Professional Documents

Culture Documents

Just Dial - Vineet

Uploaded by

Vineet Singh0 ratings0% found this document useful (0 votes)

27 views1 pageVSS Mani founded Just Dial in 1996 after the failure of his first venture. Just Dial focused on voice-enabled local searches until 2007, after which it offered information through both web and voice platforms. Just Dial's growth was enabled by India's growing telecom and internet industries, which allowed it to penetrate the consumer market. Just Dial had a successful IPO in 2013, becoming the most valuable Indian internet company, due to investors rewarding its high growth despite concerns about its high valuation.

Original Description:

yo

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVSS Mani founded Just Dial in 1996 after the failure of his first venture. Just Dial focused on voice-enabled local searches until 2007, after which it offered information through both web and voice platforms. Just Dial's growth was enabled by India's growing telecom and internet industries, which allowed it to penetrate the consumer market. Just Dial had a successful IPO in 2013, becoming the most valuable Indian internet company, due to investors rewarding its high growth despite concerns about its high valuation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views1 pageJust Dial - Vineet

Uploaded by

Vineet SinghVSS Mani founded Just Dial in 1996 after the failure of his first venture. Just Dial focused on voice-enabled local searches until 2007, after which it offered information through both web and voice platforms. Just Dial's growth was enabled by India's growing telecom and internet industries, which allowed it to penetrate the consumer market. Just Dial had a successful IPO in 2013, becoming the most valuable Indian internet company, due to investors rewarding its high growth despite concerns about its high valuation.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

When it comes to business, timing is more valuable than anything.

No one would know it better than

VSS Mani. After the failure of his first venture, Ask Me, VSS Mani founded Just Dial in 1996. Just Dial

focused on voice enabled local search until 2007. Post 2007, Just Dial has been offering information on

local businesses through a combination of web and voice based platform. As of March 2013 Just Dial had

7,400+ employees, 9.1 million+ listings of local businesses, and an estimated $50+ MM revenues. Just

Dials phenomenal growth has been because of two key factors the rapid growth of telecom, and

internet industry in India allowed Just Dial to increase penetration in the consumer market and

resistance to the temptation of becoming a B2B focused BPO business allowed Just Dial to establish a

foothold in the nascent B2C local search market. Today Just Dial has few competitors and runs a

profitable operation.

Just Dials IPO debuted on Indian bourses on June 5 this year. It was the biggest public offering of any

Indian consumer internet company and raised $150+ MM (919.4 Crores). The public offer was

subscribed over 11 times and listed at more than 11% premium to the IPO price of 530. Also, Just Dial

is the most valuable Indian internet firm with a market cap of $740+ MM.

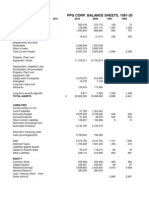

Company Market Cap as on July 4, 2013

$500 MM (3,029 Crores)

$525 MM (3,150 Crores)

$740+ MM (4,457 Crores)

Just Dial IPOs success stands proof to the fact that investors reward high growth, and they do so more

often in the Internet industry. Just Dial IPO is trading at over 72x its FY13 expected EPS of 60, and this

valuation than that of any comparable peers including Info Edge. However, Just Dials revenues have

grown at a CAGR of about 40% between 2008 and 2012 while Info Edges revenues had grown at under

15% over the same period. Even as several analysts have termed Just Dials valuation to be

unsustainable, the investors are confident that Just Dial would sustain high growth driven by growing

broadband and mobile internet penetration in India. Sceptics may still choose to wait for an impending

capitulation in Just Dials stock price, but investors will most likely stay dialled into the company as long

as it is able to deliver on investor expectations and continues its strong growth.

You might also like

- SIC - Sunpharma Ranbaxy M&ADocument16 pagesSIC - Sunpharma Ranbaxy M&AAmitrojitNo ratings yet

- Culture and Compensation at SRF Limited - E12 PDFDocument16 pagesCulture and Compensation at SRF Limited - E12 PDFVineet Singh100% (2)

- MOB Project - Erste Group Transformation Case Analysis QuestionsDocument12 pagesMOB Project - Erste Group Transformation Case Analysis QuestionsSuperfresh LorthongNo ratings yet

- Airtel Merger and AcquisitionDocument9 pagesAirtel Merger and AcquisitionTasvir ZaidiNo ratings yet

- Justdial Ipo Crisil 261211Document16 pagesJustdial Ipo Crisil 261211boomtech0285No ratings yet

