Professional Documents

Culture Documents

CAMEL Model

Uploaded by

Vengatesh Sl0 ratings0% found this document useful (0 votes)

21 views31 pagesOriginal Title

CAMEL Model PPT

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views31 pagesCAMEL Model

Uploaded by

Vengatesh SlCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 31

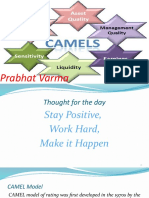

CAMEL Model

Performance Evaluation Tool for

Banks

Introduction to CAMEL Model

• CAMEL Model is one such rating system that proved to be

better for performance measurement, evaluation and

strategic planning for future growth and development of

the Indian banks in the light of changing requirements of

this sector.

• CAMEL model as a tool is very effective, efficient and

accurate to be used for evaluating the performance in

banking industries and to anticipate the future and relative

risk.

• CAMEL, as a rating system for judging the soundness of

Banks is a quite useful tool that can help in mitigating the

conditions and risks that lead to Bank failures.

Introduction to CAMEL Model

The CAMEL stands for

• C - Capital adequacy

• A - Asset quality

• M – Management

• E - Earning

• L – Liquidity

Objective of CAMEL Model

• To analyze the capital adequacy of selected

banks

• To assess the asset quality of selected banks

• To evaluate the management efficiency of

selected banks

• To determine the earnings quality of selected

banks

• To identify the liquidity position of selected

bank

C - Capital adequacy

• Capital Adequacy is an important indicator of the

financial health of a banking entity.

• This indicates the banks capacity to maintain capital

commensurate with the nature and extent of all types

of risks, as also the ability of the bank’s managers to

identify, measure, monitor and control these risks.

• It reflects the overall financial condition of the banks

and also the ability of management to meet the

requirement for additional capital.

• This ratio acts as an indicator of bank leverage.

C - Capital adequacy

1. Capital Adequacy Ratio (CAR): Capital adequacy ratio is the

ratio which safeguards banks against insolvency, protects

banks against surplus leverages, insolvency and keeps them

out of difficulty.

CAR= (Tier-I + Tier-II + Tier-III)/RWA

• Tier-I capital includes equity capital and free reserves.

• Tier-II capital comprises of subordinate debt of 5-7 years

tenure, revaluation reserves, hybrid debt capital instruments

and undisclosed reserves and cumulative perpetual preference

shares.

• Tier-III capital comprises of short-term subordinate debt. The

higher the CAR, the stronger the bank.

C - Capital adequacy

Interpretation of CAR:

Higher value of CAR ratio indicates better

solvency and financial strength of the banks

and lower value indicates poor solvency and

financial strength of the banks.

C - Capital adequacy

2. Debt Equity Ratio (D/E Ratio): Debt Equity

Ratio in banks is a measure of the quantum

of banks business that is financed through

the blend of debt and equity. It is a measure

of financial leverage of a bank.

D/E Ratio = Total Outside Liabilities/ Net Worth

Higher ratio indicates less protection for the

creditors and depositors in the banking

system.

C - Capital adequacy

3. Total Advances to Total Assets Ratio (Tot ADV /

Tot ASS Ratio): This is an important parameter to

measure the aggressiveness of banks in lending.

This ratio indicates a bank’s sternness in lending

which ultimately results in better profitability.

Total advances also include receivables. The value

of Total Assets excludes the revaluation of all the

assets.

Tot ADV / Tot ASS Ratio = Total Advances/ Total

Assets

A- Asset Quality

Asset Quality reflects the magnitude of credit risk

prevailing in the bank due to its composition and

quality of loans, advances, investments and off-

balance sheet activities. The financial soundness

of a bank is determined with the quality of assets

that the bank possesses. Asset quality defines the

financial health of banks against loss of value in

the assets, as asset weakening, risks the solvency

of the financial institutions especially banks.

A- Asset Quality

4. Net Non-Performing Assets (NPA) to Net Advances Ratio

(NNPA’s/ ADV Ratio):

• It is a measure of the overall quality of banks advances. It

shows the actual financial burden on the bank. An NPA are

those assets for which interest is overdue for more than

three months or ninety days. Net NPAs are calculated by

reducing cumulative balance of provisions outstanding at

the end of the period as well as some other interest

adjustments, from gross NPAs.

• NNPA’s/ ADV Ratio = Net Non-Performing Assets / Net

Advances.

• Higher ratio reflects rising bad quality of loans.

A- Asset Quality

5. Net NPA to Total Assets Ratio (Tot NPA / Tot

ASS Ratio): The average NET NPA TO TOTAL

ASSET RATIO indicates the efficiency of the

bank in assessing credit risk and, to an extent,

recovering the debts. Lower the ratio better is

the performance of the bank.

Net NPA to Tot ASS Ratio = Net NPA / Total

Assets.

M- Management Efficiency

The Management Efficiency parameters signal the

ability of the board of directors and senior

managers to identify, measure, monitor and control

risks associates with the bank. The management of

the bank takes crucial decisions depending on its

risk perception. It sets vision and goals for the

organization and sees that it achieves them. This

parameter is used to evaluate management

efficiency as to assign premium to better quality

banks and discount poorly managed ones.

M- Management Efficiency

6. Total Expenditure to Total Income Ratio (Tot EXP

/ Tot INC Ratio): Every banking organization is keen

on controlling its expenditure as it is an essential

aspect to enhance the profits for the bank. It is

justified that in case of banks, keeping a close watch

on expenditure would enable it to enhance its

return to its equity share holders. A substantial part

of operating expense of banks consists of salaries to

employees, technological up gradations and branch

rationalization, especially the new generation

banks.

M- Management Efficiency

Tot EXP / Tot INC Ratio = Total Expenditure /

(Net Interest Income + Non- interest Income)

It is ideal for banks to have a lower ratio as it

will enhance the profits of the bank and

subsequently enhance returns to the

stakeholders

M- Management Efficiency

7. Total Advance to Total Deposit Ratio (Tot

ADV/Tot DEP Ratio): The ratio measures the

efficiency and ability of the bank's

management in converting the deposits

available with the bank (excluding other funds

like equity capital, etc.) into high earnings

advances. It indicates the quantum of advances

a bank has as against the deposits it has

mobilized.

M- Management Efficiency

Tot ADV/Tot DEP Ratio = Total Advances /

Total Deposit.

A higher ratio indicates more reliance on

deposits for lending, whilst a low ratio signifies

less reliance on deposits.

M- Management Efficiency

8. Asset Turnover Ratio (ATR): Asset Turnover

measures how quickly a bank turns over its

asset through its income, both interest incomes

as well as non-interest income. It measures the

ability of a bank to use its assets to efficiently

generate income.

ATR = Total Income/ Total Assets

The higher the ratio indicates that the bank is

utilizing all its assets efficiently to generate

income.

M- Management Efficiency

9. Diversification Ratio (DIVRSF ratio): This

ratio measures the ability of the bank to

generate income other than interest income

from regular banking activities

DIVRSF Ratio= (Total Income - Interest Income)

/ Total Income

A high ratio indicates increasing proportion of

fee-based income.

M- Management Efficiency

10. Profit Per Employee (PPE): It is to measure the

efficiency of the banks management as this ratio

measures the company’s profits in relation to

number of employees. The ratio indicates the

surplus earned per employee. It specifies the

average profit generated per person employed. An

upright management will inspire and stimulate

employee to earn more profit for the bank.

A high ratio clearly signifies efficient management.

PPE= Profits After tax/ Number of Employees.

M- Management Efficiency

11. Business Per Employee (BPE): Business per

employee ratio shows the productivity of

employees of the bank and is used as a tool to

measure the efficiency of all the employees of

a bank in generating business for the bank. It

indicates how much business each employee is

producing for the bank. Business is in terms of

sum of Total Deposits and Total Advances in a

particular year of the bank.

M- Management Efficiency

A high business per employee ratio means that

employees are generating adequate sales or

revenue for the bank which is a clear indicator

of efficient and sound management of the

bank, while a low ratio is often a sign of low

productivity. A high ratio is good for the bank

as it automatically signifies efficient bank

management

BPE= Total Income / Number of Employees.

E- Earnings Quality

12. Net Profit Margin (NPR): It is explained as

percentage of revenue that is residual after all

operating expenses, interest, taxes and

preferred stock dividends other than common

stock dividend is deducted from the total

income of the bank.

• A high Net Profit Margin clearly signifies that

the bank has stable and steady earnings.

• NPR = Net profit After Taxes / Total Income

E- Earnings Quality

13. Return on Equity (ROE): The return on

equity (ROE), also known as return on

investment (ROI), is a sound measure of return,

since it is the product of the operating

performance, debt- equity management and

asset turnover of the bank. ROE measures how

much the shareholders earned for their

investment in the bank. This ratio indicates

how profitable a bank is by comparing its net

income to its average shareholders’ equity.

E- Earnings Quality

ROE = Net Income / Average Shareholders

Equity

The higher the ratio percentage, the more

efficient the bank is in earnings and utilizing its

equity base to generate better return is to

investors

E- Earnings Quality

14. Net Interest Margin (NIM): NIM, shows the

ability of the bank to keep the interest on deposits

low and interest on advance high. It is an important

measure of a bank's core income (income from

lending operations).

NIM = (Interest Income - Interest Expense) /

Interest Earning Assets.

A higher NIM indicates better earnings as against

the total assets.

E- Earnings Quality

15. Interest Income to Total Income Ratio

(INTINC/ Tot INC Ratio): Interest income to total

income indicates the capability of the bank in

generating interest income from its advances.

INTINC/ Tot INC Ratio = Interest Income / Total

Income.

Ideally banks would like to have a high ratio as it

signifies regularity in income and represents the

income of the bank in the regular course of

banking operations.

L- Liquidity

Every bank should ensure that it is able to

maintain adequate level of liquidity to meet its

financial commitments in a timely manner.

Liquidity in banks is managed by an effective

mechanism called the Asset and Liability

Management. It reduces maturity mismatches

between assets and liabilities to optimize

returns.

L- Liquidity

16. Liquid Assets to Total Deposit Ratio (LATD Ratio):

This is an important parameter to measure liquidity

as it evaluates the amount of cash that the bank has

from the deposits that it has generated. Cash being

liquid of all the assets gives the complete picture of

the liquidity of the bank. Banks need to maintain

sound cash to deposit ratio so as to ensure that large

volume of cash is not maintained, as idle cash does

not generate any returns and will subsequently

endanger the earnings quality of the bank.

LATD Ratio = Liquid Assets / Total Deposits

L- Liquidity

17. Liquid Assets to Total Assets: Liquid Assets

to Total Assets indicates that what percent of

total assets are held as liquid assets. This

liquidity can be considered to be adequate

enough to meet the immediate liabilities of the

banks. This ratio shows the degree of liquidity

preference adopted by the Bank. Higher value of

this ratio indicates higher liquidity of banks and

lower value indicates lower liquidity of banks

Liquid Assets / Total Assets

Conclusion

Understand the following:

1. the financial position of the banks and also the

ability of management to meet the requirement for

additional capital requirement.

2. determine the quality of assets that the bank

possess.

3. It will be possible to evaluate management

efficiency as to assign premium to better quality

banks and ignore the non-performing asset.

4. To determine the profitability position of the bank

5. To study the adequate level of liquidity to meet its

financial commitments.

