Professional Documents

Culture Documents

All About Cash: Name: Section: Score: Problems

Uploaded by

Aira Mae Hernandez CabaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

All About Cash: Name: Section: Score: Problems

Uploaded by

Aira Mae Hernandez CabaCopyright:

Available Formats

All about Cash 2019

Name:

Section:

Score:

SOLUTION:

Problems

Book balance 17,194 Bank Balance 31,948

1. The following data pertaining to the cash transactions and bank account of Add: Add:

Mandirigma Company for the month of May are available to you: Proceeds of a bank loan 5,700 Deposit in transit 4,880

Proceeds from a customer note 8,100 Stolen check 800

Cash balance, per records, May 31 P17,194 Less: Less:

Cash balance, per bank statement, 5/31 31,948 Bank service charge 109 Outstanding checks 6,728

Bank service charge for May 109 Debit memo 125 Bank error (Check No. 2772) 900

Debit memo for the cost of printed checks NSF check 760

delivered by the bank 125

Adjusted balance 30,000 Adjusted balance 30,000

Outstanding checks, May 31 6,728

Deposit of May 30 not recorded by bank

until June 1 4,880

Proceeds of a bank loan of May 30, net of

interest of P300 5,700

Proceeds from a customer's promissory

note, including interest of P100 8,100

Check No. 2772 issued to a supplier

entered in the accounting records at

P2,100 but deducted in the bank

statement at an erroneous amount of 1,200

Stolen check lacking an authorized

signature, deducted from Mandirigma's

account by the bank in error 800

Customer's check returned by the bank

marked NSF; no entry has been made

in the accounting records to record the

returned check 760

What is the correct cash balance at May 31? P30,000

FEU – IABF Page 1

All about Cash 2019

2. The following data pertain to Lincoln Corporation on December 31, 2019: 3. Shine Company reported an imprest petty cash fund of P50,000 with the following

details:

Current account at Metrobank P1,800,000 Currencies 20,000

Current account at Allied Bank (100,000)

Payroll account 500,000 Coins 2,000

Foreign bank account (in equivalent pesos) 800,000 Petty cash vouchers:

Savings deposit in a closed bank 150,000

Gasoline payments 3,000

Postage stamps 1,000

Employee’s post dated check 4,000 Medical supplies 1,000

IOU from employees 10,000 Repairs of office equipment 1,500

Credit memo from a vendor for a purchase return 20,000

Loans to employees 3,500

Traveler’s check 50,000

Money order 30,000 A check drawn by the entity payable to the order

Petty cash fund (P4,000 in currency and expense receipts for of Juan de la Cruz, petty cash custodian,

P6,000) 10,000

Pension fund 2,000,000 representing replenishment 15,000

DAIF check of customer 15,000 An employee check returned by the bank for

Customer’s check dated 1/1/20 80,000

insufficiency of fund 3,000

Time deposit – 30 days 200,000

Money market placement (due 6/30/20) 500,000 A sheet of paper with names of several employees

Treasury bills, due 4/31/20 (purchased 12/31/19) 200,000 together with contribution for a birthday gift of

Treasury bills, due 1/31/20 (purchased 2/1/19) 300,000

a co-employee. Attached to the sheet of paper is

The cash and cash equivalents as of December 31, 2019 is P3,384,000 a currency of 5,000

What amount of petty cash fund should be reported in the statement of financial

position? P37,000

FEU – IABF Page 2

All about Cash 2019

4. The information below is from the books of the Seminole Corporation on June 30: Book balance 1,405,000

Balance per bank statement P11,164 Add: Deposit in transit 750,000

Receipts recorded but not yet deposited Collection of note 2,500,000

in the bank 1,340 Interest on note 150,000 3,400,000

Bank charges not recorded 16 Total 4,805,000

Note collected by bank and not Less: Carefree Company deposited credited

recorded on books 1,120

to our account 1,100,000

Outstanding checks 1,100

NSF checks - not recorded on books nor

redeposited 160 Bank service charge 45,000 1,145,000

Adjusted book balance 3,660,000

Assuming no errors were made, compute the cash balance per books on June 30

before any reconciliation adjustments. P10,460 Bank balance 5,630,000

Add: Error by depositor on recording check 45,000

SOLUTION: Total 5,675,000

Bank balance 11,164 Book balance 10,460 Less: Preauthorized payments for water

Add: Add: bills 205,000

Deposit in transit 1,340 Note collected by bank 1,120 NSF customer check 220,000

Less: Less: Outstanding checks 1,650,000 2,075,000

Outstanding checks 1,100 Bank service charge 16 3,600,000

NSF checks 160

Adjusted balance 11,404 Adjusted balance 11,404 The check erroneously recorded by the depositor was made for the proper amount of

P249,000 in payment of account. However, it was entered in the cash payments journal as

P294,000.

SOLUTION:

Book balance 1,405,000 Bank balance 5,630,000 The entity authorized the bank to automatically pay its water bills as submitted directly to

Add: Add: the bank.

Collection of note 2,500,000 Deposit in transit 750,000

Interest on note 150,000

What amount should be reported as cash in bank on March 31? P3,630,000

Error by depositor 45,000

Less: Less:

Bank service charge 45,000 Error in credit to our account 1,100,000

Preauthorized payments 205,000 Outstanding checks 1,650,000

NSF check 220,000

Adjusted balance 3,630,000 Adjusted balance 3,630,000

5. Careless Company prepared the following bank reconciliation on March 31:

FEU – IABF Page 3

All about Cash 2019

Use the following information for the next two questions.

In preparing the bank reconciliation for the month of December, Case Company provided

Divine Company prepared the following bank reconciliation on December 31: the following data:

Balance per bank statement 3,800,000

Balance per bank statement 2,800,000 Deposit in transit 520,000

Add: Deposit in transit 195,000 Amount erroneously credited by bank to Case's

Checkbook printing charge 5,000 account 40,000

Error made by Divine in recording Bank service charge for December 5,000

check issued in December 35,000 NSF check 50,000

NSF check 110,000 345,000 Outstanding checks 675,000

Total 3,145,000

Less: Outstanding check 100,000 8. What is the adjusted cash in bank? P3,605,000

Note collected by bank including

P15,000 interest 215,000 315,000 9. What is the unadjusted cash in bank balance per book? P3,660,000

Balance per book 2,830,000

SOLUTION:

Book balance 3,660,000 Bank balance 3,800,000

The entity had cash on hand P500,000 and petty cash fund P50,000 on December 31.

Less: Add:

Bank service charge 5,000 Deposit in transit 520,000

6. What amount should be reported as cash in bank at year-end? P2,895,000

NSF check 50,000 Less:

Error in credit to our account 40,000

7. What total amount of cash should be reported at year-end? P3,445,000

Outstanding checks 675,000

SOLUTION: Adjusted balance 3,605,000 Adjusted balance 3,605,000

Book balance 2,830,000 Bank balance 2,800,000

Add: Add:

Collection of note 215,000 Deposit in transit 195,000

Less: Less:

Checkbook printing charge 5,000 Error in credit to our account

Error by Divine 35,000 Outstanding checks 100,000

NSF check 110,000

Adjusted balance 2,895,000 Adjusted balance 2,895,000

Cash in bank 2,895,000

Cash on hand 500,000

Petty cash fund 50,000

Total cash 3,445,000

Use the following information for the next two questions.

FEU – IABF Page 4

All about Cash 2019

Earth Company provided the following data for the purpose of reconciling the cash balance

per book with the balance per bank statement on December 31: Use the following information for the next three questions.

Balance per book 850,000

Balance per bank statement 2,000,000 Palawan Company kept all cash in a checking account. An examination of the bank

Outstanding checks, including certified check of P100,000 500,000 statement for the month of December revealed a bank statement balance of P8,470,000.

Deposit in transit 200,000

December NSF checks (of which P50,000 had been A deposit of P950,000 placed in the bank’s night depository on December 29 does not

redeposited and cleared on December 27) 150,000 appear on the bank statement. Checks outstanding on December 31 amount to P270,000.

Erroneous credit to Earth Company's account,

representing The bank statement showed that on December 25 the bank collected a note for Palawan

proceeds of loan granted to another company 300,000 Company and credited the proceeds of P935,000 to the entity’s account which included

Proceeds of note collected by bank for Earth, net of service P35,000 interest.

charge of P20,000 750,000

Palawan Company discovered that a check written in December for P183,000 in payment

of an account had been recorded as P138,000.

10. What amount should be reported as cash in bank at year-end? P1,500,000

Included with the December 31 bank statement was an NSF check for P250,000 that

SOLUTION:

Palawan Company had received from a customer on December 20.

Book balance 850,000 Bank balance 2,000,000

Add: Add:

The bank statement showed a P15,000 service charge for December.

Collection of note 750,000 Deposit in transit 200,000

Less: Less: 11. What is the adjusted cash in bank on December 31? P9,150,000

NSF check 100,000 Error in credit to our account 300,000 12. What is the unadjusted balance per book on December 31? P8,525,000

Outstanding checks 400,000 13. Provide the adjusting entry for the NSF check.

A/R 250,000

Adjusted balance 1,500,000 Adjusted balance 1,500,000 Cash 250,000

SOLUTION:

Book balance 8,525,000 Bank balance 8,470,000

Add: Add:

Collection of note 935,000 Deposit in transit 950,000

Less: Less:

Bank service charge 15,000 Outstanding checks 270,000

Error in recording 45,000

NSF check 250,000

Adjusted balance 9,150,000 Adjusted balance 9,150,000

FEU – IABF Page 5

All about Cash 2019

THEORIES a. Savings account balances.

b. Margin accounts held with brokers.

c. Temporary investments serving as collateral for outstanding loans.

27. Which of the following is not considered cash for financial reporting purposes?

d. Minimum deposits required to be maintained in connection with a

a. Petty cash funds and change funds

borrowing arrangement.

b. Money orders, certified checks, and personal checks

35. Under which section of the statement of financial position is "cash restricted for

c. Coin, currency, and available funds

plant expansion" reported?

d. Postdated checks and I.O.U.'s

a. Current assets.

28. Which of the following is considered cash?

b. Non-current assets.

a. Certificates of deposit (CDs)

c. Current liabilities.

b. Money orders

d. Equity.

c. Money market savings certificates

36. A cash equivalent is a short-term, highly liquid investment that is readily

d. Postdated checks

convertible into known amounts of cash and

29. Travel advances should be reported as

a. is acceptable as a means to pay current liabilities.

a. supplies.

b. has a current market value that is greater than its original cost

b. cash because they represent the equivalent of money.

c. bears an interest rate that is at least equal to the prime rate of interest at

c. investments.

the date of liquidation.

d. none of these.

d. is so near its maturity that it presents insignificant risk of changes in

30. Which of the following items should not be included in the Cash caption on the

interest rates.

statement of financial position

37. Bank overdrafts generally should be

a. Coins and currency in the cash register

a. reported as a deduction from the current asset section.

b. Checks from other parties presently in the cash register

b. reported as a deduction from cash.

c. Amounts on deposit in checking account at the bank

c. netted against cash and a net cash amount reported.

d. Postage stamps on hand

d. reported as a current liability.

31. All of the following may be included under the heading of "cash" except

38. Deposits held as compensating balances

a. currency.

a. usually do not earn interest.

b. money market funds.

b. if legally restricted and held against short-term credit may be included as

c. checking account balance.

cash.

d. savings account balance.

c. if legally restricted and held against long-term credit may be included

32. In which account are post-dated checks received classified?

among current assets.

a. Receivables.

d. none of these.

b. Prepaid expenses.

39. Which of the following is an appropriate reconciling item to the balance per bank in

c. Cash.

a bank reconciliation?

d. Payables.

a. Bank service charge.

33. In which account are postage stamps classified?

b. Deposit in transit.

a. Cash.

c. Bank interest.

b. Office supplies.

d. Chargeback for NSF check.

c. Receivables.

d. Inventory.

40. Which of the following is not true?

34. What is a compensating balance?

FEU – IABF Page 6

All about Cash 2019

a. The imprest petty cash system in effect adheres to the rule of a. Checks cleared during the period

disbursement by check. b. NSF checks

b. Entries are made to the Petty Cash account only to increase or decrease c. Bank charges for the period

the size of the fund or to adjust the balance if not replenished at year-end. d. Errors made by the depositor

c. The Petty Cash account is debited when the fund is replenished. 48. Whichstatement in relation to a certified check is false?

d. All of these are not true. a. A certified check is a liability of the bank certifying it

41. A Cash Over and Short account b. A certified check will be accepted by many persons who would not

a. is not generally accepted. otherwise accept a personal check

b. is debited when the petty cash fund proves out over. c. A certified check is one drawn by a bank upon itself

c. is debited when the petty cash fund proves out short. d. A certified check should not be included in the outstanding checks

d. is a contra account to Cash.

42. The journal entries for a bank reconciliation 49. Which statement in relation to bank reconciliation is true?

a. are taken from the "balance per bank" section only. a. Bank service charge will cause the cash balance per ledger to be higher

b. may include a debit to Office Expense for bank service charges. than that reported by the bank, all other things being equal

c. may include a credit to Accounts Receivable for an NSF check. b. Credit memos will cause the cash balance per ledger to be higher than that

d. may include a debit to Accounts Payable for an NSF check. reported by the bank, all other things being equal.

43. When preparing a bank reconciliation, bank credits are c. Outstanding checks will cause the cash balance per ledger to be greater

a. added to the bank statement balance. than the balance reported by the bank, all other things being equal.

b. deducted from the bank statement balance. d. The cash amount reported in the statement of financial position must be

c. added to the balance per books. the balance reported in the bank statement.

d. deducted from the balance per books. 50. Which of the following must be deducted from the bank statement balance in

44. If the balance shown in the bank statement is less than the correct cash balance preparing a bank reconciliation which ends with adjusted cash balance?

and neither the entity nor the bank has made any errors, there must be a. Deposit in transit

a. Deposits credited by the bank but not yet recorded by the entity b. Outstanding check

b. Outstanding checks c. Reduction of loan charged to the account of the depositor

c. Deposit in transit d. Certified check

d. Bank charges not yet recorded by the entity

45. If the cash balance shown in the accounting records is less than the correct cash

balance and neither the entity nor the bank has made any errors, there must be

a. Deposits credited by the bank but not yet recorded by the entity

b. Deposits in transit

c. Outstanding checks

d. Bank charges not yet recorded by the entity

46. Bank reconciliations are normally prepared on a monthly basis to identify

adjustments needed in the depositor’s records and to identify bank errors.

Adjustments on the part of the depositor should be recorded for

a. Bank errors, outstanding checks and deposits in transit

b. All items except bank errors, outstanding checks and deposits in transit

c. Book errors, bank errors, deposits in transit and outstanding checks

d. Outstanding checks and deposits and transit

47. Bank statements provide information about all of the following, except

FEU – IABF Page 7

You might also like

- Cash Shortage Computation: SolutionDocument4 pagesCash Shortage Computation: SolutionCJ alandyNo ratings yet

- Operation - Manual Cubase 5Document641 pagesOperation - Manual Cubase 5Samiam66682% (17)

- Bank Recon Solutions Exercise 2 3Document7 pagesBank Recon Solutions Exercise 2 3Kevin James Sedurifa OledanNo ratings yet

