Professional Documents

Culture Documents

AUD Bank Reconciliation

Uploaded by

Shaine PacsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AUD Bank Reconciliation

Uploaded by

Shaine PacsonCopyright:

Available Formats

Rhandrae Tolentino

BSA 3-A

4. The following data are available for the cash in bank of Ellen Company for February of the current year:

a. Deposit made by the company this February, 120,000.

b. Deposit in Transit, January 31, 200,000.

c. Customer’s check representing receipts in January amounting to 21,000 was erroneously recorded

by the company as 12,000.

d. Check of the company in January amounting to 2,000 was erroneously recorded by the company as

20,000.

e. Deposit acknowledged by the bank in February, 150,000.

f. Erroneous bank charge in January, 13,000.

g. Erroneous bank credit in February, 14,000.

h. Customer’s note collected, January 31, 10,000.

i. Customer’s note collected, February 28, 12,000.

Required:

a. Deposit in Transit in February 28.

Deposit in transit, Jan. 31 200,000

Add: Deposit made by the company February 120,000

Total 320,000

Less: Deposit acknowledged by the bank this month 150,000

Deposit in Transit, Feb. 28 170,000

b. Unadjusted book receipts in February.

The following are the adjusting entries to be recorded in the company’s books. Note that only book

reconciling items are recorded.

Deposit made by the company - February 120,000

Add: Credit memo in January 31 - Customer's notes collected 10,000

Errors in January corrected in February's book receipt:

Understatement of cash receipts in January for Customer's check (P21,000- P12,000) 9,000

Overstatement of cash disbursements in January for customer's check (P20,000-P2,000) 18,000

Total unadjusted book receipt 157,000

c. Unadjusted bank receipts in February.

Deposit acknowledged by the bank - February 150,000

Add: Credit memo in February (customer's notes collected) 12,000

Errors in January corrected in February's bank receipt:

Overstatement of cash disbursements in January (erroneous bank charge January) 13,000

Errors in February affecting bank receipts:

Overstatement of cash receipt in February (erroneous bank credit February) 14,000

Total unadjusted bank receipts 189,000

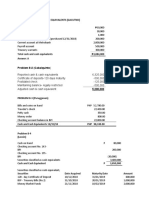

5. In your audit of the cash account of Ann Company, you have ascertained the following data relative to the

debits per books and credit per bank:

Book debits in February 380,000

Bank credits in February 310,000

Interest earned on the deposits in January but taken up in the books in February 5,000

Interest earned on the deposits in February but taken up in the books in March, 6,000

Collection by the bank for the account of the depositor (this amount was collected

by the bank in January but was taken up in the books of the depositor in February 15,000

Loan granted by the bank to the depositor (this amount was credited by the bank

on February 27 but not yet taken up in the books of the depositor in February 30,000

Check from customer in January amounting to 20,000 but was taken up in the book as 2,000

Check issued to supplier in January amounting to 1,000 but was taken up in the book as 10,000

Erroneous bank credit-February, 18,000

Undeposited collections as of January 31 250,000

Required: Compute for the undeposited collections at the end of February.

Undeposited collections, Jan. 31 250,000

Add: Deposits made by the company

Book Debits 380,000

Less: Interest earned in January 5,000

Collection by the bank in January 15,000

Understatement of CR in January (P20,000-P2,000) 18,000

Overstatement of CD in January (P10,000-P1,000) 9,000 333,000

Total 583,000

Less: Deposits acknowledged by the bank

Bank Credits 310,000

Less: Interest earned in February 6,000

Loan granted by the bank in February 30,000

Erroneous bank credit - February 18,000

Erroneous bank charge - January 10,000 246,000

Undeposited collections, Feb. 28 337,000

6, The following data are available for the Cash in Bank of Rizza Company for February of the current year:

a. Checks issued by the company during February, 150,000.

b. Outstanding checks, January 31, 52,000.00

c. Customer’s check, representing receipts in January amounting to 12,000 was erroneously

recorded by the company as 21,000.

d. Check of the company in January amounting to 20,000 was erroneously recorded by the

company as 2,000.

e. Checks paid by the bank in February, 130,000.

f. Erroneous bank charge in January, 10,000.

g. Erroneous bank charge in February, 12,000.

h. Bank service charge, January, 2,000.

i. Bank service charge, February, 3,000.

Required: Compute for the following:

1. Outstanding checks on February 28.

Outstanding checks, Jan. 31 52,000

Add: Checks issued by the company - February 150,000

Total 202,000

Less: Checks paid by the bank - February 130,000

Outstanding checks, Feb. 28 72,000

2. Unadjusted book disbursement in February.

Checks issued by the company - February 150,000

Add: Debit memo in January (bank service charge) 2,000

Errors in Jan. corrected in February’s book disbursement:

Overstatement of cash receipts in January for customer's check (P21,000-P12,000) 9,000

Understatement of cash disbursements in January for customer's check (P20,000-P2,000) 18,000

Total unadjusted book disbursement 179,000

3. Unadjusted bank disbursement in February.

Checks paid by the bank - February 130,000

Add: Debit memo in February (bank service charge) 3,000

Errors in January corrected in February's bank disbursements:

Overstatement of cash receipts in January (erroneous bank credit January 31) 10,000

Error in February affecting bank disbursements:

Overstatement of cash disbursements in February (erroneous bank charge) 12,000

Total unadjusted bank disbursement 155,000

7. In the audit of the cash account of the Prudylyn Inc., the following information, relative to the credits per

books and debits per bank, were disclosed by the records of the company and its bank statement with BPI:

Credits per books in February, 200,000

Debits per bank statement in February, 150,000

Check from customer in January amounting to 2,000 but was taken up in the books as, 20,000.

Check issued to supplier in January amounting to 10,000 but was taken up in the book as, 1,000

Check issued to supplier in February amounting to 12,000, but was taken up in the book as, 21,000.

Check of the company recorded in the bank in January as 10,000 when the correct amount is 15,000.

Amortization of pag-ibig housing loan automatically debited by the bank on January 31, as per

automatic debit agreement, but taken up in the books of the depositor in February, 15,000

Amortization of pag-ibig housing loan automatically debited by the bank on February 28, as per

automatic debit agreement, but taken up in the books of the depositor in March, 15,000

Erroneous Bank Credit- January, 18,000

Erroneous Bank Charge – February 10,000

Deposits in January properly recorded by the company as 15,000 but was recorded in the bank as

51,000

Outstanding checks, January 31, 15,000

Bank Service charge for January, 1,000.

Bank service Charge for February, 2000.

Required: Compute for the outstanding checks at the end of February.

Outstanding checks, January 31 15,000

Add: Checks issued by the company this month

Book credits 200,000

Less: Overstatement of CR in January (P20,000-P2,000) 18,000

Understatement of the CD in January (P10,000-P1,000) 9,000

Overstatement of CD in February (P21,000-P12,000) 9,000

Amortization of PAG-IBIG housing loan in January 15,000

Bank service charge January 1,000 148,000

Total 163,000

Less: Checks by the bank

Bank credits 150,000

Less: Understatement of CD in January (P15,000-P10,000) 5,000

Amortization of PAG-IBIG housing loan in February 15,000

Erroneous bank credit - January 18,000

Erroneous bank charge - February 10,000

Overstatement of deposit (P51,000-P15,000) 36,000

Bank service charge February 2,000 64,000

Outstanding checks, February 28 99,000

8. Data concerning the cash records of Lyndon Company for the months of September and October of the

current year follow:

a. Undeposited book balance on September 30 amounted to 2,258,000.

b. Total receipts per book in October, 1,400,000.

c. Total disbursements per book in October, 2,400,000.

d. Unadjusted bank balance on September 30 amounted to 2,100,000

e. Total credits per bank in October amounted to 1,200,000.

f. Total debits per bank in October amounted to 2,500,000.

g. NSF checks on September 30 amounted to 60,000 while on October 31 amounted to 40,000.

h. Collection of accounts receivable not recorded by the company on September 30, 30,000 and 50,000

on October 31.

i. Erroneous bank charge on September 30, 10,000 and 18,000 on October 31.

j. Erroneous bank credit on September 30, 7,000 and 9,000 on October 31.

k. Understatement of check in payment of rent payable on September 30, 90,000 and 120,000 on

October

31.

l. Deposit in Transit on September 30, 130,000.

m. Outstanding checks on October 31, 30,000.

Required: Based on the above data, answer the following questions:

a. How much is the deposit in transit, October 31?

Deposit in transit, beginning 130,000

Add: Deposits made by the company

Book receipts 1,400,000

Less: Credit last month 30,000 1,370,000

Total 1,500,000

Less: Deposits acknowledged by the bank

Bank receipts 1,200,000

Less: Credit memo this month 50,000

Erroneous bank charge - September 10,000

Erroneous bank credit - October 9,000 1,131,000

Deposit in transit, end 369,000

b. How much is the outstanding checks, September 30?

Outstanding checks, beginning 95,000

Add: Checks issued by the company

Book Disbursements 2,400,000

Less: Debit last month 60,000

Understatement of check in payment of rent -

90,000

September

Add: Understatement of check in payment of rent -

120,000 2,370,000

October

Total 2,465,000

Less: Checks paid by the bank

Bank disbursements 2,500,000

Less: Debit memo this month 40,000

Erroneous bank charge - October 18,000

Erroneous bank credit - September 7,000 2,435,000

Outstanding checks, end 30,000

c. How much is the adjusted cash in bank balance September 30?

d. How much is the adjusted cash receipts during October?

e. How much is the adjusted cash in bank balance October 31?

Balance October Balance

Sept. 30 Receipts Disbursement Oct. 31

Bank Balance 2,100,000 1,200,000 2,500,000 800,000

Deposit in transit

Sept. 30 130,000 (130,000)

Oct. 31 369,000 369,000

Outstanding checks

Sept. 30 (95,000) (95,000)

Oct. 31 30,000 (30,000)

Erroneous bank charge

Sept. 30 10,000 (10,000)

Oct. 31 (18,000) 18,000

Erroneous bank credit

Sept. 30 (7,000) (7,000)

Oct. 31 (9,000) (9,000)

Adjusted Balance c. 2,138,000 d. 1,420,000 2,410,000 e. 1,148,000

Balance October Balance

Sept. 30 Receipts Disbursement Oct. 31

Book Balance 2,258,000 1,400,000 2,400,000 1,258,000

NSF checks

Sept. 30 (60,000) (60,000)

Oct. 31 40,000 (40,000)

Credit memo

Sept. 30 30,000 (30,000)

Oct. 31 50,000 50,000

Understatement of checked in payment

of rent

Sept. 30 (90,000) (90,000)

Oct. 31 120,000 (120,000)

Adjusted Balance c. 2,138,000 d. 1,420,000 2,410,000 e. 1,148,000

f. Provide the adjusting journal entries.

Adjusting Entries Debit Credit

1.) Accounts Receivable 40,000

Cash in bank 40,000

2.) Cash in bank 50,000

Accounts Receivable 50,000

3.) Rent payable 120,000

Cash in bank 120,000

You might also like

- Quiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaDocument8 pagesQuiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaAlexNo ratings yet

- BANK RECON and PROOF OF CASHDocument2 pagesBANK RECON and PROOF OF CASHJay-an AntipoloNo ratings yet

- Cash Shortage Computation: SolutionDocument4 pagesCash Shortage Computation: SolutionCJ alandyNo ratings yet

- Basic Concepts of PartnershipDocument7 pagesBasic Concepts of PartnershipKhim CortezNo ratings yet

- Cash ProblemsDocument5 pagesCash ProblemsAnna AldaveNo ratings yet

- Audit of Cash - IllustrationDocument6 pagesAudit of Cash - IllustrationRNo ratings yet