- Just DialDocument3 pagesJust Dialrapols9No ratings yet

- Just Dial IpoDocument14 pagesJust Dial IpoSantosh SwamyNo ratings yet

- Just DialDocument50 pagesJust Dialsili core100% (1)

- Just Dial 1Document33 pagesJust Dial 1kartik379No ratings yet

- Analysis On The Basis of 7 Ps and SwotDocument28 pagesAnalysis On The Basis of 7 Ps and Swotvedanshjain100% (3)

- Lyxor ChinaH Versus Lyxor MS India Portfolio Risk and ReturnDocument3 pagesLyxor ChinaH Versus Lyxor MS India Portfolio Risk and ReturnSana BatoolNo ratings yet

- Political Factors:: Pestel Analysis of The Wives of Migrant Workers Who Reside in KeralaDocument4 pagesPolitical Factors:: Pestel Analysis of The Wives of Migrant Workers Who Reside in KeralaShaina DewanNo ratings yet

- Project On IPO of Cafe Coffee DayDocument45 pagesProject On IPO of Cafe Coffee DayVinit Dawane100% (1)

- Hershey India Private LimitedDocument9 pagesHershey India Private LimitedBharath Raj SNo ratings yet

- Internal Analysis of InfosysDocument3 pagesInternal Analysis of InfosysWilliam McconnellNo ratings yet

- Auto SmartDocument3 pagesAuto SmartLatambhat GmailNo ratings yet

- Case Study PDFDocument15 pagesCase Study PDFEr Ajay SharmaNo ratings yet

- Maruti Suzuki Financial Ratios, Dupont AnalysisDocument12 pagesMaruti Suzuki Financial Ratios, Dupont Analysismayankparkhi100% (1)

- 5 - G2B and G2C Pakistan - Mudasir Rasool - 13879Document4 pages5 - G2B and G2C Pakistan - Mudasir Rasool - 13879saadriazNo ratings yet

- Brand Equity of Google - Black BookDocument8 pagesBrand Equity of Google - Black BookHarkiran AnandNo ratings yet

- There Are Two Ways To Place An Order:: Online FormDocument6 pagesThere Are Two Ways To Place An Order:: Online FormakashNo ratings yet

- ERP@ Hero HondaDocument4 pagesERP@ Hero HondavishwesheswaranNo ratings yet

- Reliance Jio Marketing StrategyDocument2 pagesReliance Jio Marketing StrategyvjNo ratings yet

- AkilAfzal ZR2001040 FinalDocument4 pagesAkilAfzal ZR2001040 FinalAkil AfzalNo ratings yet

- Honest Tea Invstmt AnalysisDocument1 pageHonest Tea Invstmt AnalysisUyen HoangNo ratings yet

- Capital First LTD - SIP ReportDocument35 pagesCapital First LTD - SIP Reportharishmittal20100% (1)

- Striders: Running Away or Towards The Growth (Group 8)Document1 pageStriders: Running Away or Towards The Growth (Group 8)Rashi VajaniNo ratings yet

- Organisations Success BHARTI AIRTELDocument6 pagesOrganisations Success BHARTI AIRTELdukedhakaNo ratings yet

- RuthDocument2 pagesRuthLeeNo ratings yet

- Finlatics Investment Banking Experience Program - Project 1: Test MarketingDocument3 pagesFinlatics Investment Banking Experience Program - Project 1: Test MarketingRoshan GupthaNo ratings yet

- An W Ale R As Ka So Si: DR Ge Xa Js H Tha Ra OntDocument33 pagesAn W Ale R As Ka So Si: DR Ge Xa Js H Tha Ra OntAsym K'ystha100% (2)

- Family BusinessDocument12 pagesFamily BusinessJagadeesh PutturuNo ratings yet

- Bharti AirtelDocument25 pagesBharti AirtelSai VasudevanNo ratings yet

- Eic-Itc Kirti SabranDocument14 pagesEic-Itc Kirti Sabrankirti sabranNo ratings yet

- Otisline Case AnalysisDocument2 pagesOtisline Case AnalysisSuhas AvgNo ratings yet

- M&a Deal AssignmentDocument16 pagesM&a Deal AssignmentNishant AnandNo ratings yet

- Verizon Acquisition of Vodafone's Indirect Interest in Verizon WirelessDocument4 pagesVerizon Acquisition of Vodafone's Indirect Interest in Verizon WirelesskikiNo ratings yet

