Professional Documents

Culture Documents

A Study of Commodity Market With Special Reference To Gold: Synopsis Report ON

Uploaded by

Ranbir SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study of Commodity Market With Special Reference To Gold: Synopsis Report ON

Uploaded by

Ranbir SinghCopyright:

Available Formats

SYNOPSIS REPORT ON A STUDY OF COMMODITY MARKET WITH SPECIAL REFERENCE TO GOLD

COMPANY

PROFILE:

Karvy has traveled the success route, towards building a reputation as an integrated financial services provider, offering a wide spectrum of services for over 20 years. Karvy, a name long committed to service at its best. A fame acquired through the range of corporate and retail services including mutual funds, fixed income, equity investments, insurance to name a few. Our values and vision of attaining total competen ce in our servicing has served as a building block for creating a great financial enterprise. KARVY, is a premier integrated financial services provider, and ranked among the top five in the country in all its business segments, services over 16 million individual investors in various capacities, and provides investor services to over 300 corporate, comprising the who is who of Corporate India. KARVY covers the entire spectrum of financial services such as Stock broking, Depository Participants, Distribution of financial products - mutual funds, bonds, fixed deposit, equities, Insurance Broking, Commodities Broking, Personal Finance Advisory Services, Merchant Banking & Corporate Finance, placement of equity, IPO, among others. Karvy has a professional management team and ranks among the best in technology, operations and research of various industrial segments. The birth of Karvy was on a modest scale in the year 1982. It began with the vision and enterprise of a small group of practicing Chartered Accountants based in Hyderabad, who founded Karvy. We started with consulting and financial accounting automation, and then carved inroads into the field of Registry and Share Transfers. Since then, we have utilized our quality experience and superlative expertise to go from strength to strength to provide better and new services to the investors. And today, we can look with pride at the fruits of our experience into comprehensive financial services provider in the Country.

KARVY Group companies are: Karvy Consultants Limited Karvy Stock Broking Limited Karvy Investor Services Limited Karvy Computershare Private Limited Karvy Global Services Limited Karvy Comtrade Limited Karvy Insurance Broking Private Limited Karvy Mutual Fund Services Karvy Securities Limited Value and Vision of Karvy Stock Broking Ltd: Our values and vision of attaining total competence in our servicing has served as the building block for creating a great financial enterprise, which stands solid on our fortress of financial strength our various companies. About Karvy Commodities Broking Limited: Commodities market, contrary to the beliefs of many people, has been in existence in India through the ages. However the recent attempt by the Government to permit Multi-commodity National levels exchanges has indeed given it, a shot in the arm. As a result two exchanges Multi Commodity Exchange (MCX) and National Commodity and derivatives Exchange (NCDEX) have come into being. These exchanges, by virtue of their high profile promoters and stakeholders, bundle in themselves, online trading facilities, robust surveillance measures and a hassle-free settlement system. The futures contracts available on a wide spectrum of commodities like Gold, Silver, Cotton, Steel, Soya oil, Soya beans, Wheat, Sugar, Channa etc., provide excellent opportunities for hedging the risks of the farmers, importers, exporters, traders

and large scale consumers. They also make open an avenue for quality investments in precious metals. The commodities market, as the movements of the stock market or debt market do not affect it provides tremendous opportunities for better diversification of risk. Realizing this fact, even mutual funds are contemplating of entering into this market.

Introduction to commodity market

Ever since the drawn of civilization, commodity trading has become an integral part of mankind. The first and foremost reason is that commodity represents the fundamental elements of lifestyle of human beings. In the early days, people used to exchange goods for goods, which was called as Barter System. With the advancement of civilization, trading system has gone through various changes and has now entered into an era of Future trading besides existence physical trading across the world. The history of Commodity Future trading can be traced back to 1688 with the introduction of Future trading in rice in Japan. This was followed by an increased participation in commodity derivatives, especially in Futures, in the industrialized countries like America and Britain. All the countries opened the avenue for introduction of Future trading in commodities in 19th century. Major commodity Future trading platforms opened in the world are Chicago Board of Trade (NYBOT) and New York Mercantile Exchange (NYMEX). A Commodity derivative is a contract which derives its value from an underlying commodity. The main purpose of Future market is to provide a mechanism for successfully managing the price risk associated with commodities. Future markets provide a platform for buyers and sellers to trade in a huge number of diverse commodities such as agricultural products, metals and energy. These markets are not only meant for hedgers, speculators and arbitrages, but also for retail investors who want to trade in booming commodity market.

Meaning of commodity derivative market

FCRA Forward Contracts (Regulation) Act, 1952 defines goods as every kind of movable property other than actionable claims, money and securities. Futures trading is organized in such goods or commodities as are permitted by the Central Government. At present, all goods and products of agricultural (including plantation), mineral and fossil origin are allowed for futures trading under the auspices of the commodity exchanges recognized under the FCRA.

A commodity derivative is a contract which derives its value from an underlying commodity. The main purpose of future market is to provide a mechanism for successfully managing the price risks associated with commodities. Future market provides a platform for buyer and seller to trade in a huge number of diverse commodities such as agriculture products, metals and energy. These markets are not only meant for hedgers, speculators and arbitrages, but also for retail investors who want to trade in booming commodity market. Commodity derivatives market trade contracts for which the underlying asset is commodity. It can be an agricultural commodity like wheat, soybeans, rapeseed, cotton, etc or precious metals like gold, silver, etc.

Gold commodity Future Market Introduction

Gold is a unique asset based on few basic characteristics. First, it is primarily a monetary asset, and partly a commodity. As much as two thirds of golds total accumulated holdings relate to store of value considerations. Holdings in this category include the central bank reserves, private investments, and high-cartage jewelry bought primarily in developing countries as a vehicle for savings. Thus, gold is primarily a monetary asset. Less than one third of golds total accu mulated holdings can be considered a commodity, the jewelry bought in Western markets for adornment, and gold used in industry. What makes Gold Special? Timeless and Very Timely Investment: For thousands of years, gold has been prized for its rarity, its beauty, and above all, for its unique characteristics as a store of value. Nations may rise and fall, currencies come and go, but gold endures. Gold is an effective diversifier: Diversification helps protect your portfolio against fluctuations in the value of any one-asset class. Gold is an ideal diversifier, because the economic forces that determine the price of gold are different from, and in many cases opposed to, the forces that influence most financial assets.

Gold is the ideal gift: In many cultures, gold serves as a family treasure or a wealth transfer vehicle that is passed on from generation to generation. Gold bullion coins make excellent gifts for birthdays, graduations, weddings, holidays and other occasions. What makes Gold different from other commodities? The flow demand of commodities is driven primarily by exogenous variables that are subject to the business cycle, such as GDP or absorption. Consequently, one would expect that a sudden unanticipated increase in the demand for a given commodity that is not met by an immediate increase in supply should, all else being equal, drive the price of the commodity upwards. However, it is our contention that, in the case of gold, buffer stocks can be supplied with perfect elasticity. If this argument holds true, no such upward price pressure will be observed in the gold market in the presence of a positive demand shock. The existence of a sophisticated liquid market in gold has, over the past 15 years, provided a mechanism for gold held by central banks and other major institutions to come back to the market. Although the demand for gold as an industrial input or as a final product (jewelry) differs across regions, it is argued that the core driver of the real price of gold is stock equilibrium rather than flow equilibrium. This is not to say that exogenous shifts in flow demand will have no influence at all on the price of gold, but rather that the large supply of inventory is likely to dampen any resultant spikes in price. The extent of this to dampening effect depends on the gestation lag within which liquid inventories can be converted in industrial inputs. In the gold industry such time lags are typically very short. The distinction between gold and commodities is important. Gold has maintained its value in after-inflation terms over the long run, while commodities have declined. Some analysts like to think of gold as a currency without a country. It is an internationally recognized asset that is not dependent upon any governments promise to pay. This is an important feature when comparing gold to conventional diversifiers like T-bills or bonds, which unlike gold, do have counter-party risk.

OBJECTIVES OF THE STUDY :

To study the mechanism of commodity market.

To study the spot gold market.

To study whether the goldsmiths of Belgaum city aware of commodity market and their perception.

