Professional Documents

Culture Documents

Health Care Costs

Uploaded by

elkharttruthOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Health Care Costs

Uploaded by

elkharttruthCopyright:

Available Formats

MAKING HEALTHCARE MORE EXPENSIVE

HEALTH INSURANCE TAX:

How it impacts Hoosiers

If you purchase coverage in Indiana: On Your Own Through a Small Employer Average increase in premiums of $2,696 over 10 years. Through a Large Employer Average increase in premiums of $2,673 over 10 years. Average increase in premiums of $7,174 over 10 years.

Individual

Average increase in premiums of $1,942 over 10 years.

Family

Average increase in Average increase in premiums of $4,662 premiums of $6,656 over 10 years. over 10 years.

Medicare If you have a Medicare Advantage plan, the tax could cost you on 65+ Years average $3,458 more in higher premiums and reduced benefits over 10 years.

Medicaid Medicaid health plan costs could increase $1,386 over 10 years, putting pressure on already strained state budgets, which could lead to decreased benefits and potentially create coverage disruption.

How it impacts Michiganders

If you purchase coverage in Michigan: On Your Own Through a Small Employer Average increase in premiums of $2,305 over 10 years. Through a Large Employer Average increase in premiums of $2,512 over 10 years. Average increase in premiums of $6,795 over 10 years.

Individual

Average increase in premiums of $1,889 over 10 years.

Family

Average increase in Average increase in premiums of $4,485 premiums of $5,700 over 10 years. over 10 years.

Medicare If you have a Medicare Advantage plan, the tax could cost you on 65+ Years average $3,838 more in higher premiums and reduced benefits over 10 years.

Medicaid Medicaid health plan costs could increase $1,366 over 10 years, putting pressure on already strained state budgets, which could lead to decreased benefits and potentially create coverage disruption.

How it impacts the national economy

Reduce future private sector employment by 146,000 to 262,000 by 2022. Reduce potential sales between $19 billion and $35 billion by 2022.

Source: Americas Health Insurance Plans trade associations Center for Policy and Research.

You might also like

- The Formula for Happy Retirement : Ways to Enjoy and Make the Most of Your Retirement YearsFrom EverandThe Formula for Happy Retirement : Ways to Enjoy and Make the Most of Your Retirement YearsNo ratings yet

- Constructing Health CareDocument1 pageConstructing Health CareCourier JournalNo ratings yet

- Medical Education Bariatric Fellowship BenefitsDocument6 pagesMedical Education Bariatric Fellowship BenefitsOmer FarooqNo ratings yet

- Sebelius Medicare BrochureDocument4 pagesSebelius Medicare BrochureErick BrockwayNo ratings yet

- MSHL Brochure EnglishDocument20 pagesMSHL Brochure Englishjakovach7No ratings yet

- Collaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterDocument4 pagesCollaborative Financial Solutions, LLC Cost-of-Living Adjustments: What They Are and Why They MatterJanet BarrNo ratings yet

- OE Powerpoint PresentationDocument35 pagesOE Powerpoint PresentationAnonymous ibpKT07GNo ratings yet

- Statement Redesign Noncovered EarningsDocument2 pagesStatement Redesign Noncovered EarningsAntonio RodriguezNo ratings yet

- SEBAC Agreement Summary: Pension ChangesDocument8 pagesSEBAC Agreement Summary: Pension ChangesHour NewsroomNo ratings yet

- Mediclaim PoliciesDocument1 pageMediclaim PoliciesnavagatNo ratings yet

- Kenneth Thorpe's Analysis of Bernie Sanders's Single-Payer Proposal.Document7 pagesKenneth Thorpe's Analysis of Bernie Sanders's Single-Payer Proposal.Dylan Matthews57% (7)

- Health Insurance Activity Sheet - Spring 2022 1Document4 pagesHealth Insurance Activity Sheet - Spring 2022 1api-632711577No ratings yet

- New State Pension Your Questions AnsweredDocument16 pagesNew State Pension Your Questions Answeredsameepverma2No ratings yet

- Horizon Presale Kit 2014off OnexchangeDocument18 pagesHorizon Presale Kit 2014off OnexchangewygneshNo ratings yet

- DRC Oct 2012 Without CartoonsDocument21 pagesDRC Oct 2012 Without CartoonsdallaschamberNo ratings yet

- HD Issue BriefDocument3 pagesHD Issue BriefSHADACNo ratings yet

- Health Cover Planning: Hello VinayDocument6 pagesHealth Cover Planning: Hello VinayRaju RajuNo ratings yet

- FY20 Decision GuideDocument28 pagesFY20 Decision Guidezein majarNo ratings yet

- 2024 Medicare Costs Guide-2Document11 pages2024 Medicare Costs Guide-2Mohammed Ishaq s.mNo ratings yet

- Background of D TipicDocument3 pagesBackground of D TipicSandeep GuptaNo ratings yet

- Financial: JourneysDocument4 pagesFinancial: Journeysapi-158508989No ratings yet

- 17 Benefits For Seniors at NYDocument24 pages17 Benefits For Seniors at NYAbu HudaNo ratings yet

- What Our Members Are Saying... : Tribute® PlanDocument6 pagesWhat Our Members Are Saying... : Tribute® PlanlocalonNo ratings yet

- Contract Summary - Appliance ParkDocument6 pagesContract Summary - Appliance ParkCourier JournalNo ratings yet

- Aviva MyRetirementDocument16 pagesAviva MyRetirementAkbar AkhtarNo ratings yet

- Healthcare Reform Timeline For Self-Funded PlansDocument1 pageHealthcare Reform Timeline For Self-Funded PlansPayerFusionNo ratings yet

- Statement Redesign OnlineDocument2 pagesStatement Redesign OnlineJoshua LaporteNo ratings yet

- 2022 Tax UpdatesDocument12 pages2022 Tax UpdatesJagmohan TeamentigrityNo ratings yet

- Healthcare Reform TimelineDocument16 pagesHealthcare Reform TimelinenfibNo ratings yet

- North Carolina and The Inflation Reduction ActDocument2 pagesNorth Carolina and The Inflation Reduction ActFOX8No ratings yet

- Case 2 - For Pop FinalDocument7 pagesCase 2 - For Pop Finalapi-283228440No ratings yet

- REPORT: The Impact of The Tax Framework On Middle Class FamiliesDocument3 pagesREPORT: The Impact of The Tax Framework On Middle Class FamiliesbwingfieldNo ratings yet

- FP Group WorkDocument12 pagesFP Group WorkStellina JoeshibaNo ratings yet

- Statement of AdviceDocument11 pagesStatement of Advicepatrick wafulaNo ratings yet

- World Financial Group PresentationDocument8 pagesWorld Financial Group PresentationThe Rostie Group50% (2)

- PayAssure InfomationDocument2 pagesPayAssure InfomationMun Kit100% (1)

- Aviva MySavingsPlan PDFDocument12 pagesAviva MySavingsPlan PDFKang YaoNo ratings yet

- It's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCDocument4 pagesIt's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Get Help Paying Your Medicare CostsDocument2 pagesGet Help Paying Your Medicare CostsdfdgfdfgfdfgNo ratings yet

- FIN102-Chapter 4 - Building WealthDocument20 pagesFIN102-Chapter 4 - Building WealthmartinmuebejayiNo ratings yet

- 2011 BCBS PlansGlance PDFDocument2 pages2011 BCBS PlansGlance PDFsakethram_gNo ratings yet

- Federal Budget 2021Document4 pagesFederal Budget 2021api-227304535No ratings yet

- The Story of Rising Against MarketsDocument4 pagesThe Story of Rising Against MarketsDeuterNo ratings yet

- Harvard HUDS Insurance AnalysisDocument5 pagesHarvard HUDS Insurance AnalysisMicah JohnsonNo ratings yet

- Taxes & Health Care ReformDocument1 pageTaxes & Health Care Reformmck_ndiayeNo ratings yet

- Aviva MyLongTermCare BrochureDocument18 pagesAviva MyLongTermCare BrochureHarmony TeeNo ratings yet

- 06/19 - A Two-In-One Financial SolutionDocument1 page06/19 - A Two-In-One Financial Solution10e3readingNo ratings yet

- Protect Our Care Fact SheetDocument3 pagesProtect Our Care Fact SheetWXMINo ratings yet

- Personal: As Much Tax As PossibleDocument3 pagesPersonal: As Much Tax As PossibleSathi SaranNo ratings yet

- 10 Reasons To Support The Health Care Reform BillsDocument8 pages10 Reasons To Support The Health Care Reform BillsjrodascNo ratings yet

- 13-441a English BrochureDocument16 pages13-441a English Brochureapi-97071804No ratings yet

- Health InsuranceDocument21 pagesHealth Insuranceadhitya0% (1)

- Maximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsFrom EverandMaximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsRating: 5 out of 5 stars5/5 (1)

- Health Care Reform Q&ADocument1 pageHealth Care Reform Q&ABusinessSolutionsIncNo ratings yet

- Fact Sheet - Health Care - FINALDocument6 pagesFact Sheet - Health Care - FINALsarahkliffNo ratings yet

- Go Paperless: Your 2021 Rate and Benefit UpdateDocument5 pagesGo Paperless: Your 2021 Rate and Benefit UpdateSixta Simbulan100% (1)

- Assignment Accounting and Finance For Engineers: Prof. AVVS SubbalakshmiDocument8 pagesAssignment Accounting and Finance For Engineers: Prof. AVVS SubbalakshmiNarasimha naidu ThotaNo ratings yet

- Section 80d of Income TaxDocument7 pagesSection 80d of Income TaxBAJRANG LAL AgrawalNo ratings yet

- RESP Child EducationDocument7 pagesRESP Child Educationzamai123No ratings yet

- Restaurants Facing FinesDocument3 pagesRestaurants Facing FineselkharttruthNo ratings yet

- Munn Court DocumentsDocument13 pagesMunn Court DocumentselkharttruthNo ratings yet

- Projects Identified For Regional Cities InitiativeDocument107 pagesProjects Identified For Regional Cities InitiativeelkharttruthNo ratings yet

- Projects Identified For Regional Cities InitiativeDocument107 pagesProjects Identified For Regional Cities InitiativeelkharttruthNo ratings yet

- Apollo 8 Onboard Voice TranscriptionDocument270 pagesApollo 8 Onboard Voice TranscriptionBob AndrepontNo ratings yet

- Hardin Probable Cause AffidavitDocument1 pageHardin Probable Cause AffidavitelkharttruthNo ratings yet

- ITRCC CEO Redondo's Bankruptcy StatementDocument30 pagesITRCC CEO Redondo's Bankruptcy StatementelkharttruthNo ratings yet

- LeDonne IndictmentDocument9 pagesLeDonne IndictmentelkharttruthNo ratings yet

- Ex-Crane Composites Worker's Federal Lawsuit.Document14 pagesEx-Crane Composites Worker's Federal Lawsuit.elkharttruthNo ratings yet

- Elkhart County Election Summary ReportDocument8 pagesElkhart County Election Summary ReportelkharttruthNo ratings yet

- Designing and Managing Integrated Marketing ChannelsDocument77 pagesDesigning and Managing Integrated Marketing ChannelsEucharistia Yacoba NugrahaNo ratings yet

- Setup and User Guide: Mediaaccess Tg788VnDocument120 pagesSetup and User Guide: Mediaaccess Tg788VnPNo ratings yet

- Supply Chain Management of Pizza HutDocument48 pagesSupply Chain Management of Pizza Hutjahan73% (15)

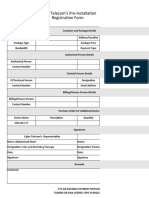

- Pre-Installation Registration FormDocument5 pagesPre-Installation Registration FormMustafa NazariNo ratings yet

- SSL TlsDocument22 pagesSSL Tlsvice pyNo ratings yet

- Wireless and Mobile Network ArchitectureDocument592 pagesWireless and Mobile Network ArchitectureMadhuri DesaiNo ratings yet

- Prem Updated ResumeDocument3 pagesPrem Updated ResumePrem KumarNo ratings yet

- FB Marketing Quotation 22 AprDocument2 pagesFB Marketing Quotation 22 AprKreatif Tuisyen100% (1)

- Initial Entry Adjusting Entry: Cash Unearned Consulting Revenue Unearned Consulting Rev Consulting RevenueDocument8 pagesInitial Entry Adjusting Entry: Cash Unearned Consulting Revenue Unearned Consulting Rev Consulting Revenuemohitgaba19No ratings yet

- Cfas ReviewerDocument6 pagesCfas ReviewerJedi Duenas100% (2)

- FTTH Network-Application of GEPON Outdoor Reserve PoE ONUDocument3 pagesFTTH Network-Application of GEPON Outdoor Reserve PoE ONUFayellaRussellNo ratings yet

- Eternal Gardens V PhilamlifeDocument3 pagesEternal Gardens V PhilamlifeDannaIngaran100% (1)

- Computer Education Class 8 - Federal BoardDocument79 pagesComputer Education Class 8 - Federal Boardshkt.ayazNo ratings yet

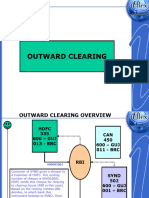

- 5-SETTLEMENT-Outward Clearing 1Document21 pages5-SETTLEMENT-Outward Clearing 1ola.cloudsNo ratings yet

- C Instant Messaging Application For The Internet of ThingsDocument4 pagesC Instant Messaging Application For The Internet of ThingsLena BojcNo ratings yet

- Cyber Security AwarenessDocument23 pagesCyber Security Awarenessnilesh100% (1)

- GSM Frequency BandsDocument2 pagesGSM Frequency Bandsamits_aumNo ratings yet

- 4.2 Student Activity PacketDocument4 pages4.2 Student Activity PacketfgonzalezNo ratings yet

- 916 3460 1 PBDocument12 pages916 3460 1 PBWiwin NovaNo ratings yet

- How To Unlock Edd CardsDocument11 pagesHow To Unlock Edd CardsotsrNo ratings yet

- Khan Sanction LetterDocument7 pagesKhan Sanction LetterArman KhanNo ratings yet

- Account Statement From 1 Aug 2018 To 31 Aug 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument6 pagesAccount Statement From 1 Aug 2018 To 31 Aug 2018: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePradeep Singh PanwarNo ratings yet

- Agriculture Bearer Plants Amendments To MFRS 116 2015 ReprintDocument4 pagesAgriculture Bearer Plants Amendments To MFRS 116 2015 ReprintTenglum LowNo ratings yet

- Caiib-Bfm-Case Studies: Dedicated To The Young and Energetic Force of BankersDocument2 pagesCaiib-Bfm-Case Studies: Dedicated To The Young and Energetic Force of BankersssssNo ratings yet

- 2nd YearDocument1 page2nd Yearredapple450413No ratings yet

- Air Logistics: BY, Aarthi Ponnusamy Shanthi PriyadarshiniDocument11 pagesAir Logistics: BY, Aarthi Ponnusamy Shanthi PriyadarshinitexcreaterNo ratings yet

- SURESH ANAND, MD M.S in MED, FACP, FCCP - American Board Allergy and ImmunologyDocument2 pagesSURESH ANAND, MD M.S in MED, FACP, FCCP - American Board Allergy and ImmunologycdeekyNo ratings yet

- Kyc Format BPCDocument2 pagesKyc Format BPCrevathy0% (1)

- Kyc Format BPCDocument2 pagesKyc Format BPCsastrylanka_1980No ratings yet

- Accounting For Developers 101Document7 pagesAccounting For Developers 101Albin StigoNo ratings yet