Professional Documents

Culture Documents

Sba Disaster Assistance Loans Business e

Uploaded by

MelizanetteTexidor0 ratings0% found this document useful (0 votes)

12 views1 pageThe SBA offers disaster assistance loans to help businesses and non-profits recover from declared disasters. There are two main types of loans - business disaster loans up to $2 million to repair or replace damaged property, inventory, and assets, and economic injury disaster loans up to $2 million for working capital needs of businesses affected regardless of property damage. Loans can be used to make property improvements to prevent future damage and may cover insurance deductibles or required code upgrades. Applicants are encouraged to apply as soon as possible after a disaster is declared as the deadline is usually 60 days, and no need to wait for other assistance before applying. The application process involves submitting an application, then an estimate of repair costs, loan review,

Original Description:

Sea interesante

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe SBA offers disaster assistance loans to help businesses and non-profits recover from declared disasters. There are two main types of loans - business disaster loans up to $2 million to repair or replace damaged property, inventory, and assets, and economic injury disaster loans up to $2 million for working capital needs of businesses affected regardless of property damage. Loans can be used to make property improvements to prevent future damage and may cover insurance deductibles or required code upgrades. Applicants are encouraged to apply as soon as possible after a disaster is declared as the deadline is usually 60 days, and no need to wait for other assistance before applying. The application process involves submitting an application, then an estimate of repair costs, loan review,

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageSba Disaster Assistance Loans Business e

Uploaded by

MelizanetteTexidorThe SBA offers disaster assistance loans to help businesses and non-profits recover from declared disasters. There are two main types of loans - business disaster loans up to $2 million to repair or replace damaged property, inventory, and assets, and economic injury disaster loans up to $2 million for working capital needs of businesses affected regardless of property damage. Loans can be used to make property improvements to prevent future damage and may cover insurance deductibles or required code upgrades. Applicants are encouraged to apply as soon as possible after a disaster is declared as the deadline is usually 60 days, and no need to wait for other assistance before applying. The application process involves submitting an application, then an estimate of repair costs, loan review,

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

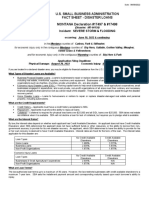

Disaster Assistance Loans

When Disaster Strikes

Even with the best preparedness planning, a disaster can BUSINESSES & NONPROFITS

affect your business or organization. The SBA’s disaster

assistance loans can be used to help you get back to

business sooner, help you make property improvements

that eliminate future damage or save lives. After a disaster

has been declared, loans can even be increased up to 20%

to make the building upgrades. Loans may also be used for

insurance deductibles, required building code upgrades

not covered by insurance or to help with relocation.

Business Disaster Loans — up to $2 million* Economic Injury Disaster Loans — up to $2 million*

SBA disaster loans are available to businesses (regardless These loans are for small businesses, agricultural

of size), and nonprofits including charitable organizations cooperatives, aquaculture enterprises and nonprofits

such as churches and private universities. affected by disaster to help meet working capital needs or

Loans enable you to repair or replace damaged or normal business operating expenses through the recovery

destroyed real estate, machinery and equipment, period. Businesses are eligible for these loans regardless of

inventory, and other business assets. The loans may also whether they have suffered property damage.

be used for structural improvements such as adding a

*The maximum loan for any combination of property damage

retaining wall or sump pump, clearing out overgrown

and/or economic injury is $2 million.

landscaping, building a safe room or elevating the

property to lessen the effect of future disasters. Questions? Visit www.sba.gov/disaster

Rebuilding Stronger is Within Reach — Start Now

There is no need to wait for settled insurance claims, potential FEMA grants or contractor estimates before applying.

Generally, the deadline to apply for these long-term, low interest rate loans is 60 days from the declared disaster—so we

encourage you to apply as soon as possible!

The Application Process

Apply Review Decide

Go to disasterloanassistance.sba.gov After an initial credit check, a loss You will be contacted with a loan

or Call (800) 659-2955 or (TTY) 7-1-1 verifier estimates the total cost to repair decision. If approved, a case manager

to request an application. or replace your damaged property. A will assist with closing the loan and

loan officer reviews the application and scheduling disbursements.

guides you through the process.

