Professional Documents

Culture Documents

Bond's Market

Uploaded by

narisalvador09Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond's Market

Uploaded by

narisalvador09Copyright:

Available Formats

BOND MARKETS

MCGRAW-HILL/IRWIN 6-1

©2009, The McGraw-Hill Companies, All Rights Reserved

PREMYO BONDS

https://www.youtube.com/watch?v=9zsuaH4Wkc8

MCGRAW-HILL/IRWIN 6-2

©2009, The McGraw-Hill Companies, All Rights Reserved

LEARNING OUTCOMES

Discuss how the capital markets operate

(the money and the bond markets)

Describe the different securities in the

bond’s market

MCGRAW-HILL/IRWIN 6-3

©2009, The McGraw-Hill Companies, All Rights Reserved

RECALL:

BOND AND BOND MARKETS

Capital

Capital markets

markets involve

involve equity

equity and

and debt

debt

instruments

instruments with

with maturities

maturities of

of more

more than

than one

one year

year

Bonds

Bonds are

are long-term

long-term debt

debt obligations

obligations issued

issued by

by

corporations

corporations and

and government

government units

units

Bond

Bond markets

markets areare markets

markets in

in which

which bonds

bonds are

are

issued

issued and

and traded

traded

Treasury

Treasurynotes

notes(T-notes)

(T-notes)and

andbonds

bonds(T-bonds)

(T-bonds)

Municipal

Municipalbonds

bonds(Munis)

(Munis)

Corporate

Corporatebonds

bonds

MCGRAW-HILL/IRWIN 6-4

©2009, The McGraw-Hill Companies, All Rights Reserved

MCGRAW-HILL/IRWIN 6-5

©2009, The McGraw-Hill Companies, All Rights Reserved

TYPES OF SECURITIES

ISSUED BY THE NATIONAL GOVERNMENT THROUGH

THE BUREAU OF THE TREASURY (BTR)

• Treasury bills (fixed-rate)

• Treasury bonds (fixed-rate coupon-bearing and zeroes)

• Retail treasury bonds (RTBs, fixed-rate coupon-bearing)

• Multi-currency retail treasury bonds (MRTBs, fixed-rate coupon-

bearing)

• Dollar-linked peso notes (fixed-rate)

Issued by the National Government through Other Entities

• Debt securities issued by government-owned and -controlled

corporations (GOCCs)

• Debt securities issued by government agencies

MCGRAW-HILL/IRWIN 6-6

©2009, The McGraw-Hill Companies, All Rights Reserved

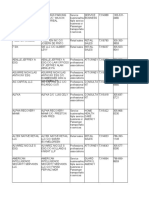

OUTSTANDING BOND ISSUES

Сurrency Outstanding bond issues Cumulative volume

sovereign

PHP 84 3 974 896 787 020

USD 20 32 106 363 000

JPY 1 100 000 000 000

corporate

USD 106 79 249 218 000

AUD 24 9 076 600 000

EUR 10 2 550 000 000

NZD 9 1 821 000 000

MCGRAW-HILL/IRWIN 6-7

©2009, The McGraw-Hill Companies, All Rights Reserved

TREASURY NOTES AND BONDS

Treasury

Treasury notes

notes and

and bonds

bonds (T-notes

(T-notes and

andT-

T-

bonds)

bonds) are

are issued

issued by

by the

the Government

GovernmentTreasury Treasury toto

finance

finance the

the national

national debt

debt and

and other

other government

government

expenditures

expenditures

The

The annual

annual budget

budget deficit

deficit isis equal

equal to to annual

annual

expenditures

expenditures (G)(G) less

less taxes

taxes (T)

(T) received

received

The

The national

national debtdebt (ND)

(ND) isis the

the sum

sum

N of

of historical

historical

annual

annual federal deficits: NDt

federal deficits: t 1

(Gt Tt )

MCGRAW-HILL/IRWIN 6-8

©2009, The McGraw-Hill Companies, All Rights Reserved

TREASURY NOTES AND BONDS

Default risk free: backed by Low returns: low interest

the full faith and credit of the rates (yields to maturity)

government reflect low default risk

Interest rate risk: because of

their long maturity, T-notes Liquidity risk: older issued T-

and T-bonds experience wider bonds and T-notes trade less

price fluctuations than money frequently than newly issued

market securities when interest T-bonds and T-notes

rates change

MCGRAW-HILL/IRWIN 6-9

©2009, The McGraw-Hill Companies, All Rights Reserved

T-notes have original maturities from over 1

to 10 years

T-bonds have original maturities from over

10 years

Issued in minimum denominations

(multiples) of $1,000

May be either fixed principal or inflation-

TREASURY indexed

NOTES AND inflation-indexed bonds are called

BONDS Treasury Inflation Protection

Securities (TIPS)

the principal value of TIPS is adjusted by

the percentage change in the Consumer

Price Index (CPI) every six months

Trade in very active secondary markets

Prices are quoted as percentages of face

value, in 32nds

MCGRAW-HILL/IRWIN 6-10

©2009, The McGraw-Hill Companies, All Rights Reserved

TREASURY STRIPS

Separate

SeparateTrading

Tradingof

ofRegistered

RegisteredInterest

Interestand

andPrincipal

Principal

Securities

Securities(STRIPS),

(STRIPS),a.k.a.

a.k.a.Treasury

Treasuryzero

zerobonds

bondsor orTreasury

Treasury

zero-coupon

zero-couponbonds

bonds

Financial

Financialinstitutions

institutionsand

andgovernment

governmentsecurities

securitiesbrokers

brokersand

and

dealers

dealerscreate

createSTRIPS

STRIPSfrom

fromT-notes

T-notesand

andT-bonds

T-bonds

STRIPS

STRIPShave

havethe

theperiodic

periodicinterest

interestpayments

paymentsseparated

separatedfrom

from

each

eachother

otherand

andfrom

fromthe

theprincipal

principalpayment

payment

one set of securities reflects interest payments

one set of securities reflects interest payments

one set of securities reflects principal payments

one set of securities reflects principal payments

STRIPS

STRIPSare

areused

usedto

toimmunize

immunizeagainst

againstinterest

interestrate

raterisk

risk

MCGRAW-HILL/IRWIN 6-11

©2009, The McGraw-Hill Companies, All Rights Reserved

TREASURY NOTES AND BONDS

“Clean”

“Clean” prices

prices are

are calculated

calculated as: as:

INT

Vb ( PVIFA id / m , Nm ) M ( PVIFid / m , Nm )

m

VVb ==the

thepresent

presentvalue

valueof

ofthe

thebond

bond

b

MM==the

thepar

parvalue

valueof

ofthe

thebond

bond

INT

INT==annual

annualinterest

interestpayment

payment(in

(indollars)

dollars)

NN==the

thenumber

numberof

ofyears

yearsuntil

untilthe

thebond

bondmatures

matures

mm==the

thenumber

numberof

oftimes

timesper

peryear

yearinterest

interestisispaid

paid

ii ==interest

d interestrate

rateused

usedtotodiscount

discountcash

cashflows

flowson

onthe

thebond

bond

MCGRAW-HILL/IRWIN

d 6-12

©2009, The McGraw-Hill Companies, All Rights Reserved

TREASURY NOTES AND BONDS

Accrued

Accrued interest

interest on

onT-notes

T-notes and

andT-bonds

T-bonds isis

calculated

calculated as:

as:

INT Actual number of days since last coupon payment

Accrued interest

2 Actual number of days in coupon period

The

The full

full (or

(ordirty)

dirty) price

price of

of aaT-note

T-note or

orT-bond

T-bond isis

the

the sum

sum of

of the

the clean

clean price

price (V

(Vbb)) and

and the

the accrued

accrued

interest

interest

MCGRAW-HILL/IRWIN 6-13

©2009, The McGraw-Hill Companies, All Rights Reserved

TREASURY NOTES AND BONDS

The

The primary

primary market

market of

ofT-notes

T-notes and

andT-bonds

T-bonds isis

similar

similar to

to that

that of

ofT-bills;

T-bills; the

theTreasury

Treasury sells

sellsT-notes

T-notes

and

andT-bonds

T-bonds through

through competitive

competitive andand

noncompetitive

noncompetitive single-bid

single-bid auctions

auctions

2-year

2-yearnotes

notesare

areauctioned

auctionedmonthly

monthly

3,

3,5,

5,and

and10-year

10-yearnotes

notesare

areauctioned

auctionedquarterly

quarterly(Feb,

(Feb,

May,

May,Aug,

Aug,and

andNov)

Nov)

30-year

30-yearbonds

bondsare

areauctioned

auctionedsemi-annually

semi-annually(Feb

(Feband

and

Aug)

Aug)

Most

Most secondary

secondary trading

trading occurs

occurs directly

directly through

through

brokers

brokers and

and dealers

dealers

MCGRAW-HILL/IRWIN 6-14

©2009, The McGraw-Hill Companies, All Rights Reserved

MUNICIPAL BONDS

Municipal

Municipalbonds

bonds(Munis)

(Munis)are

aresecurities

securitiesissued

issuedby

bystate

stateand

and

local

localgovernments

governments

to fund imbalances between expenditures and receipts

to fund imbalances between expenditures and receipts

to finance long-term capital outlays

to finance long-term capital outlays

Attractive

Attractiveto

tohousehold

householdinvestors

investorsbecause

becauseinterest

interestisisexempt

exempt

from

fromfederal

federalandandmost

mostlocal

localincome

incometaxes

taxes

General

Generalobligation

obligation(GO)

(GO)bonds

bondsare

arebacked

backedbybythe

thefull

fullfaith

faith

and

andcredit

creditof ofthe

theissuing

issuingmunicipality

municipality

Revenue

Revenuebondsbondsare aresold

soldto

tofinance

financespecific

specificrevenue

revenue

generating

generatingprojects

projects

MCGRAW-HILL/IRWIN 6-15

©2009, The McGraw-Hill Companies, All Rights Reserved

MUNICIPAL BONDS IN THE

PHILIPPINES

Our local government units are expressly authorized to

issue bonds, debentures, securities, collateral notes and

other obligations to finance self-liquidating, income-

producing development and livelihood projects.

As early as 1998, the Bankers Association of the

Philippines and the Development Bank of the Philippines

created the Local Government Unit Guarantee Corporation

(LGUGC) to facilitate LGU bond floatation. Even before

the creation of the LGUGC, there were municipal bond

flotation—although very few—in the market.

MCGRAW-HILL/IRWIN 6-16

©2009, The McGraw-Hill Companies, All Rights Reserved

The LGUGC was the first privately managed

local government guarantee corporation set up in

a developing country in Asia.

Among the LGUGC-guaranteed LGU bonds

were those issued by the cities of Caloocan and

Tagaytay; Puerto Princesa and the Municipality

of Infanta.

MCGRAW-HILL/IRWIN 6-17

©2009, The McGraw-Hill Companies, All Rights Reserved

But while we were the first in Asia to come up

with this initiative, our municipal bond market

has not been fully developed and utilized as a

tool of economic development at the local level.

As a matter of fact, the records of the LGUGC

would readily indicate that there have only been

a handful of LGU bond issuances. The

LGUGC guarantees more bank loans than bond

6-18

floatation by our LGUs.

MCGRAW-HILL/IRWIN

©2009, The McGraw-Hill Companies, All Rights Reserved

MUNICIPAL BONDS

Compare

Compare Muni

Muni returns

returns with

with fully

fully taxable

taxable corporate

corporate

bonds

bonds by

by finding

finding the the after-tax

after-tax return

return for

for corporate

corporate

bonds:

bonds: iiaa == iibb(1

(1 –– t)t)

iai ==after-tax

after-taxrate

rateof

ofreturn

returnon

onaataxable

taxablecorporate

corporatebond

bond

a

ibi ==before-tax

before-taxrate

rateof

ofreturn

returnon

onaataxable

taxablebond

bond

b

tt==marginal

marginaltotal

totalincome

incometax

taxrate

rateof

ofthe

thebond

bondholder

holder

Alternately,

Alternately, convert

convert Muni

Muni interest

interest rates

rates to

to tax

tax

equivalent

equivalent rates

rates of

of return:

return: iibb == iiaa/(1

/(1 –– t)t)

MCGRAW-HILL/IRWIN 6-19

©2009, The McGraw-Hill Companies, All Rights Reserved

MUNICIPAL BONDS

Primary

Primarymarkets

markets

firm commitment underwriting: a public offering of Munis made

firm commitment underwriting: a public offering of Munis made

through

throughananinvestment

investmentbank,bank,where

wherethe

theinvestment

investmentbank

bankguarantees

guarantees

aaprice

pricefor

forthe

thenewly

newlyissued

issuedbonds

bondsbybybuying

buyingthe

theentire

entireissue

issueand

and

then

thenreselling

resellingitittotothe

thepublic

public

best efforts offering: a public offering in which the investment

best efforts offering: a public offering in which the investment

bank

bankdoes

doesnot

notguarantee

guaranteeaafirm

firmprice

price

private placement: bonds are sold on a semi-private basis to

private placement: bonds are sold on a semi-private basis to

qualified

qualifiedinvestors

investors(generally

(generallyFIs)

FIs)

Secondary

Secondarymarkets:

markets:Munis

Munistrade

tradeinfrequently

infrequentlydue

duemainly

mainly

to

toaalack

lackof

ofinformation

informationon

onbond

bondissuers

issuers

MCGRAW-HILL/IRWIN 6-20

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

Corporate

Corporate bonds

bonds are

are long-term

long-term bonds

bonds issued

issued by

by

corporations

corporations

A Abond

bond indenture

indenture isis the

the legal

legal contract

contract that

that

specifies

specifies the

the rights

rights and

and obligations

obligations ofof the

the issuer

issuer

and

and the

the holders

holders

Bearer

Bearer versus

versus registered

registered bonds

bonds

Term

Term versus

versus serial

serial bonds

bonds

Mortgage

Mortgage bonds

bonds are

are secured

secured debt

debt issues

issues

MCGRAW-HILL/IRWIN 6-21

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

BEARER VERSUS REGISTERED BONDS

REGISTERED BONDS

Bearer

Bearerbonds

bonds

debt instrument whose

fixed-income security that is owned

fixed-income security that is owned

bondholder's information is

by

bythe

theholder,

holder,or

orbearer,

bearer,rather

ratherthan

than kept on record with the issuing

by a registered owner.

by a registered owner. party.

