Professional Documents

Culture Documents

CH 04

Uploaded by

Hiền Anh0 ratings0% found this document useful (0 votes)

73 views56 pagesOriginal Title

ch04

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

73 views56 pagesCH 04

Uploaded by

Hiền AnhCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 56

Fundamentals of Corporate Finance

Fifth Edition, International Adaptation

Robert Parrino, Ph.D.; David S. Kidwell, Ph.D.;

Thomas W. Bates, Ph.D.; Stuart Gillan, Ph.D.

Chapter 4

Analyzing Financial Statements

Copyright ©2022 John Wiley & Sons, Inc.

Chapter 4: Analyzing Financial

Statements

Copyright ©2022 John Wiley & Sons, Inc. 2

Learning Objectives (1 of 2)

1. Explain the four perspectives from which financial

statements can be viewed

2. Describe common-size financial statements, explain

why they are used, and be able to prepare and use them

to analyze the historical performance of a firm

3. Discuss how financial ratios facilitate financial

analysis and be able to compute and use them to

analyze a firm’s performance

Copyright ©2022 John Wiley & Sons, Inc. 3

Learning Objectives (2 of 2)

4. Describe the DuPont system of analysis and be able to

use it to evaluate a firm’s performance and identify

corrective actions that may be necessary

5. Explain what benchmarks are, describe how they are

prepared, and discuss why they are important in

financial statement analysis

6. Identify the major limitations in using financial

statement analysis

Copyright ©2022 John Wiley & Sons, Inc. 4

4.1 Background for Financial Statement Analysis

LEARNING OBJECTIVE

Explain the four perspectives from which financial statements

can be viewed

• Background for Financial Statement Analysis

• Perspectives on Financial Statement Analysis

o Stockholders

o Managers

o Creditors and

o Other stakeholders

• Guidelines for Financial Statement Analysis

o Trend analysis

o Benchmark

L.O. 4.1 Copyright ©2022 John Wiley & Sons, Inc. 5

Background for Financial Statement

Analysis

• The typical financial statement analysis involves the

use of financial statements to analyze a company’s

performance and assess its strengths and weaknesses

• There are four basic and different perspectives that are

necessary when analyzing financial statements

• The section introduces some helpful guidelines for

financial statement analysis

L.O. 4.1 Copyright ©2022 John Wiley & Sons, Inc. 6

Perspectives on Financial Statement

Analysis

• Stockholders focus on net cash flows, risk, rate of return, and

the market value of the firm’s stock

• Managers focus on rate of return, efficient use of assets,

controlling costs, increasing net cash flows, increasing the

market value of the firm’s stock, and job security

• Creditors focus on the predictability of revenues and expenses,

the ability to meet short-term obligations, the ability to make

loan payments as scheduled and avoidance of changes in risk

• Other stakeholders, including suppliers and employees, who

also have claims on the firm’s cash flows, have similar interests.

L.O. 4.1 Copyright ©2022 John Wiley & Sons, Inc. 7

Guidelines for Financial Statement

Analysis

• Understand which perspective: stockholder, manager,

creditor, or other stakeholders

• Use audited financial statements

• Use 3 to 5 years of statements to enable trend analysis

• Benchmark to competitors of similar size with similar

products and services

L.O. 4.1 Copyright ©2022 John Wiley & Sons, Inc. 8

4.2 Common-Size Financial Statements

LEARNING OBJECTIVE

Describe common-size financial statements, explain why

they are used, and be able to prepare and use them to

analyze the historical performance of the firm

• Common-Size Financial Statements

• Common-Size Balance Sheets

• Common-Size Income Statements

L.O. 4.2 Copyright ©2022 John Wiley & Sons, Inc. 9

Common-Size Financial Statements

• Common-size financial statements show the dollar

amount of each item as a percentage of a reference

value

o Common-size balance sheet use total assets as the

reference value; each item is expressed as a percentage

of total assets

o Common-size income statement use net sales as the

reference value; each item is expressed as a percentage

of net sales

L.O. 4.2 Copyright ©2022 John Wiley & Sons, Inc. 10

Common-Size Balance Sheet

• The Common-Size Balance Sheet standardizes the

amount in a balance sheet account by converting the

dollar value of each item to its percentage of total

assets

o Dollar values on a regular balance sheet provide

information on the number of dollars associated with a

balance sheet account

o Percentage values on a common-size balance sheet

provide information on the relative size or importance

of the dollars associated with a balance sheet account

L.O. 4.2 Copyright ©2022 John Wiley & Sons, Inc. 11

Exhibit 4.1 Common-Size Balance Sheets

for Diaz Manufacturing on December 31

($ millions)

