Professional Documents

Culture Documents

Eds Dilemma-Instructors Comments

Uploaded by

raptors90Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eds Dilemma-Instructors Comments

Uploaded by

raptors90Copyright:

Available Formats

Entrepreneurial Finance

Eds Dilemma: To hire his daughter or not? Case Observations (For purposes of the Winter 2010 offering of Entrepreneurial Finance only do not distribute)

Transition Planning: Step 1 -- Establishing Objectives

Objective 1. Provide for the family 2. Maintain the value of the business over the transition period 3. Prepare for the future 4. Maintain family harmony 5. Minimize Tax

Eds Priority

Highest given hard work over many years, expensive homes and lifestyle High given uncertainty over whether he will be able to retire soon

High given concerns that Luke and Nancy cannot share decisionmaking in the long term Debatable as family had many past feuds and Ed argues with Luke & pays special attention to Nancy Not crucial but still important given corporate structure

Transition Planning Step 1 Establishing Objectives

Merski Holding Sole Shareholder: Ed Merski

Niagara Paving Sole Shareholder: Merski Holding

Niagara Manufacturing

Manufactures & sells asphalt to Niagara Paving

Sole Shareholder: Lydia Merski

Niagara Transport Leases trucks to Niagara Paving Shareholdings of children of Ed and Lydia Merski: Luke 60%; Maria 20%; Nancy 20%

Transition Planning Step 2 -- Assess the family

Stanislaw (Deceased) Gertrude (78)

Ed (58) Lydia (56)

Donna (56) Ferris

Jacob (54) Sara (50)

Pam (52) (Divorced)

Larry (50) Rose (45)

Kurt (46) Irene (43)

Karen (42) Ron (46)

Maria (37) Matt (42) Luke (36) Barb (39) Nancy (27) Allan (30)

2 unmarried sons

1 married son; 1 married daughter

2 sons (1 married); 1 daughter

3 daughters (2 married)

2 daughters

2 sons; 1 daughter

Transition Planning Step 3 -- Assess Business

Ed Merski President Greg Seppi Paving Crew Head Marcus Giampolo Asphalt Repair Head

Luke Merski General Manager

David Jones Sales Manager

Judy Holt Office Manager

Paving Crews (30)

Asphalt Manufacturing Staff (10-20)

Asphalt Repair Staff (4-10)

Sales Staff (2)

Clerical Staff (5)

Transition Planning Step 3 -- Assess Business

Key Success Factors and related crucial roles (individuals responsible for those tasks are listed in brackets): Negotiations with suppliers (Ed) Relationships with customers (David and Ed) Timely delivery efficient logistics management (Luke) Effective management of internal operations (Luke) Union negotiations (Ed) Major capital expenditures (Ed) Invoicing and Collections (Judy) Financing (Ed)

Transition Planning Step 3 -- Assess Business

2001 2002 2003

Sales growth Gross margin as % of sales Net income as % of sales

n.a. 24.5% 2.0%

9.1% 24.2% 2.5%

25.0% 24.7% 4.0%

Under Eds leadership, Niagaras gross margins have been 4% higher than its competitors

With a 25% income tax rate and $15 projected sales level, Eds leadership means $15 million *4%*(1-0.25) or $450,000 in higher after-tax profits annually

company is highly liquid (2.5 current ratio) and most of debt is the shareholders loan Longevity of key non-family members-David Jones and Judy Holt

Current Transition Plans

Retirement Planning Ed will retire from business in a few year at which time Luke will take control of business Estate Planning Dont know contents of will but it appears that the Luke will eventually be left a 60% controlling position in Niagara with each of his sisters receiving a 40% interest Current market value of Niagara is approximately $10 million (80% of book value of $12.2 million) Thus, value of Lukes inheritance will be three times that of each sister $6 million versus $2 million Disability Planning?

Impact of Eds Decision to allow Nancy to join Niagara

Decision Impact Allow Luke may be unhappy Nancy to if he is concerned that Nancys new active position in the Join company will reduce his slice of the inheritance Niagara if Nancy exerts too much control and influences the company in directions not to Lukes liking, including pushing for takeover of competitor which would increase expected net income by ($300,000-4.5% of $2.5 million loan)*(1-0.25) or $141,000 annually but increases uncertainty of income Lukes concerns may be offset if Nancy can make significant contribution to company outside of Lukes sphere of activity and if Nancy can handle and keep David with the company Dont allow Luke will eventually gain control of company in which case David will likely leave. It is unclear that Luke can run Niagara on his own. Nancy and possibly Lydia will be unhappy

What roles can Nancy take in Niagara?

Role Negotiations with Suppliers Negotiations with Customer Union negotiations Office Management Assessment Nancy has worked with a supplier but in an e-commerce role

Nancy has no experience but likely able to work with David (given her confident positive personality) Nancy has no experience but aspires to improve relations here Some past experience (her ability to interact with Judy Holt is unknown)

You might also like

- 2022 FedEx Economic Impact ReportDocument33 pages2022 FedEx Economic Impact Reportyorchbfmv04No ratings yet

- Northmeadow Construction Company Update: Services DivisionDocument3 pagesNorthmeadow Construction Company Update: Services DivisionCyrill Joyce Santelices EgualNo ratings yet

- Link Company BrochureDocument46 pagesLink Company BrochureDaniel ValeNo ratings yet

- Group 5 - Cty Cổ phần Nước giải khát Chương DươngDocument20 pagesGroup 5 - Cty Cổ phần Nước giải khát Chương Dương2121013027No ratings yet

- A Private Developer's Roadmap for Affordable Housing: Profitable Rental Apartment Solutions in CanadaFrom EverandA Private Developer's Roadmap for Affordable Housing: Profitable Rental Apartment Solutions in CanadaNo ratings yet

- Annual Report and Accounts 2021Document410 pagesAnnual Report and Accounts 2021Tran Thien PhuongNo ratings yet

- ACCT1511: HW Solutions Topic 8Document10 pagesACCT1511: HW Solutions Topic 8iwhy_No ratings yet

- Philippine Construction Company Update: Services DivisionDocument3 pagesPhilippine Construction Company Update: Services DivisionGerean Abeleda-VillasNo ratings yet

- Topic 5 (Project Initialization - MOV Business Case)Document33 pagesTopic 5 (Project Initialization - MOV Business Case)Visnu ManimaranNo ratings yet

- Citi Bank 2022 Family Office Survey ReportDocument50 pagesCiti Bank 2022 Family Office Survey ReportRoshan GaikwadNo ratings yet

- The Intentional Apartment Developer: A Programmatic Guide for Planning, Designing, Building, Leasing, Managing, and SellingFrom EverandThe Intentional Apartment Developer: A Programmatic Guide for Planning, Designing, Building, Leasing, Managing, and SellingNo ratings yet

- Lecture 2 Financial Planning PostDocument29 pagesLecture 2 Financial Planning PostHồng KhanhNo ratings yet

- Ceres Gardening Company Submission TemplateDocument8 pagesCeres Gardening Company Submission TemplateDeepika ChandrashekarNo ratings yet

- The Cost of Doing Business Study, 2022 EditionFrom EverandThe Cost of Doing Business Study, 2022 EditionNo ratings yet

- Financial Accounting: Analyzing Transactions and Their Effects On Financial StatementsDocument52 pagesFinancial Accounting: Analyzing Transactions and Their Effects On Financial StatementsSebastián GómezNo ratings yet

- Chap 002Document15 pagesChap 002sueernNo ratings yet

- Sound Transit - Capital Program Realignment Presentation - May 28, 2020Document29 pagesSound Transit - Capital Program Realignment Presentation - May 28, 2020The UrbanistNo ratings yet

- Business Studies P1 M4Document6 pagesBusiness Studies P1 M4Asir Awsaf AliNo ratings yet

- FINM1416 2022S2 FinalExam+solsDocument6 pagesFINM1416 2022S2 FinalExam+solsMa HiNo ratings yet

- Financial AccountingDocument43 pagesFinancial AccountingazargalaxykustagiNo ratings yet

- CIBC 2012 Performance at A GlanceDocument194 pagesCIBC 2012 Performance at A GlanceshoagNo ratings yet

- Clevergroup DigitalmarketingDocument18 pagesClevergroup DigitalmarketingKim HoaNo ratings yet

- Corporate Finance Test 1Document3 pagesCorporate Finance Test 1Kevin VerhagenNo ratings yet

- Macroeconomics: Ninth Canadian EditionDocument48 pagesMacroeconomics: Ninth Canadian EditionUzma KhanNo ratings yet

- Business MagazineDocument14 pagesBusiness MagazineMarionne SaubonNo ratings yet

- Sample Pre-Seen Analysis Research NotesDocument24 pagesSample Pre-Seen Analysis Research NotesAnuradha Nalinda BandaraNo ratings yet

- Copt 2021Document44 pagesCopt 2021William HarrisNo ratings yet

- Annexure F: Formative Assessment 1 (Fa1)Document10 pagesAnnexure F: Formative Assessment 1 (Fa1)Antoinette Van der WesthuizenNo ratings yet