The coupons for interest payments By archiving the owner's

The coupons for interest payments

are

arephysically

physicallyattached

attachedto

tothe

the

security.

name, address, and other

security.

The bondholder is required to details, issuers ensure they're

The bondholder is required to making the bond's coupon

submit

submitthe

thecoupons

couponsto toaabank

bankfor

for

payment

paymentand andthen

thenredeem

redeemthethe

payments to the correct

physical

physicalcertificate

certificatewhen

whenthethebond

bond person.

reaches

reachesthe

thematurity

maturitydate.

date.

MCGRAW-HILL/IRWIN 6-22

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

TERM VERSUS SERIAL BONDS

TERM BONDS SERIAL BONDS

notes issued by a bond issue that is structured so

that a portion of the

companies to the outstanding bonds mature at

regular intervals until all of the

public or investors bonds have matured.

with Because the bonds mature

gradually over a period of years,

scheduled maturity these bonds are used to finance

projects that provide a consistent

dates. income stream for bond repayment.

MCGRAW-HILL/IRWIN 6-23

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

MORTGAGE BONDS

mortgage

mortgage bond

bond is

is secured

secured by

by aa

mortgage,

mortgage, oror aa pool

pool of

of mortgages,

mortgages,

that

that are

are typically

typically backed

backed byby real

real

estate

estate holdings

holdings andand real

real property,

property,

such

such as

as equipment.

equipment.

MCGRAW-HILL/IRWIN 6-24

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

Debentures

Debentures and

and subordinated

subordinated debentures

debentures

Convertible

Convertible bonds

bonds versus

versus non-convertible

non-convertible bonds

bonds

icvb incvb opcvb

icvb

i ==rate

rateof

ofreturn

returnon

onaaconvertible

convertiblebond

bond

cvb

incvb

i ==rate

rateof

ofreturn

returnon

onaanonconvertible

nonconvertiblebond

bond

ncvb

op

opcvb = value of the conversion option

cvb = value of the conversion option

Stock

Stock warrants

warrants give

give bondholders

bondholders the

the opportunity

opportunity

to

to purchase

purchase common

common stock

stock at

at aa prespecified

prespecified price

price

MCGRAW-HILL/IRWIN 6-25

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

Debentures

Debentures

aatype

typeof

ofbond

bondororother

otherdebt

debtinstrument

instrumentthat

thatisisunsecured

unsecured

by

bycollateral.

collateral.

Subordinated

Subordinated debentures

debentures

isisan

anunsecured

unsecuredloan

loanor

orbond

bondthat

thatranks

ranksbelow

belowother,

other,more

more

senior

seniorloans

loansororsecurities

securitieswith

withrespect

respectto

toclaims

claimsononassets

assetsor

or

earnings.

earnings.

Subordinated debentures are thus also known as junior

Subordinated debentures are thus also known as junior

securities.

securities.InInthe

thecase

caseof

ofborrower

borrowerdefault,

default,creditors

creditorswho

whoown

own

subordinated

subordinateddebt debtwill

willnot

notbebepaid

paidout

outuntil

untilafter

aftersenior

senior

bondholders

bondholdersare arepaid

paidin

infull.

full.

MCGRAW-HILL/IRWIN 6-26

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

Callable

Callablebonds

bonds

also

alsoknown

knownasasaaredeemable

redeemablebond,

bond,isisaabond

bondthat

thatthe

the

issuer

issuermay

mayredeem

redeembefore

beforeititreaches

reachesthe

thestated

statedmaturity

maturity

date.

date.

AAcallable

callablebond

bondallows

allowsthe

theissuing

issuingcompany

companyto topay

payoff

off

their

theirdebt

debtearly

early

Non-callable

Non-callable bonds

bonds

bond

bondthatthatisisonly

onlypaid

paidout

outatatmaturity.

maturity.The

Theissuer

issuerofofaa

non-callable

non-callablebond bondcan’t

can’tcall

callthe

thebond

bondprior

priorto

toits

itsdate

date

of

ofmaturity.

maturity.

MCGRAW-HILL/IRWIN 6-27

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

AASinking

Sinking fund

fund provision

provision isis aa requirement

requirement that

that

the

the issuer

issuer retire

retire aa certain

certain amount

amount of

of the

the bond

bond issue

issue

early

early as

as the

the bonds

bonds approach

approach maturity.

maturity.

MCGRAW-HILL/IRWIN

6-28

©2009, The McGraw-Hill Companies, All Rights Reserved

CORPORATE BONDS

Primary

Primarymarkets

marketsare

areidentical

identicalto

tothat

thatof

ofMunis

Munis

Secondary

Secondarymarkets

markets

the

theexchange

exchangemarket

market(e.g.,

(e.g.,PSE,

PSE,NYSE)

NYSE)

the

theover-the-counter

over-the-counter(OTC)

(OTC)market

market

Bond

Bondratings

ratings

the

thetwo

twomajor

majorbond

bondrating

ratingagencies

agenciesare

areMoody’s

Moody’sand

and

Standard

Standard& &Poor’s

Poor’s(S&P)

(S&P)

bonds

bondsare

arerated

ratedby

byperceived

perceiveddefault

defaultrisk

risk

bonds

bondsmay

maybe

beeither

eitherinvestment

investmentor

orspeculative

speculative(i.e.,

(i.e.,junk)

junk)

grade

grade

MCGRAW-HILL/IRWIN 6-29

©2009, The McGraw-Hill Companies, All Rights Reserved

BOND MARKET INDEXES

Managed

Managed by

by major

major investment

investment banks

banks

Reflect

Reflect both

both the

the monthly

monthly capital

capital gain

gain and

and loss

loss on

on

bonds

bonds plus

plus any

any interest

interest (coupon)

(coupon) income

income earned

earned

Changes

Changes in in values

values ofof bond

bond indexes

indexes can

can bebe used

used by

by

bond

bond traders

traders to

to evaluate

evaluate changes

changes inin the

the investment

investment

attractiveness

attractiveness ofof bonds

bonds ofof different

different types

types and

and

maturities

maturities

MCGRAW-HILL/IRWIN 6-30

©2009, The McGraw-Hill Companies, All Rights Reserved

BOND MARKET PARTICIPANTS

The

Themajor

majorissuers

issuersof

ofdebt

debtmarket

marketsecurities

securitiesare

arefederal,

federal,

state

stateand

andlocal

localgovernments,

governments,and

andcorporations

corporations

The

Themajor

majorpurchasers

purchasersof

ofcapital

capitalmarket

marketsecurities

securitiesare

are

households,

households,businesses,

businesses,government

governmentunits,

units,and

andforeign

foreign

investors

investors

businesses and financial firms (e.g., banks, insurance companies,

businesses and financial firms (e.g., banks, insurance companies,

and

andmutual

mutualfunds)

funds)are

arethe

themajor

majorsuppliers

suppliersof

offunds

fundsfor

forMunis

Munisand

and

corporate

corporatebonds

bonds

foreign investors and governments are the major suppliers of funds

foreign investors and governments are the major suppliers of funds

for

forT-notes

T-notesand

andT-bonds

T-bonds

MCGRAW-HILL/IRWIN 6-31

©2009, The McGraw-Hill Companies, All Rights Reserved

INTERNATIONAL BONDS AND

MARKETS

International bond markets involve unregistered bonds that are

International bond markets involve unregistered bonds that are

internationally

internationallysyndicated,

syndicated,offered

offeredsimultaneously

simultaneouslytotoinvestors

investorsinin

several

severalcountries,

countries,and

andissued

issuedoutside

outsideof

ofthe

thejurisdiction

jurisdictionof

ofany

anysingle

single

country

country

Eurobonds are long-term bonds issued outside the country of the

Eurobonds are long-term bonds issued outside the country of the

currency

currencyininwhich

whichthey

theyare

aredenominated

denominated

Foreign Bonds are long-term bonds issued outside of the issuer’s

Foreign Bonds are long-term bonds issued outside of the issuer’s

home

homecountry

country

Brady Bonds are bonds swapped for an outstanding loan to a less

Brady Bonds are bonds swapped for an outstanding loan to a less

developed

developedcountry

country

Sovereign Bonds are Brady Bonds that have had their underlying

Sovereign Bonds are Brady Bonds that have had their underlying

collateral

collateralremoved

removedand andthe

thecreditworthiness

creditworthinessofofthe

thecountry

countryisis

substituted

substitutedinstead

instead

MCGRAW-HILL/IRWIN 6-32

©2009, The McGraw-Hill Companies, All Rights Reserved

Proverbs 10:9

Whoever walks in integrity walks

securely, but whoever takes the crooked

path shall be found out.

MCGRAW-HILL/IRWIN 6-33

©2009, The McGraw-Hill Companies, All Rights Reserved

You might also like

- Private Equity: Access for All: Investing in Private Equity through the Stock MarketsFrom EverandPrivate Equity: Access for All: Investing in Private Equity through the Stock MarketsNo ratings yet

- All About Bonds, Bond Mutual Funds, and Bond ETFs, 3rd EditionFrom EverandAll About Bonds, Bond Mutual Funds, and Bond ETFs, 3rd EditionRating: 4.5 out of 5 stars4.5/5 (3)

- Walmart Sample Training ProgramDocument17 pagesWalmart Sample Training ProgramNisha BrosNo ratings yet

- Financial SystemDocument16 pagesFinancial Systemshivakumar N100% (2)

- Summary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionFrom EverandSummary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionNo ratings yet

- RE Capital Markets 6.9 330pDocument82 pagesRE Capital Markets 6.9 330pAirollNo ratings yet

- Babok Businessanalysis Poster Big SizeDocument1 pageBabok Businessanalysis Poster Big SizebensardiNo ratings yet

- 509 Chapter 05 SummaryDocument12 pages509 Chapter 05 Summarygenevieve_gnzlsNo ratings yet

- Audit of Warehouse and InventoryDocument51 pagesAudit of Warehouse and InventoryArun Karthikeyan100% (2)

- Issue of DebenturesDocument28 pagesIssue of DebenturesFalguni Mathews100% (1)

- ISDA Documentation of DerivativesDocument12 pagesISDA Documentation of Derivativesed_nycNo ratings yet

- Bodie Investments CH02Document36 pagesBodie Investments CH02rafat.jalladNo ratings yet

- Week 5Document18 pagesWeek 5Agnes Patricia MendozaNo ratings yet

- Chapter 4 Fixed Income MarketsDocument47 pagesChapter 4 Fixed Income MarketsJihen Mejri0% (1)

- Goverment Securities Market: A Billion Heart BeatDocument36 pagesGoverment Securities Market: A Billion Heart BeatSumit SharmaNo ratings yet

- Bodie 11e PPT Ch02Document33 pagesBodie 11e PPT Ch02Muhammad Sofian MaksarNo ratings yet

- WEEK 2A Bodie - 11e - PPT - Ch02Document33 pagesWEEK 2A Bodie - 11e - PPT - Ch02ytbhmkNo ratings yet

- Learning Module 1: Introduction & Securities Markets: Portfolio ManagementDocument35 pagesLearning Module 1: Introduction & Securities Markets: Portfolio ManagementYaonik HimmatramkaNo ratings yet

- Chapter 02Document25 pagesChapter 02GIAO NGUYỄN VÕ QUỲNHNo ratings yet

- Financial MarketsDocument25 pagesFinancial MarketsqumzNo ratings yet

- BBK 1 Financial Markets IntroDocument14 pagesBBK 1 Financial Markets IntroWashington AraujoNo ratings yet

- Eun7e CH 012Document35 pagesEun7e CH 012Shruti AshokNo ratings yet

- Financial Markets: From Wikipedia, The Free EncyclopediaDocument24 pagesFinancial Markets: From Wikipedia, The Free Encyclopediaraden chandrajaya listiandokoNo ratings yet

- Macroeconomic (Saving and Investment)Document110 pagesMacroeconomic (Saving and Investment)Sheillie KirklandNo ratings yet

- rsm430 Lecture 1 Overview of Bond Market and Bond ValuationDocument30 pagesrsm430 Lecture 1 Overview of Bond Market and Bond ValuationGrace IdreesNo ratings yet

- FINMARDocument82 pagesFINMARGlendel Carl EguiaNo ratings yet

- Mishkin Econ13e PPT 02Document26 pagesMishkin Econ13e PPT 02Omar 11No ratings yet

- Economics MrunalSir Notes AnnotatedDocument19 pagesEconomics MrunalSir Notes AnnotatedakankshaNo ratings yet

- FI06 Corporate Bonds 6523d7e802edbDocument65 pagesFI06 Corporate Bonds 6523d7e802edbKinzimbu Asset ManagementNo ratings yet

- Gestión Bancaria: Master en Banca y Finanzas Cuantitativas (QF), 2008Document285 pagesGestión Bancaria: Master en Banca y Finanzas Cuantitativas (QF), 2008Tegegn ZelekeNo ratings yet

- Capital Market: Instructor: Ph.D. MBA. Ana María BallesterosDocument45 pagesCapital Market: Instructor: Ph.D. MBA. Ana María BallesterosRodrigo MontesolerNo ratings yet

- IBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalDocument66 pagesIBA EMBA Class - Security Market & MF - Aug 28 2023 - FinalAbhinandanNo ratings yet

