Professional Documents

Culture Documents

Mishkin Embfm12ege Ch21

Uploaded by

محمد ابوشريف0 ratings0% found this document useful (0 votes)

20 views29 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views29 pagesMishkin Embfm12ege Ch21

Uploaded by

محمد ابوشريفCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 29

The Economics of Money, Banking, and

Financial Markets

Twelfth Edition, Global Edition

Chapter 21

The IS Curve

Copyright © 2019 Pearson Education, Ltd.

Preview

• This chapter develops the IS schedule, which describes

the relationship between real interest rates and aggregate

output when the market for real goods and services is in

equilibrium.

Copyright © 2019 Pearson Education, Ltd.

Learning Objectives

• List the four components of aggregate demand (or planned

expenditure).

• List and describe the factors that determine the four

components of aggregate demand (or planned

expenditure).

• Solve for the goods market equilibrium.

• Describe why the IS curve slopes downward and why the

economy heads to a goods market equilibrium.

• List the factors that shift the IS curve and describe how

they shift the IS curve.

Copyright © 2019 Pearson Education, Ltd.

Planned Expenditure and Aggregate

Demand (1 of 2)

• Planned expenditure is the total amount of spending on

domestically produced goods and services that

households, businesses, the government, and foreigners

want to make.

• Aggregate demand is the total amount of output

demanded in the economy.

Copyright © 2019 Pearson Education, Ltd.

Planned Expenditure and Aggregate

Demand (2 of 2)

• The total quantity demanded of an economy’s output is the

sum of 4 types of spending:

– Consumption expenditure (C)

– Planned investment spending (I)

– Government purchases (G)

– Net exports (NX)

Copyright © 2019 Pearson Education, Ltd.

The Components of Aggregate Demand

• In Keynes’ view, consumption expenditure is positively

related to disposable income, which is available for

spending:

• The consumption function can be expressed as

– : autonomous consumption expenditure

– : marginal propensity to consume, which is a constant

between 0 and 1.

Copyright © 2019 Pearson Education, Ltd.

Investment Spending

• Fixed investment are always planned.

• Inventory investment can be unplanned.

• Planned investment spending

– Interest rates

– Expectations

Copyright © 2019 Pearson Education, Ltd.

Planned Investment Spending

• Investment function (fixed investment plus planned

inventory investment)

– : autonomous investment

– : responsiveness of investment to real interest rate

• The real interest rates on investment is subject to financial

frictions () that hinder the efficient functioning of financial

markets

Copyright © 2019 Pearson Education, Ltd.

Net Exports

• Two components: autonomous net exports and the part of

net exports that is affected by changes in real interest

rates

• Net export function:

Copyright © 2019 Pearson Education, Ltd.

Government Purchases and Taxes

• The government affects aggregate demand in two ways:

through its purchases and taxes

• Government purchases:

• Government taxes:

Copyright © 2019 Pearson Education, Ltd.

Goods Market Equilibrium (1/2)

• Keynes recognized that equilibrium would occur in the

economy when the total quantity of output produced in the

economy equals the total amount of aggregate demand

(planned expenditure).

• Solving for goods market equilibrium:

Aggregate Output () = Consumption Expenditure () +

Planned Investment Spending () + Government

Purchases () + Net Exports ()

Copyright © 2019 Pearson Education, Ltd.

Goods Market Equilibrium (2/2)

•

Copyright © 2019 Pearson Education, Ltd.

Understanding the IS Curve

• What the IS curve tells us: traces out the points at which

the goods market is in equilibrium

• Examines an equilibrium where aggregate output equals

aggregate demand

• Assumes fixed price level where nominal and real

quantities are the same

• IS curve is the relationship between equilibrium aggregate

output and the interest rate.

Copyright © 2019 Pearson Education, Ltd.

Figure 1 The IS Curve

Copyright © 2019 Pearson Education, Ltd.

Why the Economy Heads Toward the

Equilibrium

• Interest rates and planned investment spending

– Negative relationship

• Interest rates and net exports

– Negative relationship

• IS curve: the points at which the total quantity of goods

produced equals the total quantity of goods demanded

• Output tends to move toward points on the curve that

satisfies the goods market equilibrium.

Copyright © 2019 Pearson Education, Ltd.

Factors That Shift the IS Curve (1 of 3)

• The IS curve shifts whenever there is a change in

autonomous factors (factors independent of aggregate

output and the real interest rate).

• One example is changes in government purchases, as in

Figure 2.