- 3i Infotech-Developing A Hybrid StrategyDocument20 pages3i Infotech-Developing A Hybrid StrategyVinod JoshiNo ratings yet

- Presented by - Kshitiz Deepanshi Bhanu Pratap Singh Manali Aditya AnjulDocument13 pagesPresented by - Kshitiz Deepanshi Bhanu Pratap Singh Manali Aditya AnjulBhanu NirwanNo ratings yet

- A PPT On ELSSDocument21 pagesA PPT On ELSSVinay BhargavaNo ratings yet

- BJP - GRP 7Document39 pagesBJP - GRP 7Jaspartap Singh100% (1)

- 108 PBM #2 Winter 2015 Part 2Document5 pages108 PBM #2 Winter 2015 Part 2Ray0% (1)

- ONGC S Growth Strategy: Presented By-Amit Kumar Srivastava Ashwani Mishra Kuldeep DixitDocument11 pagesONGC S Growth Strategy: Presented By-Amit Kumar Srivastava Ashwani Mishra Kuldeep Dixitsrmashwani0% (2)

- BCG Matrix SonyDocument8 pagesBCG Matrix SonyRashmi Preet SareenNo ratings yet

- Merger of Bharti Airtel With ZainDocument4 pagesMerger of Bharti Airtel With ZainDarshan VaghelaNo ratings yet

- Financial Modelling AssignmentDocument6 pagesFinancial Modelling AssignmentMomin AbrarNo ratings yet

- FM Project Report On Zee EntertainmentDocument9 pagesFM Project Report On Zee EntertainmentKumar RohitNo ratings yet

- Business Law AssignmentDocument4 pagesBusiness Law AssignmentMOHIT SINGHNo ratings yet

- Nirala Sweets and Kasuri Barfi Presented To:: Umair Yaseen 083147 Imran Khalid 083137 Asima Amjad 083241 NaeemDocument36 pagesNirala Sweets and Kasuri Barfi Presented To:: Umair Yaseen 083147 Imran Khalid 083137 Asima Amjad 083241 NaeemAnam Hashmi0% (1)

- Impact of Celebrity Endorsement On Consumer Buying Behaviour in The State of GoaDocument14 pagesImpact of Celebrity Endorsement On Consumer Buying Behaviour in The State of GoaAnshuman NarangNo ratings yet

- Annual Report of InfosysDocument3 pagesAnnual Report of InfosysChirag GogriNo ratings yet

- Zaplet and Rightnow TechnologyDocument4 pagesZaplet and Rightnow TechnologySaniya sohailNo ratings yet

- Presentation On SWOT Analysis of Infosis: Pioneer Institute of Professional StudiesDocument11 pagesPresentation On SWOT Analysis of Infosis: Pioneer Institute of Professional StudiestvishnutiwariNo ratings yet

- Risk Assessment DmartDocument4 pagesRisk Assessment DmartLokesh_Jain_7208100% (1)

- Atal Pension YojanaDocument2 pagesAtal Pension YojanakrithikNo ratings yet

- Discuss Internal, Domestic and Global Environments of Business Revealed by This Case?Document5 pagesDiscuss Internal, Domestic and Global Environments of Business Revealed by This Case?alphius17No ratings yet

- Godrej Builds 'Sampark' With Distributors - E-Business - Express Computer IndiaDocument2 pagesGodrej Builds 'Sampark' With Distributors - E-Business - Express Computer IndiaPradeep DubeyNo ratings yet

- Just DialDocument39 pagesJust DialJagannath Baranwal0% (1)

- Just Dial 123Document32 pagesJust Dial 123kartik379No ratings yet

- Just Dial-A Case Study in Service Marketing: Submitted To: Prof. Devang PatelDocument30 pagesJust Dial-A Case Study in Service Marketing: Submitted To: Prof. Devang Patelkartik379No ratings yet

- Suzlon Enegry Ltd-11 Annual Report PDFDocument162 pagesSuzlon Enegry Ltd-11 Annual Report PDFVineet SinghNo ratings yet

- Course Paper On Regression Analysis of Gold PricesDocument16 pagesCourse Paper On Regression Analysis of Gold PricesVineet Singh33% (3)

- Jain Irrigation Systems Strategy Report (HBS Case Study)Document17 pagesJain Irrigation Systems Strategy Report (HBS Case Study)Vineet Singh100% (3)