2020 2020 2019 2019 2018 2018

% of % of % of

Assets Assets Assets

Assets

Cash and marketable securities $ 288.5 15.3 $ 16.6 1.1 $ 8.2 0.6

Accounts receivable 306.2 16.2 268.8 18.0 271.5 19.4

Inventories 423.8 22.4 372.7 24.9 400.0 28.6

Other current assets 21.3 1.1 29.9 2.0 24.8 1.8

Total current assets $1,039.8 55.0 $ 688.0 46.1 $ 704.5 50.4

Plant and equipment (net) 399.4 21.1 394.2 26.4 419.6 30.0

Goodwill and other assets 450.0 23.8 411.6 27.6 273.9 19.6

Total assets $1,889.2 100.0 $1,493.8 100.0 $1,398.0 100.0

L.O. 4.2 Copyright ©2022 John Wiley & Sons, Inc. 12

Common-Size Balance Sheets for Diaz

Manufacturing on December 31 ($ millions)

Liabilities and Stockholders’ Equity:

Accounts payable and accruals $ 349.3 18.5 $ 325.0 21.8 $ 395.0 28.3

Notes payable 10.5 0.6 4.2 0.3 14.5 1.0

Accrued income taxes 18.0 1.0 16.8 1.1 12.4 0.9

Total current liabilities $ 377.8 20.0 $ 346.0 23.2 $ 421.9 30.2

Long-term debt 574.0 30.4 305.6 20.5 295.6 21.1

Total liabilities $ 951.8 50.4 $ 651.6 43.6 $ 717.5 51.3

Common stock (54,566,054 shares) 0.5 0.0 0.5 0.0 0.5 0.0

Additional paid-in capital 892.4 47.2 892.4 59.7 892.4 63.8

Retained earnings 67.8 3.6 (50.7) (3.4) (155.8) (11.1)

Less: Treasury stock (23.3) (1.2) – – (56.6) (4.0)

Total stockholders’ equity $ 937.4 49.6 $ 842.2 56.4 $ 680.5 48.7

Total liabilities and equity $1,889.2 100.0 $1,493.8 100.0 $1,398.0 100.0

L.O. 4.2 Copyright ©2022 John Wiley & Sons, Inc. 13

Common-Size Income Statement

• The most useful way to prepare a common size income

statement is to express each account as a percentage of

net sales

• Each expense is interpreted as the cost incurred to

generate $1 in sales

L.O. 4.2 Copyright ©2022 John Wiley & Sons, Inc. 14

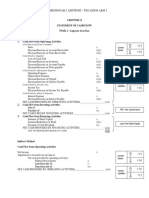

Common-Size Income Statements for

Diaz Manufacturing for Fiscal Years

Ending December 31 ($ millions) (1 of 2)

2020 2020 2019 2019 2018 2018

% of % of % of

Net Net Net

Sales Sales Sales

Net sales $1,563.7 100.0 $1,386.7 100.0 $1,475.1 100.0

Cost of goods sold 1,081.1 69.1 974.8 70.3 1,076.3 73.0

Selling and administrative expenses 231.1 14.8 197.4 14.2 205.7 13.9

Earnings before interest, taxes,

depreciation, and amortization

(EBITDA) $ 251.5 16.1 $ 214.5 15.5 $ 193.1 13.1

Depreciation 83.1 5.3 75.3 5.4 71.2 4.8

Earnings before interest and taxes $ 168.4 10.8 $ 139.2 10.0 $ 121.9 8.3

(EBIT)

L.O. 4.2 Copyright ©2022 John Wiley & Sons, Inc. 15

Common-Size Income Statements for

Diaz Manufacturing for Fiscal Years

Ending December 31 ($ millions) (2 of 2)

Interest expense 5.6 0.4 18.0 1.3 27.8 1.9

Earnings before taxes (EBT) $ 162.8 10.4 $ 121.2 8.7 $ 94.1 6.4

Taxes 44.3 2.8 16.1 1.2 27.9 1.9

Net income $ 118.5 7.6 $ 105.1 7.6 $ 66.2 4.5

Dividends – – –

Addition to retained earnings $ 118.5 $105.1 $66.2

L.O. 4.2 Copyright ©2022 John Wiley & Sons, Inc. 16

4.3 Financial Ratios and Firm Performance

LEARNING OBJECTIVE

Discuss how financial ratios facilitate financial analysis and be able

to compute and use them to analyze a firm’s performance

• Financial Ratios and Firm Performance

• Why Ratios Are Better Measures

• Short-Term Liquidity Ratios

• Efficiency Ratios

• Leverage Ratios

• Profitability Ratios

• Market-Value Indicators

• Concluding Comments on Ratios

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 17

Financial Ratios and Firm

Performance

• Other specialized financial ratios help analysts

interpret the myriad of numbers in financial

statements.

• Financial ratios can be used to measure a firm’s

o liquidity

o efficiency

o leverage

o profitability and

o market value

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 18

Why Ratios Are Better Measures

• Financial ratios establish a common reference point

across firms, even though the numerical value of the

reference point will differ from firm-to-firm

o Ratios make it easier to compare the performance of

large firms to that of small firms

o Ratios make it easier to compare the current and

historical performance of a single firm as the firm

changes over time (trend analysis)

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 19

Short-Term Liquidity Ratios

• Liquidity ratios indicate a firm’s ability to pay short-term

obligations with short-term assets without endangering the firm.

In general, higher ratios are a favorable indicator

Equation 4.1

Equation 4.2

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 20

Efficiency Ratios (1 of 2)

• Efficiency ratios indicate a firm’s ability to use assets to produce

sales. These are also called asset turnover ratios. In general,

higher numbers are a favorable indicator. For days sales in

inventory, however, a lower number is favorable.

Equation 4.3

Equation 4.4

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 21

Efficiency Ratios (2 of 2)

Equation 4.5

Equation 4.6

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 22

Asset Turnover Ratios

Equation 4.7

Equation 4.8

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 23

Leverage Ratios

• Financial leverage ratios indicate whether a firm is using the

appropriate amount of debt financing. In general, higher debt ratios

indicate greater potential return and greater bankruptcy risk.

Equation 4.9

Equation 4.10

Equation 4.11

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 24

Coverage Ratios

• For the following ratios, a higher number generally

indicates less bankruptcy risk and (possibly) lower

potential return

Equation 4.12

Equation 4.13

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 25

Profitability Ratios (1 of 2)

• Profitability ratios indicate whether a firm is generating

adequate profit from its assets. In general, higher ratios

indicate better performance.

Equation 4.14

Equation 4.15

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 26

Profitability Ratios (2 of 2)

Equation 4.16

Equation 4.17

Equation 4.18

Equation 4.19

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 27

Market-Value Indicators

• Market-value ratios indicate how the market is valuing the firm’s

equity. Higher ratios indicate greater shareholder wealth.

Equation 4.20

Equation 4.21

Equation 4.22

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 28

Exhibit 4.3: Ratios for Time-Trend

Analysis for Diaz Manufacturing for

Fiscal Years Ending December 31

Financial Ratio 2020 2019 2018

Liquidity Ratios:

Current ratio 2.75 1.99 1.67

Quick ratio 1.63 0.91 0.72

Efficiency Ratios:

Inventory turnover 2.55 2.62 2.69

Days’ sales in inventory 143.14 139.31 135.69

Accounts receivable turnover 5.11 5.16 5.43

Days’ sales outstanding 71.43 70.74 67.22

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 29

Ratios for Time-Trend Analysis for

Diaz Manufacturing for Fiscal Years

Ending December 31 (1 of 2)

Financial Ratio 2020 2019 2018

Total asset turnover 0.83 0.93 1.06

Fixed asset turnover 3.92 3.52 3.52

Leverage Ratios:

Total debt ratio 0.50 0.44 0.51

Debt-to-equity ratio 1.02 0.77 1.05

Equity multiplier 2.02 1.77 2.05

Times interest earned 30.07 7.73 4.38

Cash coverage 44.91 11.92 6.95

Profitability Ratios:

Gross profit margin 30.86% 29.70% 27.04%

Operating profit margin 10.77% 10.04% 8.26%

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 30

Ratios for Time-Trend Analysis for

Diaz Manufacturing for Fiscal Years

Ending December 31 (2 of 2)

Financial Ratio 2020 2019 2018

Net profit margin 7.58% 7.58% 4.49%

EBIT return on assets 8.91% 9.32% 8.72%

Return on assets 6.27% 7.04% 4.74%

Return on equity 12.64% 12.48% 9.73%

Market-Value Indicators:

Price-earnings ratio 22.40 18.43 14.29

Earnings per share $2.17 $1.93 $1.21

Market-to-book ratio 2.83 1.63 1.39

Note: Numbers may not add up because of rounding.

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 31

Concluding Comments on Ratios

• The group of ratios presented in this chapter is a fair

representation of the ratios needed to analyze the

performance of a business

• When using ratios, it is important that you ask

yourself, “What does this ratio mean, and what is it

measuring?”

