Professional Documents

Culture Documents

Silver Fundamentals-Fundamentally Flawed?: Special Report

Uploaded by

zdejopan1276Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Silver Fundamentals-Fundamentally Flawed?: Special Report

Uploaded by

zdejopan1276Copyright:

Available Formats

SPECIAL REPORT

Silver Fundamentals—Fundamentally Flawed?

Gold Fields Mineral Service (GFMS Ltd) published a document on the Silver Investment Market in

late April 2009. I carefully went over this report and will offer some comments, but my main

analysis centers around the fundamental case for silver. Both GFMS and CPM Group will be issue

their respective reports on the silver market each year.

Being a proponent of true free markets, not the version that is “spun” by way of the mainstream

financial press, we only need to go to Ayn Rand of Atlas Shrugged fame to “check our premises”

and verify that we have not overlooked something or assumed something that is not valid.

First, we must define what we are trying to prove or at least examine, and this is simple (not

easy): just how “tight” is the current silver supply? Before delving deeper it is absolutely essential

to define our “givens.”

Givens: The basis for this analysis

The silver bullion market will be examined

Allowing for the amount of commercial grade silver per CPM Group

Coin market will be mentioned but not pertinent to this analysis

As mentioned to our readership, we examine the bullion market more carefully, because this is the

market that sets the “price” for silver. Yes the coin market is an important aspect of the silver

market, making up roughly fifty percent of the total, but this silver is not deliverable against a

COMEX contract or London Bullion Market Association (LBMA) position.

There are two main studies on the silver market. I have both and have read them for years. One is

produced by CPM Group of New York, and this year’s CPM Silver Yearbook 2009 . The other is

sponsored by the Silver Institute and is produced by GFMS of the United Kingdom. Your editor has

met and spoken with the principals of both of these organizations at a face-to-face level.

Although no one in this industry knows the true amount of physical silver bullion existing in

commercial form (1000-oz. bars), we need to begin our analysis at some point. Therefore rather

than give you my opinion of how much exists, let me cite the two best-known studies on the silver

market.

Page 1 © Copyright 2009 – www.silver-investor.com

According to this year’s study by CPM in their Silver Yearbook 2008, page 17, the Estimated Silver

Bullion Inventories, Year-End, were less than 400 million ounces. However, this year’s study, just

released, put the figure at nearly 600 million ounces. This is primarily due to increased silver

production and increased recycling.

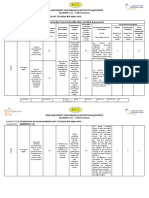

As we can see (chart on next page), according to CPM there is approximately 600 million ounces of

fine bullion available. Now before moving onward, we must examine what GFMS has to state about

total silver bullion inventory, and here we find a much larger number, primarily about 200 million

ounces more in fact. While reviewing all the data for this segment over several weeks, it suddenly

dawned on me that we can “arbitrarily” add 200 million ounces at any point in time—because this

is the float of recycled silver each and every year. Specifically, the amount of silver recycled in

2008 was closer to 250 million ounces per the new CPM report.

So, it does not make either of the studies right or wrong; it just helps to explain a wide fudge

factor in the data. Let me be very clear: this is “my take” on the matter and is NOT that of GFMS. I

only wish to keep this discussion as fair and open as possible without resorting to “bookkeeping”

entries of silver. In other words, a great deal of silver—over 200 million ounces—is always in the

recycling pipeline as film, scrap, or as many may not know—liquids.

Going a bit further, people who are very studied on the silver market may recall that in March 2006

an article was penned about the debate between Jeffrey Christian of CPM Group and Philip Klapwijk

of GFMS concerning silver inventories. Without going into all the details, the GFMS survey has

maintained that more silver is available than the CPM Group but cannot point to it, and my bias is

to that which can be proven.

For the purposes of my analysis I will take the “best case” scenario and use the 600-million-ounce

case of commercial grade silver. Again, you can use any number you wish. The purpose is not to

determine exactly how much silver exists in commercial form, and the main purpose is to give a

strong indication of just how tight the silver market is at present.

Page 2 © Copyright 2009 – www.silver-investor.com

Known:

Barclays ETF, 283 Million Ounces

Zurich Cantonal Bank, 50+ Million Ounces

ETF Securities, 17 Million

Central Fund of Canada, 58 Million

Bullion Management Group, 5 Million

COMEX, 118 Million

Total: 530 Million +

Basically we have very little silver that is not accounted for as investment silver. This gives us a

very clear message that the market must be very tight presently. COMEX is only about 20% of the

total market yet it has a huge influence, as does the LBMA, because of the massive amount of

paper contracts bought and sold on a daily basis. Additionally, two new silver investment vehicles

were added recently, Silver Bullion Trust and another Silver ETF. On top of that bullish news, China

has recently started to offer silver bullion investment to their general public. Can you imagine what

will happen if ½% of over a billion people discover the fundamental value of silver?

If we look forward we must consider that if new purchases of silver are going to continue, and that

is a very reasonable assumption, at what point do we start to see delivery delays and/or price

increases?

The first Silver ETF was introduced in April 2006, so in three short years we have gone from 130

million ounces (what SLV began with as their projected “allotment”) to 350+ million ounces. This

yields a total increase of 220 million ounces in three years’ time. If the silver demand continues

unabated for three more years at a similar pace, where will the silver come from? (Note: 350 is the

total of Barclays, Zurich, and ETF Securities combined.)

Central Fund of Canada recently added another $210 million in mid April to purchase more gold

and silver bullion. Additionally, all the others mentioned above—Barclay’s, Zurich Cantonal, and

ETF Securities—added to their holdings the past two months. Increased investment demand is

expected to continue for several years into the future as more people seek silver to diversify their

holdings into precious metals including silver.

Page 3 © Copyright 2009 – www.silver-investor.com

As the founder of Silver-Investor.com I have devoted most of my life to studying the financial

markets, money, metals, and mining. You are all welcome to visit the website daily as new news

items are posted on a regular basis. Further, for those “Silver Bulls” you might consider our free

list and that way you are certain to stay informed on this dynamic market.

Remember Get Real, Buy Real

Sincerely,

David Morgan

For those that are serious about making money --our paid subscribers received an

exclusive username and password, once they enter the MEMBERS ONLY portion of the

website we have an in depth report named "How to use the Morgan Report" provides you

with information about the reports and how to use them to your best advantage.

Information contained herein has been obtained from sources believed to be reliable, but there is no

guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary

should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein

are statements of our judgment as of this date and are subject to change without notice. Any action taken as

a result of reading this independent market research is solely the responsibility of the reader. Stone

Investment Group is not and does not profess to be a professional investment advisor, and strongly

encourages all readers to consult with their own personal financial advisors, attorneys, and accountants before

making any investment decision. Stone Investment Group and/or independent consultants or members of

their families may have a position in the securities mentioned. Mr. Morgan does consult on a paid basis both

with private investors and various companies. Investing and speculation are inherently risky and should not be

undertaken without professional advice. By your act of reading this independent market research letter, you

fully and explicitly agree that Stone Investment Group will not be held liable or responsible for any decisions

you make regarding any information discussed herein.

Page 4 © Copyright 2009 – www.silver-investor.com

You might also like

- Your Guide To Buying SilverDocument14 pagesYour Guide To Buying SilverLeo von Lüttichau100% (4)

- How To Make A Fortune Buying & Selling Gold Coins!Document35 pagesHow To Make A Fortune Buying & Selling Gold Coins!outbackjack9No ratings yet

- Not Free, Not Fair - The Long Term Manipulation of The Gold Price - Sprott Asset Management Special ReportDocument67 pagesNot Free, Not Fair - The Long Term Manipulation of The Gold Price - Sprott Asset Management Special Reportfree404100% (1)

- Precious Metals Buyers GuideDocument44 pagesPrecious Metals Buyers GuideGuillaume PriolNo ratings yet

- Business Plan: Malaysian NGV SDN BHDDocument81 pagesBusiness Plan: Malaysian NGV SDN BHDMurtaza ShaikhNo ratings yet

- Gold EconomicsDocument7 pagesGold EconomicsRezwan UllahNo ratings yet

- The Gold Stock SecretDocument19 pagesThe Gold Stock SecrethahahaNo ratings yet

- Mylchreest Gold London BullionDocument59 pagesMylchreest Gold London BullionZerohedge100% (2)

- Evolution of Human Resource ManagementDocument13 pagesEvolution of Human Resource Managementmsk_1407No ratings yet

- The Trader's Great Gold Rush: Must-Have Methods for Trading and Investing in the Gold MarketFrom EverandThe Trader's Great Gold Rush: Must-Have Methods for Trading and Investing in the Gold MarketNo ratings yet

- GPM Gold Guide v14Document37 pagesGPM Gold Guide v14TFMetalsNo ratings yet

- Debunking The Gold Bubble Myth: By: Eric Sprott & Andrew MorrisDocument4 pagesDebunking The Gold Bubble Myth: By: Eric Sprott & Andrew Morrisscribd_tsan100% (1)

- Guide To Investing in Gold & SilverDocument12 pagesGuide To Investing in Gold & Silveravoman123100% (1)

- Delivery For OutSystems Specialization Sample Exam - enDocument8 pagesDelivery For OutSystems Specialization Sample Exam - enmahesh manchalaNo ratings yet

- G1 - Introduction Generator ProtectionDocument21 pagesG1 - Introduction Generator ProtectionOoi Ban JuanNo ratings yet

- Junior Copper ReportDocument59 pagesJunior Copper Reportkaiselk100% (1)

- BBA - Study On Gold As A Safer Investment CommodityDocument94 pagesBBA - Study On Gold As A Safer Investment CommoditySANJU GNo ratings yet

- Sprott Silver UpdatesDocument6 pagesSprott Silver Updatesshawn2207No ratings yet

- Bullion Banking Explained February 2000Document3 pagesBullion Banking Explained February 2000chrisbanick@gmail.comNo ratings yet

- Gold Market Lending BlanchardDocument28 pagesGold Market Lending Blanchardbabstar999No ratings yet

- Gold Update: Bernie Doyle Investment AdvisorDocument12 pagesGold Update: Bernie Doyle Investment AdvisorBernie DoyleNo ratings yet

- Thunder Road Report 26Document57 pagesThunder Road Report 26TFMetalsNo ratings yet

- A Study of Commodity Market With Special Reference To Gold: Synopsis Report ONDocument8 pagesA Study of Commodity Market With Special Reference To Gold: Synopsis Report ONRanbir SinghNo ratings yet

- Gold-Physical Vs MF DemystifiedDocument4 pagesGold-Physical Vs MF Demystifiedmcube4uNo ratings yet

- There's No Gold - COMEX Report Exposes Conditions Behind Physical Crunch - Zero HedgeDocument7 pagesThere's No Gold - COMEX Report Exposes Conditions Behind Physical Crunch - Zero HedgeRobert GatesNo ratings yet

- AWN ThePerfectGoldPortfolioDocument8 pagesAWN ThePerfectGoldPortfolioCraig CannonNo ratings yet

- IMT 20 Managerial Economics M3Document3 pagesIMT 20 Managerial Economics M3solvedcareNo ratings yet

- Gold Price Literature ReviewDocument8 pagesGold Price Literature Reviewea0kvft0100% (1)

- Gold Price Fluctuation Research PaperDocument4 pagesGold Price Fluctuation Research Papergz91rnat100% (1)

- Great Gold Silver Ride 2012Document26 pagesGreat Gold Silver Ride 2012shamikbhoseNo ratings yet

- Gold As CollateralDocument0 pagesGold As Collateralkoib789No ratings yet

- The Casey Research Silver 2011 Silver Investing Guide 2011 Silver InvestingDocument17 pagesThe Casey Research Silver 2011 Silver Investing Guide 2011 Silver Investinglenrok4321No ratings yet

- Gold Report 2010Document13 pagesGold Report 2010auroeaNo ratings yet

- Physical Gold Is Not Physical Gold - Swiss GoldplanDocument2 pagesPhysical Gold Is Not Physical Gold - Swiss GoldplantigerkillerNo ratings yet

- Alch29 LeasesDocument3 pagesAlch29 LeasesAmol KulkarniNo ratings yet

- Curtis Hesler - It's No Time To Ditch Gold AnalysisDocument3 pagesCurtis Hesler - It's No Time To Ditch Gold AnalysisDraženSNo ratings yet

- Towards HyperinflationDocument14 pagesTowards Hyperinflationpaganrongs100% (1)

