Professional Documents

Culture Documents

ESB 5th Sec

Uploaded by

Esraa Sayed Abdelhamed Sayed0 ratings0% found this document useful (0 votes)

6 views47 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views47 pagesESB 5th Sec

Uploaded by

Esraa Sayed Abdelhamed SayedCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 47

FAILING

Ways to Finance Your Latest Business

Venture

Get a Bank Loan

Lending standards have gotten much stricter,

but banks such as J.P. Morgan Chase and Bank

of America have earmarked additional funds

for small business lending. So why not apply?

Use a Credit Card

Using a credit card to fund your business is some

serious risky business. Fall behind on your

payment and your credit score gets whacked. Pay

just the minimum each month and you could

create a hole you'll never get out of. However,

used responsibly, a credit card can get you out of

the occasional jam and even extend your

accounts payable period to shore up your cash

flow.

Pledge Some of Your Future Earnings

Young, ambitious and willing to make a bet on your future

earnings? Consider how Kjerstin Erickson, Saul Garlick and Jon

Gosier are trying to raise money. Through an online

marketplace called the Thrust Fund, the three have offered up

a percentage of their future lifetime earnings in exchange for

upfront, undesignated venture funding. Erickson is willing to

swap 6 percent of her future lifetime earnings for $600,000.

The other two entrepreneurs are each offering 3 percent of

future earnings for $300,000. Beware: the legality and

enforceability of these "personal investment contracts" have

yet to be established.

Attract an Angel Investor

When pitching an angel investor, all the

old rules still apply: be succinct, avoid

jargon, have an exit strategy. But the

economic turmoil of the last few years has

made a complicated game even trickier.

Secure an SBA Loan

With banks reluctant to take any chances with their own

money in the wake of the credit crisis, loans guaranteed

by the U.S. Small Business Administration have become a

hot commodity. Indeed, funds to support special breaks

on fees and guarantees on SBA-backed loans have run out

a number of times. And while SBA-backed loans are open

to any small business

Raise Money from Your Family and

Friends

Hitting up family and friends is the

most common way to finance a

start-up. But when you turn loved

ones into creditors, you're risking

their financial future and

jeopardizing important personal

relationships.

Get a Microloan

The lack of a credit history, collateral or the inability to

secure a loan through a bank doesn't mean no one will lend

to you. One option would be to apply for a microloan, a

small business loan ranging from $500 to $35,000.

Microloans are often so small that commercial banks can't

be bothered lending the funds. Instead of a bank, you need

What is an Organizational Chart?

An organizational chart shows the internal

structure of an organization or company. The

employees and positions are represented by

boxes or other shapes, sometimes including

photos, contact information, email and page

links, icons and illustrations. Straight or elbowed

lines link the levels together

z

How to Obtain the Right

Financing for Your Business

Estimating Financial Needs

If you seek the help of a financial planner, you

need to make sure the one you choose is

appropriate for your needs.

However, if the business is just starting, it can be

very difficult since there is no universal method for

estimating startup costs. The Small Business

Administration (sba.gov) suggests that you

consider the following:

Determine seed money needed to start up.

Determine which costs are onetime costs.

Determine ongoing costs.

Separate your costs into fixed (does not change) or

variable with sales.

Do you need to renovate the facility?

dentify which costs are essential or optional.

Fixed assets are those that are of a relatively permanent

nature and are necessary for the functioning of the

business.

Working capital is current assets, less current liabilities,

that a firm uses to produce goods and services, and to

finance the extension of credit to

customers.

q uit y Fun di n g )

Equity finance (E to g m o n e y fu n d y o u r

e r n a tiv e t o b o rr o w in

An alt a n ) is in v es ti n g e it her

(e .g . a tr a d it io n a l ban k lo

bus in es s so m e o n e e ls e 's

e y (i f y o u have it ) o r

your o w n m o n an c in g .

. T h is is call e d e q u it y fin

money in y o u r b u s in e ss

d e b t f in a n c e a n d eq u ity

m a in d if fe re n c e b e tw een

The m e s a p a rt o w n e r o f

is th at th e in v e s to r b eco

finance it th e b u s in e s s m a k e s.

n e s s a n d s h a re s a ny p ro f

you r b u s i

:The main sources of equity capital are

family and friends - an important source of equity

for new businesses

business angels - wealthy individuals

who invest their own funds (typically

up to $2 million) into start-up

businesses with strong growth potential

venture capitalists - professional

investors that invest funds (generally

$2-10 million) in operating companies

with high growth potential

public float - raising money

by issuing securities (e.g.

shares) to the public.

Advantages of equity financing

Freedom from debt - unlike debt finance, you

don't make repayments on investments. Not

having the burden of debt can be a huge

advantage, particularly for small start-up

businesses.

Business experience and contacts - as

well as funds, investors often bring

valuable experience, managerial or

technical skills, contacts or networks, and

credibility to the business.

Follow-up funding - investors are often

willing to provide additional funding as

the business develops and grows.

DISADVANTAGES OF EQUITY

FINANCING

Shared ownership - in return for investment

funds, you will have to give up some control of

your business. Investors not only share profits,

they also have a say in how the business is run.

While this has advantages, you need to think

carefully about how much control you

surrender.

Personal relationships -

accepting investment funds

from family or friends can

affect personal relationships if

the business fails.

Time and money - approaching

investors and becoming investment-

ready is demanding. It takes time and

money. Your business may suffer if

you have to spend a lot of time on

investment strategies.

Angel Investor

Angel Inverstor now refers to anyone who

invests his or her money in an

entrepreneurial company (unlike institutional

venture capitalists, who invest other people's

money).

REASONS WHY ANGEL INVESTING IS BEST FOR

SMALL BUSINESSES

Quick Approval

Without institutional investors,

stockholders and board members, angel

investors are freer to operate and invest.

A Personal Touch

Any investor puts in money with the

intention of getting it back with profit.

Getting the much-needed Funds

Angel investors often give the funds in form of a lump

sum. “This is of immense benefit for quick growth of a

venture. In most other types of investments, money is

released in instalments and is mostly spread over time,”

Independence

The best thing about angel investors is that they

don’t aspire for board memberships or take

interest in future funding.

EXIT STRATEGIES FOR

INVESTORS

Merger & Acquisition (M&A).

This normally means merging with a

similar company, or being bought by

a larger company.

Initial Public Offer.

Startups, you can do initial

public offers (IPO) where you

sell a part of your business to the

public in the form of shares.

Make it your cash cow.

If you are in a stable, secure marketplace, with a

business that has a steady revenue stream, pay

off investors, find someone you trust to run it

for you, while you use the remaining cash to

develop your next great idea.

Liquidation and close.

Even lifetime entrepreneurs can decide

that enough is enough. One often-

overlooked exit strategy is simply to

shutdown, close the business doors, and

liquidate.

,,,THANK YOU

You might also like

- How to Get Funding For Your New Product IdeaFrom EverandHow to Get Funding For Your New Product IdeaRating: 4.5 out of 5 stars4.5/5 (6)

- Research Papers On Internal and External Sources of FinanceDocument8 pagesResearch Papers On Internal and External Sources of Financevvjrpsbnd100% (1)

- ReporDocument7 pagesReporRichard SarominesNo ratings yet

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Sources of Finance For Startups and SMEsDocument4 pagesSources of Finance For Startups and SMEsTawanda Percy MutsandoNo ratings yet

- What Is Finance?: Raise Money Sale Debt EquityDocument6 pagesWhat Is Finance?: Raise Money Sale Debt EquitykiranaishaNo ratings yet

- BFI 305 Financing Small Business QPDocument11 pagesBFI 305 Financing Small Business QPministarz1No ratings yet

- Investment Opportunities or A Study in The Context of BangladeshDocument12 pagesInvestment Opportunities or A Study in The Context of BangladeshOpen NokuNo ratings yet

- Training 3Document11 pagesTraining 3darkeNo ratings yet

- Basic ConceptDocument11 pagesBasic ConceptSoumya TiwaryNo ratings yet

- Financial Model CapitalDocument8 pagesFinancial Model CapitalBEDOLIDO FERNIL R.No ratings yet