All SBA programs and services are extended to the public on a nondiscriminatory basis. (5/2022)

You might also like

- Sba Disaster Assistance Loans CommunityDocument1 pageSba Disaster Assistance Loans CommunityMelizanetteTexidorNo ratings yet

- Sba Disaster Assistance Loans HomeownerDocument1 pageSba Disaster Assistance Loans HomeownerMelizanetteTexidorNo ratings yet

- Disaster Loans Fact Sheet CT Irene 09-02-11Document2 pagesDisaster Loans Fact Sheet CT Irene 09-02-11BridgeportCTNo ratings yet

- Small Business Admin NY 13365 Fact Sheet 10-30-12Document2 pagesSmall Business Admin NY 13365 Fact Sheet 10-30-12awbmcNo ratings yet

- U. S. Small Business Administration Fact Sheet - Disaster Loans MISSISSIPPI Declaration 14738 & 14739Document2 pagesU. S. Small Business Administration Fact Sheet - Disaster Loans MISSISSIPPI Declaration 14738 & 14739rleeflowersNo ratings yet

- NY 12776 Fact Sheet Hurricane Irene 08-31-11Document2 pagesNY 12776 Fact Sheet Hurricane Irene 08-31-11Watershed PostNo ratings yet

- Disaster Loan Program: Fact Sheet About U. S. Small Business Administration (Sba) Disaster LoansDocument2 pagesDisaster Loan Program: Fact Sheet About U. S. Small Business Administration (Sba) Disaster Loansmozart20No ratings yet

- Disaster Playbook One-Pager 8.1.18 Logo V1 PDFDocument2 pagesDisaster Playbook One-Pager 8.1.18 Logo V1 PDFJay LewisNo ratings yet

- Three Step Process SBA Disaster Loans PDFDocument2 pagesThree Step Process SBA Disaster Loans PDFChrisNo ratings yet

- Three Step Process SBA Disaster LoansDocument2 pagesThree Step Process SBA Disaster LoansLarryDCurtisNo ratings yet

- WV 17624 Agency Fact SheetDocument2 pagesWV 17624 Agency Fact SheetAnna SaundersNo ratings yet

- U.S. Small Business Administration Fact Sheet - Disaster LoansDocument2 pagesU.S. Small Business Administration Fact Sheet - Disaster LoansNews 5 WCYBNo ratings yet

- Maine Department of Economic & Community DevelopmentDocument2 pagesMaine Department of Economic & Community DevelopmentNEWS CENTER MaineNo ratings yet

- US Small Business Administration Disaster Loan Information For August StormDocument2 pagesUS Small Business Administration Disaster Loan Information For August StormKaren WallNo ratings yet

- SBA Loan InformationDocument2 pagesSBA Loan InformationNews 5 WCYBNo ratings yet

- Tax Return Transcript - WEBE - 104242078732Document4 pagesTax Return Transcript - WEBE - 104242078732Blake WeberNo ratings yet

- SBA Low-Cost, Long-Term Loan ApplicationDocument2 pagesSBA Low-Cost, Long-Term Loan ApplicationMichelle SolomonNo ratings yet

- SBA Fact SheetDocument2 pagesSBA Fact SheetWGCU NewsNo ratings yet

- MT 17497 Fact Sheet PresidentialDocument2 pagesMT 17497 Fact Sheet PresidentialNBC MontanaNo ratings yet

- U.S. Small Business Administration Fact Sheet - Disaster Loans MARYLAND Declaration 15829 & 15830Document2 pagesU.S. Small Business Administration Fact Sheet - Disaster Loans MARYLAND Declaration 15829 & 15830Chris SwamNo ratings yet

- SBA Disaster Loans Fact SheetDocument2 pagesSBA Disaster Loans Fact SheetSelahNo ratings yet

- SBA Fact SheetDocument2 pagesSBA Fact SheetKatherine WorshamNo ratings yet

- SBA Paycheck Protection ProgramDocument3 pagesSBA Paycheck Protection ProgramDawn TurnerNo ratings yet

- MS - 17836 - Fact - Sheet - 2023 - 03 - 26Document2 pagesMS - 17836 - Fact - Sheet - 2023 - 03 - 26USA TODAY NetworkNo ratings yet

- Build Back Safer and StrongerDocument2 pagesBuild Back Safer and StrongerKristofer PlonaNo ratings yet

- What Is Engineering InsuranceDocument4 pagesWhat Is Engineering InsuranceParth Shastri100% (1)

- Home Affordable Refinance Faqs: March 29, 2010Document26 pagesHome Affordable Refinance Faqs: March 29, 2010456456456y45y45No ratings yet

- Keith Curry,, ,: Credit MemoDocument14 pagesKeith Curry,, ,: Credit MemoJesusNo ratings yet

- Financial Guarantees: Department of Development and Environmental Services (DDES)Document10 pagesFinancial Guarantees: Department of Development and Environmental Services (DDES)Naveen KumarNo ratings yet

- Preparing To Apply For Disaster Assistance March 24 2024Document84 pagesPreparing To Apply For Disaster Assistance March 24 2024sara.severensNo ratings yet

- City of Miami: Small Business Emergency Loan ProgramDocument5 pagesCity of Miami: Small Business Emergency Loan Programal_crespoNo ratings yet

- New WBDC Applicant Guide For SBA Loans Under The CARES Act 3.30.2020Document111 pagesNew WBDC Applicant Guide For SBA Loans Under The CARES Act 3.30.2020Jacob FrydmanNo ratings yet

- 2020-04-02 COVID-19 Small Business Relief ResourcesDocument6 pages2020-04-02 COVID-19 Small Business Relief ResourcesBenny RubinNo ratings yet

- Chief Credit Officer, Chief Risk Officer, Head of Distressed AssDocument3 pagesChief Credit Officer, Chief Risk Officer, Head of Distressed Assapi-79240515No ratings yet

- (February 2012) : Commercial Property InsuranceDocument11 pages(February 2012) : Commercial Property InsuranceShweta Yashwant ChalkeNo ratings yet

- Succession PlanningDocument2 pagesSuccession PlanningRomit DasguptaNo ratings yet

- PA 17744 Fact SheetDocument2 pagesPA 17744 Fact SheetFOX56 NewsNo ratings yet

- Homeowner Foreclosure Help Protects and Defends Struggling Homeowners. New Consumer Defense Program Helps Homeowners Fight Back and Save Their Home From Foreclosure.Document4 pagesHomeowner Foreclosure Help Protects and Defends Struggling Homeowners. New Consumer Defense Program Helps Homeowners Fight Back and Save Their Home From Foreclosure.PR.comNo ratings yet

- Eidl Faq 3.27.20Document6 pagesEidl Faq 3.27.20EddieNo ratings yet

- Home Work - I Economics of DisasterDocument6 pagesHome Work - I Economics of DisasterKarthik VadlapatlaNo ratings yet

- Binder Materials Legal Issues in Time of DisasterDocument36 pagesBinder Materials Legal Issues in Time of DisasterkitkatchaiosNo ratings yet

- Reorganization and Private WorkDocument1 pageReorganization and Private Work27 Md. Rakibul IslamNo ratings yet

- Flood: Are You Prote Cted From The Next Disaste R ?: We Can't Replace Your Memories, But We Can Help You Build New OnesDocument2 pagesFlood: Are You Prote Cted From The Next Disaste R ?: We Can't Replace Your Memories, But We Can Help You Build New OnesIvan BodnaryukNo ratings yet

- Project FinanceDocument37 pagesProject FinanceFarhana DibagelenNo ratings yet

- Managing Personal Finance NotesDocument32 pagesManaging Personal Finance NotesMonashreeNo ratings yet

- Financial Insurance & Guarantee Risk SheetDocument6 pagesFinancial Insurance & Guarantee Risk SheetMartin PittNo ratings yet

- Income-Based Repayment (IBR) For Federal Student Loans: Collaborative Financial Solutions, LLCDocument4 pagesIncome-Based Repayment (IBR) For Federal Student Loans: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Grow Long Beach Fund Term SheetDocument1 pageGrow Long Beach Fund Term SheetCFANo ratings yet

- Finance1 LectureDocument16 pagesFinance1 LectureRegimhel Dalisay75% (4)

- ProjectDocument8 pagesProjectYograj PawarNo ratings yet

- Frequently Asked Questions: COVID-19 Economic Injury Disaster Loan (EIDL)Document11 pagesFrequently Asked Questions: COVID-19 Economic Injury Disaster Loan (EIDL)Jake BourqueNo ratings yet

- Credit LendingDocument64 pagesCredit LendingZubair Mirza100% (2)

- FOCE COM MN18020 23-570 PNP SBA Offers Disaster Assistance To Non-Profits in MN 2023-07-24Document2 pagesFOCE COM MN18020 23-570 PNP SBA Offers Disaster Assistance To Non-Profits in MN 2023-07-24Mike MaybayNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- ABC Mortgage Guide 6.1 Version 6 - 2017 PDFDocument18 pagesABC Mortgage Guide 6.1 Version 6 - 2017 PDFnorman carniolNo ratings yet

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- Business LoansDocument8 pagesBusiness LoansRoyce Feb V. Lungan100% (2)

