Chapter 3(a) GDP Determination with Govt.

and Open Economy The Four Sector Model Circular Flow of the Economy

�Govt. Expenditure And National Income

In Keynesian Model, Govt. Expenditure(G) is treated as Autonomous Expenditure(Doesnt depend on the level of income of the economy). Assumption Govt spends on goods and services but imposes No Taxes. Y=C+I+G

� Y=C+I+G Where C = a+bY Substituting, Y = a+bY + I + G Y bY = a + I +G Y(1 b) = a + I + G Y = 1/(1 b) * (a + I + G)

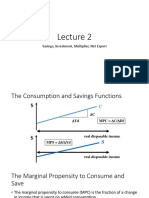

Z AE = C + I + G E

I+G

C = a + bY C + I + G T

45 National Income Y3 X

�BUDGET SURPLUS FUNCTION

Y National Saving

S0

I

S1

Real Rate of Interest

r0

E0

Private Investment

r1

E1

Saving & Investment

I0

I1

�If G < T it is Budget Surplus Where, G = Govt. Expenditure T = Tax Revenue What it leads to: Positive Saving will lead to increase in National Saving. Make more funds available for Pvt. Sector to borrow. This will cause real Rate of Interest to fall. Hence, higher Pvt. Investment will occur.

�Why Keynesian Theory is relevant only in the short run?

Stock of Capital, techniques of production, efficiency of labor, size of population, forms of business organization have been assumed to be constant. Also price level in the economy is assumed to remain unchanged. Thus, Income and Labor employment are directly related to each other.

�How Trade of Goods and Services Affects an Economy?

It Affects Product Market. Influences the determination of NI as Net Exports (Exports-Imports) is a part of agg. Demand for o/p produced by an economy.

�How Capital Flows Affects an Economy?

Provide fund for financing domestic investment For financing Govt. budget deficits. If (demand for fund > domestic national saving), then : * Private Sector & Govt. get them through borrowing * Or through direct investment by foreign investors.

�What is an Open Economy?

An Open Economy is one which has trade relations and financial capital flows between countries and other economies of the world. For Example India is getting affected by the crisis situation of Economy in US and Euro Zone.

�What are the Four Sectors?

1) 2) 3) 4) Households Sector Firms Sector Government Sector Foreign Trade Sector

�AGGREGATE DEMAND Or AGGREGATE EXPENDITURE

AE

CONSUMPTION DEMAND

INVESTMENT DEMAND

GOVERNMENT DEMAND

FOREIGN TRADE DEMAND

+ NX

�Aggregate Demand (Agg. Expenditure)

Total expenditure which at given fixed prices all households, business firms, government and foreign trade want to make on goods and services in a period at various level of national income.

AE = C + I + G + (X-M)

where, AE=Agg. Expenditure C= Consumption Expenditure I= Investment Expenditure G= Govt. Expenditure (X-M)=Net Exports or NX

Z AE = C + I +G + Xn

C + I + G + NX

I + G + NX

C = a + b(Y-T) T

45 National Income Y3 X

� Y = C + I + G + (X M) Where C = a+bY Substituting, Y = a+bY + I + G + NX Y bY = a + I + G + NX Y(1 b) = a + I + G + NX Y = 1/(1 b) * (a + I + G + NX) --- (1) Where (1/1 b) is the multiplier in Equation 1

� Rate of Interest An instrument of Monetary Policy in Rate of Interest -- in borrowing by people - in Consumption Expenditure -- shift in the consumption curve (at given level of Income) Income Tax An Instrument of Fiscal Policy in Income Tax -- in Disposable Income in Consumption Expenditure -- shift in the Consumption Curve(at given level of Income)

�NET EXPORT FUNCTION

It is the difference between Exports and Imports

Exports Depend upon spending decision of foreigners on the goods & services produced in our country. Hence, they are autonomous part of Aggregate Expenditure.

Imports Depend on decision of domestic resident of our country on the goods & services produced in foreign countries. Hence, Imports are function of GDP. GDP increases, Imports Increases

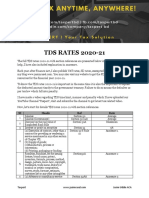

�GDP(Y) 0 1000 1500 2000

EXPORTS(X) 800 800 800 800

IMPORTS M = 0.25Y 0 250 375 500

NET EXPORTS = (X M) 800 550 425 300

3000

3200 3500 4000 4500

800

800 800 800 800

750

800 875 1000 1125

50

0 -75 -200 -325

�Exports & Imports

1000 800

Exports

M = 0.25Y M X = 800

500

Import Function

2000 4000

GDP(Y)

Net Exports

1000 800 500 X M = 800 0.25Y

GDP(Y)

3200

NX

�Shift in Net Export Function

While calculating Net Export, it is assumed that factor other than national income remain constant. These factors are: * Foreign Income * The relative International Prices * Exchange rate between currencies. But if they change, there will be shift in the Net Export curve.

Net Export curve will shift upward : when exports of the home country increases, import propensity remaining the same and vice versa.

�Shift in Net Export Function due to Changes in the Autonomous Exports. Propensity to Import remaining the same

Exports & Imports

GDP NX0

NX1

NX2

�Shift in Net Export Function due to Changes in Import propensity. Exports remaining the same

Y

NX

(X M)2 (X M)0 NX2 X GDP (X M)1 NX1 NX0

�Savings Investment Approach

In Four Sector Model : * Private Planned Saving has been augmented by Government Saving (T G) * Domestic Investment has been augmented by Net Exports. This approach uses Leakages and Injections into National Income Flow to explain the determination of equilibrium level of National Income (GDP).

� Basically, Savings are leakage from the National Income Flow while Investment is an injection of money in the National Income Flow.

In Four Sector Model : Tax & imports are additional leakages While Govt. Expenditure & Exports are additional injections. Thus for National Income to be in equilibrium : S+T+M=I+G+X Or S + (T G) = I + (X M) Where, (T G) is Govts Budget Surplus (X M) is Net Exports

�Determination of GDP in an Open Economy

Augmented Saving & Investment S + (T G)

Y1 National Income I + (X - M)

�THANK YOU