Professional Documents

Culture Documents

Hiaa Chart

Uploaded by

Peter J. MahonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hiaa Chart

Uploaded by

Peter J. MahonCopyright:

Available Formats

HOMEOWNER FLOOD INSURANCE AFFORDABILITY ACT

KEY PROVISIONS OF SENATE AND HOUSE MEASURES

Issue Biggert-Waters (P.L. 112-557) Passed July 6, 2012 S. 1926 Passed Jan. 30, 2014 H.R. 3370 (as amended)

Would remove new policy, lapsed policy and sales triggers for actuarial rates on pre-FIRM primary residences Would retroactively refund owners pre-FIRM rate: FEMA would refund the insurance rates already collected if the new rates are lower than the premiums previously paid. Rate differences would be paid after FEMA releases final regulations and provides the new rate tables Bill would not impact second homes, businesses, severe repetitive loss properties whose rates under BW-12 will go up 25 percent a year until the full risk rate is achieved. However rate increases triggered by a propertys sale would be delayed for second homes or business properties

Pre-FIRM Properties1

Phases out subsidies for second homes, business properties, severe repetitive loss properties, or substantially improved/damaged properties rates for these properties will increase by 25 percent per year until premiums meet full actuarial costs Pushes pre-FIRM subsidized primary residences to full risk rates upon sale or lapse of policy

Would delay up to four years annual premium insurance rate increases associated with the sale of a pre-FIRM primary home (upon the sale of a preFIRM home, the new buyer immediately assumes the full actuarial rate) Bill would not impact second homes, businesses, severe repetitive loss properties or substantially improved/damaged properties (i.e. existing owners who do not sell) whose rates under BW-12 will go up 25 percent a year until the full risk rate is achieved

Grandfathered Properties2

For properties located in areas not previously designated as an area having special flood hazards and becomes designated as such (i.e. a grandfathered property), the chargeable risk premium will be phased in over a five year period, at the rate of 20 percent following the effective date of the remapping

Would delay up to four years the loss of grandfathering

Would restores subsidized rates for grandfathered properties Would permanently allow grandfathering to continue

Pre-FIRM: built before the communitys first Flood Insurance Rate Map (FIRM) became effective and not been substantially damaged or improved. 2 The NFIP provides a lower-cost flood insurance option known as grandfathering. It is available for property owners who have a flood insurance policy in effect when the new flood map becomes effective and then maintain continuous coverage OR have built in compliance with the flood insurance rate map (FIRM) at the time of construction. Source: FEMA, National Flood Insurance Program

NACO.ORG | PAGE 1

HOMEOWNER FLOOD INSURANCE AFFORDABILITY ACT

KEY PROVISIONS OF SENATE AND HOUSE MEASURES

Issue

Biggert-Waters (P.L. 112-557) Passed July 6, 2012

S. 1926 Passed Jan. 30, 2014

Would maintain BW-12 regarding annual rate increases

H.R. 3370 (as amended)

Increased annual rate increase within any single risk classification (grouping of policies) from 10 to 20 percent Annual Rate Increases Subject to FEMAs Authority to Increase Rates Phases out subsidies for second homes, business properties, severe repetitive loss properties, or substantially improved/damaged properties rates for these properties will increase by 25 percent per year until premiums meet full actuarial cost

Would allow up to 20 percent rate increase on pre-FIRM primary homes Would delay up to four years implementation of BW-12 on subsidized grandfathered properties; provision would expire six months after FEMA provides affordability framework or when FEMA certifies their flood mapping approach results in technically credible flood maps in NFIP zones

Would limit annual rate increase within any single risk classification (grouping of policies) to 5-15 percent of pre-BW-12 premiums until actuarial rates are met; 5 percent floor only applies to preFIRM primary residences (all other properties/buildings may see an increase between 0-15 percent)

Affordability Study

Requires FEMA to conduct study on possible methods to encourage and maintain participation in the NFIP as well as making the NFIP more affordable for certain people through targeted assistance. Study will also include economic analysis by the National Academy of Sciences Study funded at $750,000 Establishes a process for local communities to request a remapping based on standards recommended by the Technical Mapping Advisory Council (Established by BW-12 to address map modernization issues) Current law limited FEMAs map appeal reimbursements to $250,000

Two years after enactment of the Act, FEMA would submit to Senate Financial Services and House Banking Committees the affordability study as authorized under BW-12 Removes cap for study funding

Would increase funding for affordability study from $750,000 (as in BW-12) to $3 million. Must submit study no later than 2 years

Map Appeals

Same as H.R. 3370

Would reimburse owner, lessees or the community for successful map appeals; removes $250,000 limitation imposed by current law

NACO.ORG | PAGE 2

HOMEOWNER FLOOD INSURANCE AFFORDABILITY ACT

KEY PROVISIONS OF SENATE AND HOUSE MEASURES

Issue

Biggert-Waters (P.L. 112-557) Passed July 6, 2012

Requires FEMA to create repayment schedule to eliminate the debt and report on its progress every six months. Requires FEMA to build up reserve fund to help meet expected future obligations of the NFIP in higher-than-average loss years. Phases out subsidies for second homes, business properties, severe repetitive loss properties, or substantially improved/damaged properties rates for these properties will increase by 25 percent per year until premiums meet full actuarial cost

S. 1926 Passed Jan. 30, 2014

H.R. 3370 (as amended)

Addressing NFIP Fiscal Solvency

Would provide short term relief to increasing premiums as well as a longterm plan to address affordability and fiscal solvency

Would address offsets through annual surcharge of $25 for primary residences and $250 for secondary residences and businesses

NACO.ORG | PAGE 3

You might also like

- 2012 NFIP Reform Act ASFPM Summary of ContentsDocument5 pages2012 NFIP Reform Act ASFPM Summary of ContentsProjectHomeNo ratings yet

- Nar Myth Buster: FEMA Risk Rating 2.0Document5 pagesNar Myth Buster: FEMA Risk Rating 2.0Isaack KandaNo ratings yet

- Statement Fugate FemaDocument8 pagesStatement Fugate FemaPeter J. MahonNo ratings yet

- CH Capital - Fannie Mae Cheet Sheet 5 Million and UpDocument2 pagesCH Capital - Fannie Mae Cheet Sheet 5 Million and Upsokcordell69No ratings yet

- ERAP RAFT Policy Change Memo 12.7.2021Document4 pagesERAP RAFT Policy Change Memo 12.7.2021Steph SolisNo ratings yet

- Homeowner Affordability and Stability Plan: Executive SummaryDocument4 pagesHomeowner Affordability and Stability Plan: Executive SummaryMohit TakyarNo ratings yet

- FEMA Region 10 130 - 228 Street, SW Bothell, Washington 98021-8627Document5 pagesFEMA Region 10 130 - 228 Street, SW Bothell, Washington 98021-8627JayNo ratings yet

- Disaster Loans Fact Sheet CT Irene 09-02-11Document2 pagesDisaster Loans Fact Sheet CT Irene 09-02-11BridgeportCTNo ratings yet

- Flood RateDocument367 pagesFlood RatetpktpkNo ratings yet

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- Maine Department of Economic & Community DevelopmentDocument2 pagesMaine Department of Economic & Community DevelopmentNEWS CENTER MaineNo ratings yet

- Sba Disaster Assistance Loans Business eDocument1 pageSba Disaster Assistance Loans Business eMelizanetteTexidorNo ratings yet

- Sba Disaster Assistance Loans HomeownerDocument1 pageSba Disaster Assistance Loans HomeownerMelizanetteTexidorNo ratings yet

- Bay Area TOAH Fund Project Loan Term Sheet Construction To Mini Perm May 2011Document2 pagesBay Area TOAH Fund Project Loan Term Sheet Construction To Mini Perm May 2011edbassonNo ratings yet

- NY 12776 Fact Sheet Hurricane Irene 08-31-11Document2 pagesNY 12776 Fact Sheet Hurricane Irene 08-31-11Watershed PostNo ratings yet

- Sba Disaster Assistance Loans CommunityDocument1 pageSba Disaster Assistance Loans CommunityMelizanetteTexidorNo ratings yet

- Flood Insurance: Our Latest ChallengeDocument32 pagesFlood Insurance: Our Latest ChallengeNational Association of REALTORS®No ratings yet

- Fannie Mae - Servicers To Use Imminent Default Indicator For HAMPDocument4 pagesFannie Mae - Servicers To Use Imminent Default Indicator For HAMPForeclosure FraudNo ratings yet

- National Flood Insurance Program: The Current Rating Structure and Risk Rating 2.0Document18 pagesNational Flood Insurance Program: The Current Rating Structure and Risk Rating 2.0Paul BlaineyNo ratings yet

- Small Business Admin NY 13365 Fact Sheet 10-30-12Document2 pagesSmall Business Admin NY 13365 Fact Sheet 10-30-12awbmcNo ratings yet

- HARP 2.0 Freddie Open Access Relief UnlimitedDocument4 pagesHARP 2.0 Freddie Open Access Relief UnlimitedAccessLendingNo ratings yet

- Senate Constitutional Amendment No. 5Document30 pagesSenate Constitutional Amendment No. 5Southern California Public RadioNo ratings yet

- City of Miami: Small Business Emergency Loan ProgramDocument5 pagesCity of Miami: Small Business Emergency Loan Programal_crespoNo ratings yet

- Foreclose NoticeDocument4 pagesForeclose NoticeRick KarlinNo ratings yet

- 2008 Housing Bill SummaryDocument16 pages2008 Housing Bill Summaryyourhometownconsultant100% (2)

- CHPC Prevailing Wages ReportDocument19 pagesCHPC Prevailing Wages ReportMichael ShavolianNo ratings yet

- Loan Guidelines Us BankDocument12 pagesLoan Guidelines Us BankcraigscNo ratings yet

- October 27, 2000: U.S. Department of Housing and Urban Development Washington, D. C. 20410-8000Document4 pagesOctober 27, 2000: U.S. Department of Housing and Urban Development Washington, D. C. 20410-8000nghiemta18No ratings yet

- Aka Eligibility For Hamp Loan ModificationDocument34 pagesAka Eligibility For Hamp Loan Modificationjohngaultt100% (1)

- Binder Materials Legal Issues in Time of DisasterDocument36 pagesBinder Materials Legal Issues in Time of DisasterkitkatchaiosNo ratings yet

- PA 17744 Fact SheetDocument2 pagesPA 17744 Fact SheetFOX56 NewsNo ratings yet

- Risk Mitigation PolicyDocument11 pagesRisk Mitigation PolicyAdrian GarciaNo ratings yet

- Chapter 10 NOTES 2021Document8 pagesChapter 10 NOTES 2021giannimizrahi5No ratings yet

- Grow Long Beach Fund Term SheetDocument1 pageGrow Long Beach Fund Term SheetCFANo ratings yet

- Bankruptcy Mortgage Gov Making Home Affordable Program Info 090423 Second Lien FactsheetDocument5 pagesBankruptcy Mortgage Gov Making Home Affordable Program Info 090423 Second Lien FactsheetDouglas Hopkins100% (1)

- Regulation HF 2: Types of Housing FinanceDocument3 pagesRegulation HF 2: Types of Housing FinanceMuhammad IshaqNo ratings yet

- Canada Monetary PolicyDocument11 pagesCanada Monetary Policygiovanni lazzeriNo ratings yet

- NSP1 Detroit October-December 2011Document22 pagesNSP1 Detroit October-December 2011Stephen BoyleNo ratings yet

- 2020-04-02 COVID-19 Small Business Relief ResourcesDocument6 pages2020-04-02 COVID-19 Small Business Relief ResourcesBenny RubinNo ratings yet

- Kristine Joy Cabatino Lorenzoln340160000089056 - LninfoDocument3 pagesKristine Joy Cabatino Lorenzoln340160000089056 - LninfoTintin LorenzoNo ratings yet

- Re 2020 Year-End Tax Planning For IndividualsDocument3 pagesRe 2020 Year-End Tax Planning For Individualselnara safronovaNo ratings yet

- Berkeleyfirst: Financing Initiative For Renewable and Solar TechnologyDocument6 pagesBerkeleyfirst: Financing Initiative For Renewable and Solar TechnologySriphani VissamrajuNo ratings yet

- Making Home Affordable: Act Now To Get The Help You NeedDocument7 pagesMaking Home Affordable: Act Now To Get The Help You NeedKathryn PriceNo ratings yet

- Elite HARP Open Access ReliefDocument4 pagesElite HARP Open Access ReliefAccessLendingNo ratings yet

- Focus On Ag (1-11-21)Document3 pagesFocus On Ag (1-11-21)FluenceMediaNo ratings yet

- 5.spotlight OnDocument4 pages5.spotlight Onihsan nawawiNo ratings yet

- Disaster Loan Program: Fact Sheet About U. S. Small Business Administration (Sba) Disaster LoansDocument2 pagesDisaster Loan Program: Fact Sheet About U. S. Small Business Administration (Sba) Disaster Loansmozart20No ratings yet

- LAMP TermsheetDocument4 pagesLAMP TermsheetJane JjNo ratings yet

- Mortgage BasicsDocument37 pagesMortgage BasicsAnkita DasNo ratings yet

- Enochian MagicDocument528 pagesEnochian MagicAudreiana Mendes0% (5)

