparNo ratings yet

- Jindal FamilyDocument31 pagesJindal FamilyOkkishoreNo ratings yet

- Rappler 1 of 3 Coco Levy Fund ScamDocument15 pagesRappler 1 of 3 Coco Levy Fund ScamHarry PeterNo ratings yet

- Basic Principles of EconomicsDocument23 pagesBasic Principles of EconomicsFrank WilliamsNo ratings yet

- Technical Analysis 2Document10 pagesTechnical Analysis 2BellwetherSataraNo ratings yet

- Development of A Business PlanDocument12 pagesDevelopment of A Business PlanCriziaClaire CosmeNo ratings yet

- Cash Flow Statement AnalysisDocument19 pagesCash Flow Statement AnalysisKNOWLEDGE CREATORS90% (10)

- 13 Controls For Differentiate StrategiesDocument15 pages13 Controls For Differentiate StrategiesAnisa KartiniNo ratings yet

- NDocument2 pagesNYna YnaNo ratings yet

- Insurance Law ProjectDocument14 pagesInsurance Law Projectlokesh4nigamNo ratings yet

- Valuation of SecuritiesDocument71 pagesValuation of Securitieskuruvillaj2217No ratings yet

- Kuruwita Textile Mills PLC: Annual Report 09/10Document42 pagesKuruwita Textile Mills PLC: Annual Report 09/10mimriyathNo ratings yet

- Reliance General Insurance CompanyDocument55 pagesReliance General Insurance Companyrajesh_dawat19910% (2)

- Emirates Case StudyDocument16 pagesEmirates Case Studymkadawi770100% (2)

- MAS MIDTERM EXAM 1ST SEM AY2017-18 - With AnswersDocument19 pagesMAS MIDTERM EXAM 1ST SEM AY2017-18 - With AnswersUy Samuel100% (1)

- Merger and Consolidation of Icici Ltd. and Icici BankDocument65 pagesMerger and Consolidation of Icici Ltd. and Icici BankArpit GuptaNo ratings yet