- Mckinsey On Finance Number 80Document207 pagesMckinsey On Finance Number 80julian.waggNo ratings yet

- Lecture 2 Tutorial SoluitionDocument3 pagesLecture 2 Tutorial SoluitionEleanor ChengNo ratings yet

- Poa Pob Sba Template 2023-2024Document21 pagesPoa Pob Sba Template 2023-2024aleenawaltersNo ratings yet

- 92nd Annual Plus4 and HMFCU Annual ReportDocument4 pages92nd Annual Plus4 and HMFCU Annual ReportPriority Trust Credit UnionNo ratings yet

- Operations Management: Sustainability and Supply Chain ManagementDocument52 pagesOperations Management: Sustainability and Supply Chain ManagementSSNo ratings yet

- 2022 Introduction Class NotesDocument68 pages2022 Introduction Class NotesFarah Luay AlberNo ratings yet

- Business Part 4Document32 pagesBusiness Part 4api-507148155No ratings yet

- Group 4 Assignement, Financial and Management Accounting-1Document10 pagesGroup 4 Assignement, Financial and Management Accounting-10pointsNo ratings yet

- Presentation To Laurentian Bank CEO and Desautels Capital ManagementDocument26 pagesPresentation To Laurentian Bank CEO and Desautels Capital ManagementZee MaqsoodNo ratings yet

- Dubai'S Financial Crisis: Credit ManagementDocument12 pagesDubai'S Financial Crisis: Credit ManagementBenjamin ChavezNo ratings yet

- ACCT1111 Chapter 1 LectureDocument74 pagesACCT1111 Chapter 1 LectureWky JimNo ratings yet

- AFAR Assignment (Occ 2) - Group 1Document46 pagesAFAR Assignment (Occ 2) - Group 1Karthik Roshan a/l RameshNo ratings yet

- CMHC Annual Report 2022 enDocument177 pagesCMHC Annual Report 2022 enHelena MarlynNo ratings yet

- Case Presentation - Woodland Furniture LTDDocument16 pagesCase Presentation - Woodland Furniture LTDLucksonNo ratings yet

- What Does Your Lender Look For in The Balance Sheet and Operating Statement and Why?Document32 pagesWhat Does Your Lender Look For in The Balance Sheet and Operating Statement and Why?MAX PAYNENo ratings yet

- HSBC Annual Report and Accounts 2021 (With Employee Share Plans)Document414 pagesHSBC Annual Report and Accounts 2021 (With Employee Share Plans)SNo ratings yet

- Boardroom-Dynamics-Sample-Paper Corporate GovernanceDocument5 pagesBoardroom-Dynamics-Sample-Paper Corporate GovernanceZahid UsmanNo ratings yet

- Group 5 PresentationDocument10 pagesGroup 5 PresentationGervinBulataoNo ratings yet

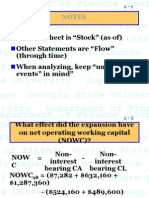

- Balance Sheet Is "Stock" (As Of) Other Statements Are "Flow" (Through Time) When Analyzing, Keep "Unusual Events" in Mind"Document22 pagesBalance Sheet Is "Stock" (As Of) Other Statements Are "Flow" (Through Time) When Analyzing, Keep "Unusual Events" in Mind"kegnataNo ratings yet

- Canadian Insolvency Landscape During The Pandemic - Natasha MacParlandDocument65 pagesCanadian Insolvency Landscape During The Pandemic - Natasha MacParlandVineetNo ratings yet

- Problem Set 4Document2 pagesProblem Set 4rtchuidjangnanaNo ratings yet

- 01 - Mish - Embfm7c - PPT - ch01 EditDocument28 pages01 - Mish - Embfm7c - PPT - ch01 Editginny HeNo ratings yet

- Class 7Document64 pagesClass 7Христина ЯблоньNo ratings yet

- Dell FY 2012 Analyst Day PresentationDocument74 pagesDell FY 2012 Analyst Day PresentationFabian R. GoldmanNo ratings yet

- LB Bls 2017 SurveyDocument24 pagesLB Bls 2017 SurveyMaja BudinskiNo ratings yet

- Agency Problems, Compensation, and Performance Management: Principles of Corporate FinanceDocument30 pagesAgency Problems, Compensation, and Performance Management: Principles of Corporate FinancechooisinNo ratings yet

- Business Management Assignment 121eDocument16 pagesBusiness Management Assignment 121eZowvuyour Zow Zow MazuluNo ratings yet

- Dolla Financial ReviewDocument9 pagesDolla Financial Reviewdac_101No ratings yet

- FinMan - Case #1Document3 pagesFinMan - Case #1Shaula Tan SombilonNo ratings yet