To analyses the impact of spot gold market on future gold market.

To study the factors such as economic factors of US, world political and other factors affect on future market.

Research methodology:

SAMPLE SIZE: 100 random sample size SAMPLE TYPE: Simple random sampling SAMPLE AREA: Belgaum city TOOL USED FOR ANALYSES: 1. Graphical Representation of Analysis: Pie charts Line Chart 2. SPSS 3. Correlation SOURCES OF DATA COLLECTION:

Primary DataQuestionnaire Observation and personal discussion with gold traders.

Secondary dataInformation collected from different websites likes Gold World, MCX etc. From various text books, journals, magazines, news papers and booklets from company.

You might also like

- Swot Analysis of Asset ClassesDocument5 pagesSwot Analysis of Asset ClassesRakkuyil Sarath33% (3)

- A Project Report On The Inventory Management at Ranna Sugar LTDDocument99 pagesA Project Report On The Inventory Management at Ranna Sugar LTDBabasab Patil (Karrisatte)67% (3)

- Gold MarketDocument25 pagesGold MarketVirendra Jha100% (1)

- Commodity Market ReportDocument10 pagesCommodity Market ReportsaturunNo ratings yet

- Gold Trading in Commodity MarketDocument67 pagesGold Trading in Commodity MarketManish BeraNo ratings yet

- Commodities How To Approach Them VRK100 07062006Document3 pagesCommodities How To Approach Them VRK100 07062006RamaKrishna Vadlamudi, CFANo ratings yet

- Commodities Market1Document65 pagesCommodities Market1Tanguturu AnushaNo ratings yet

- Comoditiy MarketDocument57 pagesComoditiy MarketMukesh ManwaniNo ratings yet

- Relationship Between Gold Price & Inflation, Interest & Exchange RatesDocument42 pagesRelationship Between Gold Price & Inflation, Interest & Exchange Rateshaikal hafizNo ratings yet

- Swot AnalysisDocument67 pagesSwot AnalysisMohmmedKhayyumNo ratings yet

- Gold Standard and Economic FreedomDocument4 pagesGold Standard and Economic FreedomHbeltraoNo ratings yet

- Ty Bba Project1Document37 pagesTy Bba Project1Shivam KharuleNo ratings yet

- Gold Prices in IndiaDocument7 pagesGold Prices in IndiatechcaresystemNo ratings yet

- GOLD AND ECONOMIC FREEDOM (Alan Greenspan)Document5 pagesGOLD AND ECONOMIC FREEDOM (Alan Greenspan)L. Crassus100% (5)

- Gold Market Lending BlanchardDocument28 pagesGold Market Lending Blanchardbabstar999No ratings yet

- Wealth Management Project Report On Gold Etf & Its BenefitsDocument19 pagesWealth Management Project Report On Gold Etf & Its BenefitsPallavi MishraNo ratings yet

- Indian Commodity MarketDocument28 pagesIndian Commodity MarketVishal VincentNo ratings yet

- 1gold Report PDFDocument86 pages1gold Report PDFrahul84803No ratings yet

- Commodity TradingDocument14 pagesCommodity Tradingpayalmathur91100% (1)

- Commodity AssignmentDocument7 pagesCommodity Assignment05550No ratings yet

- Review of Literature 3. Rationale of Study 4. Objectives of The Study 5. Research Methodology 6. Hypotheses of The StudyDocument15 pagesReview of Literature 3. Rationale of Study 4. Objectives of The Study 5. Research Methodology 6. Hypotheses of The Studysourabhjain94No ratings yet

- Commodity ProjectDocument74 pagesCommodity Projectbalki123No ratings yet

- Alternative Investment OptionsDocument8 pagesAlternative Investment OptionsVimal BujadNo ratings yet

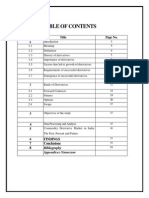

- Chapter No. Title Page No. 1: Findings 7 Conclusions 8Document58 pagesChapter No. Title Page No. 1: Findings 7 Conclusions 8Reu GeorgeNo ratings yet