- Fema South Carolina State Profile 03 2021Document4 pagesFema South Carolina State Profile 03 2021Andrew JamesNo ratings yet

- Equity Release United States Loan HUD: LenderDocument5 pagesEquity Release United States Loan HUD: Lender9870050214No ratings yet

- Fifteen Day Notice To Pay Rent or Quit: (Rent Demand For February 1, 2021 Through June 30, 2021)Document3 pagesFifteen Day Notice To Pay Rent or Quit: (Rent Demand For February 1, 2021 Through June 30, 2021)LOLANo ratings yet

- Mortgagee Letter 2010-02Document2 pagesMortgagee Letter 2010-02Jeremy EricksonNo ratings yet

- RSC Rescue Alternative 9-29-08Document2 pagesRSC Rescue Alternative 9-29-08perrytruthteamNo ratings yet

- SB12, NV 2021Document1 pageSB12, NV 2021Kristyn LeonardNo ratings yet

- Announcement SEL-2010-07 May 27, 2010: Selling Guide UpdatesDocument5 pagesAnnouncement SEL-2010-07 May 27, 2010: Selling Guide Updatesapi-26722057No ratings yet

- Servicing Guide Announcement SVC-2012-05: Payment of Homeowners' Association Dues and Condo AssessmentsDocument3 pagesServicing Guide Announcement SVC-2012-05: Payment of Homeowners' Association Dues and Condo AssessmentsForeclosure FraudNo ratings yet

- Loan Modification Program InfoDocument3 pagesLoan Modification Program InfoDeborah Tarpley HicksNo ratings yet

- Rockaway Times 8-8-19 PDFDocument44 pagesRockaway Times 8-8-19 PDFPeter J. MahonNo ratings yet

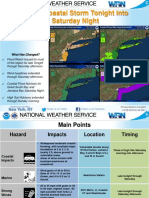

- WxBriefing FBDocument11 pagesWxBriefing FBPeter J. MahonNo ratings yet

- Rockaway Times 8-8-19 PDFDocument44 pagesRockaway Times 8-8-19 PDFPeter J. MahonNo ratings yet

- Rockaway Times - 8-15-2019 PDFDocument44 pagesRockaway Times - 8-15-2019 PDFPeter J. MahonNo ratings yet

- WxBriefing FB FLDSTRMDocument11 pagesWxBriefing FB FLDSTRMPeter J. MahonNo ratings yet

- Winter Weather: Decision Support Briefing #4 As Of: 6 AM Feb 12, 2019Document9 pagesWinter Weather: Decision Support Briefing #4 As Of: 6 AM Feb 12, 2019Peter J. MahonNo ratings yet

- Rockaway Times 21419Document44 pagesRockaway Times 21419Peter J. MahonNo ratings yet

- WxBriefing FBDocument18 pagesWxBriefing FBPeter J. MahonNo ratings yet

- Rockaway Times 7-11-19Document48 pagesRockaway Times 7-11-19Peter J. MahonNo ratings yet

- WxBriefing FBDocument9 pagesWxBriefing FBPeter J. MahonNo ratings yet

- WxBriefing FBDocument7 pagesWxBriefing FBPeter J. MahonNo ratings yet

- WxBriefing FBDocument7 pagesWxBriefing FBPeter J. MahonNo ratings yet

- WxBriefing FBDocument7 pagesWxBriefing FBPeter J. MahonNo ratings yet

- RockawayTimes2719 PDFDocument44 pagesRockawayTimes2719 PDFPeter J. MahonNo ratings yet

- RockawayTimes2719 PDFDocument44 pagesRockawayTimes2719 PDFPeter J. MahonNo ratings yet

- WxBriefing FBDocument14 pagesWxBriefing FBPeter J. MahonNo ratings yet

- WxBriefing FBDocument18 pagesWxBriefing FBPeter J. MahonNo ratings yet

- Heavy Rain, Coastal Flooding, and Strong Winds Thu Night - Fri NightDocument7 pagesHeavy Rain, Coastal Flooding, and Strong Winds Thu Night - Fri NightPeter J. MahonNo ratings yet

- Rockaway Times 112918Document48 pagesRockaway Times 112918Peter J. MahonNo ratings yet

- Rockaway Times 11719Document36 pagesRockaway Times 11719Peter J. MahonNo ratings yet

- Reminder For W 13th RoadDocument1 pageReminder For W 13th RoadPeter J. MahonNo ratings yet

- Coastal BriefDocument8 pagesCoastal BriefPeter J. MahonNo ratings yet

- First SnowDocument10 pagesFirst SnowPeter J. MahonNo ratings yet

- Rockaway Times 121318Document48 pagesRockaway Times 121318Peter J. MahonNo ratings yet

- Rockaway Times 11818Document44 pagesRockaway Times 11818Peter J. MahonNo ratings yet

- Farid Khan v. Boohoo - Motion To DismissDocument23 pagesFarid Khan v. Boohoo - Motion To DismissThe Fashion LawNo ratings yet

- Customary Law of Italy Comparative World HistoryDocument11 pagesCustomary Law of Italy Comparative World HistorySaurin ThakkarNo ratings yet

- Office of The Ombudsman Vs Carmencita CoronelDocument3 pagesOffice of The Ombudsman Vs Carmencita CoronelEzekiel Japhet Cedillo EsguerraNo ratings yet

- Persuasive EssayDocument3 pagesPersuasive Essayapi-252319989No ratings yet

- User Guidance: Request For Expression of Interest - Returnable SchedulesDocument15 pagesUser Guidance: Request For Expression of Interest - Returnable SchedulesThanhNo ratings yet

- Legal Metrology Act, 2009Document10 pagesLegal Metrology Act, 2009prakharNo ratings yet

- Macariola v. AsuncionDocument2 pagesMacariola v. AsuncionVanityHughNo ratings yet

- GoalDocument3 pagesGoalabhi_gkNo ratings yet

- Collapsed Garage SuitDocument9 pagesCollapsed Garage SuitJoanna EnglandNo ratings yet

- Land LawDocument2 pagesLand LawpickgirlNo ratings yet

- Vda. de Mistica V NaguiatDocument9 pagesVda. de Mistica V NaguiatZannyRyanQuirozNo ratings yet

- Principal of Severability PDFDocument1 pagePrincipal of Severability PDFShashank YadauvanshiNo ratings yet

- San Miguel Corp Employees Union V BersamiraDocument1 pageSan Miguel Corp Employees Union V BersamiraGlenda OzaetaNo ratings yet

- Cicl 2Document34 pagesCicl 2Val Justin DeatrasNo ratings yet

- LGL-WMS-015 - C - Instruction For Managing Conflict of InterestDocument12 pagesLGL-WMS-015 - C - Instruction For Managing Conflict of Interestnebodepa lyftNo ratings yet

- Msds UMBDocument9 pagesMsds UMBDwi April YantoNo ratings yet

- In The Lands Tribunal of The Hong Kong Special Administrative RegionDocument46 pagesIn The Lands Tribunal of The Hong Kong Special Administrative RegionpschilNo ratings yet

- Lambino Vs Comelec - G.R. No. 174153 October 25, 2006Document3 pagesLambino Vs Comelec - G.R. No. 174153 October 25, 2006Francisco III MoraldeNo ratings yet

- Crim Pro Outline-Case ChartDocument42 pagesCrim Pro Outline-Case ChartMichael MroczkaNo ratings yet

- MSC Circ 1084 Hot Work PrinciplesDocument2 pagesMSC Circ 1084 Hot Work PrinciplesThurdsuk NoinijNo ratings yet

- Federal Judges' Views On Allocution in SentencingDocument79 pagesFederal Judges' Views On Allocution in Sentencing92589258No ratings yet

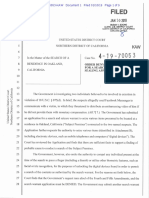

- 4 19 70053Document9 pages4 19 70053Mike WuertheleNo ratings yet

- United States Court of Appeals Third CircuitDocument20 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- Faculty of Law: Jamia Millia IslamiaDocument21 pagesFaculty of Law: Jamia Millia IslamiaFaisal HassanNo ratings yet

- Course - Legal Aspects of Business: Individual Project WorkDocument5 pagesCourse - Legal Aspects of Business: Individual Project WorkAaditya ByadwalNo ratings yet

- Choa VS ChoaDocument2 pagesChoa VS Choacmv mendozaNo ratings yet

- PVL2601 Study NotesDocument24 pagesPVL2601 Study Notesmmeiring1234100% (5)

- Ball Bearings - InvoiceDocument1 pageBall Bearings - InvoiceBj AfemanNo ratings yet

- Revenue Regulations No. 2-40Document3 pagesRevenue Regulations No. 2-40June Lester100% (1)

- Kiko ReactionDocument3 pagesKiko ReactionChe-che ManzanoNo ratings yet