Professional Documents

Culture Documents

Letter From The U.S. Department of Housing and Urban Development

Uploaded by

mramos6179Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter From The U.S. Department of Housing and Urban Development

Uploaded by

mramos6179Copyright:

Available Formats

U.S.

Department of Housing and Urban Development

,

III I

I

Honolulu Field Office Region IX 1132 Bishop Street, Suite 1400 Honolulu, Hawaii 96813-4918 www.hud.gov espanol.hud.gov

June 3, 2013

The Honorable Kirk Caldwell Mayor City and County of Honolulu 530 South King Street, Room 300 Honolulu, HI 96813

Dear Mayor Caidwell SUBJECT: On-Site Program Monitoring Community Development Block Grant (CDBG) April 11-25, 2011 and May 2013 Follow-up

This is in response to the City and County of Honolulus (City) letter dated January 31, 2013, regarding its subrecipient, Opportunities and Resources, Inc. (ORI) Anuenue Hale, and its two projects known as the Anuenue Hale Aloha Gardens project and the Camp Pineapple 808 project. In April 2011, the HUD Honolulu Field Office conducted an on-site monitoring of the Citys CDBG program. The review focused on four areas of compliance: (1) property acquisition and use; (2) record keeping; (3) public service costs; (4) financial management and oversight. The monitoring and follow-up monitoring resulted in eight findings related to ORI and two conflict of interest issues involving City management and staff. The attached enclosure summarizes HUDs findings and the recommended corrective actions in accordance with 24 CFR 570.9 10. A finding is a determination of non-compliance with a program regulation and requires corrective action. A concern is a deficiency in program performance; a concern is not statutory, regulatory, or a program requirement. To close the finding noted herein and the 2011 open ORI finding, the City has 45 days from the date of this letter to comply with the corrective actions. As part of HUDs on-going efforts to assist the City in managing its CDBG funds HUD selected the National Association for Latino Community Asset Builders (NALCAB), a HUD has approved CDBG technical assistant provider, to provide CDBG technical assistance to the City. The NALCAB has made initial contacts with Ms. Holly Kawano of your staff to arrange the technical assistance. HUD anticipates the NALCAB will begin its on-site technical assistance late June or early July 2013.

The Honolulu Field Office appreciates the cooperation and courtesy provided by your staff during the reviews and are available to provide program technical assistance as needed. If you have any questions regarding this report, please call me at (808) 457-4678. Sincerely,

Mark A. Chandler Director Community Planning and Development HUD Honolulu Field Office Enclosure cc: Mr. Nelson Koyanagi (w/enclosure) Director, Acting Department of Budget and Fiscal Services City and County of Honolulu 530 South King Street, Room 208 Honolulu, HI 96813 Ms. Pamela Witty Oakland (w/enclosure) Director Designate Department of Community Services City and County of Honolulu 715 South King Street, Room 311 Honolulu, HI 96813 Ms. Holly Kawano (w/enclosure) Federal Grants Coordinator Department of Budget and Fiscal Services City and County of Honolulu 530 South King Street, Room 208 Honolulu, HI 96813

Enclosure MONITORING REPORT

-

May 2013

This report is based on documentation provided by the Citys Department of Budget and Fiscal Services including letters dated April 5, 2012, July 31, 2012, October 31, 2012, and January 31, 2013, regarding open monitoring findings related to the Citys subrecipient Opportunities and Resources, Inc. (ORI) Anuenue Hale. ORI received CDBG assistance to develop the Aloha Gardens Project with two facilities (Wellness Center and Camp Pineapple 808). Both facilities have failed to meet the CDBG Program national objective requirement. HUD has also advised the City of additional project issues that are of major concern and so noted in this report. CPD Finding 1: Non-Compliance with a CDBG National Objective In 2003, the Citys subrecipient, ORI, used CDBG funds to acquire 30 acres of land and construct the Aloha Gardens Wellness Center and the Camp Pineapple 808 facilities. Acquisition is an eligible CDBG activity under 24 CFR 570.20 1(a). The purpose of the facilities was to serve elderly and developmentally disabled persons, which are presumed benefit categories under the CDBG national objectives at 24 CFR 570.208(a)(2). Despite the proposed compliance with the national objective, ORI used and marketed Camp Pineapple 808 to individuals and organizations that did not exclusively serve the elderly and disabled. The Weilness Center was also underutilized in this regard. Criteria: This activity does not qualify under the national objective of limited clientele presumed benefit. In order to meet this requirement, an activity must exclusively serve a group of persons in the following categories: abused children, battered spouses, elderly persons, adults meeting the Bureau of Census Current Population Reports definition of severely disabled, homeless persons, illiterate adults, persons living with AIDS, and migrant farm workers, as set forth in 24 CFR 570.208(a)(2)(A). Condition: HUD acknowledges that the City has worked with ORI for the last two years in an attempt to increase the appropriate use of Aloha Gardens (Weilness Center and Camp Pineapple 808 facilities) to ensure compliance with the CDBG national objective of serving the elderly and developmentally disabled adults. The City indicated that ORI provides services to a sufficient number of seniors and clients with disabilities at the Wellness Center. In addition, the City has confirmed that Camp Pineapple 808 has served more clients by moving day clients from the Wellness Center to Camp Pineapple 808.

For the quarters ending June 30 thru December 2012, the City reported Camp Pineapple 808 use as follows: 1. Increased its number of overnight eligible clients to 30 users per month, but the use was primarily day usage. 2. The actual overnight usage by the eligible clients was 56 clients for two overnight stays in July, 3. No actual overnight use in August and September 2012, and 4. Fifty-six (56) clients used the facility for two overnight stays in November 2012. Based on these facts, ORI failed to meet the 25-person per-night standard used to justify the CDBG eligibility of the projects. In May 2013 HUD noted, ORI reinstated its marketing of Camp Pineapple 808 to the public for weddings, parties, banquets, fundraisers, corporate retreats, conferences and family reunions despite failing to meet a CDBG national objective and in direct conflict of its CDBG subrecipient agreement. ORIs advertisement can be found easily on the on the internet at www.carnppineapple808.com and is being implemented at the same time the City is reportedly conducting regular ORI CDBG compliance reviews. ORIs noncompliance and the Citys failure to report the noncompliance raising serious questions about the Citys ORI CDBG compliance reviews.

Cause:

Since 2003, the City and ORI have documented ORIs obligation to comply with the CDBG requirements related to the CDBG national objective and eligible use requirements for the CDBG-assisted Aloha Gardens facilities. The City wrote ORI reminding it of its obligation to serve exclusively the elderly and disabled persons, and ORI regularly acknowledged these requirements. However, the City took and continues to take no action to enforce its written requirements and ORI operated and continues to operate the facilities in non-compliance with the CDBG national objectives requirements.

Effect:

After extensive follow-up analysis of the Citys ORI Aloha Gardens project records, staff and management interviews, and Aloha Gardens program implementation over the last seven to ten years, HUD has concluded that there is insufficient documentation or records to demonstrate program compliance with a national objectives as required by 24 CFR 570.208, and 570.506. Additionally, records available support the conclusion that the City will not enforce and take action to ensure CDBG program compliance on ORIs CDBG assisted projects.

Corrective Action: 1. The City is advised to reimburse its CDBG program $7,924,850 with non-federal funds. 2. Until the funds are repaid to the CDBG program the City must record the $7,924,850 payable to the CDBG program as an accounts payable in its accounting records for disallowed program costs. 3. Upon receipt of the funds into the Citys local CDBG account, the City must revise the IDIS draws and cancel the Aloha Gardens activities. The funds shall be noted as a return of grant funds and must be promptly reprogrammed for other CDBG-eligible activities.

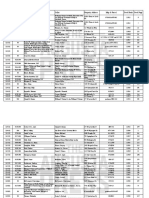

CPD Finding 2: Acquisition and Construction Payments Criteria: HUD regulations at 24 CFR 570.506(h) require grantees to maintain documentation of financial records in accordance with the requirements at 24 CFR 570.502(b). This includes records of a subrecipients CDBG expenditures. Such documentation must include, to the extent applicable, invoices, schedules containing comparisons of budgeted amounts and actual expenditures, construction progress payments (signed by appropriate parties, e.g., general contractor and/or a project architect), and/or other financial documentation appropriate to the nature of the activity. In accordance with 24 CFR 570.502 and 503 CDBG recipient and subrecipients are required to comply with uniform administrative requirements and cost principles in their expenditure of CDBG funds. All cost reimbursements are subject to federal cost principles applicable to the particular organization, If a sub-award is provided to a non-profit organization, Circular A-122 shall apply; if a sub-award is provided to a State or local government, Circular A-87 shall apply. Costs must be allowable, reasonable, and allocable. Condition: The City authorized $7,924,850 in CDBG payments for the Aloha Gardens project. Analysis of the payments (Table 1) revealed construction contract payments for the Aloha Gardens project included work that did not pertain to CDBG activities/projects. ORI used CDBG funds to pay for costs not associated with the CDBG-assisted Aloha Gardens project, payment requests were not detailed enough to confirm the costs were attributable to the CDBG-assisted sites and therefore, these costs are disallowed. Cause: The City did not have adequate oversight of the Aloha Gardens project. Contracts and payment requests that included CDBG and non-CDBG sites usually did not break down the cost between the sites and, on occasion, ORI submitted to the City payment application numbers for construction related costs that were not sequential or were missing from the Citys files. Effect: The Citys processing of misidentified project sites and failure to identify sites properly raise serious concerns about the reliability of the CDBG payments, prevent CDBG fund accountability, and raise the likelihood of duplicate/overlapping payments. In addition, the City and ORIs use of CDBG funds on the private residence and ORI Housing Duplex subject these properties to CDBG program requirements. Corrective Action: Resolution of this finding is subject to completion of the corrective action in Finding 1.

Table 1 Aloha Gardens: Summary of Cost Analysis

Issue Contract documents for the CDBG assisted ALoha Gardens projects (Wellness Center and Campground) specifically identified Property Tax Map Keys (TMK) 6-4-03-013. ORI requested and the City approved the use of CDBG funds for expense documents identified with TMK 6-4-003:002, a Helemano Plantation identified property. Expenses included mass grading for 40 acres (30 acres designated CDBG and 10 acres designated ORI) and other costs not easily identifiable to a specific project or facility.

Site Description

TMK 6-4-003:002

Total Payment $2,5 16,71194

Unidentified Site

$1,604,284.01

TMK 6-4-003:013

$923,589.09

TMK 6-4-003:003

$763,483.87

TMK 6-4-003:011

$597,780.48

CDBG expenses not easily identifiable to a specific project or facility but includes costs for ORIs housing duplex ($6,751), contractor office equipment, contractor office supplies, consultant fees and various planning meetings costs. TMK 6-4-003:013 is associate with the Aloha Gardens project, however expenses include approximately $85,000 in administrative fees charged by the contractor and $275 for vegetation control for a private property near Pearl Harbor. TMK 6-4-003:003 is associate with the Aloha Gardens project and is the original TMK for the acquisition of the 40 acres acquired by ORI (30 acres designated CDBG and 10 acres designated ORI). Expenses include $751,737 for the CDBG portion of the site and $11,747 in costs not identifiable to a specific project or facility. TMK 6-4-003:011 is the original TMK for a CDBG acquired parking lot next to and used by Helemano Plantation. The Citys Department of Planning and Permitting identified the parking lot as illegal. The Citys Department of Community Services advised ORI of the parking lot status and encouraged the removal of the parking lot. ORI agreed to remove the parking lot but instead retained the parking lot. The City did not enforce its own requirements to remove the parking lot despite having knowledge of the ORI violation. The use of CDBG funds to acquire property considered illegal by the City at a value of a legally permitted property resulted in an overpayment and ineligible use of CDBG funds. The $551,899.58 in administration expenses are a mixture of construction costs related to administrative spaces and contractor administrative fees added on to the construction bill. The documentation is insufficient to confirm whether the expenses are CDBG eligible or costs related to ORIs non-CDBG projects.

Administration

$551,899.58

Campground Wellness Center Aloha Gardens

$410,446.40 $323,259.42 $134,635.10

ORI

$74,445.23

Miscellaneous

$8,042.88

Vocational Center Environmental Helemano Total

$7,919.50 $4,850.25 $3,501.25 $7,924 85000

Expenses related to the campground construction but include contractor administrative fee charges. Expenses related to the weilness center construction. With the exception of a $16,562 expense, the documentation identified as Aloha Gardens is insufficient to confirm whether the expenses are CDBG eligible or costs related to ORIs non-CDBG projects. Expenses are generally consultant and engineering fees. The documentation is insufficient to confirm whether the expenses are CDBG eligible or costs related to ORIs non-CDBG projects. The documentation is insufficient to confirm whether the expenses are CDBG eligible or costs related to ORIs non-CDBG projects. Cost appears related to ORIs vocational food facility, not the Aloha Gardens Project. Expenses related to an environmental assessment. Costs related to Helemano Plantation subdivision, zone changes and special use permit.

CPD Finding 3: Property Acquisition Criteria:

Unpermitted Parking Lot

As set forth in 24 CFR 570.502 and 503, CDBG grantees and subrecipients must comply with the policies, guidelines, and requirements of the uniform administrative requirements codified at 24 CFR 85 for governments and 24 CFR 84 for nonprofits, and the costs principles in 0MB Circulars A-87 for governments and A-122 for nonprofits. Costs must be allowable, reasonable, and allocable to federal funds.

Condition:

The City authorized ORI to acquire a, City Department of Planning and Permitting identified illegal, three-acre parking lot adjacent to ORIs Planation Hale project with CDBG funds for a training facility for mentally challenge clients. In April and December 2003, the Citys Department of Community Services affirmed the unpermitted status of the parking lot and notified ORI that property could only be used for ingress and egress. The ORI acknowledged and agreed to replace the parking lot with landscaping but reversed its decision and kept the parking lot, in spite of being in violation of the Citys permits.

Cause:

The City took no action toward enforcing its own land-use requirements, thus allowing the parking lot acquisition to proceed as if it were a permitted parking lot. The City did not act to enforce the CDBG or its local requirements.

Effect:

The City and ORI knowingly used $597,780 in CDBG funds to acquire property in violation of local land-use law resulting in an overpayment and ineligible use of CDBG funds.

Corrective Action:

Resolution of this finding is subject to the corrective action in Finding 1.

CPD Finding 4: Property Acquisition Criteria:

Cost Reasonableness

CDBG regulations at 24 CFR 570.6 10 require CDBG grantees and subrecipients to comply with uniform administrative requirements and cost principles as set forth at 24 CFR 570.202. All cost reimbursements are subject to those federal cost principles applicable to the particular organization. If a sub-award is to a non-profit organization, Circular A-122 shall apply; if a sub-award is to a State or local government, Circular A-87 shall apply. Costs must be allowable, reasonable, and allocable. Grantees and subrecipients must establish the costs basis for real property transactions and are advised by HUD to obtain appraisals of the market value of the property to determine the cost-reasonableness of the asking price or proposed sales offer price. Appraisals must meet requirements of 49 CFR 24.103. There is a three-step process for determining just compensation: 1. Appraiser estimates propertys fair market value; 2. Review appraiser evaluates appraisal; used as basis for estimate of just compensation; and 3. Agency establishes the estimate of just compensation to be offered (may not be less than the approved fair market value). Condition: The City authorized a $597,780 CDBG payment for an unpermitted parking lot, failed to ensure the property appraisal was based on the City permitted use of the site (agricultural), and permitted ORI to use CDBG funds to pay nearly eight (8) times the cost of a similarly zoned property adjoining the site. Cause: Based on records available for review it appears the City and ORI did not notify the appraiser that the parking lot was unpermitted even though the City documented and advised ORI that the parking lot had to be removed and that the three acres could only be used for ingress and egress to the Helemano training facility. Effect: It is appears the City and ORI used CDBG funds to pay more than the fair-market value for the acquired property, raising serious questions about the City and ORIs use of CDBG funds. Corrective Action: Resolution of this finding is subject to the corrective action in Finding 1.

Public Service Costs

In addition to the $7.9 million in CDBG funds to construct the Aloha Gardens project, the City awarded CDBG public service funds to ORI to provide services to persons with physical and mental disabilities. HUD s review of the Citys CDBG public service agreements with ORI and CDBG expenses revealed issues resulting in the CDBG program finding below.

CPD FindingS: Public Service Costs and Expenditures Criteria: In accordance with 24 CFR 570.506(h) grantees are required to maintain evidence to support how subrecipients use CDBG funds. Such documentation must include, to the extent applicable, invoices, schedules containing comparisons of budgeted amounts and actual expenditures, construction progress schedules signed by appropriate parties (e.g., general contractor and/or a project architect), and/or other documentation appropriate to the nature of the activity.

CDBG regulations at 24 CFR 570.6 10 require CDBG grantees and subrecipients to

comply with uniform administrative requirements and cost principles in their expenditure of CDBG funds. All cost reimbursements are subject to those federal cost principles applicable to the particular organization. If a sub-award is to a non-profit organization, Circular A-122 shall apply; if a sub-award is to a State or local government, Circular A-87 shall apply. Costs must be allowable, reasonable, and allocable.

Condition:

HUDs follow-up review of the Citys public service subrecipient agreements with ORI revealed that the City authorized payment to ORI for questionable and ineligible CDBG expenses, as follows:

City Subrecipient Contract # F76820 F76820 F76820 F84461 FY2004 F84461 FY2004 F84461 PY2004 F84461 FY2004 F84461 FY2004 F84461 FY2004 P84461 FY2006 F84461 FY2006 F8446 1 FY2006 F8446 1 FY2006 F8446 1 FY2006 Total Ineligible & Questionable Cost

-

Expense Grant Research Start Up Administration Office Rent Office Supplies Auto Lease Auto Insurance Medical Clerk Medical Director/Consultants Office Rent Office Supplies Auto Lease Auto Insurance Medical Director/Consultants

Amount $6.000.00 $25,000.00 $20,000.00 $37,800.00 $12,000.00 $12,000.00 $2,500.00 $21,600.00 $45,449.00 $18,900.00 $2,931.00 $7,200.00 $300.00 $15,000.00 $226,680

Public Service Cost Eligibilit Ineligible Questionable Ineligible Questionable Questionable Ineligible Ineligible Questionable Questionable Questionable Questionable Ineligible Ineligible Questionable

Cause: Analysis of the Citys records revealed that the City did not analyzed ORIs proposed CDBG public service budget for program eligibility and cost reasonableness. As a result, the City authorized, through budgets incorporated as part of the ORI public service subrecipient agreement, ineligible and questionable CDBG expenses. Effect: The Citys records fail to demonstrate that payments to ORI under the public service subrecipient agreements were direct costs for implementing a public service activity, resulting in ineligible and questionable CDBG program payments that include, but are not limited to, grant research and management fees. Corrective Action: The City needs to reimburse, with non-federal funds, the CDBG program for $226,680 or provide supporting documentation for the eligibility of the CDBG expenditures on the public services costs identified by HUD as ineligible or questionable.

10

Loan Forgiveness

In addition to the $7.9 million in CDBG funds to construct the Aloha Gardens project, the City awarded and loaned $815,000 and $350,000 in 1989 and 1995, respectively, in CDBG funds to ORI for its Helemano Planation facilities to provide services to persons with physical and mental disabilities. On July 26, 2010, and October 15, 2010, the $815,000 and $350,000 loan agreements were amended to forgive ORI of its CDBG debt. On April 26, 2011, the City officially canceled the notes payable. HUDs review of the Citys CDBG loan forgiveness revealed issues resulting in the CDBG program finding below.

CDBG Finding 6: Loan Forgiveness Criteria:

CDBG grantees are responsible for ensuring that CDBG funds are used in accordance with program requirements, 24 CFR 570.50 1(b). Grantees need to have systems and procedures in place for the overall management of the CDBG program. Grantees must also provide for and encourage citizens to participate in the development of any consolidated plan and action plan, any substantial amendment to the consolidated plan and action plan, and the performance report in accordance with 24 CFR 9 1.105. Finally, grantees must comply with HUDs conflict of interest requirements in accordance with 24 CFR 570.611(b) by preventing employees and elected officials with potential conflict of interests from exercising any function and authority over CDBG activities.

Condition:

The City made a decision to forgive ORI nearly $1.2 million in CDBG loans in which City employees, running for elected office, were directly involved in approving, developing, or recommending the ORI CDBG loan forgiveness while receiving campaign donations from ORI representatives. The financial relationship with ORI and City staff created a CDBG conflict of interest situation. The Citys decision to forgive ORI was out of the ordinary, not consistent with the Citys practice to deny loan forgiveness, and processed without established loan forgiven procedures raises further questions related to the conflict of interest and the decision to forgive ORIs CDBG loans.

Cause:

CDBG regulations do not prevent the City from deciding to change a CDBG loan to a grant; however, the City is required to follow grants management, citizen participation, and conflict of interest requirements. City management did not follow the requirements and decided to forgive ORIs CDBG loans despite the concerns raised by the Citys Budget Director in a December 18, 2009, memorandum that: Noted loan forgiveness is not the normal position of Department of Community Services and raises concerns of favoritism and access to federal funds; and

11

Suggested avoid being unfair to projects by considering forgiving loans going forward and not forgive repayments that are already owed The Citys failure to follow the CDBG process supports the Citys Budget Directors concerns of favoritism and access to federal funds, especially given the fact that the forgiveness was finalized immediately after an election in which a conflict of interest existed.

Effect:

The Citys decision to forgive ORIs $1.2 million loan and not follow the citizen participation and conflict of interest requirements resulted in the loss of $1.2 million in potential CDBG program income that could have been used for other CDBG projects to support the Citys low- and moderate-income citizens.