- TRT - Mod 3Document11 pagesTRT - Mod 3darkeNo ratings yet

- A Guide To Seed FundraisingDocument15 pagesA Guide To Seed Fundraisingvivek singhNo ratings yet

- Morgan Stanley IBDocument3 pagesMorgan Stanley IBAnkit BhardwajNo ratings yet

- 1 - Financial DecisionsDocument9 pages1 - Financial DecisionsByamaka ObedNo ratings yet

- Finance Managing Your Finances and All That It TakesDocument4 pagesFinance Managing Your Finances and All That It TakesAtakelt HailuNo ratings yet

- BPL - Unit 06 - FundingDocument11 pagesBPL - Unit 06 - FundingSuresh SubramaniNo ratings yet

- Financing Methods For StartupsDocument8 pagesFinancing Methods For Startupskartika AgarwalNo ratings yet

- Funding Your StartupDocument8 pagesFunding Your Startup153KAPIL RANKANo ratings yet

- Sources of Financing Your BusinessDocument9 pagesSources of Financing Your Businessopssup4No ratings yet

- Session 1: The Entrepreneur Finding His ResourcesDocument12 pagesSession 1: The Entrepreneur Finding His ResourcesDivine Paula BioNo ratings yet

- Startup Funding in IndiaDocument5 pagesStartup Funding in IndiaManoj Kumar MannepalliNo ratings yet

- Smart CapitalDocument35 pagesSmart Capitalno es anonimousNo ratings yet

- Microfinance Note 1Document12 pagesMicrofinance Note 1Vandi GbetuwaNo ratings yet

- Angel Investors-WPS OfficeDocument29 pagesAngel Investors-WPS OfficePJ Rizalyn ChivaNo ratings yet

- BASIC CONCEPT OF FINANCE AllignedDocument11 pagesBASIC CONCEPT OF FINANCE AllignedSoumya TiwaryNo ratings yet

- Company: 2. Financial Management in Old CompaniesDocument3 pagesCompany: 2. Financial Management in Old CompaniesVikash SinghNo ratings yet

- Major Sources of Finance For SME's and Start UpsDocument6 pagesMajor Sources of Finance For SME's and Start UpsPurvansh Trivedi100% (1)

- Investing, Purchaing Power, & Frictional CostsDocument12 pagesInvesting, Purchaing Power, & Frictional Costss2mcpaul100% (1)

- 1.1 General Introduction About The SectorDocument22 pages1.1 General Introduction About The SectorishfaqnazirbabaNo ratings yet

- A Guide To Seed FundraisingDocument15 pagesA Guide To Seed FundraisingMridul UpadhyayNo ratings yet

- Y Combinator Guide To Seed FundraisingDocument12 pagesY Combinator Guide To Seed FundraisingOluwasegun OluwaletiNo ratings yet

- Sources of Financing Business IdeasDocument11 pagesSources of Financing Business IdeasГена КрокодилNo ratings yet

- Finance Dissertation SampleDocument8 pagesFinance Dissertation SampleSomeoneToWriteMyPaperForMeEvansville100% (1)

- Financial Literacy Project 660 760 763 443 867 907 PDFDocument33 pagesFinancial Literacy Project 660 760 763 443 867 907 PDFSanchit Gupta 660No ratings yet

- Startup FundraisingDocument15 pagesStartup FundraisingJason CharlesNo ratings yet

- Project ManagementDocument6 pagesProject ManagementEmuyeNo ratings yet

- Ecommerce II AssignmnetDocument8 pagesEcommerce II Assignmnetsushant aryalNo ratings yet

- Memo Eng Fin 1Document16 pagesMemo Eng Fin 1api-357022570No ratings yet

- A Project Report On: "Capital Structure"Document57 pagesA Project Report On: "Capital Structure"Sankalp PariharNo ratings yet

- Your Rich Life: A Human Approach to Investment and Building the Wealth of Your DreamsFrom EverandYour Rich Life: A Human Approach to Investment and Building the Wealth of Your DreamsNo ratings yet

- Ethics in Banking-The Way Forward by CA Rakesh Kaushik Published in Bank Quest July-Sept 2018Document5 pagesEthics in Banking-The Way Forward by CA Rakesh Kaushik Published in Bank Quest July-Sept 2018Rakesh KaushikNo ratings yet

- An Example of Personal Finance Is Debating Whether or Not To Save Five DollarsDocument3 pagesAn Example of Personal Finance Is Debating Whether or Not To Save Five DollarsBryan LluismaNo ratings yet

- By :vaibhav Malhotra Email:Vaibhav4u38@Document104 pagesBy :vaibhav Malhotra Email:Vaibhav4u38@emmanuel JohnyNo ratings yet

- Sources of New Business FinancingDocument11 pagesSources of New Business FinancingBurhan Al MessiNo ratings yet

- Researching Financing OptionsDocument2 pagesResearching Financing OptionsAbdulRehman100% (1)

- Introduction To Venture CapitalDocument5 pagesIntroduction To Venture CapitalKanya RetnoNo ratings yet

- Business Financing Opportunities - 08 - 2010Document22 pagesBusiness Financing Opportunities - 08 - 2010asdfasdfadfadsf1No ratings yet

- Account and Finance DissertationDocument6 pagesAccount and Finance DissertationCustomPaperServicesCanada100% (1)

- Personal Finance ReviewDocument11 pagesPersonal Finance ReviewSmartKidDevelopmentNo ratings yet

- 2-What Do Investors Care About-NotesDocument19 pages2-What Do Investors Care About-NotesGen AbulkhairNo ratings yet

- Project Design and Dev't 2Document23 pagesProject Design and Dev't 2asratNo ratings yet

- 8 Fundraising Steps For Building A New BusinessDocument4 pages8 Fundraising Steps For Building A New BusinessSachin KhuranaNo ratings yet

- Module 10 FinancingDocument8 pagesModule 10 FinancingDonna Cece MelgarNo ratings yet

- What Benefits Will Be Derived by The Business From Thye Loan or InvestmentsDocument2 pagesWhat Benefits Will Be Derived by The Business From Thye Loan or Investmentsdarryl franciscoNo ratings yet

- Financial Analysis TestDocument16 pagesFinancial Analysis TestLewie KhawNo ratings yet

- Financial Literacy NotesDocument11 pagesFinancial Literacy NotesMaimai Durano100% (1)

- Literature On Personal Debt ManagementDocument16 pagesLiterature On Personal Debt ManagementANNKNo ratings yet

- ESB 3rd SecDocument64 pagesESB 3rd SecEsraa Sayed Abdelhamed SayedNo ratings yet

- ESB 4th SecDocument54 pagesESB 4th SecEsraa Sayed Abdelhamed SayedNo ratings yet

- ESB 8th SecDocument28 pagesESB 8th SecEsraa Sayed Abdelhamed SayedNo ratings yet

- H13-311 V3.0.Document43 pagesH13-311 V3.0.Esraa Sayed Abdelhamed SayedNo ratings yet

- Security 4CSDocument6 pagesSecurity 4CSEsraa Sayed Abdelhamed SayedNo ratings yet

- Lesson 5 SecurityDocument60 pagesLesson 5 SecurityEsraa Sayed Abdelhamed SayedNo ratings yet

- Securiy Part2 ExplainationDocument26 pagesSecuriy Part2 ExplainationEsraa Sayed Abdelhamed SayedNo ratings yet

- 98-367 2E Lesson 1 SlidesDocument41 pages98-367 2E Lesson 1 SlidesEsraa Sayed Abdelhamed SayedNo ratings yet

- 98-367 2E Lesson 2 SlidesDocument47 pages98-367 2E Lesson 2 SlidesEsraa Sayed Abdelhamed SayedNo ratings yet

- 1 Financial Market 6097Document56 pages1 Financial Market 6097Rishma NarodiaNo ratings yet

- A Study On Cooperative Banks in India With Special Reference To Lending PracticesDocument6 pagesA Study On Cooperative Banks in India With Special Reference To Lending PracticesSrikara Acharya100% (1)

- CV SofianingsihDocument5 pagesCV SofianingsihPrilianNo ratings yet

- Insolvency Law and Corporate RehabilitationDocument33 pagesInsolvency Law and Corporate RehabilitationElizar JoseNo ratings yet

