Professional Documents

Culture Documents

ECC102 Chapter 27

Uploaded by

Clarisha fritzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ECC102 Chapter 27

Uploaded by

Clarisha fritzCopyright:

Available Formats

The Exchange Rate and the Balance of

Payments

Chapter 27

Economics 3ed: Global and Southern African Perspectives © 2020 1

Main ideas

After studying this chapter, you will be able to:

• Describe the foreign exchange market and define the exchange rate

• Explain the factors that influence the demand for and supply of rands

• Show the demand for and supply of the rand graphically and indicate the

equilibrium in the foreign exchange market

• Distinguish between the nominal exchange rate and the real exchange rate

• Calculate the real exchange rate

• Explain the trends and fluctuations in the exchange rate and explain interest

rate parity and purchasing power parity

• Describe the alternative exchange rate policies and explain their effects

• Discuss the balance of payments accounts and explain what causes an

international deficit

• Calculate the various balances of the balance of payments

Economics 3ed: Global and Southern African Perspectives © 2020 2

The Foreign Exchange Market

• Whenever people buy things from another country, they use the currency of that

country to make the transaction

Trading Currencies

• The currency of one country is exchanged for the currency of another in the foreign

exchange market

Exchange Rates

• An exchange rate is the price at which one currency exchanges for another currency

in the foreign exchange market

• A strengthening of the exchange rate is called an appreciation and a weakening is

called a depreciation

An Exchange Rate is a Price

• An exchange rate is a price – the price of one currency in terms of another

• The foreign exchange market is a competitive market – demand and supply

determine the price

Economics 3ed: Global and Southern African Perspectives © 2020 3

What is Money?

The Demand for One Money is the Supply of Another Money

• When people who are holding the money of some other country want to exchange it

for South African rand, they demand South African rand and supply that other

country’s money

Demand in the Foreign Exchange Market

• People buy South African rand in the foreign exchange market so that they can buy

South African exports

• They also buy South African rand so that they can buy South African assets such as

bonds, shares, businesses and property or so that they can keep part of their money

holding in a South African rand bank account

• The quantity demanded depends on many factors, but the main ones are:

1. The exchange rate

2. World demand for South African exports

3. Interest rates in South Africa and other countries

4. The expected future exchange rate

Economics 3ed: Global and Southern African Perspectives © 2020 4

The Foreign Exchange Market

The Law of Demand for Foreign Exchange

• The higher the exchange rate, the smaller is the quantity of South African rand

demanded in the foreign exchange market

• The exchange rate influences the quantity of rand demanded for 2 reasons:

Exports Effect

• The larger the value of South African exports, the larger is the quantity of South

African rand demanded in the foreign exchange market

• The value of South African exports depends on the prices of locally – produced

goods and services expressed in the currency of the foreign buyer – these prices

depend on the exchange rate

Expected Profit Effect

• The larger the expected profit from holding South African rand, the greater is the

quantity of South African rand demanded in the foreign exchange market – expected

profit depends on the exchange rate.

Economics 3ed: Global and Southern African Perspectives © 2020 5

The Foreign Exchange Market

Demand Curve for South African Rand

FIGURE 27.1

• A change in the exchange rate, brings a

FIGURE 28.11

change in the quantity of South African rand

demanded and a movement along the

demand curve

Supply in the Foreign Exchange Market

• The quantity of South African rand supplied

in the foreign exchange market depends on

many factors, but the main ones are:

1. The exchange rate

2. South African demand for imports

3. Interest rates in South Africa and other

countries

4. The expected future exchange

Economics 3ed: Global and Southern African Perspectives © 2020 6

The Foreign Exchange Market

The Law of Supply of Foreign Exchange

• The higher the exchange rate, the greater is the quantity of South African rand

supplied in the foreign exchange market

• The exchange rate influences the quantity of rand supplied for two reasons:

Imports Effect

• The larger the value of South African imports, the larger is the quantity of South

African rand supplied in the foreign exchange market

• The value of South African imports depends on the prices of foreign-produced goods

and services expressed in South African rand – these prices depend on the

exchange rate

Expected Profit Effect

• The stronger the exchange rate today, the larger is the expected profit from selling

South African rand today and holding foreign currencies, so the greater is the

quantity of South African rand supplied

Economics 3ed: Global and Southern African Perspectives © 2020 7

The Foreign Exchange Market

Supply Curve for South African Rand

• A change in the exchange rate, brings a change in the quantity of South African rand

supplied and a movement along the supply curve

Market Equilibrium

• At the equilibrium exchange rate, there is neither a shortage nor a surplus – the

quantity supplied equals the quantity demanded

FIGURE27.2

FIGURE 28.10 FIGURE 27.3

FIGURE 28.11

Economics 3ed: Global and Southern African Perspectives © 2020 8

Exchange Rate Fluctuations

Changes in the Demand for South African Rand FIGURE 27.4

The demand for the rand in the foreign exchange

market changes when there is a change in:

World Demand for South African Exports

• An increase in world demand for SA exports

increases the demand for the rand

SA’s Interest Rate Relative to the Foreign

Interest Rate

• The higher the interest rate that people can

make on South African assets compared with

foreign assets, the more South African assets

they buy

• South African interest rate differential – South

African interest rate minus the foreign interest

rate

The Expected Future Exchange Rate

• A rise in the expected future exchange rate increases the profit that people expect to

make and the demand for South African rand increases today

Economics 3ed: Global and Southern African Perspectives © 2020 9

Exchange Rate Fluctuations

Changes in the Supply of South African Rand FIGURE 27.5 ŚĂŶŐĞƐŝŶƚŚĞ^ƵƉƉůLJŽĨ^ŽƵƚŚ

This occurs when there is a change in:: ĨƌŝĐĂŶƌĂŶĚ

South African Demand for Imports

• An increase in the South African demand for

imports increases the supply of South African

rand in the foreign exchange market

South Africa’s Interest Rate Relative to the

Foreign Interest Rate

• The larger the South African interest rate

differential, the smaller the supply of SA rand in

the foreign exchange market

The Expected Future Exchange Rate

A fall in the expected future exchange rate

decreases the profit that can be made by holding

South African rand and decreases the quantity of

South African rand that people want to hold – the

supply of South African rand in the foreign exchange

market then increases

Economics 3ed: Global and Southern African Perspectives © 2020 10

Exchange Rate Fluctuations

Changes in the Exchange Rate

• If the demand for South African rand increases and the supply does not change, the

exchange rate strengthens (the currency appreciates) – if it decreases the exchange

rate weakens (the currency depreciates)

• This works similarly for the supply of the South African rand

Fundamentals, Expectations and Arbitrage

• New information or expectations about the fundamental influences on the exchange

rate – the world demand for South African exports, South African demand for imports

and the South African interest rate relative to the foreign interest rate – makes the

expected exchange rate change

• Profiting by trading in the foreign exchange market often involves arbitrage: The

practice of buying in one market and selling for a higher price in another related

market

• Arbitrage also removes profit from borrowing in one currency and lending in another

and buying goods in one currency and selling them in another

Economics 3ed: Global and Southern African Perspectives © 2020 11

Exchange Rate Fluctuations

• These arbitrage activities bring about:

Interest Rate Parity

• Equal rates of return

Purchasing Power Parity

• Equal value of money

The Real Exchange Rate

• This is the relative price of foreign produced-goods and services to South African-

produced goods and services

The Short Run

• If the nominal exchange rate changes, the real exchange rate also changes

The Long Run

• The nominal exchange rate and the price level are determined together and the real

exchange rate does not change when the nominal exchange rate changes

Economics 3ed: Global and Southern African Perspectives © 2020 12

Exchange Rate Policy

Three possible exchange rate policies are: FIGURE 27.6

1. Flexible Exchange Rate

• Determined by demand and supply in

the foreign exchange market with no

direct intervention by the central bank

2. Fixed Exchange Rate

• Determined by a decision of the

government or the central bank and is

achieved by central bank intervention in

the foreign exchange market to block the

unregulated forces of demand and

supply

3. Crawling Peg

• Follows a path determined by a decision

of the government or the central bank

and is achieved in a similar way to a

fixed exchange rate by central bank

intervention in the foreign exchange

market

Economics 3ed: Global and Southern African Perspectives © 2020 13

Financing International Trade

Balance of Payments Accounts

• A country’s balance of payments accounts record its international trading, borrowing

and lending in four accounts:

1. Current account –receipts from exports of goods and services sold abroad,

payments for imports of goods and services from abroad, net interest income paid

abroad and net transfers abroad

2. Capital transfer account – capital transfers and the acquisition or disposal of non-

produced, non-financial assets

3. Financial account – foreign investment in South Africa minus South African

investment abroad

4. Change in net gold and other foreign reserves – change in South Africa’s official

reserves, which are the government’s holdings of foreign currency and gold

An Individual’s Balance of Payments Accounts

• Records the income from supplying the services of factors of production and the

expenditure on goods and services

Economics 3ed: Global and Southern African Perspectives © 2020 14

Financing International Trade

Borrowers and Lenders

• A country that is borrowing more from the rest of the world than it is lending is called

a net borrower

• A net lender is a country that is lending more to the rest of the world than it is

borrowing

Debtors and Creditors

• A debtor nation is a country that during its entire history has borrowed more from the

rest of the world than it has lent to it

• A creditor nation is a country that during its entire history has invested more in the

rest of the world than other countries have invested in it

Current Account Balance

• CAB = NX + Net interest income + Net transfers

Net Exports

• Exports of goods and services minus imports of goods and services

Economics 3ed: Global and Southern African Perspectives © 2020 15

Financing International Trade

• The government sector balance is equal to net taxes minus government expenditures

on goods and services

• The private sector balance is saving minus investment

Where is the Exchange Rate?

