Professional Documents

Culture Documents

Gainesboro Case

Uploaded by

Danny4118Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gainesboro Case

Uploaded by

Danny4118Copyright:

Available Formats

Danielle Doughlin Case Analysis: Gainesboro Machine Tools Corporation Executive Summary Traditionally Gainesboro had been able

to maintain its position as an industry leader in the CAD/CAM market. The case illustrates how increased market entry and competition can create a dilemma for companies and put downward pressure on earnings. The result is that if a company like Gainesboro is to have a fighting chance they must be innovative and come up with products that not only challenge there competitors but set them apart so they can once again be the powerhouse they once were. The ability to accomplish a competitive advantage does not solely lie in innovation but on a companys ability to structure itself correctly. Gainesboros task at reinventing itself should include the corporate image advertising campaign and the residualdividend payout policy. To be successful Gainesboro needs to signal to the market that the know what business they are in and communicated what that is effectively, the also must maintain control over cashflows by controlling dividend payout and boosting revenues through product innovation etc. Questions 1. In theory, to fund an increased dividend payout or a stock buyback, a firm might invest less, borrow more, or issue more stock. Which of those three elements is Gainesboros management willing to vary, and which elements remain fixed as a matter of the companys policy? It is clear that Gainesboro, as a matter of company priority wants to increase per share value to shareholders. It is also quite clear the companys goal is to pay a dividend (this is highlighted throughout the case and in Gainesboros letter to shareholders stating the intend to resume the dividend payout in 2005. Another issue that is clear about Gainesboro is that the organizational culture is one that is adverse to debt. The cap the company has imposed is 40%; this means the debt to equity ratio is never to exceed this percentage. In 2004 when the company had to borrow funds externally in order to pay a dividend the debt level rose to 22% and the case indicates that it was an issue discussed often in meetings and is still a issue of discussion among the companys older executives. In light of the companys sensitivity to debt (fixed element) I deem it an unlikely source of funds to finance the 2005 dividend they promised. Although a 2005 dividend was promised it does not mean that a stock buyback is out of the question or off the table. However each option requires an additional source of funds. According to the article What Do We Know About Stock Repurchases, financial economists state that corporate managers use repurchases to signal their optimism about the firms prospects to the market. Overall the consensus seems to be that managers

often say that they are repurchasing stock in order to increase earnings per share. However the authors propose that this assumption is flawed and that shrinking the size of a firm only adds value if the firm is failing to earn its cost of capital on its marginal investments. In light of this article it is unfortunate that the case does not address the discount rate or cost of capital. The case explicitly states that Gainesboro prefers equity to debt financing so it is reasonable to assume that they initially would seek to issue more stock to finance the dividend versus borrowing. The company is also very committed and optimistic about its new Artificial Workforce and it is highly unlikely that fewer investments at this point will be a chosen option. Based on the companies favored approach in the past, in theory theyre likely to issue stock (this is based on past assumptions and does not analyze the signaling consequences of such a decision). 2. What happens to Gainesboros financing need and unused debt capacity if: The numbers outlined below were derived by using the assumptions provided in the case and making some assumptions of my own. I estimated the cost of debt (after- tax) to be 6.5% (pre tax 10%) and selected a tax rate 35% consistent with cases weve done in the past. Also I weighted the P/E ratio to reflect what was stated in the case that 75% of earning would come from new projects like the Artificial Workforce and 25% would come from the traditional molds and presses products. a. no dividends are paid? If no dividends are paid there is no need for external funds. However this result does not compensate for negative market response due to the inability to meet the promise management made to shareholders in the letter the issued in 2004. Unused debt capacity would be 15.5 million (40% Debt maximum * the difference between Equity and Debt). EPS is about $0.90 (based on 18.6 million shares outstanding). b. a 20% payout is pursued? At a 20% payout the debt to equity ratio increases to 36.6% and the unused debt capacity falls to 10.0 million and dividends would require an additional $3.7 million in financing (need). EPS would be $.89 and Dividends would be $.20 per share. c. a 40% payout is pursued? At a 40% payout the D/E ratio increases dramatically to 38.4% way above what Gainesboro executives would be comfortable with. The financing needed would be $7.3 million and the unused debt capacity would be a mere 4.6 million. EPS would be $0.88 and Dividend paid would be $0.39.

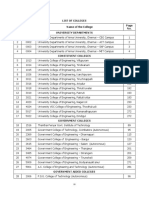

Dividend Payout 0% 20% 40%

2005 34.6% 36.4% 38.1%

2006 33.2% 38.2% 43.5%

2007 27.6% 36.1% 45.8%

2008 21.0% 32.5% 46.5%

2009 12.2% 26.0% 43.6%

2010 6.0% 21.4% 42.0%

2011 -5.2% 10.9% 33.7%

The above table illustrates how sensitive the debt to equity ratio is to the three proposed dividend payout options. The sensitivity analysis favors the zero payout option but this is not in line with Gainesboros organizational goals to return earnings to the shareholder in this manner (pay a dividend). The next best option is then the 20% payout option for the simple fact that for the forecasted period it is the option that stays within the 40% debt constraint. However with management uneasy when they had a debt to equity ratio of 22% in 2004, I find it hard to believe that they would accept the 32.5 -38.2% range that occurs during 2005-2008. The 2009 and 2010 numbers are also in Gainesboros senior executives uneasy range. Things dont look favorable at all until 2011. d. a residual payout policy is pursued? The above numbers show the precarious nature of making such a decision in the midst of corporate restructuring. The whole premise of these calculations is based upon the ability of Gainesboro to capitalize on its competitive advantage with the Artificial Workforce and to recognize their forecasted gains/profits and to maintain/gain market share. Therefore these forecasts are merely estimates that expect a positive outcome where like the case alluded to competition is keen and a competitor is already looking to introduce a comparable product by the end of the year. Due to the potential external factors such as economic indicators, competition but still in an effort to signal optimism and encourage investor confidence. I believe a mixed approach is warranted. The residual payout policy is best because it allows you the flexibility of declaring a dividend only when you have the excess cash flows to do so and it would dramatically decrease the reliance on external funds. Residual payout policy focuses on projects with positive NPVs and promotes wise investments. If this intention to change policy is effectively communicated to shareholders they should be pleased. They will receive a dividend when the company has the surplus funds available and in times when they dont they have the assurance that the money is invested wisely in worthwhile ventures. Also if the company is successfully able to reposition themselves as an advanced system, high technology firm, these companies typically declare lower dividends. As it relates to 2005 even with the adoption of the dividend policy I strongly suggest a dividend no matter how small be paid to shareholders since it was promised in an effort to signal that management is in control of the current and future operations of the firm. 3. How might Gainesboros various providers of capital, such as its stockholders and creditors, react if Gainesboro declares a dividend in 2005? What are the arguments for and against the zero payout, 40% payout, and residual payout policies? What