- Account Statement 081221 070122Document52 pagesAccount Statement 081221 070122anandalogyNo ratings yet

- Credit Cards TruistDocument1 pageCredit Cards TruistKerry HawkNo ratings yet

- Reconciliation Government Wide Financial Statements Capital AssetsDocument19 pagesReconciliation Government Wide Financial Statements Capital AssetssikanderNo ratings yet

- Commission Chart Digital Seva KendraDocument28 pagesCommission Chart Digital Seva KendraDsl, DahejNo ratings yet

- Lesson 4 Reorganizing The Financial Statements in Practice Part 3Document4 pagesLesson 4 Reorganizing The Financial Statements in Practice Part 3randyNo ratings yet

- Indiana Loan Broker AgreementDocument2 pagesIndiana Loan Broker AgreementalokprasadNo ratings yet

- Bharat ChemicalDocument6 pagesBharat ChemicalgauravpalgarimapalNo ratings yet

- Financial-Analysis-Procter&Gamble-vs-Reckitt BenckiserDocument5 pagesFinancial-Analysis-Procter&Gamble-vs-Reckitt BenckiserPatOcampoNo ratings yet

- Unit 3 COST Accounting CycleDocument6 pagesUnit 3 COST Accounting CycleJaizer TimbrezaNo ratings yet

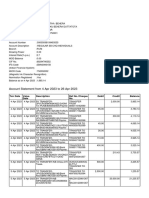

- Account Statement From 4 Apr 2023 To 26 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 4 Apr 2023 To 26 Apr 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceBIKRAM KUMAR BEHERANo ratings yet

- Inv# 2485 - Mared Al Iraqiya - CP - Al-Mared - 20200312 - CCTV VIDocument1 pageInv# 2485 - Mared Al Iraqiya - CP - Al-Mared - 20200312 - CCTV VIHussein AlhakimNo ratings yet

- FAR Pre-Week Part 1Document24 pagesFAR Pre-Week Part 1John DoeNo ratings yet

- Accounting 102 Intermediate Accounting Part 1 PPE, Government Grant, Borrowing Costs QuizDocument10 pagesAccounting 102 Intermediate Accounting Part 1 PPE, Government Grant, Borrowing Costs QuizKissy LorNo ratings yet

- Stepbystep Approach Co Op Soc AuditDocument118 pagesStepbystep Approach Co Op Soc Auditraj pandeyNo ratings yet

- Case Notes EcoPakDocument8 pagesCase Notes EcoPakGajan SelvaNo ratings yet

- The Savings and Loan Crisis - Assignment PDFDocument2 pagesThe Savings and Loan Crisis - Assignment PDFtylerNo ratings yet

- Imt 41Document4 pagesImt 41Nothing786No ratings yet

- Ae 15 Bs Acc 1 Home Based ActivityDocument4 pagesAe 15 Bs Acc 1 Home Based ActivityMae Ann RaquinNo ratings yet

- School of Business & Management: Course Outline & Accompanying Teaching & Learning PlanDocument6 pagesSchool of Business & Management: Course Outline & Accompanying Teaching & Learning PlanGurmanjot KaurNo ratings yet

- Regional Payments (Land Seeker, Reimbursements, Regional Staff Business Trip, Petty Cash)Document1 pageRegional Payments (Land Seeker, Reimbursements, Regional Staff Business Trip, Petty Cash)Brayan Victor Grovas FernandezNo ratings yet

- Business Accounting Revision For Journal EntriesDocument2 pagesBusiness Accounting Revision For Journal Entriesshelal lodhiNo ratings yet

- Debt Securities - BondsDocument6 pagesDebt Securities - BondsStacy SmithNo ratings yet

- Jake Burgmeier ResumeDocument2 pagesJake Burgmeier Resumeapi-510316324No ratings yet

- Samplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityDocument6 pagesSamplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityStar RamirezNo ratings yet

- TRAINING REPORT (Pankaj Bhardwaj)Document48 pagesTRAINING REPORT (Pankaj Bhardwaj)Pankaj BhardwajNo ratings yet

- AtmDocument127 pagesAtmPuja Ghosh100% (3)