You might also like

- Synopsis of Financial Analysis of Indian Overseas BankDocument8 pagesSynopsis of Financial Analysis of Indian Overseas BankAmit MishraNo ratings yet

- Financial Ratio AnalysisDocument41 pagesFinancial Ratio Analysismbapriti100% (2)

- Financial Health of BanksDocument26 pagesFinancial Health of BanksVINITHANo ratings yet

- Commercial Bank Financial PerformanceDocument8 pagesCommercial Bank Financial PerformanceShaoli MofazzalNo ratings yet

- Analyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachDocument6 pagesAnalyzing Financial Performance of ABAY Banks in Ethiopia: CAMEL ApproachAshebirNo ratings yet

- Unit 6mfrbDocument46 pagesUnit 6mfrbSweety TuladharNo ratings yet

- Financial Analysis of A BankDocument7 pagesFinancial Analysis of A BankLourenz Mae AcainNo ratings yet

- Aashi Gupta (FE1702) - Prakhar Sikka (FE1730)Document12 pagesAashi Gupta (FE1702) - Prakhar Sikka (FE1730)Suprabha GambhirNo ratings yet

- Chap 5Document23 pagesChap 5selva0% (1)

- Theoretical FrameworkDocument3 pagesTheoretical Frameworkm_ihamNo ratings yet

- Performance Measures: 1. Return On Asset Measure Evaluation of PerformanceDocument4 pagesPerformance Measures: 1. Return On Asset Measure Evaluation of PerformanceMohamed LibanNo ratings yet

- Research Methodology: 4.2 Data AnalysisDocument5 pagesResearch Methodology: 4.2 Data AnalysisShibani shet tanawadeNo ratings yet

- Final ProjectDocument90 pagesFinal ProjectdgpatNo ratings yet

- Financial Ratios of Major Commercial Banks SSRNDocument61 pagesFinancial Ratios of Major Commercial Banks SSRNobp51No ratings yet

- CAMELDocument30 pagesCAMELnguyentrinh.03032003No ratings yet

- Camel Final PPT 03Document13 pagesCamel Final PPT 03Ishan Shah0% (1)

- Bank Lending Abhishek KumarDocument16 pagesBank Lending Abhishek KumarShashi ThakurNo ratings yet

- OIB Has Grown Its Paid Up Capital To Birr 3 BillionDocument10 pagesOIB Has Grown Its Paid Up Capital To Birr 3 BillionKemia AwelNo ratings yet

- A Study of Performance Evaluation OF Top 6 Indian BanksDocument12 pagesA Study of Performance Evaluation OF Top 6 Indian BanksKeval PatelNo ratings yet

- Sector Specific Ratios and ValuationDocument10 pagesSector Specific Ratios and ValuationAbhishek SinghNo ratings yet

- Definition of NPADocument3 pagesDefinition of NPAsajilapkNo ratings yet

- Capital Adequacy Asset Quality Management Soundness Earnings & Profitability Liquidity Sensitivity To Market RiskDocument23 pagesCapital Adequacy Asset Quality Management Soundness Earnings & Profitability Liquidity Sensitivity To Market RiskCharming AshishNo ratings yet

- By M. Saqib Shahzad 361-570-88: ROA Net Profit After Taxes / AssetsDocument9 pagesBy M. Saqib Shahzad 361-570-88: ROA Net Profit After Taxes / AssetsSaqib ShahzadNo ratings yet

- Class 12 AccountDocument9 pagesClass 12 AccountChandan ChaudharyNo ratings yet

- CAMELS Ratios MethodologyDocument4 pagesCAMELS Ratios Methodologyanand guptaNo ratings yet

- Ratio AnalysisDocument23 pagesRatio AnalysishbijoyNo ratings yet

- Module 2Document27 pagesModule 2MADHURINo ratings yet

- Camel 1Document7 pagesCamel 1Papa PappaNo ratings yet

- Financial Statements Analysis - Q&aDocument6 pagesFinancial Statements Analysis - Q&aNaga NagendraNo ratings yet

- Bank Performance EvaluationDocument24 pagesBank Performance EvaluationRidwan AhmedNo ratings yet

- ExtraDocument12 pagesExtraSujit Kumar YadavNo ratings yet

- Project Report SbiDocument41 pagesProject Report SbiK R Î ZNo ratings yet

- Unit 3 Financial Statement Analysis BBS Notes eduNEPAL - Info - PDFDocument3 pagesUnit 3 Financial Statement Analysis BBS Notes eduNEPAL - Info - PDFGrethel Tarun MalenabNo ratings yet

- City Union Bank Weekly Report AnalysisDocument12 pagesCity Union Bank Weekly Report AnalysisleoatcitNo ratings yet

- Measuring Bank Performance & Risk with Key RatiosDocument45 pagesMeasuring Bank Performance & Risk with Key RatiospavithragowthamnsNo ratings yet

- The Assessment of Banking Performances-Indicators of Performance in Bank AreaDocument5 pagesThe Assessment of Banking Performances-Indicators of Performance in Bank Areazhalak04No ratings yet

- CAMEL AnalysisDocument11 pagesCAMEL AnalysisChirag AbrolNo ratings yet

- Note On Financial Ratio AnalysisDocument9 pagesNote On Financial Ratio Analysisabhilash831989No ratings yet

- 06 Camel AnalysisDocument37 pages06 Camel Analysissachinp patilNo ratings yet

- Camels RatingDocument12 pagesCamels RatingImtiaz AhmedNo ratings yet

- Camels Model of Performance Evaluation of Banks: By, Tripura, Sishira.P, S.Neha, Mythili.MDocument30 pagesCamels Model of Performance Evaluation of Banks: By, Tripura, Sishira.P, S.Neha, Mythili.MMythili MadapatiNo ratings yet

- Ratio Analysis M&M and Maruti SuzukiDocument36 pagesRatio Analysis M&M and Maruti SuzukiSamiSherzai50% (2)

- Performance Evaluation of A Bank (CBM)Document34 pagesPerformance Evaluation of A Bank (CBM)Vineeth MudaliyarNo ratings yet

- Commercial Banking System and Role of RBI - Assignment April 2023 BZesppk7IEDocument7 pagesCommercial Banking System and Role of RBI - Assignment April 2023 BZesppk7IERohit GambhirNo ratings yet

- Financial AnalysisDocument28 pagesFinancial AnalysisLowelyn PresidenteNo ratings yet

- Applying The CAMELS Performance Evaluation Approach For Emirates NBD BankDocument20 pagesApplying The CAMELS Performance Evaluation Approach For Emirates NBD BankAnirudha PaulNo ratings yet

- Bank Administration: Ratio AnalysisDocument33 pagesBank Administration: Ratio AnalysisSharma AmitNo ratings yet

- Bank Performance Measurement & Analysis & PCADocument46 pagesBank Performance Measurement & Analysis & PCAVenkatsubramanian R IyerNo ratings yet

- Evaluating Bank PerformanceDocument39 pagesEvaluating Bank PerformancePrashamsa RijalNo ratings yet

- Chapter 3: Ratio Analysis.: ST ST ST STDocument36 pagesChapter 3: Ratio Analysis.: ST ST ST STmkjhacal5292No ratings yet

- Meaning of Ratio AnalysisDocument31 pagesMeaning of Ratio AnalysisPrakash Bhanushali100% (1)

- CAMEL Model With Detailed Explanations and Proper FormulasDocument4 pagesCAMEL Model With Detailed Explanations and Proper FormulasHarsh AgarwalNo ratings yet

- Ratio Analysis Guide: Liquidity, Activity, Leverage, and Profitability RatiosDocument13 pagesRatio Analysis Guide: Liquidity, Activity, Leverage, and Profitability RatiosSarthak GulatiNo ratings yet

- The Assessment of Banking Performances-Indicators of Performance in Bank AreaDocument5 pagesThe Assessment of Banking Performances-Indicators of Performance in Bank AreahasanfriendshipNo ratings yet

- Accounting ManagamentDocument15 pagesAccounting ManagamentRajat SinghNo ratings yet

- Ratio Analysis of Mahindra N Mahindra LTDDocument15 pagesRatio Analysis of Mahindra N Mahindra LTDMamta60% (5)

- Analyzing Commercial Bank PerformanceDocument29 pagesAnalyzing Commercial Bank PerformanceGing freexNo ratings yet

- Break Even Analysis and Ratio AnalysisDocument63 pagesBreak Even Analysis and Ratio AnalysisJaywanti Akshra Gurbani100% (1)