should Ashley Swenson recommend to the board of directors with regard to a longterm dividend payout policy for Gainesboro Machine Tools Corporation? The case explicitly outlines the potential benefits and shortcomings of these different payout policies. The zero payout policy would place emphasis on Gainesboros new and advanced technologies. It would signal that the company belonged in a high-growth, high technology category of firms. It all boils down to perception though. Like we learn in marketing what we want to be perceived as and what we are actually perceived as by our customers (in this case the market) are sometimes entirely different. If the market still views Gainesboro as a traditional electrical-equipment company then the market would expect strong capital appreciation and a lower dividend payout. With a 40% payout is advocated based on the expectation of an increase in sales and future orders. According to the companys investment banker a high dividend payout may (operative word) signal a strong, positive market response placing the firms payout strategically between that of the industrial-equipment industry and the machine-tool industry. Also other advocates of this method believe it would signal to the market that the company has conquered its past issues and improve investor confidence in the firm. However this strategy should only be implemented if the company is able to finance it internally. One must remember the success of this strategy is based upon the expectation of future positive earning and one should not hedge against earnings yet to be realized by borrowing a substantial amount of funds to finance this 40% dividend policy. As Ive outlined in the previous question I believe the residual-dividend payout policy to be best. The main purpose of this method is to only declare a dividend after you have funded all projects with a positive NPV. A valid point was made that investors pay managers to use their funds to generate returns in a method that they themselves could not achieve. This method would reward investors with higher valuation multiples. Another defense of this method is that if the firm is growing then it should not need to payout a dividend and that dividends are primarily paid by those companies which are either mature firms or experiencing stagnant growth. The potential downside is that in some years no dividend would potentially be declared and this would put downward pressure on Gainesboros stock price. This is a problem that I believe can be solved by issuing a detailed letter about managements plans and direction for the firm. Explaining the new products/industry changers on the horizon and stating the intent to invest in projects, which ultimately increase the value, and per share value to the investor. 4. How might various providers of capital, such as stockholders and creditors, react if Gainesboro repurchased its shares? Should Gainesboro do so? Like I mentioned above when I cited the article in response to question 1, stock repurchases are popular methods companys employ to signal that theyre confident in their future earnings and potential growth. It is also a method to increase the per share market value of the stock to current investors.

However for Gainesboro it boils down to whether or not the company is undervalued in terms of the reflection of its current share price. If Gainesboro were undervalued then it would be wise to repurchase stock. Their existing problem of whether or not to pay a dividend and for how much would not be satisfied. The problem is once a company issues a dividend they set a precedent and such dividends become an expectation. In this case the expectation is further compounded by managements explicitly stating its intent to issue a dividend in 2005. Failure to issue a dividend can be a negative signal to investors. It is always important to meet or exceed market expectation. So even if it would be beneficial to conduct a stock buyback program it would also mean that there are fewer funds available to payout a dividend in 2005 as promised. 5. Should Swenson recommend the corporate-image advertising campaign and corporate name change to the Gainesboros directors? Do the advertising and name change have any bearing on the dividend policy or the stock repurchase policy that you propose? Now no advertising campaign alone can change a companys earnings or growth. What is important is Gainesboros ability to communicate to investors, market analysts, etc. what kind of firm it wants to be. Thats the precipice of marketing, effectively positioning your company in the eyes of your target market. It would appear that the new product and associated applications for the Artificial Workforce is a game changer. This new product line coupled with the fact that the company expects to shift 75% of all earnings/business to this product and similar CAD/CAM products with only 25% being dedicated to the electrical-industrialequipment do propel Gainesboro into a new industry (so to speak). Repositioning a firm that has already had an established place or reputation in the market can be difficult but if the new product and related applications are as good as management says they are then a well place corporate-image advertising campaign can be successful in helping Gainesboro achieve the desired position they wish to hold with investors and analysts. This campaign does not directly affect my proposed dividend payout policy but it could support it. Successfully repositioning the company can allow or help investors and the market see why a lower dividend is not a bad signal but in keeping with Gainesboros new position as a high growth advanced technological company. Conclusion The ability for a business to rise from the ashes and reinvent itself is no small task but Gainesboro has that potential. In order to be successful the firm needs to overcome its current cash flow problem and implement that residual dividend payout policy which relaxes the pressure to increase debt or dilute EPS (issuance of new stock) in an effort to finance dividends. Successful repositioning of the company, new innovative products like

the Artificial Workforce and the new recommend residual-dividend payout policy should allow Gainesboro to enjoy some financial flexibility and liquidity and ultimately be able to maximize value and return for all relevant stakeholders.

