Professional Documents

Culture Documents

Chap 12 - Selected Ex & Prob

Uploaded by

Steven Sanderson0 ratings0% found this document useful (0 votes)

47 views2 pagesThe transaction treats Ben Manion and etheridge co. As one entity when they are two separate entities. The pencil sharpener could be depreciated to match the expense with revenue. The inventory was written up to its market value when it should have remained at cost.

Original Description:

Original Title

Chap 12 - Selected Ex & Prob

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe transaction treats Ben Manion and etheridge co. As one entity when they are two separate entities. The pencil sharpener could be depreciated to match the expense with revenue. The inventory was written up to its market value when it should have remained at cost.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

47 views2 pagesChap 12 - Selected Ex & Prob

Uploaded by

Steven SandersonThe transaction treats Ben Manion and etheridge co. As one entity when they are two separate entities. The pencil sharpener could be depreciated to match the expense with revenue. The inventory was written up to its market value when it should have remained at cost.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

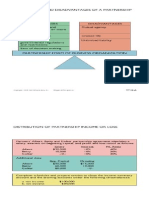

EXERCISE 12-1

Time period assumption.

Cost principle.

Economic entity assumption.

Revenue recognition principle.

Full disclosure principle.

Matching principle.

Going concern assumption.

Noopons

EXERCISE 12-2

1. No violation of generally accepted accounting principles.

2. This is a violation of the economic entity assumption. The

transaction treats Ben Manion and Etheridge Co. as one

entity when they are two separate entities. No journal

entry should have been made since Ben Manion should

have used personal assets to purchase the truck. If cash

assets of the company were used, the debit entry could

be to Accounts Receivable—B. Manion, or the debit entry

could be to B. Manion, Drawing.

3. This is a question of matching and materiality. The pencil

sharpener could be depreciated to match the expense

with revenue since the pencil sharpener has an estimated

useful life of 5 years. However, the pencil sharpener

should not be depreciated because the cost of it is not

material. Since the cost of the sharpener is not material, it

should be expensed immediately. The correct journal

entry at the time of purchase is:

Miscellaneous Expense..

25

Cash...

25

4. This is a violation of the cost principle because the

equipment was recorded at its estimated market value

and not its exchange value. The correct journal entry is:

PROBLEM 12-3B

Costs Total Percent

Incurred Estimated Complete

Year _(CurrentPeriod) + Cost = _(Current Period)

2004 $ 3,000,000 $20,000,000 15%

2005 9,000,000 $20,000,000 45%

2006 5,000,000 $20,000,000 25%

2007 3,000,000 $20,000,000 15%

Totals $20,000,000

Percent Revenue

Complete Total Recognized

‘Current Period) X_ Revenue = (Current Period,

15% $28,000,000 $ 4,200,000

45% 28,000,000 12,600,000

25% 28,000,000 7,000,000

15% 28,000,000 4,200,000

$28,000,000

EXERCISE 12-2 (Continued)

65,000

5. This is a violation of the cost principle. The inventory was

written up to its market value when it should have

remained at cost. Thus, no journal entry should have

been made.

You might also like

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Reaction Paper To Chapter 6Document3 pagesReaction Paper To Chapter 6Steven Sanderson100% (1)

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Chapter 21 Reaction PaperDocument4 pagesChapter 21 Reaction PaperSteven Sanderson100% (1)

- Reaction Paper To Chater 13Document2 pagesReaction Paper To Chater 13Steven Sanderson100% (5)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapters 10,11 and 12 Assessment QuestionsDocument10 pagesChapters 10,11 and 12 Assessment QuestionsSteven Sanderson100% (1)

- Chapter 10 Reactioin PaperDocument2 pagesChapter 10 Reactioin PaperSteven SandersonNo ratings yet

- Reaction Report To Student OrientationDocument1 pageReaction Report To Student OrientationSteven SandersonNo ratings yet

- Chapters 13, 14, 15, 16 Assessment QuestionsDocument11 pagesChapters 13, 14, 15, 16 Assessment QuestionsSteven Sanderson100% (5)

- Chapter One and 2 Assessment QuestionsDocument6 pagesChapter One and 2 Assessment QuestionsSteven Sanderson100% (3)

- Chapters 7,8,9 Assesment QuestionsDocument9 pagesChapters 7,8,9 Assesment QuestionsSteven Sanderson100% (3)

- Accounting II - Chap 14 Lecture NotesDocument6 pagesAccounting II - Chap 14 Lecture NotesSteven Sanderson100% (4)

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Acounting II - Chap 12 Accounting Principles - Part II - SLNDocument12 pagesAcounting II - Chap 12 Accounting Principles - Part II - SLNSteven Sanderson100% (2)

- CH 14Document54 pagesCH 14Steven SandersonNo ratings yet

- Acct II - Chapter 15 Lecture NotesDocument4 pagesAcct II - Chapter 15 Lecture NotesSteven Sanderson100% (1)

- Chapter 13 - Teaching ExhibitsDocument6 pagesChapter 13 - Teaching ExhibitsSteven SandersonNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Chap 19 - Selected Ex & ProbDocument6 pagesChap 19 - Selected Ex & ProbSteven Sanderson100% (1)

- Chap 13 - Selected Ex & ProbDocument1 pageChap 13 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 18 - Selected Ex & ProbDocument6 pagesChap 18 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 14 - Selected Ex & ProbDocument8 pagesChap 14 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 16 - Selected Ex & ProbDocument3 pagesChap 16 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap. 23 - Selected Ex. & Prob.Document5 pagesChap. 23 - Selected Ex. & Prob.Steven SandersonNo ratings yet

- Chap 15 - Selected Ex & ProbDocument7 pagesChap 15 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 20 - Selected Ex & ProbDocument3 pagesChap 20 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chapter 13 - Lecture NotesDocument6 pagesChapter 13 - Lecture NotesSteven Sanderson100% (3)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)