- Primo Corporation and Sonia Company Consolidated Financial StatementsDocument2 pagesPrimo Corporation and Sonia Company Consolidated Financial StatementsLabLab ChattoNo ratings yet

- Proof of Cash Cebu CompanyDocument6 pagesProof of Cash Cebu CompanyCJ alandyNo ratings yet

- Practice Set 1 (Modules 1 - 3) 371Document8 pagesPractice Set 1 (Modules 1 - 3) 371Marielle CastañedaNo ratings yet

- Solving partnership problems involving sale of non-current assets and insolvency of partnersDocument5 pagesSolving partnership problems involving sale of non-current assets and insolvency of partnersshudayeNo ratings yet

- Partnership profit distribution and capital accountsDocument9 pagesPartnership profit distribution and capital accountsGarp BarrocaNo ratings yet

- CashDocument7 pagesCashhellohello100% (1)

- Accounting Review and Tutorial Services in San Isidro, Nueva EcijaDocument8 pagesAccounting Review and Tutorial Services in San Isidro, Nueva EcijaEiuol Nhoj Arraeugse100% (3)

- Assignment 3 Prepare A Cash Budget KarununganDocument3 pagesAssignment 3 Prepare A Cash Budget KarununganRenzo KarununganNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Illustration: Formation of Partnership Valuation of Capital A BDocument2 pagesIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNo ratings yet

- Tutorial BienDocument2 pagesTutorial BienCarlo Baculo100% (1)

- Cash and Accrual Basis: Topic OverviewDocument20 pagesCash and Accrual Basis: Topic OverviewAngelieNo ratings yet

- 33Document2 pages33yes yesnoNo ratings yet

- Refresher Course: Audit of Cash and Cash EquivalentsDocument4 pagesRefresher Course: Audit of Cash and Cash EquivalentsFery Ann100% (1)

- Cash and Cash EquivalentDocument22 pagesCash and Cash EquivalentDanielle Nicole MarquezNo ratings yet

- Quiz VIII - ARDocument3 pagesQuiz VIII - ARBLACKPINKLisaRoseJisooJennieNo ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry SaludoNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- ACP 311 My Test Bank Problem SolvingDocument22 pagesACP 311 My Test Bank Problem SolvingJamaica DavidNo ratings yet

- Proof of Cash - DiscussionDocument4 pagesProof of Cash - DiscussionJoyce Anne GarduqueNo ratings yet

- Problem set on partnership liquidation and distribution of assetsDocument5 pagesProblem set on partnership liquidation and distribution of assetsHoney OrdoñoNo ratings yet

- DICTIOFORMULA Audit of CashDocument13 pagesDICTIOFORMULA Audit of CashEza Joy ClaveriasNo ratings yet

- Audit Prob Cash AnsDocument7 pagesAudit Prob Cash AnsNoreen BinagNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Recording Transactions in a Property Appraisal Business WorksheetDocument1 pageRecording Transactions in a Property Appraisal Business WorksheetKizaru50% (2)

- Proof of Cash Syria CompanyDocument4 pagesProof of Cash Syria CompanyCJ alandy100% (1)

- Problem 12 27Document4 pagesProblem 12 27Bella RonahNo ratings yet

- SDocument18 pagesSdebate dd0% (1)

- Answer Key - Chapter 5 - 2020 EditionDocument37 pagesAnswer Key - Chapter 5 - 2020 EditionDaniel DialinoNo ratings yet

- LNU-AA-23-02-01-18 ExamDocument13 pagesLNU-AA-23-02-01-18 ExamAmie Jane MirandaNo ratings yet

- 1.1.2.a Assignment - Partnership Formation and OperationDocument14 pages1.1.2.a Assignment - Partnership Formation and OperationGiselle MartinezNo ratings yet

- DocxDocument352 pagesDocxsino akoNo ratings yet

- Midterm ExaminationDocument6 pagesMidterm ExaminationJamie Rose Aragones100% (1)