You might also like

- Group B&D - Case 19 - Fonderia PresentationDocument24 pagesGroup B&D - Case 19 - Fonderia PresentationVinithi Thongkampala100% (2)

- Group 10 - Case 1 - Gainesboro Machine Tools CorporationDocument4 pagesGroup 10 - Case 1 - Gainesboro Machine Tools CorporationYubaraj AdhikariNo ratings yet

- Diageo CaseDocument5 pagesDiageo CaseMeena67% (9)

- Case 26 Rockboro Group ADocument27 pagesCase 26 Rockboro Group AKanoknad KalaphakdeeNo ratings yet

- List of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case PreparationDocument4 pagesList of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case Preparationdd100% (2)

- Case Study On Gainesboro Machine Tools CorporationDocument13 pagesCase Study On Gainesboro Machine Tools Corporationemehmehmeh86% (7)

- Eastboro Case SolutionDocument22 pagesEastboro Case Solutionuddindjm100% (2)

- Case 29 Gainesboro Machine Tools CorporationDocument33 pagesCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- Dividend Policy Case (Gainesboro Machine Tools) - Session 2-Group 8Document19 pagesDividend Policy Case (Gainesboro Machine Tools) - Session 2-Group 8api-2001200071% (7)

- Case 3: Rockboro Machine Tools Corporation Executive SummaryDocument1 pageCase 3: Rockboro Machine Tools Corporation Executive SummaryMaricel GuarinoNo ratings yet

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- Nike Case StudyDocument9 pagesNike Case Studyjmatsanura194% (18)

- Nike Case Final Group 4Document15 pagesNike Case Final Group 4Monika Maheshwari100% (1)

- Fonderia Di Torino FinancialsDocument4 pagesFonderia Di Torino Financialspeachrose12No ratings yet

- Hill Country Snack Foods Case AnalysisDocument5 pagesHill Country Snack Foods Case Analysisdivakar62No ratings yet

- Final Case Study G M Machine Tools CorpDocument5 pagesFinal Case Study G M Machine Tools CorpShadab Akhter100% (1)

- Syndicate 6 - Gainesboro Machine Tools CorporationDocument12 pagesSyndicate 6 - Gainesboro Machine Tools CorporationSimon ErickNo ratings yet

- Gainesboro Case PresentationDocument21 pagesGainesboro Case PresentationIto Puruhito100% (2)

- Case 26 Assignment AnalysisDocument1 pageCase 26 Assignment AnalysisNiyanthesh Reddy50% (2)

- Gainesboro Case AnalysisDocument8 pagesGainesboro Case AnalysisJhimcee Ghlenn Corvera100% (1)

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- Nike CaseDocument7 pagesNike CaseNindy Darista100% (1)

- Hill CountryDocument8 pagesHill CountryAtif Raza AkbarNo ratings yet

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Fonderia Di TorinoDocument9 pagesFonderia Di TorinobiancanelaNo ratings yet

- The Financial DetectiveDocument7 pagesThe Financial DetectivearifhafiziNo ratings yet

- Midterm Case California Pizza KitchenDocument2 pagesMidterm Case California Pizza KitchenAhmed El Khateeb100% (1)

- Hill Country CaseDocument5 pagesHill Country CaseDeepansh Kakkar100% (1)

- Discuss The Relevance of Dividend Policy in Financial Decision MakingDocument6 pagesDiscuss The Relevance of Dividend Policy in Financial Decision MakingMichael NyamutambweNo ratings yet

- Lindenberg-Anlagen GMBH: Stromerzeugungs-Und Pumpenanlagen SchaltanlagenDocument10 pagesLindenberg-Anlagen GMBH: Stromerzeugungs-Und Pumpenanlagen SchaltanlagenБогдан Кендзер100% (1)

- Gainesboro Machine Tools Corporatio1Document7 pagesGainesboro Machine Tools Corporatio1Endrit Avdullari100% (1)

- Gainesboro CaseDocument16 pagesGainesboro Caseapi-402685925No ratings yet

- Gainsboro CorporationDocument3 pagesGainsboro Corporationarshdeep1990No ratings yet

- Eastboro Machine Tools CorporationDocument32 pagesEastboro Machine Tools Corporationrifki100% (2)

- Eastboro Case Write Up For Presentation1Document4 pagesEastboro Case Write Up For Presentation1Paula Elaine ThorpeNo ratings yet

- Gainesboro Machine ToolsDocument2 pagesGainesboro Machine ToolsedselNo ratings yet

- Gainesboro Machine Tools CorporationDocument22 pagesGainesboro Machine Tools CorporationAnthony Royupa100% (1)

- Case 25 Gainesboro-Exh8Document1 pageCase 25 Gainesboro-Exh8odie99No ratings yet

- Paper Gainesboro Machine Tools CorporationDocument19 pagesPaper Gainesboro Machine Tools CorporationMuhammad Ridwan NawawiNo ratings yet

- Syndicate 1 - Investment DetectiveDocument3 pagesSyndicate 1 - Investment DetectiveAntonius CliffSetiawanNo ratings yet

- Deluxe CorpDocument7 pagesDeluxe CorpUdit UpretiNo ratings yet

- Fonderia Di Torino SDocument15 pagesFonderia Di Torino SYrnob RokieNo ratings yet

- Investment Detective CaseDocument3 pagesInvestment Detective CaseWidyawan Widarto 闘志50% (2)

- Eastboro Machine Tools - Class (Version 1)Document12 pagesEastboro Machine Tools - Class (Version 1)Shriniwas Nehete100% (1)

- Fonderia Di Torino (Final)Document4 pagesFonderia Di Torino (Final)Tracye Taylor100% (2)

- Corporate Finance - Hill Country Snack FoodDocument11 pagesCorporate Finance - Hill Country Snack FoodNell MizunoNo ratings yet

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- Syndicate 1 An Introduction To Debt Policy and ValueDocument9 pagesSyndicate 1 An Introduction To Debt Policy and ValueBernadeta PramudyaWardhaniNo ratings yet

- Case Nike Cost of Capital - FinalDocument7 pagesCase Nike Cost of Capital - FinalNick ChongsanguanNo ratings yet

- Fonderia DI TorinoDocument19 pagesFonderia DI TorinoA100% (3)

- DeluxeDocument4 pagesDeluxeshielamaeNo ratings yet

- An Introduction To Debt Policy and Value - Syndicate 4Document9 pagesAn Introduction To Debt Policy and Value - Syndicate 4Henni RahmanNo ratings yet

- General Mills' PaperDocument9 pagesGeneral Mills' PaperSarah McDermottNo ratings yet

- Jetblue: Relevant Sustainability Leadership (A) : Situational AnalysisDocument1 pageJetblue: Relevant Sustainability Leadership (A) : Situational AnalysisShivani KarkeraNo ratings yet

- Problem StatementDocument3 pagesProblem StatementLeo Pratama GaniNo ratings yet

- Overview of The Problem:: 0%, 20%, 40% Dividend Payout Along With Residual Payout PolicyDocument2 pagesOverview of The Problem:: 0%, 20%, 40% Dividend Payout Along With Residual Payout PolicyJhonSteveNo ratings yet

- Case 25 NotesDocument5 pagesCase 25 NotesRohit AggarwalNo ratings yet

- Warner Body WorksDocument32 pagesWarner Body WorksPadam Shrestha100% (2)

- Paying Back Your ShareholdersDocument7 pagesPaying Back Your Shareholdersnopri dwi rizkiNo ratings yet

- Ahmad Ali: by Essay MasterDocument8 pagesAhmad Ali: by Essay MasterDaniyal AsifNo ratings yet

- Dye-Sensitized Solar CellDocument7 pagesDye-Sensitized Solar CellFaez Ahammad MazumderNo ratings yet

- UXBenchmarking 101Document42 pagesUXBenchmarking 101Rodrigo BucketbranchNo ratings yet

- ch-1 NewDocument11 pagesch-1 NewSAKIB MD SHAFIUDDINNo ratings yet

- Jesus Chavez AffidavitDocument21 pagesJesus Chavez AffidavitThe Dallas Morning NewsNo ratings yet

- PS4 ListDocument67 pagesPS4 ListAnonymous yNw1VyHNo ratings yet

- Role of Commodity Exchange in Agricultural GrowthDocument63 pagesRole of Commodity Exchange in Agricultural GrowthSoumyalin Santy50% (2)

- Intro To Law CasesDocument23 pagesIntro To Law Casesharuhime08No ratings yet

- MELC5 - First ObservationDocument4 pagesMELC5 - First ObservationMayca Solomon GatdulaNo ratings yet

- Proposal For Real Estate Asset Management and Brokerage ServicesDocument2 pagesProposal For Real Estate Asset Management and Brokerage ServicesTed McKinnonNo ratings yet

- TNEA Participating College - Cut Out 2017Document18 pagesTNEA Participating College - Cut Out 2017Ajith KumarNo ratings yet

- Science Technology and SocietyDocument46 pagesScience Technology and SocietyCharles Elquime GalaponNo ratings yet

- 4-Page 7 Ways TM 20Document4 pages4-Page 7 Ways TM 20Jose EstradaNo ratings yet

- SRL CompressorsDocument20 pagesSRL Compressorssthe03No ratings yet

- Supply Chain Management: A Framework of Understanding D. Du Toit & P.J. VlokDocument14 pagesSupply Chain Management: A Framework of Understanding D. Du Toit & P.J. VlokchandanaNo ratings yet

- The Leaders of The NationDocument3 pagesThe Leaders of The NationMark Dave RodriguezNo ratings yet

- 6401 1 NewDocument18 pages6401 1 NewbeeshortNo ratings yet

- CALIDocument58 pagesCALIleticia figueroaNo ratings yet

- Java Magazine JanuaryFebruary 2013Document93 pagesJava Magazine JanuaryFebruary 2013rubensaNo ratings yet

- Fort - Fts - The Teacher and ¿Mommy Zarry AdaptaciónDocument90 pagesFort - Fts - The Teacher and ¿Mommy Zarry AdaptaciónEvelin PalenciaNo ratings yet

- Spitzer 1981Document13 pagesSpitzer 1981Chima2 SantosNo ratings yet

- Brahm Dutt v. UoiDocument3 pagesBrahm Dutt v. Uoiswati mohapatraNo ratings yet

- Parts Catalog: TJ053E-AS50Document14 pagesParts Catalog: TJ053E-AS50Andre FilipeNo ratings yet

- Rid and Clean Safety DataDocument1 pageRid and Clean Safety DataElizabeth GraceNo ratings yet

- Symptoms: Generalized Anxiety Disorder (GAD)Document3 pagesSymptoms: Generalized Anxiety Disorder (GAD)Nur WahyudiantoNo ratings yet

- Wastewater Treatment: Sudha Goel, Ph.D. Department of Civil Engineering, IIT KharagpurDocument33 pagesWastewater Treatment: Sudha Goel, Ph.D. Department of Civil Engineering, IIT KharagpurSubhajit BagNo ratings yet

- IIT JEE Physics Preparation BooksDocument3 pagesIIT JEE Physics Preparation Booksgaurav2011999No ratings yet

- BSBHRM405 Support Recruitment, Selection and Induction of Staff KM2Document17 pagesBSBHRM405 Support Recruitment, Selection and Induction of Staff KM2cplerkNo ratings yet

- Book TurmericDocument14 pagesBook Turmericarvind3041990100% (2)

- 1 Piling LaranganDocument3 pages1 Piling LaranganHannie Jane Salazar HerreraNo ratings yet