0% found this document useful (0 votes)

62 views29 pagesFinancial - Hwa Well Textiles (BD) PLC.

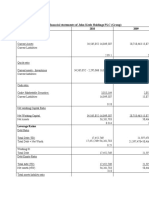

The document presents a financial ratio analysis of Hwa Well Textiles (BD) PLC covering the years 2019 to 2024, focusing on various liquidity, profitability, leverage, and asset management ratios. Key findings include consistently high liquidity ratios indicating underutilized assets, a rising total debt ratio suggesting increased reliance on short-term liabilities, and significant improvements in inventory turnover by 2024. The analysis highlights the company's strategic shift towards a debt-free structure and the need for earnings stability due to fluctuations in EBIT.

Uploaded by

tony102083Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

62 views29 pagesFinancial - Hwa Well Textiles (BD) PLC.

The document presents a financial ratio analysis of Hwa Well Textiles (BD) PLC covering the years 2019 to 2024, focusing on various liquidity, profitability, leverage, and asset management ratios. Key findings include consistently high liquidity ratios indicating underutilized assets, a rising total debt ratio suggesting increased reliance on short-term liabilities, and significant improvements in inventory turnover by 2024. The analysis highlights the company's strategic shift towards a debt-free structure and the need for earnings stability due to fluctuations in EBIT.

Uploaded by

tony102083Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd