Professional Documents

Culture Documents

Ch03 - The adjusting process đã chuyển đổi

Uploaded by

Nguyễn Quốc Kiệt0 ratings0% found this document useful (0 votes)

17 views26 pagesThe document discusses adjusting entries in accrual-based accounting, including the need to record revenues and expenses in the proper periods, the two categories of adjusting entries (prepayments and accruals), how to prepare an adjusted trial balance, and the order of the financial statements. It also notes some potential ethical issues that can arise from accrual accounting if items like depreciation expense are not recorded accurately.

Original Description:

Original Title

Ch03_The-adjusting-process-đã-chuyển-đổi

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses adjusting entries in accrual-based accounting, including the need to record revenues and expenses in the proper periods, the two categories of adjusting entries (prepayments and accruals), how to prepare an adjusted trial balance, and the order of the financial statements. It also notes some potential ethical issues that can arise from accrual accounting if items like depreciation expense are not recorded accurately.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views26 pagesCh03 - The adjusting process đã chuyển đổi

Uploaded by

Nguyễn Quốc KiệtThe document discusses adjusting entries in accrual-based accounting, including the need to record revenues and expenses in the proper periods, the two categories of adjusting entries (prepayments and accruals), how to prepare an adjusted trial balance, and the order of the financial statements. It also notes some potential ethical issues that can arise from accrual accounting if items like depreciation expense are not recorded accurately.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 26

Chapter 3

The adjusting process

201044 - The adjusting process

Learning objectives

• Differentiate between accrual and cash-basis accounting

• Explain why adjusting entries are needed

• Journalise and post adjusting entries

• Explain the purpose of and prepare an adjusted trial balance

• Prepare the financial statements from the adjusted trial balance

• Describe the ethical challenges in accrual accounting

1/2/2020 201044 - The adjusting process 2

3.1. Accrual versus cash-basis

accounting

• Accrual accounting records the effect of each transaction as it

occurs

• Cash-basis accounting records only cash receipts and cash

payments. It ignores receivables, payables and other items

• In accrual accounting, revenues are recorded when earned, which

is not necessarily in the same accounting period as when the

corresponding cash is received

• Most businesses use the accrual basis as covered in this book

1/2/2020 201044 - The adjusting process 3

3.1. Accrual versus cash-basis

accounting

Ex:

1. Suppose Smart Touch purchases $200 of office supplies

on credit on 15 Jun and pays to supplier on 03 Jul.

2. Suppose Smart Touch performs services and earns

revenue of $1,000 on 20 Jun but collects no cash

(Cash will be collected on 05 Jul)

Indicate the difference in recording above transactions on

the cash-basic accounting and accrual-basic accounting.

1/2/2020 201044 - The adjusting process 4

3.2. Why we adjust the accounts

• Accrual accounting requires adjusting entries at the end of the

period

• Adjusting entries assign revenues to the period when they are

earned and expenses to the period when they are incurred

• Adjustments are needed to properly measure two things: (1) profit

(loss) in the income statement, and (2) assets and liabilities in the

balance sheet

Tên DN

Tên báo cáo

Ngày

Lập BC, 3 cái

FS 1/2/2020 201044 - The adjusting process 5

3.3. Two categories of adjusting entries

• The two basic categories of adjusting entries are prepayments

(defferals) and accruals

• In a prepaid adjustment, the cash payment occurs before an

expense is recorded or the cash receipt occurs before the revenue

is earned

• An accrual records an expense before the cash payment or it

records the revenue before the cash is received

• Adjusting entries fall into five types: prepaid expenses, depreciation

of non-current assets, accrued expenses, accrued revenues,

unearned revenues

1/2/2020 201044 - The adjusting process 6

3.3. Two categories of adjusting entries

Prepaid expenses

• Prepaid expenses are advance payments of expenses

• Examples include prepaid rent, insurance, supplies

• Prepaid expenses are considered assets rather than expenses

• When the prepayment is used up, the used portion of the asset

becomes an expense via an adjusting journal entry

Ex: Smart Touch prepays three months’ office rent of $3,000 ($1,000

per month x 3 months) on 01 June 201N

1/2/2020 201044 - The adjusting process 7

3.3. Two categories of adjusting entries

Depreciation

• Property, plant and equipment assets are long-lived, non-current,

tangible assets used in the operation of a business

• As a business uses non-current assets, their value and usefulness

decline

• The decline in usefulness of a non-current asset is an expense, and

accountants systematically spread the asset’s cost over its useful

life

• The allocation of a non-current asset’s value to expense is called

depreciation

1/2/2020 201044 - The adjusting process 8

3.3. Two categories of adjusting entries

Depreciation

• The accumulated depreciation account is the sum of all the

depreciation recorded for the asset, and that total increases

(accumulates) over time

• Accumulated depreciation is a contra asset

Ex: On 01 June, Smart Touch purchased furniture for $18,000. Its

expected useful life is five years.

Dr. Dep

Cr Acc Dep, Furniture 18,000/12x5 x ???

1/2/2020 201044 - The adjusting process 9

3.3. Two categories of adjusting entries

Accrued expenses

• The term accrued expense refers to an expense incurred before

paying for them

• Examples include accruing salary expense and accruing interest

expense

• An accrued expense hasn’t been paid for yet and always creates a

liability

Ex: Sheena Bright pays its employee a monthly salary of $1,800 - half

on the 17th and half on the first day of next month.

1/2/2020 201044 - The adjusting process 10

3.3. Two categories of adjusting entries

Accrued revenues

• Businesses can earn revenue before they receive the cash, which

creates accrued revenues

• Accrued revenue is revenue that has been earned but for which the

cash has not yet been collected

Ex: Assume that Smart Touch is hired on 16 June to perform e-

learning services for the Central Queensland University. Under this

agreement, Smart Touch will earn $800 monthly.

During June, for work performed from 16 June to 30 June, Smart

Touch will earn half a month’s fee, $400.

1/2/2020 201044 - The adjusting process 11

3.3. Two categories of adjusting entries

Unearned revenues (Deferred revenue)

• Some businesses collect cash from customers in advance of

performing work

• Receiving cash before earning it creates a liability to perform work in

the future called unearned revenue

• The business owes a product or a service to the customer, or it

owes the customer his or her money back

• Only after completing the job will the business earn the revenue.

Because of this delay, unearned revenue is also called deferred

revenue

1/2/2020 201044 - The adjusting process 12

3.3. Two categories of adjusting entries

Unearned revenues (Deferred revenue)

• Ex: A legal firm engages Smart Touch to provide e-learning

services, agreeing to pay $600 in advance monthly, beginning

immediately. Sheena Bright collects the first amount on 21 June.

1/2/2020 201044 - The adjusting process 13

3.3. Two categories of adjusting entries

1/2/2020 201044 - The adjusting process 14

3.3. Two categories of adjusting entries

Ex: Information for the adjustments at 30 June 201N of Smart

Touch

(a) Prepaid rent expired, $1,000

(b) Supplies used , $100

(c) Depreciation on furniture, $300

(d) Depreciation on building, $200

(e) Accrued salary expense, $900

(f) Accrued interest on loan, $100

(g) Accrued service revenue, $400

(h)Service revenue that was collected in advance and now had been

earned, $200

Required: Journalising and posting to T-accounts all the above

adjustments.

3.4. The adjusted trial balance

• Prepared after adjusting entries are posted

• Useful step in preparing financial statements

• Often appears on a work sheet

1/2/2020 201044 - The adjusting process 16

3.4. The adjusted trial balance

1/2/2020 201044 - The adjusting process 17

3.5. The financial statements

• The income statement reports revenues and expenses

• The statement of changes in equity shows why capital changed

during the period

• The balance sheet reports assets, liabilities and owners’ equity

• The financial statements should be prepared in the following

order:

(1) income statement to determine profit or loss;

(2)statement of changes in equity which needs profit or loss

from the income statement to calculate ending capital;

(3)balance sheet which needs the amount of ending

capital to achieve its balancing feature

1/2/2020 201044 - The adjusting process 18

3.5. The financial statements

1/2/2020 201044 - The adjusting process 19

3.5. The financial statements

1/2/2020 201044 - The adjusting process 20

3.5. The financial statements

1/2/2020 201044 - The adjusting process 21

3.6. Ethical issues in accrual accounting

• Accrual accounting provides opportunities for unethical behaviour

• For example, a dishonest businessperson could omit depreciation

expense at the end of the year

• Failing to record depreciation would overstate profit as calculated by

mandated accrual principles and disclose a more favourable picture

of the business’ financial position than actually existed

1/2/2020 201044 - The adjusting process 22

Summary: Chapter 3

• Accrual accounting records revenues and expenses when they are

earned/incurred

• Cash-basis accounting records revenues and expenses when cash

is received or paid

• Accrual accounting requires adjusting entries at the end of the

period

• The two basic categories of adjusting entries are prepayments and

accruals

• The adjusted trial balance includes all the transactions captured

during the period on the trial balance plus/minus any adjusting

journal entries made at the end of the period

• The financial statements must be prepared in order

1/2/2020 201044 - The adjusting process 23

Tasks in class

Textbook: Chapter 3

• Quick Check

• Starters

• Exercises

1/2/2020 201044 - The adjusting process 24

Tasks at home

1/ Homework:

Textbook: Chapter 3

• Problems

• Apply

2/ Self-study:

Key References [2]: Chapter 4

1/2/2020 201044 - The adjusting process 25

The end of Chapter 3

The adjusting process

201044 - The adjusting process

You might also like

- Private BankingDocument49 pagesPrivate Bankingcamwills2100% (11)

- How To Start A Clothing Line PDFDocument6 pagesHow To Start A Clothing Line PDFSANDEEP KUMARNo ratings yet

- EBS-Manual Automatic Config FileDocument12 pagesEBS-Manual Automatic Config FilepaiashokNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Isys6300 - Business Process Fundamental: Week 8 - The General Ledger and Financial ReportingcycleDocument37 pagesIsys6300 - Business Process Fundamental: Week 8 - The General Ledger and Financial ReportingcycleEdwar ArmandesNo ratings yet

- Establish & Maintain An Accural Accounting SystemDocument34 pagesEstablish & Maintain An Accural Accounting SystemMagarsaa Hirphaa100% (2)

- Part 2 Basic Accounting Journalizing LectureDocument11 pagesPart 2 Basic Accounting Journalizing LectureKong Aodian100% (2)

- Chapter 2 - Recording Business TransactionsDocument6 pagesChapter 2 - Recording Business TransactionsHa Phuoc HauNo ratings yet

- Unit 5 - Financial Reporting and Analysis PDFDocument118 pagesUnit 5 - Financial Reporting and Analysis PDFEstefany MariáteguiNo ratings yet

- Model Question Paper RVO-IBBIDocument20 pagesModel Question Paper RVO-IBBIBhaskar Jain100% (1)

- Accounting CycleDocument33 pagesAccounting CycleKristelle JoyceNo ratings yet

- Citf Practice TestDocument18 pagesCitf Practice TestAvnish Cuppoor81% (16)

- Chapter 3 Adjusting The Accounts-8EDocument28 pagesChapter 3 Adjusting The Accounts-8Emyechoes_1233% (3)

- Merger and Consolidation of Icici Ltd. and Icici BankDocument65 pagesMerger and Consolidation of Icici Ltd. and Icici BankArpit GuptaNo ratings yet

- Chapter 13 PowerPointDocument89 pagesChapter 13 PowerPointcheuleee100% (1)

- CMA Data For Bank Loan ProposalDocument29 pagesCMA Data For Bank Loan Proposalshardaashish0055% (11)

- Module in Fabm 1: Department of Education Schools Division of Pasay CityDocument6 pagesModule in Fabm 1: Department of Education Schools Division of Pasay CityAngelica Mae SuñasNo ratings yet

- Chapter 3 - The Adjusting ProcessDocument7 pagesChapter 3 - The Adjusting ProcessHa Phuoc HauNo ratings yet

- Ch03 - The Adjusting ProcessDocument24 pagesCh03 - The Adjusting ProcessBảo DươngNo ratings yet

- CH 03Document7 pagesCH 03lephuongtrucnhi30No ratings yet

- Adjusting EntriesDocument18 pagesAdjusting EntriesAmie Jane MirandaNo ratings yet

- Ch04 - Completing the accounting cycle đã chuyển đổiDocument26 pagesCh04 - Completing the accounting cycle đã chuyển đổiNguyễn Quốc KiệtNo ratings yet

- Ch01 - The Role of Accounting in Business - FinalDocument51 pagesCh01 - The Role of Accounting in Business - FinalBảo DươngNo ratings yet

- Week 1 OneslideperpageDocument73 pagesWeek 1 OneslideperpageBarry AuNo ratings yet

- Session 2a Handout PDFDocument7 pagesSession 2a Handout PDFChin Hung YauNo ratings yet

- The Accounting Cycle ContinuedDocument20 pagesThe Accounting Cycle ContinuedJjimin PJNo ratings yet

- Finnancial AccountingDocument10 pagesFinnancial AccountingNaveenNo ratings yet

- Chapter+3 the+Adjusting+ProcessDocument61 pagesChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- Adjusting EntriesDocument69 pagesAdjusting EntriesMadia Mujib100% (1)

