Professional Documents

Culture Documents

FSB Report Summary Shadow Banking $67 Trillion

Uploaded by

Gill Wallace HopeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FSB Report Summary Shadow Banking $67 Trillion

Uploaded by

Gill Wallace HopeCopyright:

Available Formats

Press release

Press enquiries: +41 61 280 8579 Press@bis.org

Ref no: 74/2012 18 November 2012

FSB Publishes Initial Integrated Set of Recommendations to Strengthen Oversight and Regulation of Shadow Banking

The Financial Stability Board (FSB) is publishing today for public consultation an initial integrated set of policy recommendations to strengthen oversight and regulation of the shadow banking system. The shadow banking system can broadly be described as credit intermediation involving entities and activities (fully or partially) outside the regular banking system or non-bank credit intermediation in short. The FSB has focused on five specific areas in which the FSB believes policies are needed to mitigate the potential systemic risks associated with shadow banking: (i) (ii) (iii) (iv) (v) to mitigate the spill-over effect between the regular banking system and the shadow banking system; to reduce the susceptibility of money market funds (MMFs) to runs; to assess and mitigate systemic risks posed by other shadow banking entities; to assess and align the incentives associated with securitisation; and to dampen risks and pro-cyclical incentives associated with secured financing contracts such as repos, and securities lending that may exacerbate funding strains in times of runs.

The consultative documents published today comprise: a report entitled An Integrated Overview of Policy Recommendations which sets out the FSBs overall approach to shadow banking issues and provides an overview of its recommendations across the five specific areas; a report entitled Policy Framework for Strengthening Oversight and Regulation of Shadow Banking Entities which sets out a high-level policy framework to assess and mitigate bank-like systemic risks posed by shadow banking entities other than MMFs (other shadow banking entities) (iii) above; and a report entitled Policy Recommendations to Address Shadow Banking Risks in Securities Lending and Repos that sets out 13 recommendations to enhance transparency, strengthen regulation of securities financing transactions, and improve market structure (v) above. The FSB welcomes comments on these documents. Comments should be submitted by 14 January 2013 by email to fsb@bis.org or post (Secretariat of the Financial Stability Board,

1/3

Centralbahnplatz 2 CH-4002 Basel Switzerland Tel: +41 61 280 8080 Fax: +41 61 280 9100 FSB@bis.org

c/o Bank for International Settlements, CH-4002, Basel, Switzerland). All comments will be published on the FSB website unless a commenter specifically requests confidential treatment. As for other areas in which the FSB believes policies are needed, the Basel Committee on Banking Supervision (BCBS) will develop policy recommendations for area (i) above by mid2013. As for areas (ii) and (iv) above, the International Organization of Securities Commissions (IOSCO) has set out final policy recommendations in its reports Policy Recommendations for Money Market Funds and Global Developments in Securitisation Markets. The FSB will continue to review the progress of the workstreams and expects to publish final recommendations in September 2013. It will thereafter work on the procedures for the consistent implementation of the policy recommendations. The FSB is also publishing today its second annual Global Shadow Banking Monitoring Report. The 2012 Monitoring Report has broadened its coverage to include 25 jurisdictions (all 24 FSB member jurisdictions and Chile), compared with 11 jurisdictions in 2011, and includes analyses on interconnectedness between banks and non-bank financial entities as well as on a specific non-bank financial subsector, namely finance companies. The main findings are: Non-bank financial intermediation grew rapidly before the crisis (in parallel with the regular banking system), from an estimated $26 trillion in 2002 to $62 trillion in 2007. It has continued to increase since, although at a slower pace, to $67 trillion at end 2011. There is considerable diversity in the relative size, composition and growth of the nonbank financial intermediaries across jurisdictions. For example, the size of the shadow banking system continues to be large relative to the regular banking system in the US and in a number of other jurisdictions. 17 jurisdictions out of 25 saw an increase in nonbank financial intermediaries since the crisis; half of these jurisdictions are emerging markets and developing economies undergoing financial deepening. Data granularity is improving, with the share of unidentified non-bank financial intermediaries within overall non-bank intermediation falling from 36% in 2010 to 18% in 2011. However, further improvements are needed in jurisdictions that still lack granular data to adequately capture the magnitude and nature of risks in the shadow banking system. The FSB plans to complement the monitoring exercise next year by obtaining more granular data on assets and liabilities as well as expanding activity-based and risk-based monitoring. Enhanced data reporting and disclosure requirements as recommended in the FSBs consultative documents published today will be essential to provide the necessary basis for such an enriched monitoring.

Notes to editors At the Cannes Summit in November 2011, the G20 Leaders endorsed the FSBs report Shadow Banking: Strengthening Oversight and Regulation which set out initial recommendations with a work plan to further develop them in the course of 2012. Five workstreams were launched to develop the above policy recommendations. The FSB

2/3

submitted a Progress Report on these workstreams to the G20 Finance Ministers and Central Bank Governors on 20 April 2012. The shadow banking system can broadly be described as credit intermediation involving entities and activities (fully or partially) outside the regular banking system or non-bank credit intermediation in short. Such intermediation, appropriately conducted, provides a valuable alternative to bank funding that supports real economic activity. But experience from the crisis demonstrates the capacity for some non-bank entities and transactions to operate on a large scale in ways that create bank-like risks to financial stability (longer-term credit extension based on short-term funding and leverage). Such risk creation may take place at an entity level but it can also form part of a complex chain of transactions, in which leverage and maturity transformation occur in stages, and in ways that create multiple forms of feedback into the regulated banking system. Like banks, a leveraged and maturity-transforming shadow banking system can be vulnerable to runs and generate contagion risk, thereby amplifying systemic risk. Such activity, if unattended, can also heighten procyclicality by accelerating credit supply and asset price increases during surges in confidence, while making precipitate falls in asset prices and credit more likely by creating credit channels vulnerable to sudden losses of confidence. These effects were powerfully revealed in 2007-09 in the dislocation of asset-backed commercial paper (ABCP) markets, the failure of an originate-to-distribute model employing structured investment vehicles (SIVs) and conduits, runs on MMFs and a sudden reappraisal of the terms on which securities lending and repos were conducted. But whereas banks are subject to a well-developed system of prudential regulation and other safeguards, the shadow banking system is typically subject to less stringent, or no, oversight arrangements. The objective of the FSBs work is to ensure that shadow banking is subject to appropriate oversight and regulation to address bank-like risks to financial stability emerging outside the regular banking system while not inhibiting sustainable non-bank financing models that do not pose such risks. The approach is designed to be proportionate to financial stability risks, focusing on those activities that are material to the system, using as a starting point those that were a source of problems during the crisis. It also provides a process for monitoring the shadow banking system so that any rapidly growing new activities that pose bank-like risks can be identified early and, where needed, those risks addressed. At the same time, given the interconnectedness of markets and the strong adaptive capacity of the shadow banking system, the FSB believes that proposals in this area necessarily have to be comprehensive. _____________ The FSB has been established to coordinate at the international level the work of national financial authorities and international standard setting bodies and to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies in the interest of financial stability. It brings together national authorities responsible for financial stability in 24 countries and jurisdictions, international financial institutions, sector-specific international groupings of regulators and supervisors, and committees of central bank experts. The FSB is chaired by Mark Carney, Governor of the Bank of Canada. Its Secretariat is located in Basel, Switzerland, and hosted by the Bank for International Settlements. For further information on the FSB, visit the FSB website, www.financialstabilityboard.org.

3/3

You might also like

- Business Innovation ObservatoryDocument20 pagesBusiness Innovation ObservatoryGill Wallace HopeNo ratings yet

- TRA To Sue Gulf News For $5.4bnDocument7 pagesTRA To Sue Gulf News For $5.4bnGill Wallace HopeNo ratings yet

- $5.4bn Social Projects For UAEDocument2 pages$5.4bn Social Projects For UAEGill Wallace Hope100% (1)

- Jordan Refugees Media Tour May 2013Document4 pagesJordan Refugees Media Tour May 2013Gill Wallace HopeNo ratings yet

- How Much Money Should Moms Be PaidDocument26 pagesHow Much Money Should Moms Be PaidGill Wallace HopeNo ratings yet

- Queen of Green IPO - UPDATE 19th November 2013Document3 pagesQueen of Green IPO - UPDATE 19th November 2013Gill Wallace HopeNo ratings yet

- Obama Foreign Policy Jan 2013Document5 pagesObama Foreign Policy Jan 2013Gill Wallace HopeNo ratings yet

- PWC Ifrs by Country Apr 2012 PDFDocument280 pagesPWC Ifrs by Country Apr 2012 PDFPrayoga CahayandaNo ratings yet

- Ending The Crisis 25th Jan 2013Document2 pagesEnding The Crisis 25th Jan 2013Gill Wallace HopeNo ratings yet

- Prayers To Settle Debts - Arabic and EnglishDocument2 pagesPrayers To Settle Debts - Arabic and EnglishGill Wallace HopeNo ratings yet

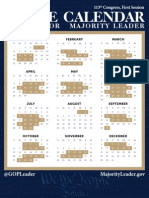

- House Calendar: 113th Congress, First SessionDocument1 pageHouse Calendar: 113th Congress, First Sessionrobertharding22No ratings yet

- Gill Wallace Hope Linkedin Profile Dec 2012Document17 pagesGill Wallace Hope Linkedin Profile Dec 2012Gill Wallace HopeNo ratings yet

- Financial Stability Board - MENA - Regional Consultative GroupDocument2 pagesFinancial Stability Board - MENA - Regional Consultative GroupGill Wallace HopeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DownloadDocument4 pagesDownloadJames CarterNo ratings yet

- All About Cash: Name: Section: Score: ProblemsDocument7 pagesAll About Cash: Name: Section: Score: ProblemsAira Mae Hernandez CabaNo ratings yet

- Income Taxation QuizzerDocument41 pagesIncome Taxation QuizzerMarriz Tan100% (4)

- The History of Paper Money in China (Pp. 136-142) John PickeringDocument8 pagesThe History of Paper Money in China (Pp. 136-142) John Pickeringzloty941No ratings yet

- Ken Fisher InterviewDocument9 pagesKen Fisher Interviewkirit0No ratings yet

- Remuneration Bill Form FormatDocument2 pagesRemuneration Bill Form FormatmanishdgNo ratings yet

- Bank Statement GeneratorDocument1 pageBank Statement GeneratorLeslie AtehNo ratings yet

- Unit - 2 BOPDocument2 pagesUnit - 2 BOPRavi SistaNo ratings yet

- HJR.192 5th - June.1933 PDFDocument4 pagesHJR.192 5th - June.1933 PDFStar GazonNo ratings yet

- Employer Contributions Payment Form R-5: Social Security SystemDocument2 pagesEmployer Contributions Payment Form R-5: Social Security SystemUncle Cheffy - MalateNo ratings yet

- Marketing of Banking ServicesDocument97 pagesMarketing of Banking ServicesAvtaar Singh100% (1)

- Broker Account Opening Form IndividualDocument27 pagesBroker Account Opening Form IndividualAbdul QayoomNo ratings yet

- ASE20091 June 2021 Question PaperDocument20 pagesASE20091 June 2021 Question PaperMusthari KhanNo ratings yet

- Redemption Manual 4 5 EditionDocument682 pagesRedemption Manual 4 5 Editionrjwall98% (193)

- C243340 SalarySlipIncludeDocument1 pageC243340 SalarySlipIncludebenq78786No ratings yet

- Iflas and Chapter 11 Classical Islamic Law and Modern BankruptcyDocument27 pagesIflas and Chapter 11 Classical Islamic Law and Modern BankruptcyManfadawi FadawiNo ratings yet

- Assignment DMBA104 MBA 1 Set-1 and 2 Jan-Feb 2023Document6 pagesAssignment DMBA104 MBA 1 Set-1 and 2 Jan-Feb 2023Nihar KambleNo ratings yet

- RCBC 112-6 Dec 31, 2015Document40 pagesRCBC 112-6 Dec 31, 2015Renniel DimalantaNo ratings yet

- Guia 14 AccountingDocument7 pagesGuia 14 AccountingCarolina Mesa TarazonaNo ratings yet

- TVM Practice Questions Fall 2018Document4 pagesTVM Practice Questions Fall 2018ZarakKhanNo ratings yet

- Issues and Problems of Islamic BankingDocument14 pagesIssues and Problems of Islamic Bankingziadiqbal19100% (9)

- Ch7 Problems SolutionDocument22 pagesCh7 Problems Solutionwong100% (8)

- MODAUD1 UNIT 6 - Audit of InvestmentsDocument7 pagesMODAUD1 UNIT 6 - Audit of InvestmentsJake BundokNo ratings yet

- Program btc2bDocument2 pagesProgram btc2bbtc2b2No ratings yet

- What Is Basel IIIDocument3 pagesWhat Is Basel IIIshaharyarkhan100% (1)

- End of Chapter Problems 3-1 (Cash Count)Document3 pagesEnd of Chapter Problems 3-1 (Cash Count)Exzyl Vixien Iexsha LoxinthNo ratings yet

- Dornbusch 6e Chapter12Document19 pagesDornbusch 6e Chapter12kushalNo ratings yet

- Day Trading Money ManagementDocument8 pagesDay Trading Money ManagementJoe PonziNo ratings yet

- Coupon Letter Template PDFDocument2 pagesCoupon Letter Template PDFJusta88% (26)

- Inflation in Pakistan Economics ReportDocument15 pagesInflation in Pakistan Economics ReportQanitaZakir75% (16)