Corrective Action:

1. The City needs to, immediately, reinstate the ORI loans and interest due until it issues a public notice and complies with the 30-day comment period advising the public of the Citys ORI loan forgiveness, including the total amount forgiven (loan and interest) and the situation involving the ORJJCity conflict of interest. 2. The City needs to provide HUD with a copy of the public notice and accounting entries reinstating the ORI CDBG loan and interest account payable addressing Corrective Action 1 above. 3. The City needs to provide a copy of the Citys loan forgiveness policy to its subrecipients that currently have an outstanding CDBG loan with the City and provide HUD with a copy of the subrecipients written receipt of the policy.

12

CPD Concern 1: Failure to Follow Up on Possible Program Violations Criteria:

As a recipient of CDBG funds, the City is obligated to administer its grant in accordance with Subpart J, Grant Administration [24 CFR 570.500 series], and Subpart K, Other Federal Requirements [24 CFR 570.600 series], and related provisions.

Condition:

HUD found many questionable management decisions regarding the Citys oversight of ORI that revealed the Citys standard oversight and enforcement practice towards ORT was a limited or no action approach toward program enforcement. A few of the no action issues are as follows: The City files contained a September 22, 2004 letter from ORI documenting that it had negotiated a $90,000 payment from the contractor in exchange for a $5.3 million CDBG contract. Despite possible violation of the anti-kickback of the CDBG program, the City took no action to address the issue until HUD, after obtaining the document, provided a copy to the letter to the Citys Budget Director nearly seven (7) years after the City received the ORI letter. The Citys Department of Planning and Permitting (DPP) advised the Citys Department of Community Services (DCS) that the Parking Lot acquired by ORI (using CDBG funds) was illegal and would fall under the 15-acre Special Use Permit (SUP) limitations and recommended that the parking lot be eliminated. Despite ORIs agreement to the terms of the SUP, on or about August 30, 2004, ORI decided to keep the parking lot against the terms established by the City and the SUP and advised DCS of its decision. DCS took no action against ORI to enforce the Citys own SUP requirements despite knowledge of the Citys position that the parking lot is illegal. In 2004 and 2007, the City reviewed ORI but failed to identify any noncompliance issues although the Citys own files contained many documented noncompliance issues.

Cause:

ORI has maintained significant support over many years by the direct involvement of high ranking City and State officials regarding ORI s projects. The direct involvement of the officials appears to have placed pressure on staff resulting in the City ignoring regulatory violations in favor of completing the project and satisfying ORIs requests.

Effect:

The City cannot assure future ORI CDBG program compliance based on the Citys history of implementing a non-enforcement approach towards ORI.

13

Corrective Action: 1. The City needs to ensure proper authorities are reviewing the possible kickback situation. 2. The City needs to train current City officials, staff, and management, including but not limited to, individuals that have and had a direct role in the oversight of the ORI Aloha Gardens project on the Copeland Anti-Kickback Act 18 USC 874. 3. The City needs to establish a system that will ensure subrecipient compliance with CPD program requirements, as measured through a decrease in non-compliance CPD program findings for the City and its subrecipients.

14

Concern 2: Records Missing and Withheld Criteria: HUD regulations found at 24 CFR 85.42(e) require grantees and subgrantees to provide access to records by the awarding agency and Comptroller General of United States, or any of their authorized representatives. HUD has the right of access to any books, documents, papers, or other records of grantees and subgrantees, which are pertinent to the grant, in order to review audits, examinations, excerpts, and transcripts, and draw conclusions regarding questionable costs. CDBG regulations at 24 CFR 570.506 require grantees to maintain records providing a full description of each activity assisted with CDBG funds. The records must demonstrate that each activity undertaken meets one of the criteria for national objective set forth in 24 CFR 570.208. Condition: During the follow up monitoring the City withheld documents from HUD claiming attorney-client privilege, and limited HUDs access to some of the Citys files. Given the lack of documentation, HUD was unable to determine the exact circumstances that caused the City to alter its long-standing policy to not approve requests for CDBG loan forgiveness in favor of forgiving $1.2 million in CDBG loans to ORI. HUD found that the City could not initially produce the entire ORI Aloha Garden project files. City staff confirmed that 40 to 50 percent of the records were missing when initially provided to HUD. After HUD inquired several times about the lack of ORI records and noted that the lack of records was out of character for the City, the City discovered more than four boxes of records in a storage complex and produced them for HUDs review. The records produced contained gaps in information that occasionally spanned years and were insufficient to demonstrate that the City reviewed expenditures for program eligibility. When questioned about the poor record keeping City management agreed that records management needed improvement. Management suggested that the City could develop a system similar to the system used by the State of Hawaii Attorney Generals Office, which has a central electronic based system that tracks and scans all incoming, outgoing, and internal communications (email, memos, letters, etc.) and is accessible by all staff involved in the project. Cause: The Citys claim to withhold CDBG records from HUD by citing attorney-client privilege in direct conflict of the CDBG program regulations. Additionally, the Citys CDBG project management is split between three and, in some cases four or five different divisions/departments. Finally, files created by the individual divisions/departments were not regularly shared between the divisions/departments.

15

Although the City has attempted over several years to address file management issues, the attempts did not improve the Citys project file management because the system lacks a central project documentation filing system that allows for cross divisionldepartment file access. Additionally, the system lacks the ability to track and scan all incoming, outgoing, and internal communications (email, memos, letters, etc.) to ensure a complete, and accurate project file and prevent the temporary or permanent loss of the project files.

Effect:

The Citys initial lack of or missing ORI records and decision to prevent HUDs unencumbered review of the records reduces the Citys ability to assure HUD that it is implementing the CDBG program within regulatory compliance and raises concerns about the integrity of the Citys ORI records and the Citys overall recordkeeping system.

Corrective Action:

1. The City must notify all subrecipients in writing of the subrecipients obligation to provide HUD access to their records and that failure to do so is a violation of program regulations that could result in disallowance of the subrecipients CPD funds. 2. The City must provide HUD with a listing of the subrecipients notified and a copy of the notice provided to the subrecipients. 3. The City needs to establish a centralized records system for documenting all grants management activity. Until the City establishes a centralized records system, the City needs to maintain all documents generated for a CPD Annual Action Plan Activity (CDBG, HOME, HOPWA and ESG), regardless of the City division creating the document, within the department responsible for developing and submitting the Citys Annual Action Plan (currently Budget and Fiscal Services).

You might also like

- Recreation Facility PlanDocument54 pagesRecreation Facility PlanviharlanyaNo ratings yet

- Forensic Audit of Housing Choice Voucher (HCV) Settlement With Housing Authority of DeKalb County (HADC)Document21 pagesForensic Audit of Housing Choice Voucher (HCV) Settlement With Housing Authority of DeKalb County (HADC)Viola DavisNo ratings yet

- Laser Engraving Manual PDFDocument21 pagesLaser Engraving Manual PDFarturo0diaz_1No ratings yet

- Sample MOADocument8 pagesSample MOAStewart Paul TorreNo ratings yet

- Ebralinag vs. Division Superintendent of CebuDocument1 pageEbralinag vs. Division Superintendent of CebuVin LacsieNo ratings yet

- CassavaKroepeck Pilar 2010Document6 pagesCassavaKroepeck Pilar 2010Anonymous yIlaBBQQNo ratings yet

- Multi Use Sports Complex Planning StudyDocument182 pagesMulti Use Sports Complex Planning StudyAwais AjmalNo ratings yet

- 09 Rec Centre CharterDocument12 pages09 Rec Centre CharterMohab NegmNo ratings yet

- Philippines: Public-Private Partnerships by Local Government UnitsFrom EverandPhilippines: Public-Private Partnerships by Local Government UnitsNo ratings yet

- Project ProposalDocument3 pagesProject ProposalJoshua Keanu83% (6)

- AD VII Housing Mo14Document8 pagesAD VII Housing Mo14Sanmarga MitraNo ratings yet

- Hallandale Beach CRA Investigation by Broward OIGDocument300 pagesHallandale Beach CRA Investigation by Broward OIGMedia Trackers FloridaNo ratings yet

- Notice U/s. 138 of N. I. Act by R.P.A.D.: Disha Enterprise Gujarati Galii, Hanuman Chwok, Ganj Golai, LaturDocument3 pagesNotice U/s. 138 of N. I. Act by R.P.A.D.: Disha Enterprise Gujarati Galii, Hanuman Chwok, Ganj Golai, LaturAdv Prashantb JadhavNo ratings yet

- StatCon Latin MaximsDocument3 pagesStatCon Latin MaximsJason CertezaNo ratings yet

- Author Agent AgreementDocument3 pagesAuthor Agent Agreementapi-276184973100% (1)

- Final SAMPLE Proposal Format Final For KKB CFW For PWDDocument6 pagesFinal SAMPLE Proposal Format Final For KKB CFW For PWDNI Ca Grace TabujaraNo ratings yet

- Ucp Article 38-39 - PDFDocument62 pagesUcp Article 38-39 - PDFIqbal HossainNo ratings yet

- Taxation Law ProjectDocument20 pagesTaxation Law ProjectJain Rajat ChopraNo ratings yet

- City Letter To HUD Re: ORI With ExhibitsDocument148 pagesCity Letter To HUD Re: ORI With ExhibitsHonolulu Star-AdvertiserNo ratings yet

- Informe Inspector General Vivienda Mayaguez 2011Document52 pagesInforme Inspector General Vivienda Mayaguez 2011Oscar J. SerranoNo ratings yet

- 2010 Nofa Training: West Virginia Coalition To End Homelessness Anna Burns, TrainerDocument69 pages2010 Nofa Training: West Virginia Coalition To End Homelessness Anna Burns, TrainerZach BrownNo ratings yet

- UMWAD Project Newsletter April 2010Document5 pagesUMWAD Project Newsletter April 2010Handicap International - PhilippinesNo ratings yet

- Ha20211020cb4 1655 1 eDocument6 pagesHa20211020cb4 1655 1 eJonathan LONo ratings yet

- The Consolidated Government of Columbus, Georgia: Consolidated Annual Performance and Evaluation Report 2005-2006Document15 pagesThe Consolidated Government of Columbus, Georgia: Consolidated Annual Performance and Evaluation Report 2005-2006Paul CowartNo ratings yet

- 2015 Legislative Wrap-UpDocument4 pages2015 Legislative Wrap-UprepjordanNo ratings yet

- 2011-2016 Legislative Accomplishments For District 44Document2 pages2011-2016 Legislative Accomplishments For District 44repjordanNo ratings yet

- HUD Monitoring North Miami Letter Sept 2012Document9 pagesHUD Monitoring North Miami Letter Sept 2012Scott GalvinNo ratings yet

- Goals and Objectives1Document5 pagesGoals and Objectives1Sudharsanamurthy PunniamurthyNo ratings yet

- Pocketof Poverty Funds Info SheetDocument2 pagesPocketof Poverty Funds Info SheetBurque MediaNo ratings yet

- Making Resettlement Work Through Partnerships: Project SnapshotDocument11 pagesMaking Resettlement Work Through Partnerships: Project SnapshotArt MacNo ratings yet

- Long Beach Civic Center RFP Consultant Agenda Item (Dec. 3, 2013)Document4 pagesLong Beach Civic Center RFP Consultant Agenda Item (Dec. 3, 2013)Anonymous 3qqTNAAOQNo ratings yet

- Housing & Urban Development Corporation Ltd. Citizen's CharterDocument7 pagesHousing & Urban Development Corporation Ltd. Citizen's CharterShivani SoniNo ratings yet

- Olene Walker Housing Loan Fund 2011 Annual ReportDocument22 pagesOlene Walker Housing Loan Fund 2011 Annual ReportState of UtahNo ratings yet

- Carroll Park ReportDocument22 pagesCarroll Park ReportChris BerinatoNo ratings yet

- Rep. Jordan Newsletter March 2012Document4 pagesRep. Jordan Newsletter March 2012Thelma DreyerNo ratings yet

- DHHL Acquisition of Mō Ili Ili PropertiesDocument6 pagesDHHL Acquisition of Mō Ili Ili PropertiesHPR NewsNo ratings yet

- Fund For Local Cooperation (FLC) : Application FormDocument9 pagesFund For Local Cooperation (FLC) : Application FormsimbiroNo ratings yet

- Project Development Plan-2nd Draft DK (1) Final DraftDocument16 pagesProject Development Plan-2nd Draft DK (1) Final DraftShane GibsonNo ratings yet

- St. Bernard Parish Current LLT Disposition PlanDocument19 pagesSt. Bernard Parish Current LLT Disposition PlanbblochnolaNo ratings yet

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- Liaison OfficerDocument4 pagesLiaison Officerhelga armstrongNo ratings yet

- Revised Chapter - 1Document6 pagesRevised Chapter - 1tanziNo ratings yet

- Dossier SogeBank - USAIDDocument17 pagesDossier SogeBank - USAIDjean_juniorjNo ratings yet

- Final Draft of Toledo City LSPDocument21 pagesFinal Draft of Toledo City LSPapi-194560166No ratings yet

- LMU Board Meeting October 3, 2013 Agenda PacketDocument12 pagesLMU Board Meeting October 3, 2013 Agenda PacketOaklandCBDsNo ratings yet

- Business Plan: Town of Bridgewater & Municipality of The District of LunenburgDocument50 pagesBusiness Plan: Town of Bridgewater & Municipality of The District of Lunenburgthelma_puraNo ratings yet

- UNDP - LA - GPAR - Strengtheing Capacity - 2012Document2 pagesUNDP - LA - GPAR - Strengtheing Capacity - 2012Ela MaeNo ratings yet

- Highlights: What We Audited and WhyDocument59 pagesHighlights: What We Audited and WhyTexas WatchdogNo ratings yet

- CO-Memo - Call For Submission-Practices-NUA-SDGsDocument15 pagesCO-Memo - Call For Submission-Practices-NUA-SDGsNicklaus GalvanNo ratings yet

- DC GeneralDocument15 pagesDC GeneralThe Washington PostNo ratings yet

- Spec Report eDocument14 pagesSpec Report eSt. Catharines StandardNo ratings yet

- 014 ScarDocument108 pages014 ScartatonyNo ratings yet

- Submission 81 Kainga Ora - Homes and Communities (Full Set 122MB)Document352 pagesSubmission 81 Kainga Ora - Homes and Communities (Full Set 122MB)Stuff NewsroomNo ratings yet

- City Council AgendaDocument21 pagesCity Council AgendawakeactiveNo ratings yet

- International AssDocument50 pagesInternational AssIsuu JobsNo ratings yet

- Multi Purpose HallDocument6 pagesMulti Purpose Hallmegumik136No ratings yet

- Special Assembly Meeting - Property Acquisition AO 2020-66Document67 pagesSpecial Assembly Meeting - Property Acquisition AO 2020-66Matt LesemanNo ratings yet

- Housing Finance & Regulatory Affairs: David L. Ledford Senior Vice PresidentDocument14 pagesHousing Finance & Regulatory Affairs: David L. Ledford Senior Vice PresidentMatthew ConnorNo ratings yet

- Hawkesbury Community Care Forum - Q and ADocument4 pagesHawkesbury Community Care Forum - Q and Awscf_auNo ratings yet

- Project Data Sheet: PDS Creation DateDocument4 pagesProject Data Sheet: PDS Creation DateJojo Aboyme CorcillesNo ratings yet

- Staff Report Action Required: Date: To: From: Wards: Reference NumberDocument4 pagesStaff Report Action Required: Date: To: From: Wards: Reference NumberarthurmathieuNo ratings yet

- Sia Case StudyDocument33 pagesSia Case Studybipasha0212No ratings yet

- HomelessReport 2012Document16 pagesHomelessReport 2012Honolulu Star-AdvertiserNo ratings yet

- Department of Public Works and Highways Iloilo City, Philippines Japan Bank For International CooperationDocument8 pagesDepartment of Public Works and Highways Iloilo City, Philippines Japan Bank For International CooperationStewart Paul TorreNo ratings yet

- 2013 Esg Application July 2013Document20 pages2013 Esg Application July 2013api-250852009No ratings yet

- The Emergence of Pacific Urban Villages: Urbanization Trends in the Pacific IslandsFrom EverandThe Emergence of Pacific Urban Villages: Urbanization Trends in the Pacific IslandsNo ratings yet