Copyright © 2019 Pearson Education, Ltd.

Figure 2 Shift in the IS Curve from an

Increase in Government Purchases

Copyright © 2019 Pearson Education, Ltd.

Application: The Vietnam War Buildup,

1964–1969

• The United States’ involvement in Vietnam began to

escalate in the early 1960s.

• Usually during a period when government purchases are

rising rapidly, central banks raise real interest rates to keep

the economy from overheating.

• The Vietnam War period, however, is unusual because the

Federal Reserve decided to keep real interest rates

constant. Hence, this period provides an excellent example

of how policy makers could make use of the IS curve

analysis to inform policy.

Copyright © 2019 Pearson Education, Ltd.

Figure 3 Vietnam War Build Up

Copyright © 2019 Pearson Education, Ltd.

Changes in Taxes

• At any given real interest rate, a rise in taxes causes

aggregate demand and hence equilibrium output to fall,

thereby shifting the IS curve to the left.

• Conversely, a cut in taxes at any given real interest rate

increases disposable income and causes aggregate

demand and equilibrium output to rise, shifting the IS curve

to the right.

Copyright © 2019 Pearson Education, Ltd.

Figure 4 Shift in the IS Curve from an

Increase in Taxes

• Another example of what shifts the IS curve is changes in

taxes, as in Figure 4

Copyright © 2019 Pearson Education, Ltd.

Application: The Fiscal Stimulus Package of

2009 (1 of 2)

• In the fall of 2008, the U.S. economy was in crisis. By the

time the new Obama administration had taken office, the

unemployment rate had risen from 4.7% just before the

recession began in December 2007 to 7.6% in January

2009.

• To stimulate the economy, the Obama administration

proposed a fiscal stimulus package that, when passed by

Congress, included $288 billion in tax cuts for households

and businesses and $499 billion in increased federal

spending, including transfer payments.

Copyright © 2019 Pearson Education, Ltd.

Application: The Fiscal Stimulus Package of

2009 (2 of 2)

• These tax cuts and spending increases were predicted to

increase aggregate demand, thereby raising the

equilibrium level of aggregate output at any given real

interest rate and so shifting the IS curve to the right.

• Unfortunately, most of the government purchases did not

kick in until after 2010, while the decline in autonomous

consumption and investment was much larger than

anticipated.

• The fiscal stimulus was more than offset by weak

consumption and investment, with the result that the

aggregate demand ended up contracting rather than rising,

and the IS curve did not shift to the right, as hoped.

Copyright © 2019 Pearson Education, Ltd.

Factors That Shift the IS Curve (2 of 3)

• Changes in autonomous spending also affect the IS curve:

– Autonomous consumption

– Autonomous investment spending

– Autonomous net exports

Copyright © 2019 Pearson Education, Ltd.

Autonomous Consumption

• A rise in autonomous consumption would raise aggregate

demand and equilibrium output at any given interest rate,

shifting the IS curve to the right.

• Conversely, a decline in autonomous consumption

expenditure causes aggregate demand and equilibrium

output to fall, shifting the IS curve to the left.

Copyright © 2019 Pearson Education, Ltd.

Autonomous Investment Spending

• An increase in autonomous investment spending increases

equilibrium output at any given interest rate, shifting the IS

curve to the right.

• On the other hand, a decrease in autonomous investment

spending causes aggregate demand and equilibrium

output to fall, shifting the IS curve to the left.

Copyright © 2019 Pearson Education, Ltd.

Autonomous Net Exports

• An autonomous increase in net exports leads to an

increase in equilibrium output at any given interest rate

and shifts the IS curve to the right.

• Conversely, an autonomous fall in net exports causes

aggregate demand and equilibrium output to decline,

shifting the IS curve to the left.

Copyright © 2019 Pearson Education, Ltd.

Factors That Shift the IS Curve (3 of 3)

• Another factor that shifts the IS curve is changes in

financial frictions

– An increase in financial frictions, as occurred during the

financial crisis of 2007–2009, raises the real cost of

borrowing to firms and hence causes investment

spending and aggregate demand to fall

Copyright © 2019 Pearson Education, Ltd.

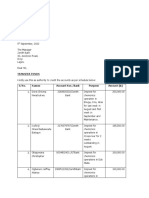

Summary Table 1 Shifts in the IS Curve from

Autonomous Changes in C̅ , I̅ , G̅ , T̅ , N̅ X̅ and f̅

Copyright © 2019 Pearson Education, Ltd.

You might also like

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- The IS Curve: © 2016 Pearson Education Ltd. All Rights Reserved. 21-1Document27 pagesThe IS Curve: © 2016 Pearson Education Ltd. All Rights Reserved. 21-1Lazaros KarapouNo ratings yet

- Parkin - Econ - Lecture - Notes - ch27 Aggregate Supply and DemandDocument45 pagesParkin - Econ - Lecture - Notes - ch27 Aggregate Supply and Demand9c696qbzngNo ratings yet

- Mishkin Embfm12ege ch22Document18 pagesMishkin Embfm12ege ch22محمد ابوشريفNo ratings yet

- AD As Analysis Chapter 23 MishkinDocument40 pagesAD As Analysis Chapter 23 MishkinmahamNo ratings yet

- GDP and Economic GrowthDocument12 pagesGDP and Economic Growthbmiskiewicz2406No ratings yet

- Chapter 10 - Aggregate S&DDocument46 pagesChapter 10 - Aggregate S&DHsu LayNo ratings yet

- Economic Issues PDFDocument10 pagesEconomic Issues PDFFathik FouzanNo ratings yet

- Unit 14 InflationDocument14 pagesUnit 14 InflationRajveer SinghNo ratings yet

- Macroeconomics: Eighth EditionDocument45 pagesMacroeconomics: Eighth Editionrafi rowatulNo ratings yet

- Mishkin Embfm12ege Ch23Document49 pagesMishkin Embfm12ege Ch23Muhammad ButtNo ratings yet

- Fiscal Policy: by Kumar Devrat Rohita Mohit Shukla Nasreen Prashant SharmaDocument19 pagesFiscal Policy: by Kumar Devrat Rohita Mohit Shukla Nasreen Prashant SharmaMohit ShuklaNo ratings yet

- CFO Macro12 PPT 19Document45 pagesCFO Macro12 PPT 19Pedro ValdiviaNo ratings yet

- Macro Chp19Document29 pagesMacro Chp19HandeeorNo ratings yet

- ECON203 - Chapter 4Document29 pagesECON203 - Chapter 4badr akrichNo ratings yet

- Case Fair Macro13e Accessible Ppt 05 (Автосохраненный)Document30 pagesCase Fair Macro13e Accessible Ppt 05 (Автосохраненный)Zhanerke NurmukhanovaNo ratings yet

- Canadian Securities: Economic PolicyDocument41 pagesCanadian Securities: Economic PolicyNikku SinghNo ratings yet

- Econ 203 Notes mt1Document6 pagesEcon 203 Notes mt1roudyjoezakhourNo ratings yet

- Lecture 2 Gross Domestic Product (Student)Document59 pagesLecture 2 Gross Domestic Product (Student)cuteserese roseNo ratings yet

- Aggregate Supply, Aggregate Demand and National OutputDocument43 pagesAggregate Supply, Aggregate Demand and National OutputChristian Jumao-as MendozaNo ratings yet

- Inflation,-Fiscal and Monetary Policies.: Dr. Seema SinghDocument25 pagesInflation,-Fiscal and Monetary Policies.: Dr. Seema SinghdushyantkrNo ratings yet

- Aggregate Output, Prices, and Economic Growth: Presenter's Name Presenter's Title DD Month YyyyDocument33 pagesAggregate Output, Prices, and Economic Growth: Presenter's Name Presenter's Title DD Month YyyybingoNo ratings yet

- Chapter 8 Notes Aggregate Expenditure ModelDocument14 pagesChapter 8 Notes Aggregate Expenditure ModelBeatriz CanchilaNo ratings yet

- Fiscal PolicyDocument21 pagesFiscal PolicycamilleNo ratings yet

- Fiscal and Monitary Policy-1Document43 pagesFiscal and Monitary Policy-1ANITTA M. AntonyNo ratings yet

- International Business Environments and Operations, 13/e Global EditionDocument24 pagesInternational Business Environments and Operations, 13/e Global EditionKHADIZA123123No ratings yet

- Economy AnalysisDocument4 pagesEconomy AnalysisAniket VermaNo ratings yet

- Chapter 31 - Parkin - PowerPointDocument15 pagesChapter 31 - Parkin - PowerPointUzair IsmailNo ratings yet

- Macroeconomics Economic Balancing 5 SectorDocument3 pagesMacroeconomics Economic Balancing 5 SectorIdha RahmaNo ratings yet

