Professional Documents

Culture Documents

Chapt 14

Chapt 14

Uploaded by

Lara Khan0 ratings0% found this document useful (0 votes)

1 views7 pagesOriginal Title

chapt 14

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views7 pagesChapt 14

Chapt 14

Uploaded by

Lara KhanCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 7

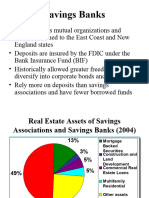

Other Lending Institution Saving

Institutions Credit Unions And

Finance Company

Financial services

Saving Finance

Credit union

institution companies

Saving bank Saving association

Savings Institutions (SIs)

•Historically referred to as Savings and Loans (S&Ls)

Savings banks (SBs) appeared in the 1980

•Specialize in long-term residential mortgages, which are

usually financed with short-term deposits of small

savers

•Faced a huge crisis during the 1982-1992 period that

saw over half of all SIs fail

The S&L Crisis of 1982-1992

• Some 4,000 SIs existed at the end of the 1970s

• By 2007, only 1,257 SIs exist

• The Federal Reserve radically changed its

monetary policy during October 1979 to October

1982

– targeted reserves rather than interest rates

– led to sudden surge in interest rates

– many SIs faced negative spreads

– SIs lost depositors because of Regulation Q

The S&L Crisis of 1982-1992

• Depository Institutions Deregulations and Monetary

Control Act (DIDMCA) of 1980 and Garn-St. Germain

Depository Institutions Act (GSGDIA) of 1982 addressed

the crisis

– allowed interest-bearing transaction accounts

– allowed SIs to offer floating- or adjustable-rate mortgages

– allowed expansion into real estate development and

commercial lending

– some SIs chose to invest in the junk bond market and suffered

large losses when the junk bond market collapsed in the mid-

1980s

Cont…..

• Real estate and land prices collapsed in many areas of the

U.S. in the mid-1980s

– many mortgages defaulted as a result

• The Federal Savings and Loan Insurance Corporation

(FSLIC) had a policy of regulatory forbearance

– i.e., its policy was to not close economically insolvent FIs,

allowing them to continue to operate

• 1,248 SIs failed in the 1982 to 1992 period

– the FSLIC became massively insolvent as a result

Cont..

• The Financial Institutions Reform, Recovery, and

Enforcement Act (FIRREA) of 1989

– abolished the FSLIC

– created a new Savings Association Insurance Fund (SAIF) that

was put under the management of the Federal Deposit

Insurance Corporation (FDIC)

– replaced the Federal Home Loan Bank Board with the Office of

Thrift Supervision (OTS)

– created the Resolution Trust Corporation (RTC) to close and

liquidate insolvent SIs

– the Qualified Thrift Lender Test (QTL) sets a floor on the

mortgage-related assets that thrifts must hold (currently at 65%)

– introduced Prompt Corrective Action (PCA), which mandates

that regulators must close problem banks and thrifts faster

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 4Document37 pagesChapter 4Lara KhanNo ratings yet

- Business LawDocument1 pageBusiness LawLara KhanNo ratings yet

- Wah College of Accountancy: Course: Economy of PakistanDocument1 pageWah College of Accountancy: Course: Economy of PakistanLara KhanNo ratings yet

- Wah College of Accountancy: Course: Introduction To BusinessDocument1 pageWah College of Accountancy: Course: Introduction To BusinessLara KhanNo ratings yet

- Divend AffectDocument6 pagesDivend AffectLara KhanNo ratings yet

- Savings BanksDocument7 pagesSavings BanksLara KhanNo ratings yet

- Chap05-All LecturesDocument40 pagesChap05-All LecturesLara KhanNo ratings yet

- FOREXDocument23 pagesFOREXLara KhanNo ratings yet