- All State 2013, 2 of 2Document1 pageAll State 2013, 2 of 2mramos6179No ratings yet

- Strategic Plan For UH AthleticsDocument8 pagesStrategic Plan For UH Athleticsmramos6179No ratings yet

- All State 2013, 1 of 2Document1 pageAll State 2013, 1 of 2mramos6179No ratings yet

- County Attorney Opinion PDFDocument70 pagesCounty Attorney Opinion PDFmramos6179No ratings yet

- Letter From Attorney General David LouieDocument5 pagesLetter From Attorney General David Louiemramos6179No ratings yet

- Kauai Mayor Transmittal Letter Bill 2491 PDFDocument4 pagesKauai Mayor Transmittal Letter Bill 2491 PDFmramos6179No ratings yet

- Kalima V State - HIFO DecisionDocument18 pagesKalima V State - HIFO Decisionmramos6179No ratings yet

- Apology by Rep. Faye Hanohano Delivered On The Floor of The State House of RepresentativesDocument1 pageApology by Rep. Faye Hanohano Delivered On The Floor of The State House of Representativesmramos6179No ratings yet

- HHSAA Swimming and Diving Results - Day 1Document9 pagesHHSAA Swimming and Diving Results - Day 1mramos6179No ratings yet

- 2013 JBF SemifinalistsDocument9 pages2013 JBF SemifinalistsPulseHNLNo ratings yet

- Race To The Top Hawaii Report Year 2 (School Year 2011-2012)Document23 pagesRace To The Top Hawaii Report Year 2 (School Year 2011-2012)mramos6179No ratings yet

- Race To The Top Year 2, Hawaii SummeryDocument2 pagesRace To The Top Year 2, Hawaii Summerymramos6179No ratings yet

- Press Release: State Urges HSTA To Make Contract ProposalDocument2 pagesPress Release: State Urges HSTA To Make Contract Proposalmramos6179No ratings yet

- Statement From HSTA, Dec. 10, 2012Document2 pagesStatement From HSTA, Dec. 10, 2012mramos6179No ratings yet

- Evaluation of The Hilo Farmers' Market Demonstration (July 1999)Document28 pagesEvaluation of The Hilo Farmers' Market Demonstration (July 1999)mramos6179No ratings yet

- Appeal Filed by Paulette Kaanohiokalani KaleikiniDocument82 pagesAppeal Filed by Paulette Kaanohiokalani Kaleikinimramos6179No ratings yet

- S. 675 Akaka AmendmentDocument14 pagesS. 675 Akaka Amendmentmramos6179No ratings yet

- National Health Insurance ACT 2012 ACT 852Document79 pagesNational Health Insurance ACT 2012 ACT 852Yeko AsempahNo ratings yet

- Notification of Dispute Raf 5: To Be Completed Where Third Party Requests Dispute ResolutionDocument4 pagesNotification of Dispute Raf 5: To Be Completed Where Third Party Requests Dispute ResolutionzbhabhaNo ratings yet

- Hindu Inheritance Act1928Document2 pagesHindu Inheritance Act1928Janani ThendralNo ratings yet

- Salient Features of RA 10591Document3 pagesSalient Features of RA 10591Shen HortzNo ratings yet

- History of Arbitration Practice and LawDocument11 pagesHistory of Arbitration Practice and LawMay RMNo ratings yet

- CCPT3 10doneDocument2 pagesCCPT3 10doneaugustapressNo ratings yet

- Formation of Reinsurance AgreementsDocument2 pagesFormation of Reinsurance AgreementsDean RodriguezNo ratings yet

- Oblicon CasesDocument231 pagesOblicon CasesJessa MaeNo ratings yet

- 05 Imperial V CADocument1 page05 Imperial V CAFrances Lipnica PabilaneNo ratings yet

- in Re Estate of JohnsonDocument8 pagesin Re Estate of JohnsonaudreyNo ratings yet

- Santos vs. Bernabe, Et AlDocument3 pagesSantos vs. Bernabe, Et AljackNo ratings yet

- Fyfe vs. PAL Inc.Document29 pagesFyfe vs. PAL Inc.Angelo Raphael B. DelmundoNo ratings yet

- Gun ControlDocument7 pagesGun Controlapi-309774071No ratings yet

- SPD ManualDocument696 pagesSPD ManualDoxCak3No ratings yet

- Form DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32Document2 pagesForm DVAT 24: Notice of Default Assessment of Tax and Interest Under Section 32hhhhhhhuuuuuyyuyyyyyNo ratings yet

- Municipal Home RuleDocument11 pagesMunicipal Home RuleJHNo ratings yet

- Laurel V GarciaDocument4 pagesLaurel V GarciaJin AghamNo ratings yet

- Seila Law LLC v. Consumer Financial Protection BureauDocument105 pagesSeila Law LLC v. Consumer Financial Protection BureauStefan Becket50% (2)

- Public International Law and Human RightsDocument144 pagesPublic International Law and Human RightsMAHESH JAINNo ratings yet

- Aala vs. Uy Case DigestDocument3 pagesAala vs. Uy Case DigestPhenix Joyce PagdatoNo ratings yet

- 01 Intro To Biochem - EditDocument5 pages01 Intro To Biochem - EditJoanne AjosNo ratings yet

- Chemistry Class 12 Project Adulteration of Food MaterialsDocument19 pagesChemistry Class 12 Project Adulteration of Food MaterialsSiddhartha GautamaNo ratings yet

- Doctrine of RepugnancyDocument12 pagesDoctrine of RepugnancyHarsh DixitNo ratings yet