0% found this document useful (0 votes)

52 views10 pagesBusiness Plan

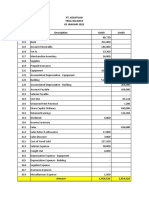

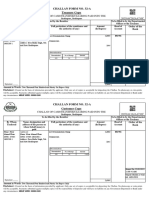

The business plan outlines a BPO service specializing in accounting and finance, offering services such as bookkeeping, payroll processing, and tax return preparation. It targets both domestic and global markets, including startups, SMEs, and individuals, while facing competition from freelancers and existing BPO firms. The model emphasizes cost-effective solutions, compliance, technology integration, and a hybrid workforce based in Dhaka with offshore teams.

Uploaded by

Mahmud KaiserCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

52 views10 pagesBusiness Plan

The business plan outlines a BPO service specializing in accounting and finance, offering services such as bookkeeping, payroll processing, and tax return preparation. It targets both domestic and global markets, including startups, SMEs, and individuals, while facing competition from freelancers and existing BPO firms. The model emphasizes cost-effective solutions, compliance, technology integration, and a hybrid workforce based in Dhaka with offshore teams.

Uploaded by

Mahmud KaiserCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd