Professional Documents

Culture Documents

Class 19

Uploaded by

Majid Iqbal0 ratings0% found this document useful (0 votes)

4 views9 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views9 pagesClass 19

Uploaded by

Majid IqbalCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

Worksheet

• A worksheet illustrates in one place the relationships

among the unadjusted trial balance, proposed adjusting

entries, and financial statements.

• A worksheet is prepared at the end of the period, but

before the adjusting entries are formally recorded in the

accounting records.

• It is not a formal step in the accounting cycle. Rather, it is

a tool used by accountants to work out the details of the

proposed end-of-period adjustments.

• It also provides them with a preview of how the financial

statements will look.

HOW IS A WORKSHEET USED?

• It allows accountants to see the effects of adjusting entries

without actually entering these adjustments in the

accounting records.

• This makes it relatively easy for them to correct errors or

make changes in estimated amounts.

• It also enables accountants and management to preview

the financial statements before the final drafts are

developed.

• Once the worksheet is complete, it serves as the source

for recording adjusting and closing entries in the

accounting records and for preparing financial statements.

• Another important use of the worksheet is in the

preparation of interim financial statements.

• Interim statements are financial statements

developed at various points during the fiscal year.

• Most companies close their accounts only once

each year.

• Yet they often need to develop quarterly or

monthly financial statements.

• Through the use of a worksheet, they can

develop these interim statements without having

to formally adjust and close their accounts.

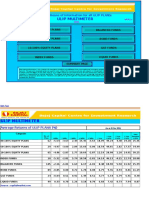

THE MECHANICS: HOW IT’S DONE

• Whether done manually or on a computer, the

preparation of a worksheet involves five basic

steps. We begin by describing these steps as if

the worksheet were being prepared manually.

• Afterward, we explain how virtually all of the

mechanical steps can be performed

automatically by a computer.

• 1. Enter the ledger account balances in the Trial

Balance columns.

• The worksheet begins with an unadjusted trial

balance. A few lines should be left blank

immediately below the last balance sheet account.

It is often necessary to add a few more accounts

during the adjusting process. Additional income

statement accounts also may be necessary.

• 2. Enter the adjustments in the Adjustments

columns.

• This step is the most important: Enter the

appropriate end-of-period adjustments in the

Adjustments columns.

• 3. Prepare an adjusted trial balance.

• The balances in the original trial balance ( blue

) are adjusted for the debit or credit amounts

in the Adjustments columns ( red ). The

adjusted trial balance is totaled to determine

that the accounts remain in balance.

• At this point, the worksheet is almost

complete. We have emphasized that financial

statements are prepared directly from the

adjusted trial balance. Thus we have only to

arrange these accounts into the format of

financial statements.

• 4. Extend the adjusted trial balance amounts into the

appropriate financial statement columns. The balance sheet

accounts—assets, liabilities, and owners’ equity—are

extended into the Balance Sheet columns; income statement

amounts, into the Income Statement columns.

• (The “Balance Sheet” and “Income Statement” captions in

the original trial balance should simplify this procedure.

Notice each amount is extended to only one column. Also,

the account retains the same debit or credit balance as

shown in the adjusted trial balance.)

• 5. Total the financial statement columns; determine and

record net income or net loss. The final step in preparing the

worksheet consists of totaling the Income Statement and

Balance Sheet columns and then bringing each set of columns

into balance. These tasks are performed on the bottom three

lines of the worksheet.

• Computers Do the Pencil-Pushing When a

worksheet is prepared by computer, accountants

perform only one of the steps listed above—

entering the adjustments.

• The computer automatically lists the ledger

accounts in the form of a trial balance. After the

accountant has entered the adjustments, it

automatically computes the adjusted account

balances and completes the worksheet. (Once the

adjusted balances are determined, completing the

worksheet involves nothing more than putting

these amounts in the appropriate column and

determining the column totals.)

You might also like

- The Accounting CycleDocument13 pagesThe Accounting CycleCheptot SammyNo ratings yet

- Worksheet PreparationDocument3 pagesWorksheet PreparationJon PangilinanNo ratings yet

- CH 4 Work Sheet2Document54 pagesCH 4 Work Sheet2Yasin Arafat ShuvoNo ratings yet

- CH 4Document59 pagesCH 4ad_jebbNo ratings yet

- Adjustments: Steps For Recording Adjusting EntriesDocument2 pagesAdjustments: Steps For Recording Adjusting EntriesYahnsea AlfaroNo ratings yet

- Year End Closing GLDocument11 pagesYear End Closing GLErshad RajaNo ratings yet

- POA REVISION LECT 8 2 22062021 041450pm 17112022 110535am 21032023 104120am 1Document69 pagesPOA REVISION LECT 8 2 22062021 041450pm 17112022 110535am 21032023 104120am 1muhammad atifNo ratings yet

- Adjusting EntriesDocument26 pagesAdjusting EntriesmaundumiNo ratings yet

- 07-Preparing Financial StatementsDocument64 pages07-Preparing Financial StatementsFenniLimNo ratings yet

- Amodia (Accounting Notes - Worksheet)Document3 pagesAmodia (Accounting Notes - Worksheet)CLUVER AEDRIAN AMODIANo ratings yet

- Completing The Accounting CycleDocument9 pagesCompleting The Accounting CycleTikaNo ratings yet

- WorksheetsDocument23 pagesWorksheetsoxygeniaxxNo ratings yet

- ADJUSTMENTS Adjusting Entries-2Document11 pagesADJUSTMENTS Adjusting Entries-2Moses IrunguNo ratings yet

- Acc201 Su2Document5 pagesAcc201 Su2Gwyneth LimNo ratings yet

- HC1011/HF1008: Topic 5 Accounting Cycle & Accounting SystemsDocument9 pagesHC1011/HF1008: Topic 5 Accounting Cycle & Accounting SystemsleNo ratings yet

- Unit 6 - Trial BalanceDocument67 pagesUnit 6 - Trial BalanceowaisNo ratings yet

- The Accounting Cycle: 9-S Tep Accounting ProcessDocument11 pagesThe Accounting Cycle: 9-S Tep Accounting ProcessLovely Mae LacasteNo ratings yet

- Acc CycleDocument3 pagesAcc CycleJomarie BenedictoNo ratings yet

- WorksheetDocument7 pagesWorksheetCamelliaNo ratings yet

- Flow Chart - Trial Balance - WikiAccountingDocument6 pagesFlow Chart - Trial Balance - WikiAccountingmatthew mafaraNo ratings yet

- Chapter 8Document50 pagesChapter 8Caleb GetubigNo ratings yet

- The Conceptual Framework of AccountingDocument34 pagesThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Chapter 4. Completing The Accounting CycleDocument3 pagesChapter 4. Completing The Accounting CycleÁlvaro Vacas González de EchávarriNo ratings yet

- What Is Accounting and What Is Its Purpose? What Is Its Role in Decision-Making?Document4 pagesWhat Is Accounting and What Is Its Purpose? What Is Its Role in Decision-Making?Jpoy RiveraNo ratings yet

- M7A Worksheet PreparationDocument6 pagesM7A Worksheet PreparationLycann Craven Gamueda RolaNo ratings yet

- Lesson 21Document15 pagesLesson 21Rica Mae ParamNo ratings yet

- AIS IntroductionDocument22 pagesAIS Introductionashleykiki.keNo ratings yet

- Accounting CycleDocument3 pagesAccounting CycleMardy DahuyagNo ratings yet

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Document14 pagesACTBAS1 - Lecture 11 (Completion of Acctg Cycle)AA Del Rosario AlipioNo ratings yet

- Accounting CycleDocument4 pagesAccounting CycleAmitNo ratings yet

- Accounting CycleDocument2 pagesAccounting CycleDNLNo ratings yet

- Accounting CycleDocument30 pagesAccounting CycleJenelle RamosNo ratings yet

- Kap 4 Parimet EkontabilitetitDocument18 pagesKap 4 Parimet EkontabilitetitEdmond KeraNo ratings yet

- The Accounting Cycle: 9-Step Accounting ProcessDocument2 pagesThe Accounting Cycle: 9-Step Accounting Processfazal rahmanNo ratings yet

- Accounting Individual AssignmentDocument2 pagesAccounting Individual AssignmentSIYAMUR RAHMANNo ratings yet

- ACTBAS1 - Lecture 11 (Completion of Acctg Cycle)Document14 pagesACTBAS1 - Lecture 11 (Completion of Acctg Cycle)ivang95No ratings yet

- The Accounting Cycle: 9-Step Accounting Process InshareDocument3 pagesThe Accounting Cycle: 9-Step Accounting Process InshareBTS ARMYNo ratings yet

- Class 20Document4 pagesClass 20Majid IqbalNo ratings yet

- Bazele Contabilitatii C4EDocument17 pagesBazele Contabilitatii C4EtamasraduNo ratings yet

- Module 6 - Worksheet and Financial Statements Part IDocument12 pagesModule 6 - Worksheet and Financial Statements Part IMJ San Pedro100% (1)

- ReconciliationDocument15 pagesReconciliationManisha AmudaNo ratings yet

- Accounting Cycle StepsDocument4 pagesAccounting Cycle StepsAntiiasmawatiiNo ratings yet

- Flow Chart - Accounting CycleDocument11 pagesFlow Chart - Accounting Cyclematthew mafaraNo ratings yet

- Seminar Week 6 (Lecture Slides Chapter 11)Document22 pagesSeminar Week 6 (Lecture Slides Chapter 11)palekingyeNo ratings yet

- Slide ACT102 ACT102 Slide 07Document34 pagesSlide ACT102 ACT102 Slide 07Yun FitrianoNo ratings yet

- Chapter 6 LectureDocument21 pagesChapter 6 LectureDana cheNo ratings yet

- Financial Accounting and Reporting - SLK - 03Document24 pagesFinancial Accounting and Reporting - SLK - 03Its Nico & SandyNo ratings yet

- Accounting ProcessDocument79 pagesAccounting ProcessKeanna Ashley GutingNo ratings yet

- Accounting Process CycleDocument12 pagesAccounting Process Cyclechandra sekhar Tippreddy100% (1)

- Introduction To Computerized Accounting: Unit 1Document88 pagesIntroduction To Computerized Accounting: Unit 1Turyamureeba JuliusNo ratings yet

- PC-14 - Day 2 - Session-2 - 23.03.2023Document13 pagesPC-14 - Day 2 - Session-2 - 23.03.2023Ajaya SahooNo ratings yet

- General Ledger and Reporting SystemDocument9 pagesGeneral Ledger and Reporting SystemAisah ReemNo ratings yet

- 04 Completing The Accounting Cycle PDFDocument39 pages04 Completing The Accounting Cycle PDFcyics TabNo ratings yet

- Ledger and Trial BalanceDocument28 pagesLedger and Trial BalanceJustine Maravilla100% (1)

- The Post of Trial Balance (Bing)Document5 pagesThe Post of Trial Balance (Bing)rezarenonnNo ratings yet

- Accounting CycleDocument9 pagesAccounting Cyclerakshit konchadaNo ratings yet

- Trial BalanceDocument8 pagesTrial BalanceYusra AmeenNo ratings yet

- Comprehensive Problem Assignment - PDFDocument20 pagesComprehensive Problem Assignment - PDFJunior RobinsonNo ratings yet

- Accounting CycleDocument4 pagesAccounting CycleCristel TomasNo ratings yet

- Business StudyDocument4 pagesBusiness Studymurganv2006No ratings yet

- Google IPO: Case Study PresentationDocument9 pagesGoogle IPO: Case Study PresentationrohtdaNo ratings yet