- On InflationDocument35 pagesOn InflationManoj ChahalNo ratings yet

- MacroeconomicsDocument8 pagesMacroeconomicscamellNo ratings yet

- Economics and Personal TatementDocument7 pagesEconomics and Personal Tatementsultana nasirNo ratings yet

- Fiscal PolicyDocument22 pagesFiscal Policyshailendersingh74No ratings yet

- Assignment#4Document2 pagesAssignment#4farhansaifal795No ratings yet

- Why Dose Govt. Impose Taxes-Fiscal Deficit: Pratima Tripathi (Imb2010012) Manupriya (Imb2010044)Document29 pagesWhy Dose Govt. Impose Taxes-Fiscal Deficit: Pratima Tripathi (Imb2010012) Manupriya (Imb2010044)Nikki ShresthaNo ratings yet

- Lesson 4b InflationDocument19 pagesLesson 4b InflationGaurav Kumar ChandelNo ratings yet

- Macroeconomics AD:ASDocument13 pagesMacroeconomics AD:ASSoumya RanaNo ratings yet

- Notes Fiscal PolicyDocument12 pagesNotes Fiscal PolicyKrish Madhav ShethNo ratings yet

- Is LMDocument30 pagesIs LMSven GartisNo ratings yet

- Mishkin Econ12eGE CH19Document47 pagesMishkin Econ12eGE CH19josemourinhoNo ratings yet

- POE 20 MacroeconomicsDocument47 pagesPOE 20 MacroeconomicsFiitjee RecordNo ratings yet

- Introduction To Macroeconomics Basic Concepts and Scope of Macroeconomic Analysis What Is Macroeconomics?Document53 pagesIntroduction To Macroeconomics Basic Concepts and Scope of Macroeconomic Analysis What Is Macroeconomics?ZAKAYO NJONYNo ratings yet

- CH 1Document14 pagesCH 1Taha Wael QandeelNo ratings yet

- Measuring GDP and Economic Growth: Chapter 21, Michael ParkinDocument21 pagesMeasuring GDP and Economic Growth: Chapter 21, Michael ParkinOyon Nur newazNo ratings yet

- Parkinmacro4 1300Document16 pagesParkinmacro4 1300Mr. JahirNo ratings yet

- Unit 5Document13 pagesUnit 5boomeshreddy8No ratings yet

- Chapter 1.4 - GDP ComponentsDocument26 pagesChapter 1.4 - GDP Componentsgon.ugarrizaNo ratings yet

- Chapter 21: MONITORING THE VALUE OF PRODUCTION: GDPDocument68 pagesChapter 21: MONITORING THE VALUE OF PRODUCTION: GDPÁnh NgọcNo ratings yet

- Lesson Week 7 ADAS .PPTX - My NotesDocument49 pagesLesson Week 7 ADAS .PPTX - My NotesMartin van der VlistNo ratings yet

- PART I: Answers To Discussion Questions ch2Document10 pagesPART I: Answers To Discussion Questions ch2hanNo ratings yet

- Principles of Economics: Twelfth EditionDocument30 pagesPrinciples of Economics: Twelfth EditionNina MchantafNo ratings yet

- Module 4Document8 pagesModule 4Piyush AneejwalNo ratings yet

- Fiscal Policy MeaningDocument27 pagesFiscal Policy MeaningVikash SinghNo ratings yet

- Fiscal PolicyDocument24 pagesFiscal Policyરહીમ હુદ્દાNo ratings yet

- Goods and Financial Market EquilibriumDocument25 pagesGoods and Financial Market EquilibriumPrathamesh RamNo ratings yet

- Winter Vacation HomeworkDocument15 pagesWinter Vacation HomeworkHadya HassNo ratings yet

- Inflation FinalDocument36 pagesInflation Finalshruti_ajey100% (2)

- Macro Lecture 4 PDFDocument40 pagesMacro Lecture 4 PDFpulkit guptaNo ratings yet

- Economics F1Document72 pagesEconomics F1amir0% (1)

- Chapter 23 Aggregate Demand and Supply AnalysisDocument54 pagesChapter 23 Aggregate Demand and Supply AnalysisTRAM NGUYEN NHU QUYNHNo ratings yet

- 3.9 Earning's Management and The Long-Run Market Performance of Initial Public OfferingDocument35 pages3.9 Earning's Management and The Long-Run Market Performance of Initial Public Offeringمحمد ابوشريفNo ratings yet

- 3.3 Underpricing and Entrepreneurial Wealth Losses in IPOs Theory and EvidenceDocument14 pages3.3 Underpricing and Entrepreneurial Wealth Losses in IPOs Theory and Evidenceمحمد ابوشريفNo ratings yet

- 9.5 Higher Market Valuation of Companies With A Small Board of DirectorsDocument13 pages9.5 Higher Market Valuation of Companies With A Small Board of Directorsمحمد ابوشريفNo ratings yet

- Corporate Governance and Capital Structure in DeveDocument20 pagesCorporate Governance and Capital Structure in Deveمحمد ابوشريفNo ratings yet

- Mishkin Embfm12ege Ch20Document25 pagesMishkin Embfm12ege Ch20محمد ابوشريفNo ratings yet

- Renewables Atlas FinalDocument128 pagesRenewables Atlas FinalOrtegaYONo ratings yet

- OD328636244353646100Document3 pagesOD328636244353646100ankit ojhaNo ratings yet

- RFQ For Buying Scrap PaperDocument23 pagesRFQ For Buying Scrap PaperBheki ShongweNo ratings yet

- Lab Assisst InstructionsDocument7 pagesLab Assisst InstructionsOlumideNo ratings yet

- Presentation 1Document36 pagesPresentation 1David DuksNo ratings yet

- Car Brand Automobile Industry in The Porte's MatrixDocument5 pagesCar Brand Automobile Industry in The Porte's MatrixAli IsmailNo ratings yet

- ACCT230 Ch7Document60 pagesACCT230 Ch7Said MohamedNo ratings yet

- What Is A SWOT AnalysisDocument23 pagesWhat Is A SWOT AnalysisvssNo ratings yet

- Marketing AspectDocument2 pagesMarketing Aspect2087296No ratings yet

- Prestige Private LimitedDocument28 pagesPrestige Private Limitedlery.aryNo ratings yet

- Quarterly Journal of Economics: Vol. 135 2020 Issue 2Document84 pagesQuarterly Journal of Economics: Vol. 135 2020 Issue 2Lucas OrdoñezNo ratings yet

- Allowable DeductionsDocument16 pagesAllowable DeductionsChyna Bee SasingNo ratings yet

- All About Advertising Fact FileDocument5 pagesAll About Advertising Fact FileVeronica RoataNo ratings yet

- Topic 3 - Tutorial Question - Contract - Part - ADocument2 pagesTopic 3 - Tutorial Question - Contract - Part - AYuenNo ratings yet

- Chapter 11-Part 1 Share Transaction Soal 1Document2 pagesChapter 11-Part 1 Share Transaction Soal 1Nicko Arisandiy0% (1)

- Fundamentals of Corporate Finance 12th Edition Ross Test BankDocument35 pagesFundamentals of Corporate Finance 12th Edition Ross Test Bankadeliahue1q9kl100% (19)

- Superbonga Beauty SalonDocument96 pagesSuperbonga Beauty SalonFatmah100% (1)

- PBO - Lecture 01 - Introduction To Business OperationsDocument5 pagesPBO - Lecture 01 - Introduction To Business OperationskevorkNo ratings yet

- Affidavit of Non OperationDocument2 pagesAffidavit of Non OperationMaRa EDNo ratings yet

- TEST 1 Part-5Document3 pagesTEST 1 Part-5minh tinhNo ratings yet

- Manappuram Chairman On CNBCDocument3 pagesManappuram Chairman On CNBCRaghu.GNo ratings yet

- ALuminium Foil ConatinerDocument22 pagesALuminium Foil ConatinerRajesh KumarNo ratings yet

- Intro To Equinix - IR - Presentation Q3 23 10.29.2023Document46 pagesIntro To Equinix - IR - Presentation Q3 23 10.29.2023alexcmorton2No ratings yet

- Far Reviewer SituationalDocument13 pagesFar Reviewer SituationalMaria Nicole PetillaNo ratings yet

- Joseph Sussman - Introduction To Transportation SystemsDocument501 pagesJoseph Sussman - Introduction To Transportation SystemsVandaNo ratings yet

- Mustika RatuDocument8 pagesMustika RatuddNo ratings yet

- National Logistics Policy AssignmentDocument18 pagesNational Logistics Policy AssignmentRAHUL DEVNo ratings yet

- S VDocument95 pagesS VSayani ChakrabortyNo ratings yet

- Arakan Tourism 5-Year Marketing PlanDocument45 pagesArakan Tourism 5-Year Marketing PlanDaniel CuñadoNo ratings yet

- 2020a1 PDFDocument2 pages2020a1 PDFHanson ChauNo ratings yet