- ms45 Dec 6Document9 pagesms45 Dec 6sudhir.kochhar3530No ratings yet

- The Securitzation of Commodities - RitterDocument6 pagesThe Securitzation of Commodities - RitterCervino InstituteNo ratings yet

- ComoditiesDocument61 pagesComoditiesShankar VarmaNo ratings yet

- Karnatak University Dharwad: Kousali Institute of Management StudiesDocument3 pagesKarnatak University Dharwad: Kousali Institute of Management StudiessavithaguttedarNo ratings yet

- Mba Project by FrajvalDocument28 pagesMba Project by FrajvalmorganNo ratings yet

- GOLD BrochureDocument8 pagesGOLD BrochurelaxmiccNo ratings yet

- BBA - Study On Gold As A Safer Investment CommodityDocument94 pagesBBA - Study On Gold As A Safer Investment CommoditySANJU GNo ratings yet

- Ajeej Ahmed-Aziz Final MRPDocument57 pagesAjeej Ahmed-Aziz Final MRPAnshu Jaisinghani HandooNo ratings yet

- Gold Return Vs Equty MarketDocument19 pagesGold Return Vs Equty MarketSharad PawarNo ratings yet

- Financial Markets: Hot Topic of The EconomyDocument8 pagesFinancial Markets: Hot Topic of The EconomyOtmane Senhadji El RhaziNo ratings yet

- How To Trade GoldDocument10 pagesHow To Trade GoldSadiq AbdulazeezNo ratings yet

- Indian Commodity MarketDocument9 pagesIndian Commodity MarketSweta SinghNo ratings yet

- Investing in CommoditiesDocument2 pagesInvesting in CommoditiesAsim QaiserNo ratings yet

- Silver Fundamentals-Fundamentally Flawed?: Special ReportDocument4 pagesSilver Fundamentals-Fundamentally Flawed?: Special Reportzdejopan1276No ratings yet

- Gold As CollateralDocument0 pagesGold As Collateralkoib789No ratings yet

- An Approach To How To Trade in Commodities Market 13052013Document6 pagesAn Approach To How To Trade in Commodities Market 13052013sskr1307No ratings yet

- Religare Dibya ProjectDocument19 pagesReligare Dibya Projectkrishna shah100% (2)

- Financial System and Monetary StandardsDocument6 pagesFinancial System and Monetary Standardsmaria angelica carbonel balinbinNo ratings yet

- Commodity MarketDocument8 pagesCommodity MarketRushabh ShahNo ratings yet

- Impact of Nsel Scam On Commodity MarketDocument30 pagesImpact of Nsel Scam On Commodity MarketPawan PunethaNo ratings yet

- Capital Market in India ProjectDocument26 pagesCapital Market in India ProjectNamrataShahaniNo ratings yet

- Study of Commodity Market ReportDocument83 pagesStudy of Commodity Market ReportAmit Yadav100% (1)

- Commodities Trading 101Document24 pagesCommodities Trading 101RandomNo ratings yet

- Final ProjectDocument90 pagesFinal Projectaryanabhi123No ratings yet

- Chap 2 International-FinanceDocument30 pagesChap 2 International-FinanceLyca RioNo ratings yet

- GPM Gold Guide v14Document37 pagesGPM Gold Guide v14TFMetalsNo ratings yet

- Commodity MarketsDocument7 pagesCommodity MarketsvalechabhushanNo ratings yet

- Investment in GoldDocument45 pagesInvestment in GoldsagarsanjanaNo ratings yet

- Commodity Market BasicsDocument16 pagesCommodity Market BasicsDeepika MahnaNo ratings yet

- Bullion Banking Explained February 2000Document3 pagesBullion Banking Explained February 2000chrisbanick@gmail.comNo ratings yet

- World Islamic Mint: NewsletterDocument16 pagesWorld Islamic Mint: NewsletterNurindah 'indah' SariiNo ratings yet

- Financial Unorthodoxy: Practicable Views on Money, Banking and InvestingFrom EverandFinancial Unorthodoxy: Practicable Views on Money, Banking and InvestingNo ratings yet

- Gold Investing Secrets: How to Diversify Your Portfolio and Build Long-Term WealthFrom EverandGold Investing Secrets: How to Diversify Your Portfolio and Build Long-Term WealthNo ratings yet

- The Commodities Investor: A beginner's guide to diversifying your portfolio with commoditiesFrom EverandThe Commodities Investor: A beginner's guide to diversifying your portfolio with commoditiesRating: 5 out of 5 stars5/5 (1)

- Welding Defects PDFDocument61 pagesWelding Defects PDFمحمد امين شريفNo ratings yet

- 19180Document2 pages19180Ranbir SinghNo ratings yet

- Welding Defects PDFDocument61 pagesWelding Defects PDFمحمد امين شريفNo ratings yet

- Full Final Absentism JVRDocument86 pagesFull Final Absentism JVRRanbir SinghNo ratings yet

- Full Final Employee Welfare in JK PaperDocument90 pagesFull Final Employee Welfare in JK PaperRanbir Singh100% (1)

- Initial Screen: For ExampleDocument21 pagesInitial Screen: For ExampleRanbir SinghNo ratings yet

- Full Final Absentism JVRDocument86 pagesFull Final Absentism JVRRanbir SinghNo ratings yet

- Report On Forbes Campbell Welfare MeasuresDocument81 pagesReport On Forbes Campbell Welfare MeasuresRanbir SinghNo ratings yet

- Spectrum of Icici PrudentialDocument8 pagesSpectrum of Icici PrudentialRanbir SinghNo ratings yet

- Reduce absenteeism at JVR ForgingsDocument16 pagesReduce absenteeism at JVR ForgingsRanbir SinghNo ratings yet

- Synopsis Attrition at JVR Forgings LimitedDocument17 pagesSynopsis Attrition at JVR Forgings LimitedRanbir SinghNo ratings yet

- Resume: Name:Amandeep Singh Address:# 67, C, B.R.S Nagar, LudhianaDocument2 pagesResume: Name:Amandeep Singh Address:# 67, C, B.R.S Nagar, LudhianaRanbir SinghNo ratings yet

- Pepsi vs Coke Merchandising StudyDocument12 pagesPepsi vs Coke Merchandising StudyRanbir SinghNo ratings yet

- ProjectDocument58 pagesProjectVignesh VikyNo ratings yet

- "Inventory, Purchase & Production Management": Synopsis Report ONDocument13 pages"Inventory, Purchase & Production Management": Synopsis Report ONRanbir SinghNo ratings yet

- RESUME SUMMARYDocument2 pagesRESUME SUMMARYRanbir SinghNo ratings yet

- Inv PatialaDocument81 pagesInv PatialaRanbir SinghNo ratings yet

- Over 15 Years Finance Experience Shared Services Branch AccountantDocument2 pagesOver 15 Years Finance Experience Shared Services Branch AccountantRanbir SinghNo ratings yet

- L-3 Schedule OveralllDocument2 pagesL-3 Schedule OveralllRanbir SinghNo ratings yet

- Resume Subhash-1Document4 pagesResume Subhash-1Ranbir SinghNo ratings yet

- Overview of Expert System ToolsDocument8 pagesOverview of Expert System ToolsRanbir SinghNo ratings yet

- Item Code Request FormatDocument5 pagesItem Code Request FormatRanbir SinghNo ratings yet

- Project Report: "Role of Sales Promotion On FMCG at Ahmedabad"Document13 pagesProject Report: "Role of Sales Promotion On FMCG at Ahmedabad"Ranbir SinghNo ratings yet

- CDCWDocument5 pagesCDCWRanbir SinghNo ratings yet

- RESUME SUMMARYDocument2 pagesRESUME SUMMARYRanbir SinghNo ratings yet

- Working ParleDocument86 pagesWorking ParleRanbir SinghNo ratings yet

- New Microsoft Office Word DocumentDocument24 pagesNew Microsoft Office Word DocumentRanbir SinghNo ratings yet

- Professor. S.Padmanaban - Resume 2013Document15 pagesProfessor. S.Padmanaban - Resume 2013Padmanaban Srinivasan Anandasayanam100% (1)

- Jaspreet 2013 Priority CompetencyDocument5 pagesJaspreet 2013 Priority CompetencyRanbir SinghNo ratings yet