0% found this document useful (0 votes)

22 views23 pagesFinancial Reporting Conceptual Framework

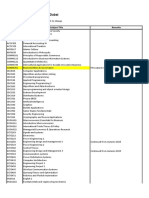

The document outlines the conceptual framework for financial reporting. It discusses the objective of general purpose financial reporting, which is to provide financial information to creditors and investors. It also discusses the qualitative characteristics of useful financial information, such as relevance and faithful representation. The framework covers topics like the elements of financial statements, recognition and derecognition of items, measurement, and presentation and disclosure. [/SUMMARY]

Uploaded by

Ben Waled AbduhasanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

22 views23 pagesFinancial Reporting Conceptual Framework

The document outlines the conceptual framework for financial reporting. It discusses the objective of general purpose financial reporting, which is to provide financial information to creditors and investors. It also discusses the qualitative characteristics of useful financial information, such as relevance and faithful representation. The framework covers topics like the elements of financial statements, recognition and derecognition of items, measurement, and presentation and disclosure. [/SUMMARY]

Uploaded by

Ben Waled AbduhasanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd