Professional Documents

Culture Documents

Bus Com Handout 1 Bus Combination

Uploaded by

Christine Repulda0 ratings0% found this document useful (0 votes)

185 views9 pagesgoodluck

Original Title

Bus-Com-Handout-1-Bus-combination

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgoodluck

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

185 views9 pagesBus Com Handout 1 Bus Combination

Uploaded by

Christine Repuldagoodluck

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

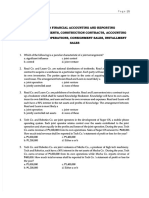

ADVANCED

FINANCIAL ACCOUNTING AND REPORTING

Handout 01 – Business Combination – Date of Acquisition

Numbers 1- 5

On December 31, 2022, PBB Corporation enters into a business combination by acquiring all the assets and

assuming all the liabilities of SUV Corporation in which the latter will be dissolved. PBB’s consideration consists

of the following:

• Cash payment of P1,977,500.

• 60,000 unissued shares of its P100 par ordinary shares with a market value of P101 per share.

• 6% P2,000,00 bonds payable.

• A contingent consideration of P1,500,000 cash on December 31, 2024 if the cash flows from operations

during the 2-year period 2022-2024 exceed P2,500,000 per year. PBB estimates that there is a 40%

change of probability that the P1,500,000 will be required.

In addition, PBB paid the following at the time of the merger:

Finder’s fee P 110,000

Diligent audit fee prior to business combination 75,000

Cost of printing and issuing stock certificates 150,000

General and administration salaries attributable to the merger 75,000

Statement of financial position for the two companies as of December 31 2022 before the merger follow:

PBB Corporation SUV Corporation

Book Value Fair Value Book Value Fair Value

Cash P 2,950,000 P 2,950,000 P 720,000 P 720,000

Receivables 1,200,000 1,200,000 900,000 900,000

Inventories 2,400,000 2,500,000 1,500,000 1,750,000

Land 3,000,000 3,200,000 3,000,000 3,100,000

Building, net 12,000,000 10,000,000 5,500,000 4,500,000

Equipment 2,000,000 2,000,000 900,000 950,000

Goodwill 750,000 750,000 50,0000 -

In process Research and Development - - - 500,000

Accounts payable P 3,600,000 P 3,750,000 P 1,120,000 P 1,200,000

Accrued expense 1,500,000 1,100,000 880,000 900,000

Share capital, P100 par 10,000,000 - 5,000,000 -

Share premium 4,200,000 - 2,500,000 -

Retained earnings 5,000,000 - 3,070,000 -

1. What is the amount of goodwill to be recognized on the acquisition date?

A. 317,500 C. 617,500

B. 1,067,500 D. 1,217,500

2. What is the amount of total assets immediately after the merger?

A. 34,332,500 C. 34,687,500

B. 34,650,000 D. 34,650,000

3. What is the amount of total liabilities immediately after the merger?

A. 9,537,500 C. 9,800,000

B. 10,990,000 D. 9,787,500

4. What are the amounts of share premium and retained earnings immediately after the merger?

Share Premium Retained Earnings

A. 4,110,000 4,740,000

B. 4,740,000 4,110,000

C. 4,050,000 4,650,000

D. 4,650,000 4,050,000

Numbers 6 - 10

On January 1, 2019, Good Corporation and Evil Company decided to enter into a business combination. Good’s

book shows assets and liabilities amounting to P1,350,000 and P300,000, respectively. The shareholders’ equity

is composed of P300,000 common stocks (P10 par); P150,000 Additional-paid in capital and P600,000 retained

earnings. The book value asset of Good is understated by P150,000 while its liability is overstated by P75,000.

Evil Company’s assets inclusive of P15,000 goodwill amounted to P500,000 while liabilities amounted to

P150,000. The shareholders’ equity composed of P120,000 common stocks (P10 par); P105,000 Additional paid

in capital and P125,000 retained earnings. The fair value of assets without goodwill and liabilities should be

reduced both by P75,000.

Good Company acquired the net assets of Evil Company by issuing 25,000 shares and cash of P10,000. Moreover,

a contingent consideration of P80,000 will be paid when the result of the pending litigation existing at the date

of acquisition on the quieting title of the land of Evil is affirmative. The determinable amount the said contingent

consideration at the date of combination amounted to P50,000. The current market price of Good Company’s

stock is traded at P12 per share.

Good Corporation paid the following as a result of business combination:

Finder’s fee P 50,000

Legal, accounting and other consulting fees 50,000

Cost of stockholders’ meeting to vote the acquisition 20,000

SEC registration of the business combination 15,000

General administrative cost 15,000

Cost of printing stock certificates 10,000

Accountant’s fee related to the stock issuance 20,000

SEC registration of new shares issued 40,000

5. How much is the result of the combination on January 1, 2019?

A. 10,000 goodwill C. 25,000 goodwill

B. 10,000 income D. 25,000 income

6. How much is the combined total asset?

A. 1,330,000 C. 1,555,000

B. 1,500,000 D. 1,575,000

7. How much is the combined total liability?

A. 350,000 C. 425,000

B. 375,000 D. 450,000

8. How much is the combined common stock?

A. 420,000 C. 670,000

B. 550,000 D. 720,000

9. How much is the combined additional paid-in capital?

A. 130,000 C. 235,000

B. 150,000 D. 255,000

10. How much is the combined retained earnings?

A. 430,000 C. 520,000

B. 450,000 D. 540,000

Numbers 11 – 12

The balance sheet of Salt Company, along with market values of its assets and liabilities, is as follows:

Book Values Market Values

Current assets P 2,000,000 P 1,500,000

Plant & equipment 30,000,000 35,000,000

Patents 100,000 2,000,000

Completed technology - 10,000,000

Broader customer base - 16,000,000

Technically skilled workforce - 3,000,000

Potentially profitable future contracts - 2,000,000

Licensing agreements - 4,000,000

Potential contracts with new customers - 1,500,000

Advertising jingles - 1,000,000

Future cost savings - 1,800,000

Goodwill 200,000 700,000

Liabilities (28,000,000) (30,000,000)

Common stock (1,000,000)

Additional paid-in capital (5,000,000)

Retained earnings 1,700,000

11. Pail Company pays P100,000,000 in cash for Salt’s Company’s assets and liabilities. Pail records goodwill of

A. 50,800,000 C. 72,500,000

B. 66,800,000 D. 76,500,000

12. Assume three months later, Salt’s patents are determined to have been worthless as of the date of

acquisition. The entry to record this information includes

A. A debit to loss of P2,000,000

B. A debit to patents of P2,000,000

C. A debit to goodwill of P2,000,000

D. A debit to retained earnings of P2,000,000

Numbers 13 – 145

AA Co. bought the net assets of BB Co. by issuing 120,000 shares at P10 par. The fair value of the shares was

P2,550,000. Immediately before the acquisition, the following balances were ascertained for BB Co.

Carrying amount Fair Value

Current assets 1,000,000 1,100,000

Noncurrent assets 1,500,000 2,200,000

Liabilities 300,000 300,000

Ordinary shares 2,000,000

Retained earnings 200,000

AA Co. also incurred the following costs:

• Professional fees to arrange business combination P27,000.

• SEC registration P12,000.

• Printing and issuing of stocks for P3,000.

13. What is the result of the business combination?

A. 450,000 C. 350,000

B. (450,000) D. (350,000)

14. What is the share premium recorded by AA Co.?

A. 1,330,000 C. 1,335,000

B. 1,350,000 D. 1,365,000

15. What is the net increase (decrease) in the retained earnings of AA Co.?

A. 450,000 C. (27,000)

B. 408,000 D. 423,000

Numbers 16 – 19

Entity A acquired the net assets of Entity B by issuing 10,000 ordinary shares with par value of P10 and bonds

payable with face amount of P500,000. The bonds are classified as financial liability at amortized cost.

At the time of acquisition, the ordinary shares are publicly quoted at P20 per share. On the other hand, the bonds

payable are trading at 110. Entity A paid P10,000 share issuance costs and P20,000 bond issue costs. Entity A

also paid P40,000 acquisition related costs and P30,000 indirect costs of business combination.

Before the date of acquisition, Entity A and Entity B reported the following data:

Entity A Entity B

Current assets 1,000,000 500,000

Noncurrent assets 2,000,000 1,000,000

Current liabilities 200,000 400,000

Noncurrent liabilities 300,000 500,000

Ordinary shares 500,000 200,000

Share premium 1,200,000 300,000

Retained earnings 800,000 100,000

At the time of acquisition, the current assets of Entity A have fair value of P1,200,000 while the noncurrent assets

of Entity B have fair value of P1,300,000. On the same date, the current liabilities of Entity B have fair value of

P600,000 while the noncurrent liabilities of Entity A have fair value of P500,000.

16. What is the goodwill or gain on bargain purchase arising from business combination?

A. 50,000 goodwill

B. 150,000 gain on bargain purchase

C. 120,000 goodwill

D. 70,000 gain on bargain purchase

17. What total amount should be expensed as incurred at the time of business combination?

A. 20,000

B. 70,000

C. 30,000

D. 50,000

18. What is Entity A’s amount of total assets after the business combination?

A. 4,520,000

B. 4,810,000

C. 4,750,000

D. 4,440,000

19. What is Entity A’s amount of total liabilities after the business combination?

A. 2,240,000

B. 2,510,000

C. 2,320,000

D. 2,130,000

Numbers 20 – 21

Summary information is given for San Miguel Brewery (SMB) and Tanduay Philippines at July 1, 2022. The

quoted market price of SMB and Tanduay shares are P36 and P40, respectively.

SMB Tanduay

Book Value Fair Value Book Value Fair Value

Current asset 24,000,000 24,000,000 8,000,000 9,000,000

Plant asset 26,000,000 25,000,000 22,000,000 26,000,000

Liabilities 15,000,000 15,500,0000 5,000,000 5,000,000

Common stock, P10 Par 20,000,000 10,000,000

APIC 3,000,000 1,000,000

Retained earnings 12,000,000 14,000,000

SMB Company acquired all the net assets of Tanduary by issuing 1,000,000 of its own shares. SMB Company

incurred the following out of pocket costs relating to the acquisition:

Legal fees to arrange the business combination P 25,000

Cost of SEC registration 12,000

Cost of printing and issuing new stock certificates 3,000

Indirect cost of combination 20,000

Finder’s fee 35,000

20. Calculate the goodwill from the business combination

A. 10,000,000 C. 10,040,000

B. 10,025,000 D. 10,060,000

21. The total retained earnings of the surviving company after the combination is

A. 13,920,000 C. 11,920,000

B. 13,980,000 D. 11,980,000

Numbers 22 – 24

The statement of Financial Position of Lumina Corporation on June 30, 2022 is presented below:

Current assets P 195,000

Land 1,320,000

Building 660,000

Equipment 525,000

Total assets P 2,700,000

Liabilities P 525,000

Ordinary shares, P5 par 900,000

Share premium 825,000

Retained earnings 450,000

Total liabilities and equities P 2,700,000

All the assets and liabilities of Lumina assumed to approximate their fair values except for land and building. It

is estimated that the land has a fair value of P2,100,000 and the fair value of the building increased by P480,000.

Enigma Corporation acquired 80% of Lumina’s outstanding shares for P3,000,000. The non-controlling interest

is measured at fair value.

The following are independent assumptions.

22. Assuming the consideration paid includes control premium of P222,000, how much is the goodwill (gain on

acquisition) on the consolidated financial statements?

A. 259,500 C. 340,500

B. 439,500 D. 410,100

23. Assuming the consideration paid includes control premium of P852,000, how much is the goodwill (gain on

acquisition) on the consolidated financial statement?

