Professional Documents

Culture Documents

If The Rupee Still Looks Vulnerable

Uploaded by

Namisha GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

If The Rupee Still Looks Vulnerable

Uploaded by

Namisha GuptaCopyright:

Available Formats

If the rupee still looks vulnerable, India has three options, none very palatable.

One is to let the currency fall further. In most countries a cheaper currency would boost exports and help close the current-account deficit. But Indias manufacturing industry is too small and too bound in red tape to ramp up quickly. So a turn-around in the balance of payments may take time during which investors could panic. Meanwhile the weaker currency may destabilise the domestic economy by adding to inflation and increasing the governments subsidies on fuel and thus its borrowing. The second option is to do the opposite and increase interest rates to attract more foreign money in, following the path of Indonesia and Brazil. But this would further hammer Indian industry, which is already in poor shape, and probably increase bad debts at banks too. If the economy slowed further as a result, equity investors might begin to worry about corporate earnings declining and pull out their roughly $200 billion of investments in listed shares. Inducing a credit crunch in India might make things even worse. The last option is to lower government borrowing. It is running at 7% of GDP (including Indias states) and has stoked excess demand in the last few years, widening the current-account deficit. The populist political mood doesnt make big spending cuts easy, though, and while it is often accused of epic profligacy, Indias central government has pretty low expenditure relative to GDPabout 15%. There is simply no way it can cut its way to a balanced budget. What India really needs is more tax revenues. But with a narrow tax baseonly 3% of Indians pay income taxthis might mean concentrating tax rises on the formal economy, which is already reeling. For now my sense is that the authorities plan is to let the rupee trade freely but hold out the threat of an interest rate rise or direct intervention in the currency market to try to scare off speculators. At the same time they will squeeze borrowing as much as is possible during an election and use administrative measures, such as higher duties, to try to cap imports. It is a bet that the economy will pick up soon and that growth will make Indias problems fade away. The trouble is that the economy is still decelerating.

Real vs. Nominal GDP

What is GDP? According to Wikipedia, Gross domestic product (GDP) refers to the market value of all final goods and services produced within a country in a given period. But there are two kinds of measurements. One is Real GDP and the other Nominal GDP. So what are they? Nominal GDP is this measurement made in current money (dollars). In other words, if you go to the store and buy something for $20, that adds $20 to the GDP. But if you buy that same thing next year for $22, then the GDP is increased by $22 in that next year, even though it is the same product. If every product experienced the same amount of price increase, then the GDP would increase by 10% without any increase in the amount of products sold. Nominal GDP in this case would not be a good representation of the health of an economy. Real GDP is adjusted for inflation. So if the product price inflated from $20 to $22 in one year, then the GDP contribution of that same product would be a zero percent increase from year to year. If all products did the same, GDP would show no increase (or decrease) as long as the same amount of products were sold. So real GDP is a measure of activity in the economy. If more products are sold, then GDP will go up or if less is sold, then GDP goes down. This is a far better measure of the economy than nominal GDP. (Of course, one has to agree on how to measure inflation.) But of course politicians will use whatever definition that puts them in the best light. In nominal GDP went up 5%, they would crow about how their policies were responsible for a huge growth in the economy. But if the 5% growth was all due to inflation and none was due to increased activity, then this is an empty argument. In fact, by printing more money, inflation can be the result and be totally responsible for any GDP growth. Patting themselves on the back for 5% growth in GDP due to inflation is totally bogus. Inflation is not healthy and is not something for which to be proud. Fortunately, economists who use GDP to tell us when we are in a recession use Real GDP growth. But many of the newspaper accounts of GDP use nominal GDP which tells us very little about the economys health unless we know the amount of inflation.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- SituationDocument2 pagesSituationNamisha GuptaNo ratings yet

- Example of - Different HR PracticesDocument33 pagesExample of - Different HR PracticesNamisha GuptaNo ratings yet

- TCS Organization StructureDocument46 pagesTCS Organization StructureKaushik Thiagarajan84% (31)

- Conflict Between Irr and NPVDocument2 pagesConflict Between Irr and NPVNamisha GuptaNo ratings yet

- You Can't Do Anything About The Length of Your Life, But You Can Do Something About Its Width and DepthDocument37 pagesYou Can't Do Anything About The Length of Your Life, But You Can Do Something About Its Width and DepthNamisha GuptaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A PDFDocument2 pagesA PDFKanimozhi CheranNo ratings yet