• Good ratios should make good economic sense when

you look at them

L.O. 4.3 Copyright ©2022 John Wiley & Sons, Inc. 32

4.4 The Dupont System: A Diagnostic Tool

LEARNING OBJECTIVE

Describe the Dupont system of analysis and be able to use it to

evaluate a firm’s performance and identify corrective actions that

may be necessary

• The Dupont System: A Diagnostic Tool

• An Overview of the DuPont System

• The ROA Equation

• The ROE Equation

• The DuPont Equation

• Applying the DuPont System

• Is Maximizing ROE an Appropriate Goal?

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 33

The Dupont System: A Diagnostic

Tool

• Fortunately, some enterprising financial managers at

the DuPont Company developed a system that ties

together some of the most important financial ratios

and provides a systematic approach to financial ratio

analysis

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 34

An Overview of the DuPont System

• Diagnostic tool for evaluating a firm’s financial health

• Uses related ratios that link the balance sheet and

income statement

• Based on two equations that connect a firm’s ROA and

ROE

• Used by management and shareholders to understand

factors that drive ROE

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 35

The ROA Equation

Equation 4.18

Equation 4.23

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 36

Two Basic Strategies to Earn a Higher

ROAa

Exhibit 4.4 To maximize a firm’s R O A, management can focus more on achieving high

profit margins or on achieving high asset turnover. High-end retailers like Tiff any & Co.

and Burberry Group plc focus more on achieving high profit margins. In contrast, grocery

and discount stores like Whole Foods Market and Walmart tend to focus more on

achieving high asset turnover because competition limits their ability to achieve very high

profit margins.

Company Asset Turnover × Profit Margin (%) = ROA (%)

High Profit Margin:

Tiffany & Co. 0.80 11.30 9.04

Burberry Group plc 1.09 12.33 13.44

High Turnover:

Whole Foods Market 2.48 3.22 7.99

Walmart Stores 2.42 3.05 7.38

a

Ratios are calculated using financial results for the fiscal year ending closest to December 2015.

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 37

The ROE Equation

Return on equity = Return on assets × Equity multiplier

Equation 4.24

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 38

The DuPont Equation

Equation 4.25

Equation 4.26

Equations 4.25 and 4.26 show that ROE is driven by

profitability, operating efficiency, and amount of

leverage (debt)

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 39

Applying the DuPont System

• The DuPont equation tells us that a firm’s ROE is

determined by three factors:

1. net profit margin, which measures the firm’s operating

efficiency and how it manages its interest expense and

taxes

2. total asset turnover, which measures the efficiency with

which the firm’s assets are utilized

3. the equity multiplier, which measures the firm’s use of

financial leverage

• The DuPont system of analysis is a useful tool to help

identify problem areas within a firm

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 40

Exhibit 4.5: Relations in the DuPont

System of Analysis for Diaz

Manufacturing in 2020 ($ millions)

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 41

Is Maximizing ROE an Appropriate

Goal?

• Is maximizing the value of ROE, as suggested by the DuPont

system equivalent to maximizing share price?

• The short answer is that the two goals are not equivalent.

• A major shortcoming of ROE is that it does not directly consider

cash flow. ROE considers earnings, but earnings are not the

same as future cash flows

• ROE does not consider risk

• ROE does not consider the size of the initial investment or the

size of future cash payments

• Despite of these shortcomings, ROE analysis is widely used in

business as a measure of operating performance

L.O. 4.4 Copyright ©2022 John Wiley & Sons, Inc. 42

4.5 Selecting a Benchmark

LEARNING OBJECTIVE

Explain what benchmarks are, describe how they are prepared, and

discuss why they are important in financial statement analysis

• Selecting a Benchmark

• Trend Analysis

• Industry Analysis

• Peer Group Analysis

L.O. 4.5 Copyright ©2022 John Wiley & Sons, Inc. 43

Selecting a Benchmark

• How do you judge whether a ratio value is too high or

too low?

• Is the value good or bad?

• The starting point for making these judgments is

selecting an appropriate benchmark—a standard that

will be the basis for meaningful comparisons

• Financial managers can gather appropriate benchmark

data in three ways: through trend, industry, and peer

group analysis

L.O. 4.5 Copyright ©2022 John Wiley & Sons, Inc. 44

Trend Analysis

• A ratio or ratio analysis is relevant only when

compared to an appropriate benchmark

• Trend Analysis – comparison to the firm’s historical

performance

L.O. 4.5 Copyright ©2022 John Wiley & Sons, Inc. 45

Industry Analysis

• A ratio or ratio analysis is relevant only when

compared to an appropriate benchmark

• Industry Analysis – comparison to the aggregate of

firms in the same industry

o Standard Industrial Classification (SIC) System

o North American Industry Classification System

(NAICS)

L.O. 4.5 Copyright ©2022 John Wiley & Sons, Inc. 46

Peer Group Analysis

o Peer Group Analysis – comparison to a select group of

firms in the same industry

L.O. 4.5 Copyright ©2022 John Wiley & Sons, Inc. 47

Exhibit 4.6 Peer Group Ratios for

Diaz Manufacturing

2020 2019 2018

Liquidity Ratios:

Current ratio 2.10 2.20 2.10

Quick ratio 1.50 1.60 1.50

Efficiency Ratios:

Inventory turnover 5.40 5.30 5.20

Days’ sales in inventory 67.59 68.87 70.19

Accounts receivable turnover 4.90 4.20 4.10

Days’ sales outstanding 76.70 89.80 90.00

L.O. 4.5 Copyright ©2022 John Wiley & Sons, Inc. 48

Peer Group Ratios for Diaz

Manufacturing (1 of 2)

2020 2019 2018

Total asset turnover 0.87 0.90 0.80

Fixed asset turnover 3.50 3.30 2.40

Leverage Ratios:

Total debt ratio 0.18 0.11 0.21

Debt-to-equity ratio 0.40 0.20 0.50

Equity multiplier 2.02 1.77 2.05

Times interest earned 7.00 5.60 1.60

Cash coverage 7.50 8.20 1.30

Profitability Ratios:

Gross profit margin 26.80% 24.10% 19.20%

Operating profit margin 12.00% 6.90% 2.70%

L.O. 4.5 Copyright ©2022 John Wiley & Sons, Inc. 49

Peer Group Ratios for Diaz

Manufacturing (2 of 2)

2020 2019 2018

Net profit margin 10.74% 3.30% 0.10%

Return on assets 9.34% 3.30% 0.80%

Return on equity 13.07% 7.00% 1.00%

Market-Value Indicators:

Price-earnings ratio 18.10 38.40 44.60

Earnings per share $1.65 $3.85 $3.78

Market-to-book ratio 2.84 1.82 1.64

L.O. 4.5 Copyright ©2022 John Wiley & Sons, Inc. 50

4.6 Using Financial Ratios

LEARNING OBJECTIVE

Identify major limitations in using financial statement analysis

• Using Financial Ratios

• Performance Analysis of Diaz Manufacturing

• Limitations of Financial Statement Analysis

L.O. 4.6 Copyright ©2022 John Wiley & Sons, Inc. 51

Using Financial Ratios

• In using financial ratios the most important tasks are to:

o Correctly interpret the ratio values

o make appropriate decisions based on this interpretation

• This section describes how to use financial ratios in

performance analysis

L.O. 4.6 Copyright ©2022 John Wiley & Sons, Inc. 52

Performance Analysis of Diaz

Manufacturing (1 of 2)

Exhibit 4.7 Peer Group Analysis for Diaz Manufacturing in 2020

Examining the differences between the ratios of a firm and its peer group is a

good way to spot areas that require further analysis.

(1) (2) (3)

Diaz Ratio Peer Group Ratio Difference

(Column 1 – Column 2)

DuPont Ratios:

Return on equity (%) 12.64 13.07 (0.43)

Return on assets (%) 6.27 9.34 (3.07)

Equity multiplier (%) 2.02 1.40 0.62

Net profit margin (%) 7.58 10.74 (3.16)

Total asset turnover 0.83 0.87 (0.04)

L.O. 4.6 Copyright ©2022 John Wiley & Sons, Inc. 53

Performance Analysis of Diaz

Manufacturing (2 of 2)

(1) (2) (3)

Diaz Ratio Peer Group Ratio Difference

(Column 1 – Column 2)

Asset Ratios:

Current ratio 2.75 2.10 0.65

Fixed asset turnover 3.92 3.50 0.42

Inventory turnover 2.55 5.40 (2.85)

Accounts receivable turnover 5.11 4.90 0.21

Profit Margins:

Gross profit margin (%) 30.86 26.80 4.06

Operating margin (%) 10.77 12.00 (1.23)

Net profit margin (%) 7.58 10.74 (3.16)

L.O. 4.6 Copyright ©2022 John Wiley & Sons, Inc. 54

Limitations of Financial Statement

Analysis

• Weaknesses of financial statement analysis:

o Not an exact science

o Relies on accounting data and historical costs

o Few guidelines or principles for determining whether a

ratio is “high” or “low,” or is a reason for confidence or

for concern

L.O. 4.6 Copyright ©2022 John Wiley & Sons, Inc. 55

Copyright

Copyright © 2022 John Wiley & Sons, Inc.

All rights reserved. Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Act without the express written permission of the

copyright owner is unlawful. Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up

copies for his/her own use only and not for distribution or resale. The Publisher assumes

no responsibility for errors, omissions, or damages, caused by the use of these programs or

from the use of the information contained herein.