- WealthDocument56 pagesWealthMelizanetteTexidorNo ratings yet

- Involucrados Con La InformaciónDocument20 pagesInvolucrados Con La InformaciónMelizanetteTexidorNo ratings yet

- Savings Tracker Summer Theme 1Document1 pageSavings Tracker Summer Theme 1MelizanetteTexidorNo ratings yet

- Savings Tracker Pineapple Theme 1Document1 pageSavings Tracker Pineapple Theme 1MelizanetteTexidorNo ratings yet

- Savings Tracker Land Theme 1Document1 pageSavings Tracker Land Theme 1MelizanetteTexidorNo ratings yet

- Full-Time Regular Basic Annual Rates - Effective November 19 2022Document1 pageFull-Time Regular Basic Annual Rates - Effective November 19 2022MelizanetteTexidorNo ratings yet

- Jigawa State Investor's HandbookDocument56 pagesJigawa State Investor's HandbookPatrick Cee Anekwe100% (1)

- Chapter 29Document35 pagesChapter 29Patty PaguianNo ratings yet

- Rental Application CA SafeRentDocument2 pagesRental Application CA SafeRentMichael SnyderNo ratings yet

- Accounts Payable ProceduresDocument9 pagesAccounts Payable ProceduresSuhas YadavNo ratings yet

- Birth Certificate UnraveledDocument6 pagesBirth Certificate UnraveledTed100% (5)

- Loan ComputationDocument13 pagesLoan ComputationJerson ArinqueNo ratings yet

- Circular No. 971-5-2013Document4 pagesCircular No. 971-5-2013Rajula Gurva ReddyNo ratings yet

- To MADE EASY Final EditionDocument183 pagesTo MADE EASY Final EditionAnonymous Ey8uMU5n0% (1)

- Gippslander Dec 2014 V1Document20 pagesGippslander Dec 2014 V1Local Extra NewspaperNo ratings yet

- Constantino V CuisiaDocument43 pagesConstantino V CuisiayousirneighmNo ratings yet

- Indian Insurance EvolutionDocument84 pagesIndian Insurance EvolutionUtsav DubeyNo ratings yet

- SMChap 004Document57 pagesSMChap 004testbank100% (2)

- 6a. Cash BudgetDocument4 pages6a. Cash BudgetMadiha JamalNo ratings yet

- Indian Money MarketDocument2 pagesIndian Money MarketSandeep KulkarniNo ratings yet

- Problems To Be Solved in ClassDocument4 pagesProblems To Be Solved in ClassAlp SanNo ratings yet

- CCSLC Mathematics Consumer Arithmetic WorksheetDocument2 pagesCCSLC Mathematics Consumer Arithmetic WorksheetMe YahooNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- CBSE Class 10 Social Science Sample Paper 01 (2019-20) : Material Downloaded From - 1 / 22Document47 pagesCBSE Class 10 Social Science Sample Paper 01 (2019-20) : Material Downloaded From - 1 / 22Rahil ShamsiNo ratings yet

- Zero Coupon Bond StudyDocument101 pagesZero Coupon Bond StudyAminul Hoque BhuiyaNo ratings yet

- Problem Questions Solutions PDFDocument4 pagesProblem Questions Solutions PDFdeepanshi jainNo ratings yet

- Interim Order in The Matter of Tribhuvan Agro Project LimitedDocument17 pagesInterim Order in The Matter of Tribhuvan Agro Project LimitedShyam SunderNo ratings yet

- Macro: MAN MAN MANDocument8 pagesMacro: MAN MAN MANbasheir123No ratings yet

- Abagon Company (Caselette)Document3 pagesAbagon Company (Caselette)Jodi Ann Echavia Alvarez0% (2)

- ACC. Final ResearchDocument35 pagesACC. Final Researchnaol ejataNo ratings yet

- Guanzon v. ArgelDocument1 pageGuanzon v. ArgelWhere Did Macky GallegoNo ratings yet

- Financial Regulation Writte ReportDocument18 pagesFinancial Regulation Writte ReportLee TeukNo ratings yet

- Deduction From Gross Income-Deduction Allowed Under Special LawDocument131 pagesDeduction From Gross Income-Deduction Allowed Under Special LawRance Harry Daza0% (2)

- 10 Company AuditDocument14 pages10 Company AuditSurendar SirviNo ratings yet

- Quarterly Earnings Preview Q3 - FY12: Saturday, January 07, 2012Document36 pagesQuarterly Earnings Preview Q3 - FY12: Saturday, January 07, 201222165228No ratings yet