- Required Ending Allowance For Doubtful AccountsDocument4 pagesRequired Ending Allowance For Doubtful AccountsAngelica SamonteNo ratings yet

- This Study Resource WasDocument1 pageThis Study Resource WasKimberly Claire AtienzaNo ratings yet

- Additional InformationDocument32 pagesAdditional InformationMabel GakoNo ratings yet

- Aud Prob - 2nd PreboardDocument13 pagesAud Prob - 2nd PreboardKim Cristian MaañoNo ratings yet

- Proof of Cash - DrillDocument3 pagesProof of Cash - DrillMark Domingo Mendoza100% (1)

- The Determination and Allocation of Excess ScheduleDocument2 pagesThe Determination and Allocation of Excess ScheduleWawex DavisNo ratings yet

- Proof of Cash Baht CompanyDocument6 pagesProof of Cash Baht CompanyCJ alandy100% (1)

- Chapter 3 Material Procurement, Use and ControlDocument3 pagesChapter 3 Material Procurement, Use and ControlKaren CaelNo ratings yet

- Process of Production For Such Sale or in The Form of Materials or Supplies To Be Consumed in The Production Process or in The Rendering of ServicesDocument11 pagesProcess of Production For Such Sale or in The Form of Materials or Supplies To Be Consumed in The Production Process or in The Rendering of ServicesRyan Prado AndayaNo ratings yet

- General Ledger Would Always Be Current After Every Transaction But The Operating Efficiency May Be Affected Depending On The Size of The Company and The Number of Transactions That Are ProcessedDocument2 pagesGeneral Ledger Would Always Be Current After Every Transaction But The Operating Efficiency May Be Affected Depending On The Size of The Company and The Number of Transactions That Are ProcessedRaca DesuNo ratings yet

- Audit Problems CashDocument18 pagesAudit Problems CashYenelyn Apistar Cambarijan0% (1)

- Cannon Ball Review Part 2 Cash and ReceivablesDocument30 pagesCannon Ball Review Part 2 Cash and ReceivablesLayNo ratings yet

- (P21,000-P12,000) (P20,000 - P2,000)Document8 pages(P21,000-P12,000) (P20,000 - P2,000)Shaine PacsonNo ratings yet

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonNo ratings yet

- FAR 0 Bank Recon and Proof of Cash Drill ProblemsDocument6 pagesFAR 0 Bank Recon and Proof of Cash Drill Problemsyeeaahh56No ratings yet

- Bank Reconciliation & Proof of CashDocument25 pagesBank Reconciliation & Proof of CashTanya MaxNo ratings yet

- Financial Accounting Part 1: Cash & Cash EquivalentDocument7 pagesFinancial Accounting Part 1: Cash & Cash EquivalentHillary Grace VeronaNo ratings yet

- AACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Document4 pagesAACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Dawson Dela CruzNo ratings yet

- Cash and Cash EquivalentsDocument8 pagesCash and Cash EquivalentsNMCartNo ratings yet

- SMP Aud2Document3 pagesSMP Aud2Shaine PacsonNo ratings yet

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonNo ratings yet

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonNo ratings yet

- Ellen Company Cash Bank ReconciliationDocument8 pagesEllen Company Cash Bank ReconciliationShaine PacsonNo ratings yet

- (P21,000-P12,000) (P20,000 - P2,000)Document8 pages(P21,000-P12,000) (P20,000 - P2,000)Shaine PacsonNo ratings yet

- (P21,000-P12,000) (P20,000 - P2,000)Document8 pages(P21,000-P12,000) (P20,000 - P2,000)Shaine PacsonNo ratings yet

- Statement of Account: Summary of Charges and CreditsDocument3 pagesStatement of Account: Summary of Charges and CreditsRye LozadaNo ratings yet

- AMANX FactSheetDocument2 pagesAMANX FactSheetamnoman17No ratings yet

- What are PREMIUMS and how are they paidDocument2 pagesWhat are PREMIUMS and how are they paidRhows BuergoNo ratings yet

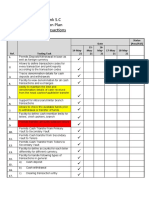

- Zamzam Bank S.C Project Test Action Plan Cash Related TransactionsDocument7 pagesZamzam Bank S.C Project Test Action Plan Cash Related Transactionstofik awelNo ratings yet

- Treasury Challan No: 0200025706 Treasury Challan No: 0200025706 Treasury Challan No: 0200025706Document1 pageTreasury Challan No: 0200025706 Treasury Challan No: 0200025706 Treasury Challan No: 0200025706Mallikarjuna SarmaNo ratings yet

- Gewecke MemoDocument17 pagesGewecke MemoCarrieonicNo ratings yet

- CH 05Document54 pagesCH 05syah RashidNo ratings yet

- Unit Ii Learning Activities Accounting StandardsDocument8 pagesUnit Ii Learning Activities Accounting StandardsChin FiguraNo ratings yet

- Draft SBLC Icbc Akhir-2Document2 pagesDraft SBLC Icbc Akhir-2PT ANUGRAH ENERGY NUSANTARANo ratings yet

- IFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Document55 pagesIFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Andualem ZenebeNo ratings yet

- HIG 2012 - Model Test PromptDocument2 pagesHIG 2012 - Model Test PromptLoïc HalleuxNo ratings yet

- HDFC SLIC OverviewDocument40 pagesHDFC SLIC Overviewprinceramji90No ratings yet

- AccountStatement01-10-2022 To 27-12-2022Document26 pagesAccountStatement01-10-2022 To 27-12-2022Amit KumarNo ratings yet

- 002 Initial Letter To Lender1Document9 pages002 Initial Letter To Lender1Armond TrakarianNo ratings yet

- Activity Ratios: By: Rabindra GouriDocument9 pagesActivity Ratios: By: Rabindra GouriRabindra DasNo ratings yet

- Implementing Ifrs 16: Leases: © Acca © AccaDocument28 pagesImplementing Ifrs 16: Leases: © Acca © AccadaisyNo ratings yet

- NCC Bank internship report on approval, disbursement & recovery systemDocument74 pagesNCC Bank internship report on approval, disbursement & recovery systemSauron88850% (2)

- BPI US Equity Feeder Fund Latest DisclosureDocument3 pagesBPI US Equity Feeder Fund Latest DisclosureJelor GallegoNo ratings yet

- (CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)Document12 pages(CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)jamNo ratings yet

- 6 Receivables ManagementDocument12 pages6 Receivables ManagementShreya BhagavatulaNo ratings yet

- Plantilla Arbitraje FragataDocument11 pagesPlantilla Arbitraje FragataÓscar alvearNo ratings yet

- Banking Decree 1969Document33 pagesBanking Decree 1969Ozim chikaNo ratings yet

- Payday LoansDocument8 pagesPayday LoansChakravarthy Narnindi SharadNo ratings yet

- Jupiter International LimitedDocument6 pagesJupiter International LimitedRahul syalNo ratings yet

- Bond Valuation ProblemsDocument4 pagesBond Valuation ProblemsMary Justine Paquibot100% (1)

- FA1 Chapter 8 EngDocument18 pagesFA1 Chapter 8 Enghahahaha wahahahhaNo ratings yet

- Wire Transfer GuideDocument2 pagesWire Transfer GuideMurdoko RagilNo ratings yet

- The Chicago Plan Revisited - 2d Paper IMFDocument85 pagesThe Chicago Plan Revisited - 2d Paper IMFuser909No ratings yet

- Org ProjectDocument78 pagesOrg Projectsvinduchoodan8614No ratings yet

- What Matters Today How Structured Trade Finance Supports The Global EconomyDocument21 pagesWhat Matters Today How Structured Trade Finance Supports The Global EconomyHicham NedjariNo ratings yet