A. 315,000 C. 102,000

B. (750,000) D. 252,000

24. Assuming the consideration paid excludes control premium of P138,000 and the fair value of the non-

controlling interest is P736,000, how much is the goodwill (gain on acquisition) on the consolidated financial

statement?

A. 469,500 C. 301,500

B. 439,500 D. 448,500

Numbers 25 – 26

Great Company has gained control over the operation of Super Corporation by acquiring 85% of its outstanding

capital stock for P15,480,000. This amount includes a control premium of P180,000. Acquisition expenses,

direct and indirect, amounted to P498,000 and P252,000, respectively.

The following is the balance of the Great and Super at book values:

Great Company Super Corporation

Cash P 21,249,000 P 768,000

Accounts receivable 1,800,000 1,950,000

Inventories 3,300,000 2,160,000

Prepaid expenses 891,000 750,000

Land 14,100,000 5,274,000

Building 9,360,000 3,348,000

Equipment 1,800,000 1,110,000

Goodwill - 1,800,000

Total assets P 52,500,000 P 17,160,000

Accounts payable P 4,050,000 P 1,518,000

Notes payable 8,400,000 4,380,000

Ordinary shares, P50 par 20,400,000 4,800,000

Share premium 9,450,000 3,600,000

Retained earnings 10,200,000 2,862,000

Total liabilities and equity P 52,500,000 P 17,160,000

The following were ascertained on the date of acquisition for Super Corporation

• The value of receivable and equipment has decreased by P150,000 and P84,000 respectively.

• The fair value of inventories are now P2,616,000 whereas the value of the land and building have

increased by P2,826,000 and P642,000 respectively.

• There was an unrecorded accounts payable amounting to P162,000 and the fair value of notes is

P4,428,000.

Compute the following balances to be presented in the consolidated financial position on the date of business

combination:

25. Total assets

A. 73,500,000 C. 61,308,000

B. 60,558,000 D. 76,788,000

26. Total shareholders’ equity

A. 42,000,000 C. 39,300,000

B. 45,000,000 D. 40,050,000

Numbers 27 – 28

The balance sheet of Padre Enterprise and Sister Company at December 31, 2021 are summarized as follows:

Padre Sister

Assets 5,000,000 2,000,000

Liabilities 1,500,000 500,000

Capital stock, P40 par 2,500,000

Capital stock, P25 par 1,000,000

Retained earnings 1,000,000 500,000

At the date of acquisition, Sister’s assets are understated while its liabilities are fairly valued. On January 1, 2022,

Padre purchased 80% of Sister Company’s outstanding shares for P2,000,000 when the fair value of Sister

Company’s net asset was P2,000,000. Padre issued 10,000 previously unissued shares in consideration of the

acquisition.

Padre is to assign an amount to the non-controlling interest at the date of acquisition based on the total fair value

of Sister’s outstanding shares.

27. How much is the consolidated assets at the date of acquisition?

A. 9,000,000 C. 8,000,000

B. 9,700,000 D. 8,700,000

28. How much is the consolidated liability at the date of acquisition?

A. 2,000,000 C. 1,800,000

B. 1,500,000 D. 500,000

29. How much is the consolidated liability at the date of acquisition?

A. 7,000,000 C. 6,000,000

B. 5,500,000 D. 6,700,000

Numbers 30 – 31

Entity A acquired 80,000 out of 100,000 outstanding ordinary shares of Entity B which enabled the former to

obtain control of the latter at an acquisition price of P1,000,000. Entity A paid P100,000 acquisition related costs

and P50,000 indirect costs of business combination. At the date of acquisition, the net assets of Entity B are

reported at P1,600,000. An asset of Entity B is overvalued by P60,000 while one liability is undervalued by

P40,000.

30. What is the initial measurement of noncontrolling interest in net assets in the consolidated statement of

financial position?

A. 320,000

B. 300,000

C. 250,000

D. 316,000

31. What is the goodwill or gain on bargain purchase arising from business combination?

A. 250,000 gain on bargain purchase

B. 150,000 gain on bargain purchase

C. 50,000 goodwill

D. 200,000 gain on bargain purchase

You might also like

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- Group Quizbowl FormattedDocument17 pagesGroup Quizbowl FormattedSarah BalisacanNo ratings yet

- Petty Cash and Cash Reconciliation ProblemsDocument9 pagesPetty Cash and Cash Reconciliation ProblemsKenncyNo ratings yet

- Quiz 5 Problems Second Semester AY2223 With AnswersDocument4 pagesQuiz 5 Problems Second Semester AY2223 With AnswersManzano, Carl Clinton Neil D.No ratings yet

- I Need A Step-By-Step Explanation For The FollowingDocument2 pagesI Need A Step-By-Step Explanation For The Followingnicolearetano417No ratings yet

- Cost Quizzer6Document6 pagesCost Quizzer6LumingNo ratings yet

- D15Document12 pagesD15neo14No ratings yet

- HW On Operating Segments BDocument3 pagesHW On Operating Segments BJazehl Joy ValdezNo ratings yet

- Cash FlowDocument3 pagesCash FlowMark IlanoNo ratings yet

- ACC 124 Investment Equity Securities AssignmentDocument2 pagesACC 124 Investment Equity Securities Assignmentslow dancerNo ratings yet

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Document7 pagesRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNo ratings yet

- Finman - Q2 Cost Os CaptDocument2 pagesFinman - Q2 Cost Os CaptJennifer RasonabeNo ratings yet

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Chapter 5 Property, Plant and Equipment GuideDocument14 pagesChapter 5 Property, Plant and Equipment GuideNaSheeng100% (1)

- Intacc Cash Flow SolutionDocument3 pagesIntacc Cash Flow SolutionMila MercadoNo ratings yet

- Exercise - Part 2Document5 pagesExercise - Part 2lois martinNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Martinez, Althea E. Bsais 1-A (Lesson 3 Actvity 6)Document3 pagesMartinez, Althea E. Bsais 1-A (Lesson 3 Actvity 6)Althea Escarpe MartinezNo ratings yet

- Audit of Inventory 2021 - ExamDocument9 pagesAudit of Inventory 2021 - ExammoreNo ratings yet

- Cost AccountingDocument31 pagesCost Accountinghyunsuk fhebieNo ratings yet

- Module #6Document20 pagesModule #6Joy RadaNo ratings yet

- Home Office & Branch Accounting Problems SolvedDocument3 pagesHome Office & Branch Accounting Problems SolvedChristianAquinoNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJoyce Anne DugayNo ratings yet

- MAS.07 Drill Balanced Scorecard and Responsibility AccountingDocument6 pagesMAS.07 Drill Balanced Scorecard and Responsibility Accountingace ender zeroNo ratings yet

- Estimated gross loss on asset dispositionDocument21 pagesEstimated gross loss on asset dispositionRujean Salar AltejarNo ratings yet

- ACC5116 - Module 1Document6 pagesACC5116 - Module 1Carl Dhaniel Garcia SalenNo ratings yet

- Zakaria Ch4Document15 pagesZakaria Ch4Zakaria Hasaneen0% (2)

- Advanced Financial Accounting TopicsDocument16 pagesAdvanced Financial Accounting TopicsNhel AlvaroNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur Salameda100% (1)

- You Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123Document3 pagesYou Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123chiji chzzzmeowNo ratings yet

- Retrospectively in The First Set of Financial Statements Authorized For Issue AfterDocument7 pagesRetrospectively in The First Set of Financial Statements Authorized For Issue Aftermax pNo ratings yet

- Accounting for Warranties and PremiumsDocument2 pagesAccounting for Warranties and PremiumsMa Teresa B. CerezoNo ratings yet

- Cost Behavior Analysis and ForecastingDocument2 pagesCost Behavior Analysis and ForecastingPotie RhymeszNo ratings yet

- 11 Just in Time Backflush CostingDocument3 pages11 Just in Time Backflush CostingIrish Gracielle Dela CruzNo ratings yet

- Batch 18 1st Preboard (P1)Document14 pagesBatch 18 1st Preboard (P1)Jericho PedragosaNo ratings yet

- Projected Financials for Water Refilling StationDocument9 pagesProjected Financials for Water Refilling StationjaneNo ratings yet

- Ia FifoDocument5 pagesIa FifoNadine SofiaNo ratings yet

- Notes and ReviewerDocument1,116 pagesNotes and ReviewerJeric Ramos De LeonNo ratings yet

- QUIZ2Document5 pagesQUIZ2LJ AggabaoNo ratings yet

- I. Concept Notes Joint CostsDocument9 pagesI. Concept Notes Joint CostsDanica Christele AlfaroNo ratings yet

- Accounting Quiz - Multiple Choice and Computational ProblemsDocument5 pagesAccounting Quiz - Multiple Choice and Computational Problemsedwin_dauzNo ratings yet

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Question: Austral & Company Has A Debt Ratio of 0.5, A Total Assets Turnover Ratio of 0.25, and A Pro ..Document3 pagesQuestion: Austral & Company Has A Debt Ratio of 0.5, A Total Assets Turnover Ratio of 0.25, and A Pro ..Malik AsadNo ratings yet

- Franchising Consignment KeyDocument22 pagesFranchising Consignment KeyMichael Jay SantosNo ratings yet

- CoMa Quiz 2Document21 pagesCoMa Quiz 2Antriksh JohriNo ratings yet

- CH 6 (WWW - Jamaa Bzu - Com)Document8 pagesCH 6 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (2)

- Test Bank For Cornerstones of Cost Management 2nd Edition by Hansen PDFDocument23 pagesTest Bank For Cornerstones of Cost Management 2nd Edition by Hansen PDFJyasmine Aura V. AgustinNo ratings yet

- 14Document3 pages14Carlo ParasNo ratings yet

- VCM Module 7 - Tools Used in Asset-Based Valuation and Asset-Based Valuation MethodsDocument58 pagesVCM Module 7 - Tools Used in Asset-Based Valuation and Asset-Based Valuation MethodsLaurie Mae ToledoNo ratings yet

- Far Ii Finals ProblemDocument17 pagesFar Ii Finals ProblemSaeym SegoviaNo ratings yet

- Cost Concepts, Classification and Segregation: M.S.M.CDocument7 pagesCost Concepts, Classification and Segregation: M.S.M.CAllen CarlNo ratings yet

- PRELIM EXAM SOLUTIONS AE211Document10 pagesPRELIM EXAM SOLUTIONS AE211Nhel AlvaroNo ratings yet

- Chapter 8 SolucionesDocument6 pagesChapter 8 SolucionesIvetteFabRuizNo ratings yet

- NAPAY, MARC JAY BSMAC 3 ACCTNG22 BLOCK BExercise 2Organization of DataDocument6 pagesNAPAY, MARC JAY BSMAC 3 ACCTNG22 BLOCK BExercise 2Organization of DataBALISORO, Ylaizza B.No ratings yet

- Final Exam Finacc1Document11 pagesFinal Exam Finacc1Grace A. ManaloNo ratings yet

- Exercise Chapter 4Document3 pagesExercise Chapter 4Nela HasanNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Mand CHODocument7 pagesMand CHOMichael BaguyoNo ratings yet

- Cash Flow Statement QuizDocument7 pagesCash Flow Statement QuizAngelo HilomaNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationZejkeara ImperialNo ratings yet

- CMA-Unit 5 - Absorbtion Costing, Operation Costing & by Product Costing - 18-19Document23 pagesCMA-Unit 5 - Absorbtion Costing, Operation Costing & by Product Costing - 18-19rohit vermaNo ratings yet

- 10 Ias 41 Agriculture Accounting For Pas 41Document19 pages10 Ias 41 Agriculture Accounting For Pas 41Cleofe Mae Piñero Aseñas100% (1)

- Management Advisory Services NotesDocument2 pagesManagement Advisory Services NotesKyla RoxasNo ratings yet

- Slides No.1Document35 pagesSlides No.1Ramez AhmedNo ratings yet

- FAC 1502 Tut Letter 201 With Q&A 2013-1 PDFDocument32 pagesFAC 1502 Tut Letter 201 With Q&A 2013-1 PDFVinny HungweNo ratings yet

- Finance Director Resume Samples: Expert Guidance for Your CareerDocument7 pagesFinance Director Resume Samples: Expert Guidance for Your CareerArojiduhu HalawaNo ratings yet

- Auditing and Assurance Principles PlanDocument31 pagesAuditing and Assurance Principles PlanJwzNo ratings yet

- Final Exam Adv Acctg2 - 1st Sem Sy2012-2013Document19 pagesFinal Exam Adv Acctg2 - 1st Sem Sy2012-2013John Paul LappayNo ratings yet

- CMPR0102 318107922 PDFDocument1 pageCMPR0102 318107922 PDFratih kusumaNo ratings yet

- Accounting contingency theory achievement and future directionsDocument16 pagesAccounting contingency theory achievement and future directionsMarthyn Maturbongs100% (1)

- Lecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceDocument16 pagesLecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceGarp BarrocaNo ratings yet

- Example 1 Illustration of 5-Step Model (Telecom Contract) Example 2 Contract Modification Example 3 Explicit vs. Implicit Performance Obligations Example 5 Variable Consideration With ContingencyDocument13 pagesExample 1 Illustration of 5-Step Model (Telecom Contract) Example 2 Contract Modification Example 3 Explicit vs. Implicit Performance Obligations Example 5 Variable Consideration With ContingencyHồ Đan ThụcNo ratings yet

- DocxDocument6 pagesDocxLeo Sandy Ambe CuisNo ratings yet

- The COSO ERM Framework: A Critique From Systems Theory of Management ControlDocument31 pagesThe COSO ERM Framework: A Critique From Systems Theory of Management ControlDedi SupiyadiNo ratings yet

- Examiners General Comments on Breach of InstructionsDocument89 pagesExaminers General Comments on Breach of InstructionsLegogie Moses AnoghenaNo ratings yet

- Compilation 1 (Midterms)Document22 pagesCompilation 1 (Midterms)Von Andrei Medina100% (12)

- Accounting Cycle For Service Business - Part 1Document35 pagesAccounting Cycle For Service Business - Part 1Michael MagdaogNo ratings yet

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- Prospectus BCom MComDocument176 pagesProspectus BCom MComdroy21No ratings yet

- With Comparative Figures For CY 2010Document8 pagesWith Comparative Figures For CY 2010sandra bolokNo ratings yet

- Consideration of Internal ControlDocument12 pagesConsideration of Internal Controlasdfghjkl100% (1)

- Iajef v3 I1 44 63 PDFDocument20 pagesIajef v3 I1 44 63 PDFrifkiNo ratings yet

- MAS 9204 Product Costing Activity-Based Costing (ABC)Document19 pagesMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaNo ratings yet

- Teachers-Learning-Guide - FABM1Document11 pagesTeachers-Learning-Guide - FABM1Lee Cerna100% (1)

- Managerial Accounting CASE Solves Missing Data Income StatementDocument3 pagesManagerial Accounting CASE Solves Missing Data Income StatementAlphaNo ratings yet

- Laporan Keuangan Auditan 2020Document219 pagesLaporan Keuangan Auditan 2020Muhammad Hasan SafariNo ratings yet

- AuditingDocument14 pagesAuditingsharventhiriNo ratings yet

- CA Intermediate Auditing & Assurance November 2022 Suggested AnswersDocument8 pagesCA Intermediate Auditing & Assurance November 2022 Suggested AnswersLegends CreationNo ratings yet

- Introduction To Management Accounting and Control: Prof Elec 4 A U G U S T 2 4, 2 0 2 1Document41 pagesIntroduction To Management Accounting and Control: Prof Elec 4 A U G U S T 2 4, 2 0 2 1Aruxi YoshiNo ratings yet