Copyright ©2022 John Wiley & Sons, Inc. 56

You might also like

- Accounting SummaryDocument39 pagesAccounting SummarySteph WynneNo ratings yet

- Statute of Limitations For Collecting A DebtDocument2 pagesStatute of Limitations For Collecting A DebtmikotanakaNo ratings yet

- CH 3Document13 pagesCH 3Madyoka Raimbek100% (1)

- Remote Deposit CaptureDocument60 pagesRemote Deposit Capture4701sandNo ratings yet

- Dissolution Deed TitleDocument2 pagesDissolution Deed TitleMuslim QureshiNo ratings yet

- Making Sense of Data I: A Practical Guide to Exploratory Data Analysis and Data MiningFrom EverandMaking Sense of Data I: A Practical Guide to Exploratory Data Analysis and Data MiningNo ratings yet

- Consumer Behaviour, 2nd Edition - Chapter 1Document42 pagesConsumer Behaviour, 2nd Edition - Chapter 1guptamadras100% (1)

- MoJen ACC Pre TermDocument8 pagesMoJen ACC Pre TermHuong Thu Ha100% (1)

- Pelican Stores Case StudyDocument9 pagesPelican Stores Case StudyPapa GomzNo ratings yet

- Vietnam-Italy Steel's logistics enhancementDocument89 pagesVietnam-Italy Steel's logistics enhancementPennyNo ratings yet

- DELL'S FINANCIAL RATIOS ANALYSIS REVEALS STRENGTHS AND WEAKNESSESDocument33 pagesDELL'S FINANCIAL RATIOS ANALYSIS REVEALS STRENGTHS AND WEAKNESSEShoang-anh-dinh-7688No ratings yet

- Cooper 2015 - Shadow Money and The Shadow WorkforceDocument30 pagesCooper 2015 - Shadow Money and The Shadow Workforceanton.de.rotaNo ratings yet

- Bar Questions in Negotiable InstrumentDocument13 pagesBar Questions in Negotiable InstrumentAlyza Montilla BurdeosNo ratings yet

- ADM 3351-Final With SolutionsDocument14 pagesADM 3351-Final With SolutionsGraeme RalphNo ratings yet

- G8 PNJ PDFDocument50 pagesG8 PNJ PDFNguyễn Ngọc Thảo UyênNo ratings yet

- GROUP 4 - HPG Financial Statement - 21.09Document27 pagesGROUP 4 - HPG Financial Statement - 21.09Hoàng ThànhNo ratings yet

- Lê Thanh Nhàn - SB01267 - Individual Assignment FIN202Document11 pagesLê Thanh Nhàn - SB01267 - Individual Assignment FIN202Thanh NhànNo ratings yet

- ISB IB3 Group Report - Starbucks TNDocument32 pagesISB IB3 Group Report - Starbucks TNYen Truong HaiNo ratings yet

- Market Research for New Ice Cream BrandDocument13 pagesMarket Research for New Ice Cream BrandTưng Tửng KhoaNo ratings yet

- Homework Questions Statistics in Pivot TablesDocument1 pageHomework Questions Statistics in Pivot TablesBĂNG NGUYỄN NGỌCNo ratings yet

- Financial Statement Analysis of Techcombank: University of Economics and Law Faculty of Accounting and AuditingDocument55 pagesFinancial Statement Analysis of Techcombank: University of Economics and Law Faculty of Accounting and AuditingLê NaNo ratings yet

- Week 1 Seminar - Understanding Financial StatementsDocument4 pagesWeek 1 Seminar - Understanding Financial StatementsMUneeb mushtaqNo ratings yet

- Chapter 2Document2 pagesChapter 2Vượng TạNo ratings yet

- Vietnam's Leading Pangasius ProducerDocument20 pagesVietnam's Leading Pangasius ProducerANo ratings yet

- Marketing Review Answers Ch1-12Document2 pagesMarketing Review Answers Ch1-12Ania MakowieckaNo ratings yet

- Solutions ExtraDocument36 pagesSolutions ExtraAkshay AroraNo ratings yet

- Lecture Notes On Mathematics For Business: International School of Business, UEH, VietnamDocument162 pagesLecture Notes On Mathematics For Business: International School of Business, UEH, VietnamTường HuyNo ratings yet

- You Work For Nokia in Its Global Cell Phone GroupDocument1 pageYou Work For Nokia in Its Global Cell Phone GroupAmit PandeyNo ratings yet

- MIGA - Week 2 Assignment Nestle'sDocument2 pagesMIGA - Week 2 Assignment Nestle'sDharshini A/P KumarNo ratings yet

- FIN201 Corporate Finance Unit GuideDocument11 pagesFIN201 Corporate Finance Unit GuideRuby NguyenNo ratings yet