- Session 1 - Overview of Financial SystemDocument20 pagesSession 1 - Overview of Financial SystemchuphamnamphuongNo ratings yet

- Fixed IncomeDocument14 pagesFixed Incomeard.denisaNo ratings yet

- The International Bond MarketDocument23 pagesThe International Bond Market2005raviNo ratings yet

- BondmarketpptDocument28 pagesBondmarketpptMia LeslieNo ratings yet

- Ch02: Financial Assets, Money and Financial TransactionsDocument10 pagesCh02: Financial Assets, Money and Financial TransactionsAbi VillaNo ratings yet

- Overview of The Bond MarketsDocument26 pagesOverview of The Bond MarketsbharatNo ratings yet

- Mutual FundDocument43 pagesMutual FundSachi LunechiyaNo ratings yet

- Bond Market in IndiaDocument13 pagesBond Market in Indiafernandesroshandaniel4962100% (1)

- Risk and Term Structure of Interest RatesDocument31 pagesRisk and Term Structure of Interest RatesJames Andrei AdlawanNo ratings yet

- 1 - Chapter 24 (Abridged) - Debt Financing - PresentationDocument57 pages1 - Chapter 24 (Abridged) - Debt Financing - Presentationyass.methniNo ratings yet

- Chapter One: Introduction To Financial Markets and InstitutionDocument14 pagesChapter One: Introduction To Financial Markets and InstitutionSADIQUE SIFATNo ratings yet

- Lecture 1 - Review of Bond Concepts and Term Structure of Interest RatesDocument20 pagesLecture 1 - Review of Bond Concepts and Term Structure of Interest RatesNiyati ShahNo ratings yet

- International Flow of Funds & Engines of GrowthDocument82 pagesInternational Flow of Funds & Engines of GrowthPanashe MachekepfuNo ratings yet

- 5.1 Prof G A Walker (Eurobond Law)Document28 pages5.1 Prof G A Walker (Eurobond Law)contactpulkitagarwalNo ratings yet

- Lecture 02 Macro-Econ102Document78 pagesLecture 02 Macro-Econ102HanaMengstu IelremaNo ratings yet

- Bond MarketDocument41 pagesBond MarketJemaimah BuhayanNo ratings yet

- KMPS CH 01Document34 pagesKMPS CH 01Ismail HossainNo ratings yet

- The Financial Environment: Markets, Institutions & Intrest RatesDocument34 pagesThe Financial Environment: Markets, Institutions & Intrest Ratesnumlit1984No ratings yet

- © FINANCE TRAINER International Fixed Income / Page 1 of 48Document48 pages© FINANCE TRAINER International Fixed Income / Page 1 of 48subrat nandaNo ratings yet

- Chapter 01Document21 pagesChapter 01robertjonascribdNo ratings yet

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDocument55 pagesInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownRagini SharmaNo ratings yet

- Financial Market & Banking OperationsDocument38 pagesFinancial Market & Banking Operationsamit chavariaNo ratings yet

- Interest Rates 1: What Are Interest Rates?: SSRN Electronic Journal January 2014Document26 pagesInterest Rates 1: What Are Interest Rates?: SSRN Electronic Journal January 2014Aina AguirreNo ratings yet

- Financial Management 5: Jason Santos, MbaDocument23 pagesFinancial Management 5: Jason Santos, MbaAbi CrisostomoNo ratings yet

- 强化 - 金融市场与产品+估值与风险模型 - lzy3 QQ2158933105Document93 pages强化 - 金融市场与产品+估值与风险模型 - lzy3 QQ2158933105Sherry YangNo ratings yet

- 10.1. Club de LondresDocument18 pages10.1. Club de Londresson goku super saiyan 99999No ratings yet

- Indian and International Debt Market - Recent Trends and DrawbacksDocument11 pagesIndian and International Debt Market - Recent Trends and DrawbacksKhushi VifiNo ratings yet

- Financial Instruments, Markets, and InstitutionsDocument6 pagesFinancial Instruments, Markets, and InstitutionsAbdikadir ali mohamedNo ratings yet

- Eun8e CH 012 PPTDocument39 pagesEun8e CH 012 PPThiitsseleneNo ratings yet

- Week 4 An Overview of Corporate FinancingDocument40 pagesWeek 4 An Overview of Corporate FinancingPol 馬魄 MattostarNo ratings yet

- The Nature and Role of Financial SystemDocument58 pagesThe Nature and Role of Financial SystemMadhu BabuNo ratings yet