- RAD ETX-204A Carrier Ethernet Demarcation Device Data SheetDocument8 pagesRAD ETX-204A Carrier Ethernet Demarcation Device Data SheetjalopiimaeNo ratings yet

- Intermediate Accounting 1 - Cash and Cash EquivalentsDocument14 pagesIntermediate Accounting 1 - Cash and Cash EquivalentsKristine Jewel MirandaNo ratings yet

- AP - Quiz 01 (UCP)Document8 pagesAP - Quiz 01 (UCP)CrestinaNo ratings yet

- SM 6Document116 pagesSM 6陳偉泓No ratings yet

- CHAPTER 15 17 InvestmentsDocument38 pagesCHAPTER 15 17 InvestmentsJinkyNo ratings yet

- Questionnaire IntactDocument10 pagesQuestionnaire Intact?????No ratings yet

- Chapter 16 Multiple ChoicesDocument6 pagesChapter 16 Multiple ChoicesMary DenizeNo ratings yet

- SolutionDocument5 pagesSolutionClariz Angelika EscocioNo ratings yet

- Oct 4 - LectureDocument4 pagesOct 4 - LectureCarl Dhaniel Garcia SalenNo ratings yet

- Chapter 5 Cost Pedro Guerrero Solman Chapter 5 Cost Pedro Guerrero SolmanDocument16 pagesChapter 5 Cost Pedro Guerrero Solman Chapter 5 Cost Pedro Guerrero Solmanhakdog kalahati sunogNo ratings yet

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- 03 Cash and Cash Equivalents (Student)Document27 pages03 Cash and Cash Equivalents (Student)Christina Dulay50% (2)

- AUD Bank ReconciliationDocument8 pagesAUD Bank ReconciliationShaine PacsonNo ratings yet

- Audit of Cash and Cash Equivalents 1Document18 pagesAudit of Cash and Cash Equivalents 1nena cabañesNo ratings yet

- Fisher Separation TheoremDocument31 pagesFisher Separation TheoremArdi Gunardi0% (3)

- Aud Prob Prelim Exam With AnswersDocument11 pagesAud Prob Prelim Exam With AnswersannyeongchinguNo ratings yet

- Exercise Bank ReconDocument9 pagesExercise Bank ReconDeviline MichelleNo ratings yet

- 06 Process CostingDocument16 pages06 Process CostingChristian Blanza LlevaNo ratings yet

- Chapter 1Document46 pagesChapter 1J Camille Mangundaya Lacsamana77% (30)

- Marketing PlanDocument12 pagesMarketing PlanAira Mae Hernandez CabaNo ratings yet

- AUDP DIS02 Receivables Key-AnswersDocument7 pagesAUDP DIS02 Receivables Key-AnswersKristina KittyNo ratings yet

- Variable Costing and Absorption CostingDocument15 pagesVariable Costing and Absorption CostingRomilCledoro100% (1)

- Management Advisory Services PDFDocument50 pagesManagement Advisory Services PDFDea Lyn Bacula100% (6)

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- IT2840D 3640D Copier Operation ManualDocument516 pagesIT2840D 3640D Copier Operation ManualChristopher CollinsNo ratings yet

- Chapter 2 EditedDocument23 pagesChapter 2 EditedttttNo ratings yet

- Shipping Wood To MarketDocument4 pagesShipping Wood To MarketAira Mae Hernandez CabaNo ratings yet

- Quiz VIII - ARDocument3 pagesQuiz VIII - ARBLACKPINKLisaRoseJisooJennieNo ratings yet

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- Corumbrillo Far q1q2Document7 pagesCorumbrillo Far q1q2Leane MarcoletaNo ratings yet

- Ac20 Quiz 3 - DGCDocument10 pagesAc20 Quiz 3 - DGCMaricar PinedaNo ratings yet

- IA1 - 1st Mock Quiz (With Suggested Answers)Document6 pagesIA1 - 1st Mock Quiz (With Suggested Answers)Rogienel ReyesNo ratings yet

- ACT1104 Assignment 4Document5 pagesACT1104 Assignment 4cjorillosa2004No ratings yet

- Financial Accounting Review Problem 1Document16 pagesFinancial Accounting Review Problem 1YukiNo ratings yet

- 33Document2 pages33yes yesnoNo ratings yet

- Inventory Sample Exercise - 2Document8 pagesInventory Sample Exercise - 2jangjangNo ratings yet

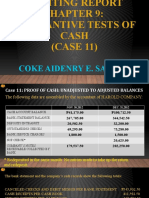

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Cash and Cash EquivalentDocument8 pagesCash and Cash EquivalentApril ManaloNo ratings yet

- Inventories&Inventoryestimation GAPASINAODocument25 pagesInventories&Inventoryestimation GAPASINAOGerly GapasinaoNo ratings yet

- P. Lete ProblemsDocument6 pagesP. Lete ProblemsPaul Andrei Lete33% (9)

- Cash QuizDocument6 pagesCash QuizGwen Cabarse PansoyNo ratings yet

- AIS - Chap 5 Questions (Midterms)Document3 pagesAIS - Chap 5 Questions (Midterms)natalie clyde matesNo ratings yet

- Dysas Center For Cpa Review (Dccpar) : Financial AccountingDocument4 pagesDysas Center For Cpa Review (Dccpar) : Financial AccountingRobi Biadnes InesNo ratings yet

- Quiz 3 Problem SolvingDocument7 pagesQuiz 3 Problem SolvingChristine Joyce BascoNo ratings yet

- MIDTERM EXAM SpecTransDocument7 pagesMIDTERM EXAM SpecTransEidel PantaleonNo ratings yet

- Chapter 13-Cash ControlDocument25 pagesChapter 13-Cash ControlShaila MarceloNo ratings yet

- ANS KEY - QUIZ ON RECEIVABLE FINANCING 12 OctDocument4 pagesANS KEY - QUIZ ON RECEIVABLE FINANCING 12 OctAzzariah DeniseNo ratings yet

- Cash-And-Cash-Equivalent - Answers On HandoutDocument6 pagesCash-And-Cash-Equivalent - Answers On HandoutElaine AntonioNo ratings yet

- MasDocument12 pagesMasKenneth RobledoNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- Review - Practical Accounting 1Document2 pagesReview - Practical Accounting 1Kath LeynesNo ratings yet

- Conceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMDocument4 pagesConceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMJanesene SolNo ratings yet

- Cost Accounting ProblemsDocument3 pagesCost Accounting ProblemsRowena TamboongNo ratings yet

- Audit Problem Inventories AnswerDocument6 pagesAudit Problem Inventories AnswerJames PaulNo ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- Chapter08 Inventory Cost Other Basis Student Copy LectureDocument9 pagesChapter08 Inventory Cost Other Basis Student Copy LectureAngelo Christian B. OreñadaNo ratings yet

- Basic Concepts Revenue Cycle: List Price, Trade Discount, Prepaid Freight, Cash DiscountDocument50 pagesBasic Concepts Revenue Cycle: List Price, Trade Discount, Prepaid Freight, Cash DiscountJean MaeNo ratings yet

- Assignment No. 2 (Solution)Document5 pagesAssignment No. 2 (Solution)Christine MalayoNo ratings yet

- Chapter 4 Caselette Audit of ReceivablesDocument37 pagesChapter 4 Caselette Audit of ReceivablesXXXXXXXXXXXXXXXXXXNo ratings yet

- Bank Reconciliation EditedDocument1 pageBank Reconciliation EditedNors PataytayNo ratings yet

- Statement of Comprehensive Income Part 2Document8 pagesStatement of Comprehensive Income Part 2AG VenturesNo ratings yet

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDocument10 pagesP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- Consideration of Internal Control in A Financial Statements AuditDocument9 pagesConsideration of Internal Control in A Financial Statements AuditJan Danielle AgaloNo ratings yet

