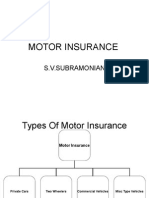

Motor Insurance

Type of policies General Regulation

Rating and Tariff

�History of Motor Insurance

1894

1895

1899

�1903

1930 & 1934

1960

�1939

1946

1988 & 1989

�Mechanically propelled vehicle Adapted for use upon roads Whether the power of propulsion is transmitted thereto from an external source

But does not includeVehicles running upon fixed rails Or in any other enclosed premises Or engine capacity is less than 49 cc

�Vehicle used for social, domestic and pleasure purposes and also for professional purposes (excluding carriage of goods other than samples) of the insured or used by insureds employees for such purpose but excluding use for hire or reward, racing, pace making, reliability trial, speed testing and use for any purpose in connection with motor trade.

�Motorized two wheeler (With or with out side car) used for social, domestic and pleasure purposes and also for professional purposes (excluding carriage of goods other than samples) of the insured or used by insureds employees for such purpose but excluding use for hire or reward, racing, pace making, reliability trial, speed testing and use for any purpose in connection with motor trade.

�Goods Carrying Vehicles (Own Goods) Private Carrier

Goods Carrying Vehicles (General Cartage) Public Carrier

Passengers Carrying Vehicles

�TYPES OF LOSSES

OWN DAMAGE Loss or damage to the vehicle

LIABILITY Loss or damage to third party

�1. 2. 3. 4. 5. 6. 7.

Fire, explosion, self ignition or lightning; Burglary, housebreaking or theft; Riot ,Strike or Malicious damage; Earthquake; Terrorism; Accidental External Means; Flood, Typhoon, Hurricane, Storm, Tempest, Inundation, Cyclone, hailstorm Frost; 8. Transit damage by road, rail or inland waterway, lift, elevator or air; 9. Landslide and rockslide.

�1. Any accident outside the geographical area; 2. Consequential loss, normal wear and tear; 3. Driving without a valid license for that class of vehicle; 4. Driving under the influence of Liquor/ drugs; 5. Vehicle not being used as per limitations to use; 6. Mechanical or electrical breakdown, failures, breakages;

�7. Contractual Liability; 8. Limitation to use; 9. Driver Clause;

10. Consequential loss;

11. Radiation or contamination;

12. Nuclear weapons;

13. War.

� For all rubber/ nylon/ plastic parts, tyres and tubes, batteries, and air bags 50%

30%

For fibre glass components

Nil

As per schedule

For all parts made of glass

Wooden parts

�Age of Vehicle

<6 months 6 months < 1 Year 1 Years < 2 Years

% of Depreciation

Nil 5% 10%

2 Years < 3 Years

3 Years < 4 Years 4 Years < 5 Years 5 Years < 10 Years 10 Years <

15%

25% 35% 40% 50%

�Age of Vehicle <6 months 6 months < 1 Year 1 Years < 2 Years 2 Years < 3 Years 3 Years < 4 Years 4 Years < 5 Years

% of Depreciation 5% 15% 20% 30% 40% 50%

�All type of Vehicle 1st Year 2nd Year 3rd Year 4th Year 5th Year

% of Discount 20% 25% 35% 45% 50%

�1. Death or bodily injury to any person including occupants carried in the vehicle.

2. Damage to property other than property

belonging to the insured or held in trust or in

the custody or control of the insured.

�1. The Act provides for unlimited liability in respect injury. 2. Rs. 6000 in respect of any one claim or of Third Party death or bodily

series of claims arising out of one event

�100%

Death Losses of two limbs or sight of two eyes or one limb and sight of one eye. Loss of one limb of sight of one eye

100%

50% 100%

Permanent Total disablement

1. Private Car-200K 2. Two wheeler-100K

�Motor Trade Package Policy

Motor Trade Internal Risks Policy

Liability Only Policy

�Rates provided are minimum Loading on tariff premium rates by 100% for adverse claims experience of the vehicle insured and individual risk perception as per the insurers assessment Further loading of 100% provided of the experience continues to be adverse No further loading

Geog. Zones Location of RTO

Private Car and Two wheeler Commercial Vehicles

Cubic Capacity of the vehicle Age of the Vehicle Entitlement of No Claim Bonus Additional Coverage opted for

�Invoice Price (X) (+) (-) (+) (+) (+) (+) Final OD

Depreciation

Rate Electrical Accessories NCB Basic TP Owner Driver LPG/CNG @ 60 Passenger Final TP

IDV

Basic OD 4% after dep. Final OD

Final TP Service Tax

�Loss of accessories by Theft additional premium @ 3% of the value minimum Rs.50

Legal Liability to Paid drivers,cleaners-Rs.25 per person

Legal Liability to employees- Rs.60

Cover for rallies / racing

� <1000 cc-Rs 15,000 >1000 cc but < 1500 cc Rs 20,000

> 1500 cc- Rs 30,000

�Vehicles specially designed or modified for

use of the blind, handicapped and mentally challenged persons - Rs.25/- per vehicle. All other vehicles - Rs.100/- per vehicle

�Motor policies can be extended to include : a) Bangladesh b) Bhutan c) Nepal d) Pakistan e) Sri Lanka f) Maldives