- Gov EthicsDocument10 pagesGov Ethicsnarisalvador09No ratings yet

- ForecastingDocument52 pagesForecastingnarisalvador09No ratings yet

- FM RVRDocument26 pagesFM RVRnarisalvador09No ratings yet

- GenElec2 Midterm Lesson-1-2Document45 pagesGenElec2 Midterm Lesson-1-2narisalvador09No ratings yet

- Letter To U.S. CongressDocument8 pagesLetter To U.S. CongressWWMTNo ratings yet

- 1 EODB Law-BOSS CARAVANDocument16 pages1 EODB Law-BOSS CARAVANgulp_burpNo ratings yet

- Review Jurnal - 3Document20 pagesReview Jurnal - 3eko hadiNo ratings yet

- AbdulSamad - 12 - 16594 - 3 - CH 06 Merchandise InventoryDocument13 pagesAbdulSamad - 12 - 16594 - 3 - CH 06 Merchandise InventoryHassaan QaziNo ratings yet

- Microbankingbulletin Spring09 PDFDocument98 pagesMicrobankingbulletin Spring09 PDFMuhammad Salman ArrifqyNo ratings yet

- Facturaev3 2 2bDocument81 pagesFacturaev3 2 2bJulian Martin De MingoNo ratings yet

- AMAZONDocument22 pagesAMAZONASHWINI PATILNo ratings yet

- Meeting 3-Group 2-How Do Firms Adapt To Discontinuous Change PDFDocument24 pagesMeeting 3-Group 2-How Do Firms Adapt To Discontinuous Change PDFArdian MustofaNo ratings yet

- Client Request FormDocument1 pageClient Request FormDenald Paz100% (1)

- Hanwha Engineering & Construction - Brochure - enDocument48 pagesHanwha Engineering & Construction - Brochure - enAnthony GeorgeNo ratings yet

- A Project Report On "Whatsapp-An Innovative Service" Submitted in The Partial Fulfilment For The Requirement of The Degree ofDocument21 pagesA Project Report On "Whatsapp-An Innovative Service" Submitted in The Partial Fulfilment For The Requirement of The Degree ofGunveen AbrolNo ratings yet

- Worldbank: New Social Impact Bond For Individual Women EntrepreneursDocument28 pagesWorldbank: New Social Impact Bond For Individual Women EntrepreneursAbhishekNo ratings yet

- Consolidated Set of The GRI Standards 2022Document747 pagesConsolidated Set of The GRI Standards 2022Justyne WebbNo ratings yet

- Organizing For Advertising and Promotion: The Role of Ad Agencies and Other Marketing Communication OrganizationsDocument20 pagesOrganizing For Advertising and Promotion: The Role of Ad Agencies and Other Marketing Communication OrganizationsPrasad KapsNo ratings yet

- Analisis Pendapatan Usahatani Jagung Dan Faktor-Faktor Yang Mempengaruhi Di Kecamatan Wajak Kabupaten MalangDocument15 pagesAnalisis Pendapatan Usahatani Jagung Dan Faktor-Faktor Yang Mempengaruhi Di Kecamatan Wajak Kabupaten MalangKezia NatashaNo ratings yet

- Hs Entrepreneurship Performance Indicators 3Document20 pagesHs Entrepreneurship Performance Indicators 3api-374581067No ratings yet

- Introduction To Mobile Forensics: Full Physical Image AnalysisDocument31 pagesIntroduction To Mobile Forensics: Full Physical Image AnalysisEsteban RamirezNo ratings yet

- A.national Value Capture Finance Policy FrameworkDocument16 pagesA.national Value Capture Finance Policy FrameworkAnirban MandalNo ratings yet

- Marketing Management Project On Coca Cola-LibreDocument38 pagesMarketing Management Project On Coca Cola-Librehamza.ashfaq2280% (1)

- Our Products: Powercore Grain Oriented Electrical SteelDocument20 pagesOur Products: Powercore Grain Oriented Electrical SteelkoalaboiNo ratings yet

- 2022 NIBS ProspectusDocument12 pages2022 NIBS ProspectusLagat ToshNo ratings yet

- 15 Marzo 21 BrikelDocument20 pages15 Marzo 21 BrikelAndres TabaresNo ratings yet

- DTDCDocument1 pageDTDCAbdullah siddikiNo ratings yet

- A To Z List of Accessible E-BooksDocument146 pagesA To Z List of Accessible E-BooksvishalmehandirattaNo ratings yet

- The Future of Manufacturing - Canada: in This Report 2 6 10Document28 pagesThe Future of Manufacturing - Canada: in This Report 2 6 10catsdeadnowNo ratings yet

- Test Bank For Valuation Measuring and Managing The Value of Companies 6th by KollerDocument5 pagesTest Bank For Valuation Measuring and Managing The Value of Companies 6th by KollerJohn Ngo100% (24)