- Did The New Fix, Fix The Fix - An Intraday Exploration of The Precious Metal FixingDocument26 pagesDid The New Fix, Fix The Fix - An Intraday Exploration of The Precious Metal Fixingpderby1No ratings yet

- MurrayPollitt 11 14 2011Document2 pagesMurrayPollitt 11 14 2011alexdgonNo ratings yet

- Eric Sprott of Sprott Asset February 2013 LetterDocument4 pagesEric Sprott of Sprott Asset February 2013 LetterallaboutvalueNo ratings yet

- $100 Silver Now A Conservative Target: The Amount of Available Silver Is Far Rarer Than The Amount of Available GoldDocument6 pages$100 Silver Now A Conservative Target: The Amount of Available Silver Is Far Rarer Than The Amount of Available Goldsushant_shaantNo ratings yet

- Boost Your Gains by Nine Times During The Greatest Gold Rally in HistoryDocument10 pagesBoost Your Gains by Nine Times During The Greatest Gold Rally in Historybayot2000No ratings yet

- Swot AnalysisDocument67 pagesSwot AnalysisMohmmedKhayyumNo ratings yet

- SEC and Menzgold - A Fresh PerspectiveDocument2 pagesSEC and Menzgold - A Fresh PerspectiveSam ObuobiNo ratings yet

- 2009 Winter Warning Volume 10 Issue 1Document6 pages2009 Winter Warning Volume 10 Issue 1stevens106No ratings yet

- The Gold Standard 44 Aug 14Document12 pagesThe Gold Standard 44 Aug 14ulfheidner9103No ratings yet

- Gold Price FluctuationsDocument7 pagesGold Price FluctuationsHaspreet SinghNo ratings yet

- Silver Producers A Call To ActionDocument5 pagesSilver Producers A Call To Actionrichardck61No ratings yet

- Silver Pssil02101Document3 pagesSilver Pssil02101trader_10No ratings yet

- Market Update MayDocument6 pagesMarket Update MayKSIRCapitalNo ratings yet

- TDGBook 2016Document138 pagesTDGBook 2016MarcoBarisonNo ratings yet

- Research Paper On Gold InvestmentDocument5 pagesResearch Paper On Gold Investmentvmehykrif100% (1)

- Secrets of The Silver MarketDocument8 pagesSecrets of The Silver MarketMauricoNo ratings yet

- From Money To Metals: The Good Campaigners' Guide To Questionable Funder$Document151 pagesFrom Money To Metals: The Good Campaigners' Guide To Questionable Funder$John SchertowNo ratings yet

- Master Thesis Gold PriceDocument8 pagesMaster Thesis Gold PriceCustomPaperCanada100% (2)

- The Gold Standard35Document10 pagesThe Gold Standard35ulfheidner9103No ratings yet

- Silver, Luxury Goods and Rare Earths: 6th September 2010Document24 pagesSilver, Luxury Goods and Rare Earths: 6th September 2010richardck50No ratings yet

- Economic Agent OrangeDocument3 pagesEconomic Agent OrangeTim PriceNo ratings yet

- The Silver Investment Market - An UpdateDocument29 pagesThe Silver Investment Market - An UpdateSGSNo ratings yet

- Bonfire of The CurrenciesDocument5 pagesBonfire of The CurrenciesNolan AndersonNo ratings yet

- Corona Associates Capital Management - Year End 2017 Investment Letter - 1.7.18Document6 pagesCorona Associates Capital Management - Year End 2017 Investment Letter - 1.7.18Julian ScurciNo ratings yet

- Live Meeting 2007 User GuideDocument25 pagesLive Meeting 2007 User Guidezdejopan1276No ratings yet

- Whole Wheat BreadDocument1 pageWhole Wheat Breadzdejopan1276No ratings yet

- Business Objects Xir2 Data Access Guide enDocument120 pagesBusiness Objects Xir2 Data Access Guide enzdejopan1276No ratings yet

- Sap QueryDocument22 pagesSap QueryRajiv KumarNo ratings yet

- Link ClickDocument8 pagesLink Clickzdejopan1276No ratings yet

- PentahoAdministrationConsole ManualDocument21 pagesPentahoAdministrationConsole Manualzdejopan1276No ratings yet

- The Effect of Electronic Coupon Value To Perceived Usefulness and Perceived Ease-of-Use and Its Implication To Behavioral Intention To Use Server-Based Electronic MoneyDocument12 pagesThe Effect of Electronic Coupon Value To Perceived Usefulness and Perceived Ease-of-Use and Its Implication To Behavioral Intention To Use Server-Based Electronic MoneyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Keystone Account Opening FormDocument6 pagesKeystone Account Opening Formenumah francisNo ratings yet

- Request For Refund or Test Date Transfer FormDocument2 pagesRequest For Refund or Test Date Transfer FormAhmed Hamdy100% (1)

- T3 Rapid Quantitative Test COA - F2311630AADDocument1 pageT3 Rapid Quantitative Test COA - F2311630AADg64bt8rqdwNo ratings yet

- Rai Work Experience SheetDocument2 pagesRai Work Experience Sheetmark langcayNo ratings yet

- Some People Say That Having Jobs Can Be of Great Benefit To TeensDocument2 pagesSome People Say That Having Jobs Can Be of Great Benefit To Teensmaia sulavaNo ratings yet

- Design of Earth Air Tunnel To Conserve Energy - FinalDocument19 pagesDesign of Earth Air Tunnel To Conserve Energy - FinalApurva AnandNo ratings yet

- File System ImplementationDocument35 pagesFile System ImplementationSát Thủ Vô TìnhNo ratings yet

- Office of The Sangguniang Panlalawigan: Hon. Francisco Emmanuel "Pacoy" R. Ortega IiiDocument5 pagesOffice of The Sangguniang Panlalawigan: Hon. Francisco Emmanuel "Pacoy" R. Ortega IiiJane Tadina FloresNo ratings yet

- Architecture Design Planning Undergraduate Postgraduate Guide 2018Document52 pagesArchitecture Design Planning Undergraduate Postgraduate Guide 2018Jack LinNo ratings yet

- MEP Works OverviewDocument14 pagesMEP Works OverviewManoj KumarNo ratings yet

- Bafb1023 Microeconomics (Open Book Test)Document4 pagesBafb1023 Microeconomics (Open Book Test)Hareen JuniorNo ratings yet

- Dialux BRP391 40W DM CT Cabinet SystemDocument20 pagesDialux BRP391 40W DM CT Cabinet SystemRahmat mulyanaNo ratings yet

- Ordinary Differential Equations Multiple Choice Questions and Answers - SanfoundryDocument7 pagesOrdinary Differential Equations Multiple Choice Questions and Answers - SanfoundrySaiman PervaizNo ratings yet

- 5c X-Tend FG Filter InstallationDocument1 page5c X-Tend FG Filter Installationfmk342112100% (1)

- VDO Gauge - VL Hourmeter 12 - 24Document2 pagesVDO Gauge - VL Hourmeter 12 - 24HanNo ratings yet

- Fisher C1 Series Pneumatic Controllers and TransmittersDocument12 pagesFisher C1 Series Pneumatic Controllers and TransmittersAnderson KundeNo ratings yet

- Genose Massal D - 6 Juli 2021Document102 pagesGenose Massal D - 6 Juli 2021Phyto LianoNo ratings yet

- 2.21 - Hazard Identification Form - Fall ProtectionDocument3 pages2.21 - Hazard Identification Form - Fall ProtectionSn AhsanNo ratings yet

- Class 10th IMO 5 Years EbookDocument71 pagesClass 10th IMO 5 Years EbookAdarsh Agrawal100% (1)

- Instructions For Form 8824Document4 pagesInstructions For Form 8824Abdullah TheNo ratings yet

- RidleyBoxManual1 17Document63 pagesRidleyBoxManual1 17Sergio Omar OrlandoNo ratings yet

- Skott Marsi Art Basel Sponsorship DeckDocument11 pagesSkott Marsi Art Basel Sponsorship DeckANTHONY JACQUETTENo ratings yet

- Product Information Flyer: CIMSTAR® 10-570-HFP With FACT™Document2 pagesProduct Information Flyer: CIMSTAR® 10-570-HFP With FACT™sobheysaidNo ratings yet

- Cenomar Request PSA Form-NewDocument1 pageCenomar Request PSA Form-NewUpuang KahoyNo ratings yet