- Check Fraud Running Rampant in 2023 Insights ArticleDocument4 pagesCheck Fraud Running Rampant in 2023 Insights ArticleJames Brown bitchNo ratings yet

- Introduce Letter - CV IDS (Company Profile)Document13 pagesIntroduce Letter - CV IDS (Company Profile)katnissNo ratings yet

- Binary File MCQ Question Bank For Class 12 - CBSE PythonDocument51 pagesBinary File MCQ Question Bank For Class 12 - CBSE Python09whitedevil90No ratings yet

- 4109 CPC For ExamDocument380 pages4109 CPC For ExamMMM-2012No ratings yet

- Aitt Feb 2017 TH Sem IIIDocument6 pagesAitt Feb 2017 TH Sem IIIMadhu KumarNo ratings yet

- Powerpoint Presentation: Calcium Sulphate in Cement ManufactureDocument7 pagesPowerpoint Presentation: Calcium Sulphate in Cement ManufactureDhruv PrajapatiNo ratings yet

- EXTENDED PROJECT-Shoe - SalesDocument28 pagesEXTENDED PROJECT-Shoe - Salesrhea100% (5)

- BST Candidate Registration FormDocument3 pagesBST Candidate Registration FormshirazNo ratings yet

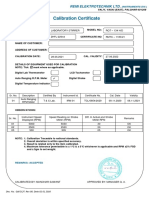

- Calibration CertificateDocument1 pageCalibration CertificateSales GoldClassNo ratings yet

- Ucm6510 Usermanual PDFDocument393 pagesUcm6510 Usermanual PDFCristhian ArecoNo ratings yet

- NOP PortalDocument87 pagesNOP PortalCarlos RicoNo ratings yet

- Doas - MotorcycleDocument2 pagesDoas - MotorcycleNaojNo ratings yet

- Sophia Program For Sustainable FuturesDocument128 pagesSophia Program For Sustainable FuturesfraspaNo ratings yet

- Everlube 620 CTDSDocument2 pagesEverlube 620 CTDSchristianNo ratings yet

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Document16 pagesOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoNo ratings yet

- Himachal Pradesh Important NumbersDocument3 pagesHimachal Pradesh Important NumbersRaghav RahinwalNo ratings yet

- Wiley Chapter 11 Depreciation Impairments and DepletionDocument43 pagesWiley Chapter 11 Depreciation Impairments and Depletion靳雪娇No ratings yet

- Form Three Physics Handbook-1Document94 pagesForm Three Physics Handbook-1Kisaka G100% (1)

- SAS SamplingDocument24 pagesSAS SamplingVaibhav NataNo ratings yet

- Vangood Quotation - Refrigerator Part - 2023.3.2Document5 pagesVangood Quotation - Refrigerator Part - 2023.3.2Enmanuel Jossue Artigas VillaNo ratings yet

- Engineering Notation 1. 2. 3. 4. 5.: T Solution:fDocument2 pagesEngineering Notation 1. 2. 3. 4. 5.: T Solution:fJeannie ReguyaNo ratings yet

- Banjara EmbroideryDocument34 pagesBanjara EmbroideryKriti Rama ManiNo ratings yet

- Wind Energy in MalaysiaDocument17 pagesWind Energy in MalaysiaJia Le ChowNo ratings yet

- Low Cost Building ConstructionDocument15 pagesLow Cost Building ConstructionAtta RehmanNo ratings yet

- Agfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Document3 pagesAgfa CR 85-X: Specification Fuji FCR Xg5000 Kodak CR 975Youness Ben TibariNo ratings yet

- SPH4U Assignment - The Wave Nature of LightDocument2 pagesSPH4U Assignment - The Wave Nature of LightMatthew GreesonNo ratings yet

- A Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDDocument3 pagesA Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDIJIRSTNo ratings yet

- Group 1 Disaster Management Notes by D. Malleswari ReddyDocument49 pagesGroup 1 Disaster Management Notes by D. Malleswari Reddyraghu ramNo ratings yet

- Walmart, Amazon, EbayDocument2 pagesWalmart, Amazon, EbayRELAKU GMAILNo ratings yet