- Adjusting EntriesDocument21 pagesAdjusting EntriesRegine ChuaNo ratings yet

- Profit or Ioss Pre and Post IncorporationDocument22 pagesProfit or Ioss Pre and Post IncorporationRanjana TrivediNo ratings yet

- 2022 Sem 1 ACC10007 Topic 3Document45 pages2022 Sem 1 ACC10007 Topic 3JordanNo ratings yet

- Accounting 04Document91 pagesAccounting 04Tamara WilsonNo ratings yet

- Cash Flow StatementDocument38 pagesCash Flow StatementSatyajit Ghosh100% (2)

- Chapter 1 - The Role of Accounting in BusinessDocument10 pagesChapter 1 - The Role of Accounting in BusinessHa Phuoc Hau100% (1)

- Accounting Principles (I) - 2Document39 pagesAccounting Principles (I) - 2ramiNo ratings yet

- Acct 2021 CH 2 Completion of The WorksheetDocument20 pagesAcct 2021 CH 2 Completion of The WorksheetAlemu BelayNo ratings yet

- Bsbfia401 Amit ChhetriDocument25 pagesBsbfia401 Amit Chhetriamitchettri419No ratings yet

- Golis University: Faculty of Business and Economics Chapter Four (Part Two) Accounting Information SystemDocument32 pagesGolis University: Faculty of Business and Economics Chapter Four (Part Two) Accounting Information Systemsaed cabdiNo ratings yet

- Fasset Discussion Class Jun 2021 Pastel - All Regions - Class Version - Session 2Document69 pagesFasset Discussion Class Jun 2021 Pastel - All Regions - Class Version - Session 2yusuf swabuNo ratings yet

- WK 3 Accrual Accounting Concepts 2 Slides Per PageDocument23 pagesWK 3 Accrual Accounting Concepts 2 Slides Per PageThùy Linh Lê Thị100% (1)

- Cash and Accrual BasisDocument2 pagesCash and Accrual Basisviji9999No ratings yet

- Chapter 1 Accounting For Income TaxDocument102 pagesChapter 1 Accounting For Income TaxNejat AhmedNo ratings yet

- Adjusting EntriesDocument4 pagesAdjusting EntriesKristine LoNo ratings yet

- Session 4 PDFDocument42 pagesSession 4 PDFmilepnNo ratings yet

- CH 4 - End of Chapter Exercises SolutionsDocument80 pagesCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNo ratings yet

- Study Objectives-: Chapter 3-The Basics of Adjusting EntriesDocument19 pagesStudy Objectives-: Chapter 3-The Basics of Adjusting EntriesMayann UrbanoNo ratings yet

- Abm 1-W6.M3.T1.L3Document21 pagesAbm 1-W6.M3.T1.L3mbiloloNo ratings yet

- Chap 3 Principle AccountingDocument52 pagesChap 3 Principle Accountingissack mohamedNo ratings yet

- 02 - General Ledger AccountingDocument24 pages02 - General Ledger AccountingYen Yen ChubiezNo ratings yet

- Completing The Accounting Cycle For A Merchandising BusinessDocument11 pagesCompleting The Accounting Cycle For A Merchandising BusinessRhea BernabeNo ratings yet

- BSBFIM801 Task 2 TemplateDocument29 pagesBSBFIM801 Task 2 TemplateMahwish AmmadNo ratings yet

- Chapter 3Document50 pagesChapter 3Galata NugusaNo ratings yet

- Principle of Accounting Topic Is: Adjusting EntriesDocument11 pagesPrinciple of Accounting Topic Is: Adjusting EntriesAhsan azizNo ratings yet

- Ac101 ch3Document21 pagesAc101 ch3Alex ChewNo ratings yet

- EBITDAC - A New Financial Metric?: Earnings Before Interest, Taxes, Depreciation, Amortization, and CoronavirusDocument24 pagesEBITDAC - A New Financial Metric?: Earnings Before Interest, Taxes, Depreciation, Amortization, and Coronavirusks frNo ratings yet

- Digos Central Adventist Academy, IncDocument3 pagesDigos Central Adventist Academy, IncPeter John IntapayaNo ratings yet

- 7 - Reporting Business Transactions Using Financial StatementsDocument15 pages7 - Reporting Business Transactions Using Financial StatementssurangauorNo ratings yet

- 3 CFSDocument65 pages3 CFSRocky Bassig100% (1)