- PESTLEDocument15 pagesPESTLETyka TrầnNo ratings yet

- Autora: Estibaliz Manzaneque Corona Directora: Covadonga Aldamiz Echevarria González de DuranaDocument49 pagesAutora: Estibaliz Manzaneque Corona Directora: Covadonga Aldamiz Echevarria González de DuranaThảo KimNo ratings yet

- Harmonising Relations Within a Professional BodyDocument25 pagesHarmonising Relations Within a Professional BodyĐạt LêNo ratings yet

- BBA - Business Statistics 201Document176 pagesBBA - Business Statistics 201zanele molifeNo ratings yet

- Quiz 1 2 3 MKT201Document21 pagesQuiz 1 2 3 MKT201Le Thi Phuong Thao (K15 HL)No ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- Bibica - Default Risk AnalysisDocument2 pagesBibica - Default Risk AnalysisThậpTamNguyệtNo ratings yet

- SCM301m Quiz 2 KeyDocument15 pagesSCM301m Quiz 2 KeyVu Dieu LinhNo ratings yet

- Risk, Return, and Valuation: by The Mcgraw-Hill Companies, Inc. Click Here For Terms of UseDocument3 pagesRisk, Return, and Valuation: by The Mcgraw-Hill Companies, Inc. Click Here For Terms of UseIndrani DasguptaNo ratings yet

- Vinacafe Bien Hoa Final ReportDocument24 pagesVinacafe Bien Hoa Final ReportQuang NguyenNo ratings yet

- MKT 304 - MKT 1505 THAO: IMC Plans Group AssignmentDocument34 pagesMKT 304 - MKT 1505 THAO: IMC Plans Group AssignmentHải Băng ĐỗNo ratings yet

- KFC's Vegetarian Voyage: A Consumer Insights Perspectives in Australia.Document22 pagesKFC's Vegetarian Voyage: A Consumer Insights Perspectives in Australia.aronno_du185No ratings yet

- UQAM CFA ResearchChallenge2014Document22 pagesUQAM CFA ResearchChallenge2014tomz678No ratings yet

- Vinamilk - Marketing Metrics - Group 6Document34 pagesVinamilk - Marketing Metrics - Group 6Luu Phuong AnhNo ratings yet

- MNC Nep PresentationDocument53 pagesMNC Nep PresentationSaajan RathodNo ratings yet

- Corning Inc Sustainability Report 2021Document92 pagesCorning Inc Sustainability Report 2021Carl AldingerNo ratings yet

- Castillo OPERRES Syllabus ELGA Term 1, AY2018-19 091118 PDFDocument13 pagesCastillo OPERRES Syllabus ELGA Term 1, AY2018-19 091118 PDFdeaNo ratings yet

- FINANCIAL PERFORMANCEDocument16 pagesFINANCIAL PERFORMANCELaston Milanzi50% (2)

- Baimau TIKIDocument57 pagesBaimau TIKIBách PhạmNo ratings yet

- Dusk at Dell Whats Wrong With The Companys StrategyDocument20 pagesDusk at Dell Whats Wrong With The Companys StrategyRajesh_Meena_3161No ratings yet

- Customer Focus and Satisfaction: Understanding Key DriversDocument18 pagesCustomer Focus and Satisfaction: Understanding Key DriversArslan SaleemNo ratings yet

- CH 04Document51 pagesCH 04Pham Khanh Duy (K16HL)No ratings yet

- Corporate finance exam calculations and returnsDocument17 pagesCorporate finance exam calculations and returnsHashimRazaNo ratings yet

- ECO121 Macroeconomics Class AssignmentDocument3 pagesECO121 Macroeconomics Class AssignmentTrần Trác Tuyền Vietnam Fanpage Sweet DreamNo ratings yet

- Fairchild SA statement of cash flows 2019Document3 pagesFairchild SA statement of cash flows 2019ulil alfarisyNo ratings yet

- Hello!: Our Members: Do Phuc Lam Bui Nhu Quynh Bui Thao Trang Dang Thuy HuongDocument20 pagesHello!: Our Members: Do Phuc Lam Bui Nhu Quynh Bui Thao Trang Dang Thuy HuongĐặng Thùy Hương0% (1)

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisAreti SatoglouNo ratings yet

- Materi Chapter 23 Cash FlowDocument2 pagesMateri Chapter 23 Cash FlowM Reza andriantoNo ratings yet

- MO Assignment 1Document26 pagesMO Assignment 1ThảoMy TrươngNo ratings yet

- Chapter 1 - Introduction To Services MarketingDocument40 pagesChapter 1 - Introduction To Services MarketingJoseph UyNo ratings yet

