Professional Documents

Culture Documents

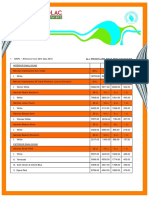

Map of The Money

Uploaded by

Casey LauOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Map of The Money

Uploaded by

Casey LauCopyright:

Available Formats

Late Stage from pro tability to expansion/exit

MENGS MAP OF THE MONEY

Growth Stage from revenue to pro tability

S TA RT U P F U N D I N G I N S I N G A P O R E J U LY 2 0 1 3

3V SourceOne Capital Ariadne Capital Clearbridge Accelerator Small World Group Biofactory Get2Volume Red Dot Ventures NRF TIS Incubators Jungle Ventures Incubator 15% $88,235 Wavemaker Labs NRF 85% $500,000 The Network Fund (TNF) Golden Gate Ventures Incuvest Asia Stream Global Plug and Play Neoteny Labs is now Silicon Straits IDEAS Ventures (Innosight) Crystal Horse SingTel Innov8 SPRING Business Angels Scheme Sirius Venture Capital coinvests up to $1.5M Accel-X with BAF, Sirius, and Accel-X BAF Spectrum Tigris Capital SPRING SEEDS coinvests with external investors at 2:1, up to $1M. Tax incentives are also available. Many other targeted grants are available see www.idm.sg NRF Proof-of-Concept grant for IHL researchers (sister to TECS). NRF Incubation Scheme SPRING TECS Proof-of-Concept and Proof-of-Value schemes fund commercialization. Pollenizer JFDI.Asia neo.com Each of these three o ers di erent propositions, but all emphasize Lean Startup methodologies. iJam Incubators invest $50,000 for typically 525%. iJam Reload follows on with up to $200,000 of funding. See http://www.idm.sg/support/ijam/ Mindefs CSIT Tech Innovation Fund has money for strategic applications. SPRING ACE matches 70% (up to $50K) to founders 30%. Angel Investors One way to reach angels is via BANSEA.org, which holds pitch sessions regularly. You can also apply to pitch at AngelsGate. Conferences like Echelon o er yet another venue. Friends, Family, and Fools Taking money from friends and family is a good way to end up with neither. Dentists, Doctors, and Mid-career entrepreneurs enjoy the advantage of wealthy classmates and friends. IDMPO runs the iJam scheme

Seed from idea to prototype

Early Stage from product to revenue

Skin in the Game Many entrepreneurs invest hundreds of thousands of dollars of their own money into their ventures. Are you prepared to go months or years without pay? If you arent willing to put money into the business, why should an investor? Believe me, they can smell an uncommitted entrepreneur a mile away. SGD sought 0 75,000 125,000 250,000 500,000

Bootstrapping: Theres always the old-fashioned way to raise money: by earning it, one dollar at a time. Who needs external nancing when youve got tons of customers?

Alternatives

Strategic Corporate Investment: A big company might nd you intriguing; try contacting the venture arms of established players in your industry.

If youre playing at this level, you probably dont need this map. JAFCO Asia JAIC Asia Capital OWW Capital Partners Gobi Partners Vickers Venture Partners Vertex are the VC arm of Temasek, and appear to be more engaged with the early stage community than most funds of this size. SBI Venture Capital Infocomm Investments Pte. Ltd. are a wholly owned subsidiary of IDA.gov.sg. SPRING Bridging Loan Programme matches bank loans 8:2. EDB Investments would need a strategic reason to invest. Formation8 are relatively new to the scene but bring considerable cash and connections in the Valley and globally. 8capita are a bunch of well respected ex-entrepreneur angels very connected with the startup scene. A number of Japanese investors both funds and corporates are expanding to Southeast Asia: Global Brain (KDDI), Fenox (IMJ), Rakuten, Gree, etc Corporate venture funds include Intel Capital, SPH, MediaCorp, and Daily Mail Group (DMGT). Phillip Capital have a number of funds at various sizes. Also look into the GIP funds http://www.contactsingapore.sg/gip/ Digital Media Partners (digitalmedia.vc) speak uent Russian. Walden International are respected investors. NRF Early Stage coinvested 50:50 in VC funds Ra es Venture Partners IDM Ventures (idmvc.com) Mercatus Capital Sequoia India iGlobe Group have been around for a while and are respected investors. Ambient Sound Investments is Toivo Annuss investment vehicle. 3V SourceOne Capital (3VS1)

SingTel Innov8 are one of the most active seed and early stage investors in Singapore, but you have to show a strategic bene t for the SingTel Group.

Mengs Map of the Money Source: Wong Meng Weng Available at mengwong.com/sg/capital/mapofthemoney.pdf Placement on map is approximate. Not all funding sources are listed; not all listed sources are active. Industry-speci c grants may be available. Investor appetites vary constantly. Comments and corrections welcome at mengwong@jfdi.asia version 20130705 1,000,000 2,000,000 4,000,000 8,000,000 16,000,000

MENGS MAP OF THE MONEY

Growth Stage from revenue to pro tability

S TA RT U P F U N D I N G I N S I N G A P O R E J U LY 2 0 1 3

3V SourceOne Capital Ariadne Capital Clearbridge Accelerator Small World Group Biofactory Get2Volume Red Dot Ventures NRF TIS Incubators Jungle Ventures Incubator 15% $88,235 Wavemaker Labs NRF 85% $500,000 The Network Fund (TNF) Golden Gate Ventures Incuvest Asia Stream Global Plug and Play Neoteny Labs is now Silicon Straits IDEAS Ventures (Innosight) Crystal Horse SingTel Innov8 SPRING Business Angels Scheme Sirius Venture Capital coinvests up to $1.5M Accel-X with BAF, Sirius, and Accel-X BAF Spectrum Tigris Capital SPRING SEEDS coinvests with external investors at 2:1, up to $1M. Tax incentives are also available. Many other targeted grants are available see www.idm.sg NRF Proof-of-Concept grant for IHL researchers (sister to TECS). NRF Incubation Scheme SPRING TECS Proof-of-Concept and Proof-of-Value schemes fund commercialization. Pollenizer JFDI.Asia neo.com Each of these three o ers di erent propositions, but all emphasize Lean Startup methodologies. iJam Incubators invest $50,000 for typically 525%. iJam Reload follows on with up to $200,000 of funding. See http://www.idm.sg/support/ijam/ Mindefs CSIT Tech Innovation Fund has money for strategic applications. SPRING ACE matches 70% (up to $50K) to founders 30%. Angel Investors One way to reach angels is via BANSEA.org, which holds pitch sessions regularly. You can also apply to pitch at AngelsGate. Conferences like Echelon o er yet another venue. Friends, Family, and Fools Taking money from friends and family is a good way to end up with neither. Dentists, Doctors, and Mid-career entrepreneurs enjoy the advantage of wealthy classmates and friends. IDMPO runs the iJam scheme

If youre playing at this level, you probably dont need this map. JAFCO Asia JAIC Asia Capital OWW Capital Partners Gobi Partners Vickers Venture Partners Vertex are the VC arm of Temasek, and appear to be more engaged with the early stage community than most funds of this size. SBI Venture Capital Infocomm Investments Pte. Ltd. are a wholly owned subsidiary of IDA.gov.sg. SPRING Bridging Loan Programme matches bank loans 8:2. EDB Investments would need a strategic reason to invest. Formation8 are relatively new to the scene but bring considerable cash and connections in the Valley and globally. 8capita are a bunch of well respected ex-entrepreneur angels very connected with the startup scene. A number of Japanese investors both funds and corporates are expanding to Southeast Asia: Global Brain (KDDI), Fenox (IMJ), Rakuten, Gree, etc Corporate venture funds include Intel Capital, SPH, MediaCorp, and Daily Mail Group (DMGT). Phillip Capital have a number of funds at various sizes. Also look into the GIP funds http://www.contactsingapore.sg/gip/ Digital Media Partners (digitalmedia.vc) speak uent Russian. Walden International are respected investors. NRF Early Stage coinvested 50:50 in VC funds Ra es Venture Partners IDM Ventures (idmvc.com) Mercatus Capital Sequoia India iGlobe Group have been around for a while and are respected investors. Ambient Sound Investments is Toivo Annuss investment vehicle. 3V SourceOne Capital (3VS1)

Early Stage from product to revenue

Late Stage from pro tability to expansion/exit

SingTel Innov8 are one of the most active seed and early stage investors in Singapore, but you have to show a strategic bene t for the SingTel Group.