- TAX320 Candidate Study GuideDocument585 pagesTAX320 Candidate Study GuideHafiz MusannefNo ratings yet

- Survey of Accounting: Introduction To Financial StatementsDocument33 pagesSurvey of Accounting: Introduction To Financial StatementsTiaraNo ratings yet

- IMT CeresDocument8 pagesIMT CeresDeepika Chandrashekar100% (1)

- World Opacity IndexDocument18 pagesWorld Opacity IndexNando ArgilliNo ratings yet

- Draft Business Plan TemplateDocument6 pagesDraft Business Plan TemplateSanket MoteNo ratings yet

- The Importance of Emerging MarketsDocument8 pagesThe Importance of Emerging MarketsranamuhammadazeemNo ratings yet

- Rich Poor Foolish ExcerptDocument35 pagesRich Poor Foolish ExcerptRahul SharmaNo ratings yet

- Inrm 57 PDFDocument186 pagesInrm 57 PDFNisar Ahmed Ansari100% (1)

- Narrative Report DoneDocument53 pagesNarrative Report DoneElaine BanezNo ratings yet

- Post Shipment FinanceDocument7 pagesPost Shipment FinanceMajja Gya Mitra MandalNo ratings yet

- ACCFA v. Alpha IncDocument5 pagesACCFA v. Alpha IncAnonymous nYvtSgoQNo ratings yet

- Internship Report of Uttara BankDocument55 pagesInternship Report of Uttara BankMd ShaonNo ratings yet

- Government of Chhattisgarh Public Health Engineering DepartmentDocument67 pagesGovernment of Chhattisgarh Public Health Engineering DepartmentSanjeev BansalNo ratings yet

- The Abkari Workers' Welfare Fund Act, 1989 PDFDocument19 pagesThe Abkari Workers' Welfare Fund Act, 1989 PDFneet1No ratings yet

- Lighthouse Point News July IssueDocument76 pagesLighthouse Point News July IssueJon FrangipaneNo ratings yet

- Know How To Calculate Cost of Electricity Consumed On A Post Paid Bill From Power Holding Nigeria PLCDocument5 pagesKnow How To Calculate Cost of Electricity Consumed On A Post Paid Bill From Power Holding Nigeria PLCIskeel SadiqNo ratings yet

- Life After High School - A Post Secondary Students Guide To Success by Shawna NarayanDocument92 pagesLife After High School - A Post Secondary Students Guide To Success by Shawna Narayanapi-344973256No ratings yet

- 9 Secrecy of Bank Deposits LawDocument3 pages9 Secrecy of Bank Deposits LawKelvin CulajaráNo ratings yet

- Skill AssessmentDocument25 pagesSkill AssessmentSansNo ratings yet

- Subsidiary BooksDocument15 pagesSubsidiary Booksmanishsingh6270100% (2)

- Applicant Consent Form: Date of BirthDocument1 pageApplicant Consent Form: Date of BirthJasminNo ratings yet

- Business Finance 2nd QuarterDocument50 pagesBusiness Finance 2nd QuarterIt's me Ghie-ann67% (3)

- 9 - McGuire V ManufacturersDocument2 pages9 - McGuire V ManufacturersMarioneMaeThiamNo ratings yet

- Examination Handbook NewDocument97 pagesExamination Handbook Newdtr17No ratings yet

- Econ 601 f14 Workshop 5 Answer Key PDFDocument7 pagesEcon 601 f14 Workshop 5 Answer Key PDFюрий локтионовNo ratings yet

- Already Done Research Work PDFDocument182 pagesAlready Done Research Work PDFjalal shahNo ratings yet

- Reading Passage 1Document9 pagesReading Passage 1Kaushik RayNo ratings yet

- NGAS Vol 2 CH 1Document7 pagesNGAS Vol 2 CH 1Monique del RosarioNo ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- A141 Tutorial 1 BkalDocument7 pagesA141 Tutorial 1 BkalCyrilraincreamNo ratings yet

- House Hacking Catalog-Project For Lean UrbanismDocument38 pagesHouse Hacking Catalog-Project For Lean UrbanismPetrică Maier-DrăganNo ratings yet

- 12 DKC Holdings Corp V CA DigestDocument2 pages12 DKC Holdings Corp V CA DigestGarette LasacNo ratings yet

- Dao Heng Bank, Inc., Now Banco de Oro Universal Bank vs. Sps. Lilia and Reynaldo LaigoDocument5 pagesDao Heng Bank, Inc., Now Banco de Oro Universal Bank vs. Sps. Lilia and Reynaldo LaigoAdrianNo ratings yet