- Adjusting EntriesDocument27 pagesAdjusting EntriesquintosjeryNo ratings yet

- Can Answer The Questions, "Where Did The Money Come From?" and "Where Did It Go?Document6 pagesCan Answer The Questions, "Where Did The Money Come From?" and "Where Did It Go?Dark PrincessNo ratings yet

- PRe 6 MaterialsDocument15 pagesPRe 6 MaterialsV-Heron BanalNo ratings yet

- Chapter 2 NotesDocument38 pagesChapter 2 NotesDonald YumNo ratings yet

- Financial Reporting and AnalysisDocument34 pagesFinancial Reporting and AnalysisRipu RanjanNo ratings yet

- 19668ipcc Acc Vol1 Chapter-3Document20 pages19668ipcc Acc Vol1 Chapter-3Vignesh SrinivasanNo ratings yet

- ACTG 2011 - Midterm Package - 2012-2013Document44 pagesACTG 2011 - Midterm Package - 2012-2013waysNo ratings yet

- Invoice: TO MR Sahil Bhandari #1403, Sector 9, Urban EstateDocument1 pageInvoice: TO MR Sahil Bhandari #1403, Sector 9, Urban EstateVarun SinglaNo ratings yet

- E Payment System Assign PDFDocument9 pagesE Payment System Assign PDFShafique Ahmed ArainNo ratings yet

- Gso Syllabus V6aDocument18 pagesGso Syllabus V6aNikhil KumarNo ratings yet

- Banking and Financial Institution Final Term TopicsDocument28 pagesBanking and Financial Institution Final Term TopicsPrincess Di BaykingNo ratings yet

- Introduction To Financial AccountingDocument7 pagesIntroduction To Financial Accountingmazni_han100% (1)

- Hinduja Leyland Finance LTDDocument28 pagesHinduja Leyland Finance LTDShekhar Landage100% (1)

- Handout. WCM - Cash ManagementDocument26 pagesHandout. WCM - Cash ManagementNaia SNo ratings yet

- Wesfarmers's Company: Le Huong Bao Linh Phan Quoc Bao Tran Thanh LongDocument16 pagesWesfarmers's Company: Le Huong Bao Linh Phan Quoc Bao Tran Thanh LongLinhberry Chunnie's GFNo ratings yet

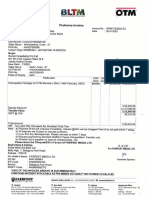

- Sorrel Otm FebDocument1 pageSorrel Otm FebGagandeep SinghNo ratings yet

- Branch Banking Concept: Services Provided at The BranchesDocument9 pagesBranch Banking Concept: Services Provided at The BranchesRobin WilliamNo ratings yet

- Final Silk Bank ReportDocument58 pagesFinal Silk Bank ReportMujahid Gill100% (1)

- Bcom 06 Block 03Document108 pagesBcom 06 Block 03Prabhu SahuNo ratings yet

- DBapplicationDocument1 pageDBapplicationGM MainstayNo ratings yet

- 3.FIM-Module III-Money Market and Capital MarketDocument12 pages3.FIM-Module III-Money Market and Capital MarketAmarendra PattnaikNo ratings yet

- 161421228Document36 pages161421228Fardeen KhanNo ratings yet

- (VAL MET) - I. Fundamental Principles of ValuationDocument5 pages(VAL MET) - I. Fundamental Principles of ValuationJoanne SunielNo ratings yet

- A Study On The Depositories in IndiaDocument22 pagesA Study On The Depositories in Indiaashna malhotraNo ratings yet

- Planning and Working Capital Management Part 1Document31 pagesPlanning and Working Capital Management Part 1Michelle RotairoNo ratings yet

- Farm Machinery and Mechanization - 12.economics of Farm MachineryDocument10 pagesFarm Machinery and Mechanization - 12.economics of Farm MachineryIrish RinganillaNo ratings yet

- National Income: Three and Four Sector ModelDocument13 pagesNational Income: Three and Four Sector ModelKratika PandeyNo ratings yet

- Reforming The International Monetary System in The 1970s and 2000s: Would An SDR Substitution Account Have Worked?Document38 pagesReforming The International Monetary System in The 1970s and 2000s: Would An SDR Substitution Account Have Worked?haygolpesenlavidaNo ratings yet

- KTVM Chapter 6Document43 pagesKTVM Chapter 6Thảo UyênNo ratings yet

- Anti Money LaunderingDocument56 pagesAnti Money LaunderingGina CambonggaNo ratings yet