Seed from idea to prototype

Skin in the Game Many entrepreneurs invest hundreds of thousands of dollars of their own money into their ventures. Are you prepared to go months or years without pay? If you arent willing to put money into the business, why should an investor? Believe me, they can smell an uncommitted entrepreneur a mile away. SGD sought 0 75,000 125,000 250,000 500,000 1,000,000 2,000,000 4,000,000

Mengs Map of the Money Source: Wong Meng Weng Available at mengwong.com/sg/capital/mapofthemoney.pdf Placement on map is approximate. Not all funding sources are listed; not all listed sources are active. Industry-speci c grants may be available. Investor appetites vary constantly. Comments and corrections welcome at mengwong@jfdi.asia version 20130705 8,000,000 16,000,000

Bootstrapping: Theres always the old-fashioned way to raise money: by earning it, one dollar at a time. Who needs external nancing when youve got tons of customers?

Alternatives

Strategic Corporate Investment: A big company might nd you intriguing; try contacting the venture arms of established players in your industry.

You might also like

- WWW Perpetualincome365 Online JVDocument10 pagesWWW Perpetualincome365 Online JV03Md Shobuj RahmanNo ratings yet

- Squeeze Page Blueprint: Masster the Skills of Writing Lead-Pulling Squeeze PagesFrom EverandSqueeze Page Blueprint: Masster the Skills of Writing Lead-Pulling Squeeze PagesNo ratings yet

- Google Search ConsoleDocument20 pagesGoogle Search ConsoleRam Kumar PasumarthiNo ratings yet

- LR-MLM Catalog ENDocument132 pagesLR-MLM Catalog ENMultiAssistants-MLMNo ratings yet

- Chipotle Mexican Grill PitchDocument5 pagesChipotle Mexican Grill PitchKyle PezziNo ratings yet

- 10 Steps To 7 Figure Sales Online in 2020Document20 pages10 Steps To 7 Figure Sales Online in 2020Samuel Olorunda0% (1)

- Groove Digital, Inc Groovefunnels Groovekart Groovepay GrooveadsDocument8 pagesGroove Digital, Inc Groovefunnels Groovekart Groovepay GrooveadsSaulofiscalNo ratings yet

- 100+ CRO Ideas You Need To StealDocument65 pages100+ CRO Ideas You Need To Stealjuan manuel espejelNo ratings yet

- ZapposDocument60 pagesZapposPayal Homagni Mondal100% (2)

- 3-Step-Content-ATM, Mani PDFDocument60 pages3-Step-Content-ATM, Mani PDFYOGESH PATELNo ratings yet

- AdEspresso 600 Facebook Ads Examples 2017Document226 pagesAdEspresso 600 Facebook Ads Examples 2017Pranay JoshiNo ratings yet

- How To Make Money Online by Writing ReviewsDocument13 pagesHow To Make Money Online by Writing ReviewsrajaukwebNo ratings yet

- 101 Ways To Promote Your Web Site Filled With Proven Internet Marketing Tips Tools Techniques and Resources To Increase Your Web Site TrafficDocument489 pages101 Ways To Promote Your Web Site Filled With Proven Internet Marketing Tips Tools Techniques and Resources To Increase Your Web Site TrafficSundeep Roy Vaish100% (1)

- Multi Level Marketing-Direct Selling-Pyramid - Money Circulation SchemesDocument75 pagesMulti Level Marketing-Direct Selling-Pyramid - Money Circulation SchemesJayanath Jayanthan67% (3)

- ASO Checklist VDocument4 pagesASO Checklist Vsunny babaNo ratings yet

- Conversion Rate CalculatorDocument8 pagesConversion Rate CalculatorzsameennNo ratings yet

- 50K+ RoadmapDocument9 pages50K+ RoadmapCameron AnthonyNo ratings yet

- How To Build Marketing PlanDocument24 pagesHow To Build Marketing PlanSyed Waseem MehdiNo ratings yet

- Generating Demand For Your ProductDocument7 pagesGenerating Demand For Your ProductankitNo ratings yet

- Nerolac Paints Color MRPL 23.09.19Document8 pagesNerolac Paints Color MRPL 23.09.19Vishnu Pratap SinghNo ratings yet

- 13 Insights From Y CombinatorDocument19 pages13 Insights From Y CombinatorRaghuram SheshadriNo ratings yet

- Ways You Can Reinvent Sxytranny - Com/ Without Resembling An AmateurDocument2 pagesWays You Can Reinvent Sxytranny - Com/ Without Resembling An Amateurmaldornug4No ratings yet

- Cyber Marketing Plan For Local RetailerDocument8 pagesCyber Marketing Plan For Local RetailerPriyank ShendeNo ratings yet

- The Road To NichesDocument21 pagesThe Road To NichesbabsNo ratings yet

- 5 Step Blueprint PDFDocument77 pages5 Step Blueprint PDFAjay KukrejaNo ratings yet

- Whitepaper: A Gaming and NFT Defi Protocol Powering A Play-To-Earn Metaverse EcosystemDocument11 pagesWhitepaper: A Gaming and NFT Defi Protocol Powering A Play-To-Earn Metaverse EcosystemJuan PerezNo ratings yet

- Digital Age PRDocument28 pagesDigital Age PRMoatasem Hatem100% (1)

- What Sapp Profit Blueprint 2Document30 pagesWhat Sapp Profit Blueprint 2David OladokunNo ratings yet

- Make Social Media Work For Your BusinessDocument35 pagesMake Social Media Work For Your BusinessAndrew Richard Thompson100% (1)

- Appo No MicsDocument322 pagesAppo No MicsAlexander Claussen100% (1)

- Useful ToolsDocument7 pagesUseful ToolsArnaud130No ratings yet

- EMarketer Worldwide Internet Social Network and Mobile Users-Q2 2014 Complete ForecastDocument53 pagesEMarketer Worldwide Internet Social Network and Mobile Users-Q2 2014 Complete ForecastOwenChen100% (1)

- Multi Level MarketingDocument148 pagesMulti Level MarketingFrancis LoboNo ratings yet

- 09-YT ADS - M3L9 - Ad Modeling Cheat Sheet FoundrDocument2 pages09-YT ADS - M3L9 - Ad Modeling Cheat Sheet FoundrThomas MackNo ratings yet

- Reseller ProposalDocument4 pagesReseller ProposalnjthakkarNo ratings yet

- Multiply Your Business PDFDocument57 pagesMultiply Your Business PDFSiu Boon100% (1)

- How To Be Successful in Eu Markets 2022Document3 pagesHow To Be Successful in Eu Markets 2022Work ClothingNo ratings yet

- 03-IGDOM Workbook M1L2Document3 pages03-IGDOM Workbook M1L2Bhim NepaliNo ratings yet

- EDU Print Profits Guide PDFDocument98 pagesEDU Print Profits Guide PDFsyed0248100% (2)

- 60 Reasons Why Entrepreneurship Is AmazingDocument11 pages60 Reasons Why Entrepreneurship Is AmazingMohamed Youssof AbdiNo ratings yet

- 8 Affiliate MarketingDocument21 pages8 Affiliate MarketingAnant MishraNo ratings yet

- Profit Funnel IdeasDocument32 pagesProfit Funnel IdeasPhillipFryNo ratings yet

- How To Choose The Best Funding Path For Your Startup - Lighter CapitalDocument17 pagesHow To Choose The Best Funding Path For Your Startup - Lighter Capitalyousef0% (1)

- Startup SecretsDocument24 pagesStartup SecretsJohn BetancourtNo ratings yet

- Uct Digital Marketing Course Information PackDocument8 pagesUct Digital Marketing Course Information PackbnhamzNo ratings yet

- TitaniumCheatSheet PDFDocument18 pagesTitaniumCheatSheet PDFDouglas MarquesNo ratings yet

- How To Drive Traffic To Your WebsiteDocument29 pagesHow To Drive Traffic To Your Websiteปาโบล ทํา100% (1)

- Product Launch RoadmapDocument59 pagesProduct Launch Roadmaphui zivaNo ratings yet