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Dissertation Accounting and Finance TopicsDocument8 pagesDissertation Accounting and Finance TopicsCheapCustomPapersSingapore100% (1)

- Accounting for Share IssuanceDocument5 pagesAccounting for Share IssuanceChinito Reel CasicasNo ratings yet

- Abp2 ReportDocument8 pagesAbp2 Reportapi-545675901No ratings yet

- Difference Between Cost Audit and Financial AuditDocument6 pagesDifference Between Cost Audit and Financial Auditfahad haxanNo ratings yet

- Pay Back Period, NPV, ROIDocument7 pagesPay Back Period, NPV, ROIAshwini shenolkarNo ratings yet

- May 21Document253 pagesMay 21sachin kumarNo ratings yet

- Mishkin FMI9ge PPT C02Document82 pagesMishkin FMI9ge PPT C02fakayha hasanNo ratings yet

- SS 16 QuestDocument34 pagesSS 16 QuestjusNo ratings yet

- Chemical Process Design - Economic EvaluationDocument18 pagesChemical Process Design - Economic EvaluationMartín Diego MastandreaNo ratings yet

- IBC Question BankDocument11 pagesIBC Question BankSagar SharmaNo ratings yet

- F9FM RQB Qs - D08ojnpDocument62 pagesF9FM RQB Qs - D08ojnpErclan25% (4)

- Set 1 Questions & AnswersDocument15 pagesSet 1 Questions & AnswersJon Loh Soon WengNo ratings yet

- Assignment 2 Front Sheet 487 Group 2Document73 pagesAssignment 2 Front Sheet 487 Group 2Tran My Yen (FGW HCM)No ratings yet

- Tutorial 9 AnswersDocument5 pagesTutorial 9 AnswersPhụng KimNo ratings yet

- MPF753+Finance+T3+2015 W5-1slideDocument40 pagesMPF753+Finance+T3+2015 W5-1slideAnkurNo ratings yet

- Career in StocksDocument17 pagesCareer in StocksVamsi KrishnaNo ratings yet

- SEBI Mutual Fund Regulations SummaryDocument11 pagesSEBI Mutual Fund Regulations SummaryKishan KavaiyaNo ratings yet

- ACT1205 - Handout No. 1 Audit of InvestmentsDocument7 pagesACT1205 - Handout No. 1 Audit of Investmentsssslll2No ratings yet

- Ambit Good & Clean Midcap Portfolio September 2020: Asset ManagementDocument20 pagesAmbit Good & Clean Midcap Portfolio September 2020: Asset ManagementVinay T MNo ratings yet

- Venture capital текстDocument3 pagesVenture capital текстАнполп ПнщааNo ratings yet

- Mutual Funds ProjectDocument44 pagesMutual Funds ProjectSun ShineNo ratings yet

- Corporate LiquidationDocument5 pagesCorporate LiquidationHelen AlvaradoNo ratings yet

- Ch. 14 Quiz Flashcards - QuizletDocument4 pagesCh. 14 Quiz Flashcards - QuizletJaceNo ratings yet

- SCM Chapter 3 Notes: Absorption vs Variable CostingDocument2 pagesSCM Chapter 3 Notes: Absorption vs Variable CostingMy PhotographsNo ratings yet

- Group 6Document6 pagesGroup 6Love KarenNo ratings yet

- Al Masane Al Kobra Mining Co. IPO ProspectusDocument506 pagesAl Masane Al Kobra Mining Co. IPO ProspectusferasshadidNo ratings yet

- APC Ch10solDocument10 pagesAPC Ch10solkeith niduelanNo ratings yet

- Accounting For Inventory, Control Accounts and A Bank ReconciliationDocument13 pagesAccounting For Inventory, Control Accounts and A Bank ReconciliationMonicah NyamburaNo ratings yet

- GSX Annual Report 2019Document195 pagesGSX Annual Report 2019happy daysNo ratings yet

- Titman PPT Ch14Document95 pagesTitman PPT Ch14candraNo ratings yet