- A. Liquidity Ratios - Short Term Solvency: Current Assets Current LiabilitiesDocument14 pagesA. Liquidity Ratios - Short Term Solvency: Current Assets Current LiabilitiesAshish kumar ThapaNo ratings yet

- CH 7 AnswersDocument5 pagesCH 7 Answersthenikkitr0% (1)

- Dec 2020Document17 pagesDec 2020Anjana TimalsinaNo ratings yet

- Week 13 - Bond FundamentalsDocument54 pagesWeek 13 - Bond FundamentalshuguesNo ratings yet

- Private Equity ExplainedDocument27 pagesPrivate Equity Explainedleonnox100% (2)

- Non-Executive Director-Chairman: Type Traded AsDocument3 pagesNon-Executive Director-Chairman: Type Traded AsAyman KhalidNo ratings yet

- Investment CriteriaDocument23 pagesInvestment Criteriaiqbal irfaniNo ratings yet

- 9706 s10 Ms 43Document6 pages9706 s10 Ms 43cherylllimclNo ratings yet

- SAPM1Document5 pagesSAPM1Shaan MahendraNo ratings yet

- Questions CF STMTDocument6 pagesQuestions CF STMTNaresh BajracharyaNo ratings yet

- AKR Corporindo (AKRA IJ/BUY/Rp3,600/Target: Rp4,730)Document7 pagesAKR Corporindo (AKRA IJ/BUY/Rp3,600/Target: Rp4,730)FREE FOR FREEDOMNo ratings yet

- Financial Instruments-Equity Instruments of Another EntityDocument7 pagesFinancial Instruments-Equity Instruments of Another EntityElla MontefalcoNo ratings yet

- Accounting StandardsDocument12 pagesAccounting StandardsREHANRAJNo ratings yet

- Castro, Geene - Activity 1 - Bsma 3205Document6 pagesCastro, Geene - Activity 1 - Bsma 3205Geene CastroNo ratings yet

- FMGTDocument40 pagesFMGTbindrapalak1905No ratings yet

- Final Exam For PhotoDocument16 pagesFinal Exam For PhotofaizaNo ratings yet

- Business Plan Template For A Startup BusinessDocument33 pagesBusiness Plan Template For A Startup BusinessWonzeNo ratings yet

- Rs. in Million Accounts Balance: Solution: Liabilities AssetsDocument2 pagesRs. in Million Accounts Balance: Solution: Liabilities AssetsNithin Duke2499No ratings yet

- Valuation of SharesDocument51 pagesValuation of SharesSwati GoyalNo ratings yet

- (Demats) - Dematerialisation or "Demat" Is A Process Whereby Investors' Securities Like SharesDocument9 pages(Demats) - Dematerialisation or "Demat" Is A Process Whereby Investors' Securities Like Sharesferoz khanNo ratings yet

- June 11 DipIFR AnswersDocument10 pagesJune 11 DipIFR AnswersjaimaakalikaNo ratings yet

- Master Budget: Sales ForecastDocument61 pagesMaster Budget: Sales ForecastLay TekchhayNo ratings yet

- Ulip MultimeterDocument17 pagesUlip MultimeterRaghu RaoNo ratings yet

- MRIDUL - A Study of Consumer Behaviour in Relation To Insurance Products in IDBI PDFDocument63 pagesMRIDUL - A Study of Consumer Behaviour in Relation To Insurance Products in IDBI PDFanjali malhotraNo ratings yet

- MGT Chapter 03 - AnswerDocument10 pagesMGT Chapter 03 - Answerlooter198No ratings yet

- CAF 2 - Energizer - Day 1 - March 2023Document14 pagesCAF 2 - Energizer - Day 1 - March 2023Muhammad Ahsan RiazNo ratings yet

- 11 Chapter 3 (Working Capital Aspects)Document30 pages11 Chapter 3 (Working Capital Aspects)Abin VargheseNo ratings yet

- Quizzer 1 - Fin-WPS OfficeDocument3 pagesQuizzer 1 - Fin-WPS Officemarie joy ortizNo ratings yet