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- Practical Accounting 2.2Document14 pagesPractical Accounting 2.2Jao FloresNo ratings yet

- Cash and Cash Equivalent Tutorial PDFDocument3 pagesCash and Cash Equivalent Tutorial PDFClara San MiguelNo ratings yet

- Research 1.sellingandsalesmanshipDocument1 pageResearch 1.sellingandsalesmanshipAira Mae Hernandez CabaNo ratings yet

- An Overview of AdvertisingDocument15 pagesAn Overview of AdvertisingAira Mae Hernandez CabaNo ratings yet

- Employment-Related Letters: Well-Displayed, Easy-To-ReadDocument4 pagesEmployment-Related Letters: Well-Displayed, Easy-To-ReadAira Mae Hernandez CabaNo ratings yet

- Feasibility Entrep Siete Pecados FinalDocument28 pagesFeasibility Entrep Siete Pecados FinalAira Mae Hernandez CabaNo ratings yet

- 2.+Provisions+and+Contingent+Liabilities Student PDFDocument4 pages2.+Provisions+and+Contingent+Liabilities Student PDFAira Mae Hernandez CabaNo ratings yet

- Marketing Plan Heaven's Touch SpaDocument22 pagesMarketing Plan Heaven's Touch SpaAira Mae Hernandez CabaNo ratings yet

- The Problem and Its SettingDocument156 pagesThe Problem and Its SettingAira Mae Hernandez CabaNo ratings yet

- 2.+Provisions+and+Contingent+Liabilities Student PDFDocument4 pages2.+Provisions+and+Contingent+Liabilities Student PDFAira Mae Hernandez CabaNo ratings yet

- Financial AnalysisDocument3 pagesFinancial AnalysisAira Mae Hernandez CabaNo ratings yet

- Client Proposal Letter SampleDocument2 pagesClient Proposal Letter SampleBushra HaroonNo ratings yet

- Factors That Satisfy Customers: Heavens Touch SpaDocument53 pagesFactors That Satisfy Customers: Heavens Touch SpaAira Mae Hernandez CabaNo ratings yet

- Nueva Ecija University of Science and Technology Papaya Off-Campus Program General Tinio, Nueva EcijaDocument61 pagesNueva Ecija University of Science and Technology Papaya Off-Campus Program General Tinio, Nueva EcijaAira Mae Hernandez CabaNo ratings yet

- Law 2 Test BanksDocument39 pagesLaw 2 Test BanksAira Mae Hernandez CabaNo ratings yet

- Price ListDocument8 pagesPrice ListAira Mae Hernandez CabaNo ratings yet

- Profit & GambitDocument1 pageProfit & GambitRahul PathrabeNo ratings yet

- Common Ideology Examples: Political IdeologiesDocument5 pagesCommon Ideology Examples: Political IdeologiesAira Mae Hernandez CabaNo ratings yet

- ART.1156-an Obligation Is A Juridical Necessity To Give, To Do orDocument1 pageART.1156-an Obligation Is A Juridical Necessity To Give, To Do orAira Mae Hernandez CabaNo ratings yet

- 6 Elements of StyleDocument5 pages6 Elements of StyleAira Mae Hernandez CabaNo ratings yet

- Annoying Things About E-Mail: Business DocumentsDocument1 pageAnnoying Things About E-Mail: Business DocumentsAira Mae Hernandez CabaNo ratings yet

- SLK 1 Grade 8 DaisyDocument15 pagesSLK 1 Grade 8 DaisyAira Mae Hernandez CabaNo ratings yet

- CHAPTER 4 Product and Service Costing: Overhead Application and Job-Order SystemDocument28 pagesCHAPTER 4 Product and Service Costing: Overhead Application and Job-Order SystemMudassar Hassan100% (1)

- Questionnaire CABADocument1 pageQuestionnaire CABAAira Mae Hernandez CabaNo ratings yet

- Cash and ReceivablesDocument30 pagesCash and ReceivablesAira Mae Hernandez CabaNo ratings yet

- Law 2 Test BanksDocument39 pagesLaw 2 Test BanksAira Mae Hernandez CabaNo ratings yet

- Office of The Sangguniang Panlalawigan: Hon. Francisco Emmanuel "Pacoy" R. Ortega IiiDocument5 pagesOffice of The Sangguniang Panlalawigan: Hon. Francisco Emmanuel "Pacoy" R. Ortega IiiJane Tadina FloresNo ratings yet

- Xanh Dương Và Trắng Đơn Giản Khởi Nghiệp Kinh Doanh Bản Thuyết Trình ĐộngDocument18 pagesXanh Dương Và Trắng Đơn Giản Khởi Nghiệp Kinh Doanh Bản Thuyết Trình Độngmai nguyễnNo ratings yet

- User Access Guide PDFDocument3 pagesUser Access Guide PDFbaldo yellow4No ratings yet

- Fridge Zanussi ZK2411VT5 ManualDocument14 pagesFridge Zanussi ZK2411VT5 ManualDragos MoscuNo ratings yet

- ADM2341 CH 8 Capstone QDocument2 pagesADM2341 CH 8 Capstone QjuiceNo ratings yet

- Ips M PM 330Document25 pagesIps M PM 330Deborah MalanumNo ratings yet

- Reviewer MathDocument261 pagesReviewer MathMac Jayson DiazNo ratings yet

- SL 70953 Liebert Gxt5 Lithium Ion 1 3kva I 230v Ups User GuideDocument70 pagesSL 70953 Liebert Gxt5 Lithium Ion 1 3kva I 230v Ups User Guidepetermaroko69No ratings yet

- 1Document6 pages1Vignesh VickyNo ratings yet

- PMP Cheat SheetDocument9 pagesPMP Cheat SheetzepededudaNo ratings yet

- Yrc1000 Options InstructionsDocument36 pagesYrc1000 Options Instructionshanh nguyenNo ratings yet

- List of Circulating Currencies by CountryDocument8 pagesList of Circulating Currencies by CountryVivek SinghNo ratings yet

- Verilog Code For Traffic Light Control Using FSMDocument7 pagesVerilog Code For Traffic Light Control Using FSMEr Pradip PatelNo ratings yet

- DZF 6050Document13 pagesDZF 6050Kevin José SánchezNo ratings yet

- Legend Sheet P&ID For As-Built - Drafting On 20210722-5Document1 pageLegend Sheet P&ID For As-Built - Drafting On 20210722-5Ludi D. LunarNo ratings yet

- SEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Document5 pagesSEBI Circular On Online Processing of Investor Service Requests and Complaints by RTAs - June 8, 2023Diya PandeNo ratings yet

- Mil DTL 11891g EngDocument96 pagesMil DTL 11891g EngJohn DrakosNo ratings yet

- Volkswagen Passat R Line Price ListDocument2 pagesVolkswagen Passat R Line Price ListDr Uvarani Sp Care Rawang TinNo ratings yet

- LT32567 PDFDocument4 pagesLT32567 PDFNikolayNo ratings yet

- List of Medical Institutions Available For Foreign Language(s)Document24 pagesList of Medical Institutions Available For Foreign Language(s)leithNo ratings yet

- January 2017Document80 pagesJanuary 2017Alexandre AGNo ratings yet

- Sendik's Oconomowoc Press AnnouncementDocument2 pagesSendik's Oconomowoc Press AnnouncementTMJ4 NewsNo ratings yet

- TechRef SoftstarterDocument11 pagesTechRef SoftstarterCesarNo ratings yet

- Studienplan Medical Engineering and Ehealth PDFDocument1 pageStudienplan Medical Engineering and Ehealth PDFluismendoza1No ratings yet

- Skott Marsi Art Basel Sponsorship DeckDocument11 pagesSkott Marsi Art Basel Sponsorship DeckANTHONY JACQUETTENo ratings yet