• In the short run, a fall in the rand lowers the real exchange rate, which makes South

African imports more costly and South African exports more competitive

• In the long run, a change in the nominal exchange rate leaves the real exchange rate

unchanged and plays no role in influencing the current account balance

Economics 3ed: Global and Southern African Perspectives © 2020 16

You might also like

- Forex The Holy Grail - Simone SiestoDocument156 pagesForex The Holy Grail - Simone SiestoBonisani Ndaba100% (3)

- South 2 PDFDocument1 pageSouth 2 PDFNovak Brodsky100% (1)

- Chapter 4 IfDocument8 pagesChapter 4 Ifobaidurrehman55No ratings yet

- Chapter 9Document63 pagesChapter 9skyeNo ratings yet

- Exchange Rate MBA-2Document28 pagesExchange Rate MBA-2SREYASHI KHETUANo ratings yet

- International Economics II - Chapter 1Document56 pagesInternational Economics II - Chapter 1seid sufiyanNo ratings yet

- Interconnected Open EconomyDocument36 pagesInterconnected Open EconomyMichaelAngeloBattungNo ratings yet

- Foreign Exchange Market: Presented by Geetha Gowthami.V Naveen.Y Vinod.MDocument17 pagesForeign Exchange Market: Presented by Geetha Gowthami.V Naveen.Y Vinod.MVinodkumar MoolaNo ratings yet

- Monetary Theories of Exchange RatesDocument22 pagesMonetary Theories of Exchange RatesSumit KumarNo ratings yet

- Exchange Rate Determination: Prepared by Mariya Jasmine M YDocument21 pagesExchange Rate Determination: Prepared by Mariya Jasmine M Ydeepika singhNo ratings yet

- Exchange Rate and BOPDocument17 pagesExchange Rate and BOPlekshmi517100% (1)

- Economics ProjectDocument27 pagesEconomics ProjectKashish AgrawalNo ratings yet

- International Exchange Systems: Click To Edit Master Subtitle StyleDocument27 pagesInternational Exchange Systems: Click To Edit Master Subtitle StyleKapil AasatNo ratings yet

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument37 pagesThe Influence of Monetary and Fiscal Policy On Aggregate DemandS. M. SAKIB RAIHAN Spring 20No ratings yet

- Determination of Foreign Exchange Chapter 4Document20 pagesDetermination of Foreign Exchange Chapter 4Sazedul Ekab100% (1)

- Monetary and Exchange SystemDocument28 pagesMonetary and Exchange SystemMrinmoy SikderNo ratings yet

- Exchange Rate Determination: South-Western/Thomson Learning © 2006Document24 pagesExchange Rate Determination: South-Western/Thomson Learning © 2006Praveen JaganNo ratings yet

- 11 Monetary Fiscal Policy AD C21Document38 pages11 Monetary Fiscal Policy AD C21minaevilNo ratings yet

- P4-Foreign Exchange RateDocument39 pagesP4-Foreign Exchange Rateenacengic99No ratings yet

- Determining Exchange Rate: TopicDocument24 pagesDetermining Exchange Rate: TopicGreeshma SinghNo ratings yet

- 2020 International Fin Syst PrintDocument31 pages2020 International Fin Syst PrintAndrea RodriguezNo ratings yet

- Multinational Financial ManagementDocument95 pagesMultinational Financial ManagementANo ratings yet

- Rates of Exchange: Radhakishan V Karthik S Jaichander Yasser FarookDocument15 pagesRates of Exchange: Radhakishan V Karthik S Jaichander Yasser FarookKarthik SankarNo ratings yet

- Foreign Exchange RateDocument8 pagesForeign Exchange RateDishaNo ratings yet

- Foreign Exchange Market: Market Where The Various National Currencies Are Sold and Bought (Not A Physical Place)Document40 pagesForeign Exchange Market: Market Where The Various National Currencies Are Sold and Bought (Not A Physical Place)Velichka DimitrovaNo ratings yet