- Banking Industry ForcesDocument43 pagesBanking Industry Forcesblackraiden100% (1)

- Summary of Chapter 3 (Understanding Business)Document3 pagesSummary of Chapter 3 (Understanding Business)Dinda LambangNo ratings yet

- Problems 1-30: Input Boxes in TanDocument37 pagesProblems 1-30: Input Boxes in TanAshekin Mahadi100% (1)

- MKT 304 Session 1-IMC - An IntroductionDocument35 pagesMKT 304 Session 1-IMC - An IntroductionDanielNo ratings yet

- Desarrollo de Caso DECIP Desarrollado - InglesDocument15 pagesDesarrollo de Caso DECIP Desarrollado - InglesLuis Alexander AvalosNo ratings yet

- Accounting For Assets, Impairments and GrantsDocument21 pagesAccounting For Assets, Impairments and GrantsSajid Iqbal100% (1)

- CH 02Document45 pagesCH 02Hiền AnhNo ratings yet

- CH 05Document48 pagesCH 05Hiền AnhNo ratings yet

- CH 03Document60 pagesCH 03Hiền AnhNo ratings yet

- CH 01Document65 pagesCH 01Hiền AnhNo ratings yet

- Fixed Asset and Depreciation Schedule: Instructions: InputsDocument5 pagesFixed Asset and Depreciation Schedule: Instructions: InputsPatrick GhariosNo ratings yet

- Instruction: Write Your Name and Answer in A Journal/paper. Submit A MAXIMUM OF 6 PICTURES OnlyDocument1 pageInstruction: Write Your Name and Answer in A Journal/paper. Submit A MAXIMUM OF 6 PICTURES Onlyhokage astroNo ratings yet

- CIR v. American Express International G.R. No. 152609, June 29, 2005Document2 pagesCIR v. American Express International G.R. No. 152609, June 29, 2005Susannie AcainNo ratings yet

- Organization Functions and DutiesDocument21 pagesOrganization Functions and DutiesmhnNo ratings yet

- REMIC and CDO Reporting Directory: Find Tax Information for Real Estate Mortgage Investment Conduits and Collateralized Debt ObligationsDocument74 pagesREMIC and CDO Reporting Directory: Find Tax Information for Real Estate Mortgage Investment Conduits and Collateralized Debt Obligationsprunfeldt5399No ratings yet

- Sandhya New CVDocument3 pagesSandhya New CVNoushad N HamsaNo ratings yet

- Balance Sheet of Bajaj FinanceDocument8 pagesBalance Sheet of Bajaj FinanceAJ SuriNo ratings yet

- URC's Formidable Market Leadership and Global ExpansionDocument2 pagesURC's Formidable Market Leadership and Global ExpansionPrince Alexis GarciaNo ratings yet

- Dusty R BouthilletteDocument16 pagesDusty R Bouthillettedanw5646No ratings yet

- Explain How Interest Rates Can Affect Supply and DemandDocument2 pagesExplain How Interest Rates Can Affect Supply and Demandhafeez ahmedNo ratings yet

- Land Bank ResoDocument1 pageLand Bank ResoErman GaraldaNo ratings yet

- General client profile and engagement detailsDocument2 pagesGeneral client profile and engagement detailsAbhiNo ratings yet

- 47-Corporate Salary Package - CSPDocument3 pages47-Corporate Salary Package - CSPmevrick_guyNo ratings yet

- LKBF 2Document8 pagesLKBF 2Aseki Shakib Khan SimantoNo ratings yet

- Improving Social Cohesion in Ethiopia's Babile DistrictDocument9 pagesImproving Social Cohesion in Ethiopia's Babile DistrictsimbiroNo ratings yet

- Manipulation of Financial Statements V0.1Document17 pagesManipulation of Financial Statements V0.1Aniket RaneNo ratings yet

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap020 PDFDocument26 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap020 PDFYopie ChandraNo ratings yet

- No Dues Certificate - 20!53!53Document2 pagesNo Dues Certificate - 20!53!53krishan chaturvediNo ratings yet

- 10 1108 - MF 06 2020 0300Document20 pages10 1108 - MF 06 2020 0300fenny maryandiNo ratings yet

- Forecasting Revenues For BusinessDocument19 pagesForecasting Revenues For BusinessLiam JNMNo ratings yet

- FAC MCQs UnitwiseDocument7 pagesFAC MCQs UnitwiseSamNo ratings yet

- Ch14 Bonds - Intermediate 2Document103 pagesCh14 Bonds - Intermediate 2BLESSEDNo ratings yet

- Chapter 11 HWDocument2 pagesChapter 11 HWVinícius AlvesNo ratings yet