- How To Upload Copyrighted Video On YouTube Without Getting Strike (With Proof)Document20 pagesHow To Upload Copyrighted Video On YouTube Without Getting Strike (With Proof)shahid khambro0% (1)

- Landing Page Design Presentation by Peter MorzDocument14 pagesLanding Page Design Presentation by Peter MorzLemonade CodingNo ratings yet

- 16 Easy and Free Ways To Get More Views On YouTube in 2020Document47 pages16 Easy and Free Ways To Get More Views On YouTube in 2020Pankaj SharmaNo ratings yet

- Email List-Building Checklist: How To Go With Email MarketingDocument3 pagesEmail List-Building Checklist: How To Go With Email MarketingsaadatNo ratings yet

- 01-Volume 1Document798 pages01-Volume 1gusestudosNo ratings yet

- Home Business MagazineDocument60 pagesHome Business MagazinePis BukNo ratings yet

- Passive IncomeDocument3 pagesPassive Incomesanidhya raiNo ratings yet

- The Advantage of Two Tier Affiliate ProgramsDocument2 pagesThe Advantage of Two Tier Affiliate ProgramsINTENTIONAL VIBSNo ratings yet

- Blogging For Mechanical Engineers FinalDocument36 pagesBlogging For Mechanical Engineers FinalSabir KhanNo ratings yet

- Reichard Maschinen, GMBH: Nonnal MaintenanceDocument4 pagesReichard Maschinen, GMBH: Nonnal MaintenanceJayanthi HeeranandaniNo ratings yet

- Chap 13 Quality AuditDocument5 pagesChap 13 Quality AuditLili AnaNo ratings yet

- CH 20Document22 pagesCH 20sumihosaNo ratings yet

- Satyam Cnlu Torts RoughdraftDocument4 pagesSatyam Cnlu Torts RoughdraftSatyam OjhaNo ratings yet

- White Label Travel Portal DevelopmentDocument5 pagesWhite Label Travel Portal DevelopmentwhitelabeltravelportalNo ratings yet

- Dragon Magazine #059 PDFDocument84 pagesDragon Magazine #059 PDFasx100% (5)

- Apollo Tyres Limited: Rating RationaleDocument4 pagesApollo Tyres Limited: Rating Rationaleragha_4544vNo ratings yet

- MCS in Service OrganizationDocument7 pagesMCS in Service OrganizationNEON29100% (1)

- Asian Paints Expansion Strategy in South PacificDocument5 pagesAsian Paints Expansion Strategy in South PacificKshitij JindalNo ratings yet

- Payment Advice TUCKSHOP IBM-20230717-20230719Document3 pagesPayment Advice TUCKSHOP IBM-20230717-20230719spraju1947No ratings yet

- Mplus FormDocument4 pagesMplus Formmohd fairusNo ratings yet

- Vault Guide To The Top Financial Services EmployersDocument385 pagesVault Guide To The Top Financial Services EmployersPatrick AdamsNo ratings yet

- JDEtips Article E1PagesCreationDocument20 pagesJDEtips Article E1PagesCreationValdir AraujoNo ratings yet

- Informatica Powercenter CourseDocument8 pagesInformatica Powercenter CourseThameemNo ratings yet

- 100 Project Manager Interview QuestionsDocument4 pages100 Project Manager Interview Questionsadon970% (1)

- Araxxe Whitepaper Revenue Assurance and Digital RevolutionDocument21 pagesAraxxe Whitepaper Revenue Assurance and Digital RevolutionAli babaNo ratings yet

- Horasis Global India Business Meeting 2010 - Programme BrochureDocument32 pagesHorasis Global India Business Meeting 2010 - Programme BrochuresaranshcNo ratings yet

- FEBRUARY 2020 Surplus Record Machinery & Equipment DirectoryDocument717 pagesFEBRUARY 2020 Surplus Record Machinery & Equipment DirectorySurplus RecordNo ratings yet

- SAP SD Functional Analyst ResumeDocument10 pagesSAP SD Functional Analyst ResumedavinkuNo ratings yet

- 1.1 World Class DC Start Up (MWDC)Document36 pages1.1 World Class DC Start Up (MWDC)Adicipto UtomoNo ratings yet

- Concrete Subcontractor AgreementDocument10 pagesConcrete Subcontractor AgreementSK ArunNo ratings yet

- Winter 2016 YSEALI Academic Fellows Information and Application Form BruneiDocument6 pagesWinter 2016 YSEALI Academic Fellows Information and Application Form BruneiHeng LyhourNo ratings yet

- Resume Vijeesh KumarDocument3 pagesResume Vijeesh KumarunniNo ratings yet

- Labor Bar Examination Questions 2018Document34 pagesLabor Bar Examination Questions 2018xiadfreakyNo ratings yet

- DMCDocument5 pagesDMCAmarpal YadavNo ratings yet

- Read This Article and Answer The Questions:: Turnover TurnoverDocument2 pagesRead This Article and Answer The Questions:: Turnover TurnoverLambourn VoafidisoaNo ratings yet

- QMS Audit Check SheetDocument7 pagesQMS Audit Check Sheetaboo2uNo ratings yet

- Trading JournalDocument8 pagesTrading JournalRakan MohammadNo ratings yet

- Section 138 NIDocument19 pagesSection 138 NINagmani Kumar100% (1)

- Market Penetration of Maggie NoodelsDocument10 pagesMarket Penetration of Maggie Noodelsapi-3765623100% (1)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyFrom EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyRating: 4 out of 5 stars4/5 (51)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Four Battlegrounds: Power in the Age of Artificial IntelligenceFrom EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceRating: 5 out of 5 stars5/5 (5)

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldFrom EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldRating: 4.5 out of 5 stars4.5/5 (55)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingFrom EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingRating: 4.5 out of 5 stars4.5/5 (41)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (709)

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldFrom EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldRating: 4.5 out of 5 stars4.5/5 (107)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- Artificial Intelligence & Generative AI for Beginners: The Complete GuideFrom EverandArtificial Intelligence & Generative AI for Beginners: The Complete GuideRating: 5 out of 5 stars5/5 (1)

- YouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelFrom EverandYouTube Secrets: The Ultimate Guide on How to Start and Grow Your Own YouTube Channel, Learn the Tricks To Make a Successful and Profitable YouTube ChannelRating: 4.5 out of 5 stars4.5/5 (48)

- The $100 Startup by Chris Guillebeau: Summary and AnalysisFrom EverandThe $100 Startup by Chris Guillebeau: Summary and AnalysisRating: 4 out of 5 stars4/5 (8)

- The World's Most Dangerous Geek: And More True Hacking StoriesFrom EverandThe World's Most Dangerous Geek: And More True Hacking StoriesRating: 4 out of 5 stars4/5 (49)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Your AI Survival Guide: Scraped Knees, Bruised Elbows, and Lessons Learned from Real-World AI DeploymentsFrom EverandYour AI Survival Guide: Scraped Knees, Bruised Elbows, and Lessons Learned from Real-World AI DeploymentsNo ratings yet

- The AI Advantage: How to Put the Artificial Intelligence Revolution to WorkFrom EverandThe AI Advantage: How to Put the Artificial Intelligence Revolution to WorkRating: 4 out of 5 stars4/5 (7)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseFrom EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseRating: 3.5 out of 5 stars3.5/5 (12)

- Artificial Intelligence: A Guide for Thinking HumansFrom EverandArtificial Intelligence: A Guide for Thinking HumansRating: 4.5 out of 5 stars4.5/5 (30)

- Who's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesFrom EverandWho's Afraid of AI?: Fear and Promise in the Age of Thinking MachinesRating: 4.5 out of 5 stars4.5/5 (13)

- HBR's 10 Must Reads on AI, Analytics, and the New Machine AgeFrom EverandHBR's 10 Must Reads on AI, Analytics, and the New Machine AgeRating: 4.5 out of 5 stars4.5/5 (69)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziFrom Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNo ratings yet

- T-Minus AI: Humanity's Countdown to Artificial Intelligence and the New Pursuit of Global PowerFrom EverandT-Minus AI: Humanity's Countdown to Artificial Intelligence and the New Pursuit of Global PowerRating: 4 out of 5 stars4/5 (4)

- Artificial Intelligence: The Insights You Need from Harvard Business ReviewFrom EverandArtificial Intelligence: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (104)