- Advance Financial AccountingDocument22 pagesAdvance Financial AccountingChandni SinghNo ratings yet

- If ProjectDocument47 pagesIf ProjectFahim KhanNo ratings yet

- Chapter 9 FinmaDocument4 pagesChapter 9 FinmaKim Patrick MarianoNo ratings yet

- Balance of Payments and Exchange RatesDocument53 pagesBalance of Payments and Exchange RatesGalib HossainNo ratings yet

- IFM8e ch04Document25 pagesIFM8e ch04Abid KhanNo ratings yet

- Mishkin Econ12eGE CH18Document42 pagesMishkin Econ12eGE CH18josemourinhoNo ratings yet

- ECONOMICS Exchange Rate DeterminationDocument21 pagesECONOMICS Exchange Rate DeterminationMariya JasmineNo ratings yet

- The Rise and Evolution of Exchange RatesDocument34 pagesThe Rise and Evolution of Exchange RatesSimoNo ratings yet

- Notes 1Document8 pagesNotes 1Praksh chandra Rajeek kumarNo ratings yet

- Eco PPT FinalDocument27 pagesEco PPT FinalPritam PatraNo ratings yet

- FX Market 2011 - Group 8Document38 pagesFX Market 2011 - Group 8aliva_sweetNo ratings yet

- Determinants of Foreign ExchangeDocument24 pagesDeterminants of Foreign ExchangeAayush SharmaNo ratings yet

- R 21 - Currency Management-An IntroductionDocument71 pagesR 21 - Currency Management-An IntroductionTisha AroraNo ratings yet

- Managing Exports: Slide 1 2005 South-Western PublishingDocument31 pagesManaging Exports: Slide 1 2005 South-Western PublishingWilliam DC RiveraNo ratings yet

- On ForixDocument14 pagesOn ForixAmoghavarsha HemanthNo ratings yet

- EnglishDocument7 pagesEnglisharibahamjad8129No ratings yet

- Foreign Exchange in The Indian ContextDocument78 pagesForeign Exchange in The Indian ContextDeepak SrivastavaNo ratings yet

- Foreign ExchangeDocument13 pagesForeign Exchangedj8ppb6rxqNo ratings yet

- Module 2Document41 pagesModule 2bhargaviNo ratings yet

- Chap 34Document7 pagesChap 34mehmet nedimNo ratings yet

- IF - IntroDocument43 pagesIF - IntroharshnikaNo ratings yet

- Chapter 25 NotesThe Exchange Rate and The Balance of PaymentsDocument6 pagesChapter 25 NotesThe Exchange Rate and The Balance of PaymentsJocelyn WilliamsNo ratings yet

- IFM8e ch04Document21 pagesIFM8e ch04adnanNo ratings yet

- Chapter 4Document24 pagesChapter 4Manjunath BVNo ratings yet

- Lecture 8 - International Trade & Open EconomyDocument46 pagesLecture 8 - International Trade & Open EconomyLakmal SilvaNo ratings yet

- Effects of Foreign Exchange Rates On Indian EconomyDocument43 pagesEffects of Foreign Exchange Rates On Indian EconomyMohamed Rizwan0% (1)

- Unit 3: Foreign Exchange and Balance of PaymentDocument23 pagesUnit 3: Foreign Exchange and Balance of PaymentSiddharth PaulNo ratings yet

- Topic 02 (A) Exchange Rate SystemsDocument15 pagesTopic 02 (A) Exchange Rate SystemsAnisha SapraNo ratings yet

- Macroeconomics 12th Edition Michael Parkin Solutions ManualDocument11 pagesMacroeconomics 12th Edition Michael Parkin Solutions Manualsarclescaladezk3tc100% (16)

- Exchange-Rate DeterminationDocument56 pagesExchange-Rate DeterminationamritamonaNo ratings yet

- Lecture - Open Economy - Exchange Rate DynamicsDocument21 pagesLecture - Open Economy - Exchange Rate DynamicsParth BhatiaNo ratings yet

- The South African RandDocument21 pagesThe South African RandAlexandru LunguNo ratings yet

- ITP - Foreign Exchange RateDocument29 pagesITP - Foreign Exchange RateSuvamDharNo ratings yet

- TFM Session Five FX ManagementDocument64 pagesTFM Session Five FX ManagementmankeraNo ratings yet

- Exchange RatesDocument46 pagesExchange RateskwekutwumasimensahNo ratings yet

- Exer 6.13 Sol (2023)Document2 pagesExer 6.13 Sol (2023)Clarisha fritzNo ratings yet

- Exercise 7.7 (2023)Document1 pageExercise 7.7 (2023)Clarisha fritzNo ratings yet

- Exer 6.29 Sol (2023)Document1 pageExer 6.29 Sol (2023)Clarisha fritzNo ratings yet

- Exercise 7.3 (2023)Document1 pageExercise 7.3 (2023)Clarisha fritzNo ratings yet

- Exer 8.5 Sol (2023)Document3 pagesExer 8.5 Sol (2023)Clarisha fritzNo ratings yet

- Tugas 1Document3 pagesTugas 1dikafaNo ratings yet

- Royal Dutch Shell Group - 2005 Case StudyDocument21 pagesRoyal Dutch Shell Group - 2005 Case StudyManatosa MenataNo ratings yet

- Western Union Money Transfer Service Terms and ConditionsDocument3 pagesWestern Union Money Transfer Service Terms and ConditionsDaryll Anne LagtaponNo ratings yet

- Hansen AISE TB - Ch18Document36 pagesHansen AISE TB - Ch18ANNISA MELIAROSA F FNo ratings yet

- Applied Economics HandoutsDocument13 pagesApplied Economics Handoutsنجشو گحوش50% (2)

- Role of RBI in FOREX MarketDocument14 pagesRole of RBI in FOREX Marketlagfdf88No ratings yet

- Session 1 Basic Cash ManagementDocument10 pagesSession 1 Basic Cash ManagementManik MehtaNo ratings yet

- MCom BFE I II 2015 16Document15 pagesMCom BFE I II 2015 16Anonymous AXQLK7No ratings yet

- Bank Audit Guidance Note 2021Document975 pagesBank Audit Guidance Note 2021Arif AhmedNo ratings yet

- International Finance Exam SolutionsDocument171 pagesInternational Finance Exam SolutionsCijaraNo ratings yet

- Foreign ExchangeDocument21 pagesForeign Exchangevinayak Ag100% (1)

- Yield Curve Spread Trades PDFDocument12 pagesYield Curve Spread Trades PDFNicoLaza100% (1)

- London Forex Rush ManualDocument56 pagesLondon Forex Rush ManualBogdanC-tin100% (3)

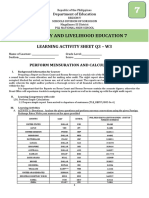

- Technology and Livelihood Education 7: Learning Activity Sheet Q3 - W3Document4 pagesTechnology and Livelihood Education 7: Learning Activity Sheet Q3 - W3Sandy Lagata100% (1)

- Bill Williams New Trading DimensionsDocument24 pagesBill Williams New Trading DimensionsAmine Elghazi50% (2)

- Vado Round Hand ShowerDocument2 pagesVado Round Hand ShowervictorNo ratings yet

- Master Server Vix PDFDocument4 pagesMaster Server Vix PDFBibiana TarazonaNo ratings yet

- Yang Ming Tariff Surcharges: Service ScopeDocument5 pagesYang Ming Tariff Surcharges: Service ScopeHuỳnh Hồng HiềnNo ratings yet

- Assignment BudgetingDocument1 pageAssignment BudgetingAtika P. MarentekNo ratings yet

- Paysafecard Direct and Paysafecash Product IdentifiersDocument11 pagesPaysafecard Direct and Paysafecash Product Identifiersflaviusapostoae208No ratings yet

- Bulloptionaimarketanalysts Is One of The World's Leading Forex, Stock and Crypto Trading PlatformDocument1 pageBulloptionaimarketanalysts Is One of The World's Leading Forex, Stock and Crypto Trading Platformjakuovie189No ratings yet

- AFM Syllabus Sept 19 June 20Document20 pagesAFM Syllabus Sept 19 June 20Quyen TuongNo ratings yet

- JYSKE Bank AUG 09 Market Drivers CurrenciesDocument5 pagesJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirNo ratings yet

- 02 Fera & Fema-1Document40 pages02 Fera & Fema-1Gyanendra TiwariNo ratings yet

- Annual Report: 8th Floor, Dina House, Ruttonjee Centre, 11 Duddell Street, Central, Hong Kong SAR, ChinaDocument56 pagesAnnual Report: 8th Floor, Dina House, Ruttonjee Centre, 11 Duddell Street, Central, Hong Kong SAR, ChinaSmallCapAnalystNo ratings yet

- ESSO Standard Eastern Inc Vs CIRDocument6 pagesESSO Standard Eastern Inc Vs CIRToya MochizukieNo ratings yet

- Bangladesh Bank Appendix 5Document133 pagesBangladesh Bank Appendix 5anika100% (1)

- Role and Functions of Reserve Bank of IndiaDocument5 pagesRole and Functions of Reserve Bank of Indiaanusaya1988No ratings yet