0% found this document useful (0 votes)

81 views13 pagesProject

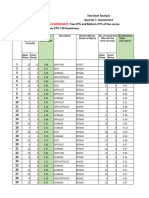

This project analyzes the Boston Housing dataset to identify key factors influencing housing prices using statistical techniques. Key findings include significant correlations between the number of rooms and housing costs, as well as the impact of proximity to the Charles River and highway accessibility on median home values. The regression model explains 74% of the variance in housing prices, indicating strong predictive power.

Uploaded by

Ardhra Santhosh MATHSCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

81 views13 pagesProject

This project analyzes the Boston Housing dataset to identify key factors influencing housing prices using statistical techniques. Key findings include significant correlations between the number of rooms and housing costs, as well as the impact of proximity to the Charles River and highway accessibility on median home values. The regression model explains 74% of the variance in housing prices, indicating strong predictive power.

Uploaded by

Ardhra Santhosh MATHSCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd