Professional Documents

Culture Documents

Story of A Security - CMLTI 2006-NC2

Uploaded by

the_akinitiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Story of A Security - CMLTI 2006-NC2

Uploaded by

the_akinitiCopyright:

Available Formats

About the FCIC at SLS (/about)

The Report (/report)

Hearings & Testimony (/hearings)

Resource Library (/resource

THE STORY OF A MORTGAGE SECURITY: INSIDE CMLTI 2006-NC2

Media Advisories (/resource /media_advisories) Archive (/resource /document-archive) Staff Data Projects (/resource/staffdata-projects)

Story of a Security (/resource/staffdata-projects/storyof-a-security) CDO Library (/resource /staff-data-projects /cdo-Library) CDO Charts (/resource /staff-data-projects /cdo-charts) Hedge Fund Survey (/resource/staffdata-projects/hedgefund-survey) Market Risk Survey (/resource/staffdata-projects/marketrisk-survey)

National (#national) Nevada (#nevada)

Arizona (#arizona)

California (#california)

Florida (#florida)

BEFORE THE CRISIS

National September 2006

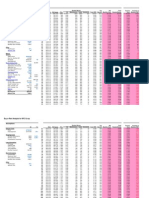

Avg Initial Loan Balance $210,580 Avg FICO Score 620 Avg Debt-to-Income Ratio 40.6 Avg Initial Interest Rate 8.64% Most Frequent Product 2/28 ARM with 40 year amortization

Note: Delinquent category includes loans 30, 60, or 90 days behind or those in bankruptcy or foreclosure. Homes Lost category includes liquidated and bank real estate owned properties.

Source: FCIC research

About This Data (#data) Download Data (http://fcic-static.law.stanford.edu/cdn_media/fcic-docs/0000-00-00_CMLTI 2006-NC2 Loan-Level Panel Data.xlsx) The 32 megabyte Excel data file contains the raw data from these 4,499 loans, including the information about the loans and the borrowers. The performance of all of the loans is also included. Primary data provided by BlackBox Logic Inc.; broker compensation data provided by IP Recovery Inc. Certain fields were altered to preserve the privacy of individual borrowers.

Interviews (/resource /interviews) Graphics (/resource /graphics) Glossary (/resource /glossary) Reports & Fact Sheets (/resource/reports)

On June 9, 2006, Citigroup agreed to purchase approximately $1 billion in loans from New Century. The characteristics of the loans to be purchased were spelled out at that time, as was the price: Citi would pay $102.55 for every $100 in mortgage balance. The trade ticket and stip (stipulation) sheet summarize the details of the deal and the pool that would be created.

Commitment letter (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-06-09_CMLTI_2006NC2_01R _ Citi Commitment Letter.pdf)

Trade ticket (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-06-09_CMLTI_2006NC2_02R _ Trade Ticket.pdf) Stip sheet (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-06-22_CMLTI_2006NC2_03R _ Stip sheet.pdf)

The deal would involve two pools of loans one that conformed to the GSE limits and one that did not. On July 20, New Century sent Citi a description of the loans in the first pool. A week later they sent a description of the two pools combined.

First tape delivery (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-07-20_CMLTI_2006NC2_04R _ First tape delivery.pdf) Second tape delivery (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-07-20_CMLTI_2006NC2_04R_ Second tape delivery.pdf)

Through late July and August, one or two at a time, loans were pulled from the pool for legal issues, because they had been sold into other pools, or for other reasons.

Emails regarding the deal

Email: July 31, 2006 (http://fcicstatic.law.stanford.edu/cdn_media /fcic-docs/Email: August 24, 2006.pdf) Email: July 31, 2006 (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-07-31_CMLTI_2006NC2_05R _ loan issues 0731b.pdf) Email: August 3, 2006 (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-03_CMLTI_2006NC2_05R _ loan issues 0803.pdf) Email: August 9, 2006 (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-09_CMLTI_2006NC2_05R _ loan issues 0809.pdf) Email: August 21, 2006 (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-21_CMLTI_2006NC2_05R _ loan issues 0821.pdf) Email: August 24, 2006 (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-24_CMLTI_2006NC2_05R _ loan issues 0824.pdf)

Due diligence for this deal was performed by 406 Partners, LLC. The review was to take place at New Century between 7/31 and 8/11. 406 Partners sent New Century the list of loans they wanted to review as per the initial sale agreement, 25% of the loans would be sampled for credit review. In the end, more than 200 loans were removed from the pool.

Email from 406 to New Century (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-07-26_CMLTI_2006NC2_06R _ due diligence start.pdf) Results of the review: Accept

(http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-00-00_CMLTI_2006NC2_07R_due diligence accept.pdf) Results of the review: Reject (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-00-00_CMLTI_2006NC2_07R_due diligence rejects.pdf)

As the loan purchase was closing on August 29th, New Century sent a final list of the 4,521 loans they were selling. Citi personnel saw violations of the initial agreement: 14 NINA loans (no income, no assets) and too few loans with prepayment penalties. They forced New Century to keep the 14 NINA loans and bargained the price down to account for the other problems.

Emails detailing the problems (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-08-29_CMLTI_2006NC2_08R _ final pool issues.pdf) Final trade summary showing 4,507 loans (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-29_CMLTI_2006NC2_09R _ trade summary.pdf)

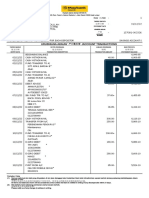

With the loans settled, $978.6 million had to be moved from Citigroup to New Century. These loans were funded by a series of warehouse lines with individual loans serving as the collateral. New Century sent Citi the wire instructions; Citi sent the money, and the individual lenders released the loans as they were paid back.

Wire instructions (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-29_CMLTI_2006NC2_10R _ Wire instructions.pdf) Tracking email from Citi to New Century (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-29_CMLTI_2006NC2_11R_ Wire confirms.pdf) Release letters (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-29_CMLTI_2006NC2_12R _ Mortgage releases.pdf)

Citi then began to market the various tranches of this mortgage-backed security

Prospectus (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-09-12_CMLTI_2006NC2_13R _ Prospectus.pdf) Fannie Mae term sheet (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-09-07_CMLTI_2006NC2_14R _ Fannie Term Sheet.pdf)

To sell the bonds, Citi needed the rating agencies to rate them. On September 11, S&P ran its model and confirmed the ratings of the individual tranches. When the deal was priced on September 12, the interest rates on some of the bonds were slightly different than those S&P had originally modeled. The final models were run on September 26 as the deal was closing. S&P sent the final ratings letter to Citi. For rating this deal, S&P earned $135,000. (A second agency, Moodys, earned $208,000.)

Moodys invoice (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-10-12_CMLTI_2006NC2_15R _ Moody's invoice.pdf) S&P Invoice (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-09-27_CMLTI_2006NC2_15bR _ S& P invoice.pdf)

S&P ratings letter to Citi (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-09-28_CMLTI_2006NC2_16aR _ S& P ratings letter to Citi.pdf) S&P final deal summary (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-09-28_CMLTI_2006NC2_16bR_ S& P final deal summary.pdf) S&P ratings summary doc (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-09-28_CMLTI_2006NC2_16cR _ S& P rating summary.pdf) S&P pre-closing checklist (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-09-28_CMLTI_2006NC2_16dR _ S& P pre-closing checklist.pdf) True sale letter (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-09-28_CMLTI_2006NC2_16eR _ S& P true sale letter and tax opinion.pdf) Model runs 9-11 (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-09-11_CMLTI_2006NC2_17aR _ S& P model docs 9-11.pdf) Model runs 9-26 (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-09-26_CMLTI_2006NC2_17bR_ S& P model docs 9-26.pdf) Waterfall (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-09-26_CMLTI_2006NC2_17cR _ S& P waterfall.pdf) Moodys rating memo (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-08-26_CMLTI_2006NC2_18R _ Moody's rating memorandum.pdf)

When the deal closed on September 26 , Citi had lined up investors around the world. Banks and funds in England, Germany, Italy, France, and China all bought pieces of the deal. Some investors merit special mention: Fannie Mae bought the A1 tranche Cheyne Finance, one of the first SIVs to collapse, bought the M1 tranche Parvest Euribor, one of the hedge funds owned by Paribas that froze redemptions, bought the M2 tranche Bear Stearns Asset Management and JP Morgan Chases securities lending group were also investors

Senior investors (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2010-10-14_CMLTI_2006NC2_20R _ Senior Investors.pdf) Mezzanine investors (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2010-11-04_CMLTI_2006NC2_20R _ Mezz Investors.pdf)

Most of the mezzanine tranches were bought by CDOs, including the cash deal Kleros Real Estate III

Kleros Real Estate III Offering Circular (http://fcicstatic.law.stanford.edu/cdn_media /fcic-docs/2006-11-00_Kleros Real Estate III_CDO Offering Circular.pdf)

In addition to cash deals, a number of synthetic/hybrid CDOs held credit default swaps (CDS) referencing the lower-rated tranches of this deal. These included Volans Funding 2007-1, Glacier Funding CDO V, and Auriga CDO

Marketing documents for some of the synthetic CDOs that referenced the deal

Auriga Pitchbook (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-12-00_Auriga_CDO Pitchbook.pdf) Auriga Offering Circular (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-12-00_Auriga_CDO Offering Circular.pdf) Auriga Term Sheet (http://fcicstatic.law.stanford.edu/cdn_media /fcicdocs/2006-12-00_Auriga_CDO Term Sheet.pdf) Volans 2007-1 Pitch Book (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2007-02-00_Volans 2007-1_CDO Pitch Book.pdf) Volans-2007-1 Term Sheet (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2007-02-00_Volans2007-1_CDO Term Sheet.pdf) Volans 2007-1 CDO Offering Circular (http://fcicstatic.law.stanford.edu/cdn_media /fcic-docs/2007-02-00_Volans 2007-1_CDO Offering Circular.pdf) Glacier Funding V Term Sheet (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2007-05-00_Glacier Funding V_CDO Term Sheet.pdf) Glacier Funding V Pitchbook (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2007-05-00_Glacier Funding V_CDO Pitchbook.pdf)

Wells Fargo was chosen as the servicer of the loans and U.S. Bank as the trustee. As servicer, Wells processes payments from the borrowers and makes any necessary payments to the investors. Their responsibilities also include dealing with borrowers who miss payments and possibly foreclosing on those borrowers who are seriously delinquent.

Pooling and servicing agreement (http://fcic-static.law.stanford.edu /cdn_media/fcicdocs/2006-09-01_CMLTI_2006NC2_19R _ Pooling and Servicing Agreement.pdf)

The bonds would perform as long as the mortgages did. The performance of CMLTI 2006-NC2 can be traced in parallel with a timeline of the crisis:

July 10, 2007: Moodys downgraded 399 residential mortgagebacked securitiesthe lower three tranches of this deal were among these downgrades August 9, 2007: BNP Paribas froze redemptions August 28, 2007: Cheyne Finance announced funding trouble October 11, 2007: More mass downgrades issued, including tranches of this deal

By 2008, foreclosures were rampant among these loans and loan modifications had begun. The lower-rated tranches were all wiped out. The A1 and some of the A2s were still performing. By late 2009, all the tranches had been downgraded. By September 2010, many borrowers whose loans were included in this securitization had moved or refinanced their mortgages; by that point, 1,917 had entered foreclosure (mostly in Florida and California), and 729 had started loan modifications. Of the 1,715 loans still active loans, 579 were seriously past due in their payments or currently in foreclosure.

Data on 4,499 loans (http://fcicstatic.law.stanford.edu/cdn_media /fcic-docs/0000-00-00_CMLTI 2006-NC2 Loan-Level Panel Data.xlsx)

About This Data The 32 megabyte Excel data file contains the raw data from these 4,499 loans, including the information about the loans and the borrowers. The performance of all of the loans is also included. Primary data provided by BlackBox Logic Inc.; broker compensation data provided by IP Recovery Inc. Certain fields were altered to preserve the privacy of individual borrowers. Download Data (http://fcic-static.law.stanford.edu/cdn_media/fcic-docs/0000-00-00_CMLTI 2006-NC2 Loan-Level Panel Data.xlsx)

Home (/)

About the FCIC at SLS (/about) The Report (/report) Hearings & Testimony (/hearings) Contact Us (http://www.stanford.edu/dept/law/forms/fcic/contact.fb)

Resource Library (/resource)

This is the live, searchable Financial Crisis Inquiry Commission (FCIC) website hosted by Stanford University's Rock Center for Corporate Governance (http://rockcenter.stanford.edu/) and Stanford Law School (http://www.law.stanford.edu/). To visit the frozen FCIC website, which is a federal record managed on behalf of the National Archives and Records Administration, please visit: http://www.cybercemetery.unt.edu /archive/fcic/20110310172443/http://fcic.gov/ (http://www.cybercemetery.unt.edu/archive/fcic/20110310172443/http://fcic.gov/)

You might also like

- Wonderlic Sample Test (50 Questions)Document7 pagesWonderlic Sample Test (50 Questions)the_akiniti79% (58)

- Wonderlic Sample Test (Answers)Document2 pagesWonderlic Sample Test (Answers)the_akiniti79% (19)

- CPA Financial Statement Documentation WPsDocument569 pagesCPA Financial Statement Documentation WPsChinh Le DinhNo ratings yet

- Brietta Vasser ResumeDocument2 pagesBrietta Vasser Resumeapi-669728207No ratings yet

- Reorganization PlanDocument31 pagesReorganization PlanBarry HarrellNo ratings yet

- Companies (Amendment) Act, 2019: 21 September 2019Document9 pagesCompanies (Amendment) Act, 2019: 21 September 2019Ravi Sankar ELTNo ratings yet

- Conflicts of InterestDocument16 pagesConflicts of InterestApaar SinghNo ratings yet

- Corporate Goverance - Exercise 2Document4 pagesCorporate Goverance - Exercise 2Aprille Gay FelixNo ratings yet

- Aladdin Synthetic CDO II, Offering MemorandumDocument216 pagesAladdin Synthetic CDO II, Offering Memorandumthe_akinitiNo ratings yet

- Lab 1Document8 pagesLab 1Nguyen Dinh Quan (K15 HCM)No ratings yet

- Repudiation LetterDocument1 pageRepudiation LetterSiddu PatilNo ratings yet

- Non Profit Budget Template 11Document15 pagesNon Profit Budget Template 11Project Management Office JTCLNo ratings yet

- Micron Business Processes: 6 Source and ProcureDocument5 pagesMicron Business Processes: 6 Source and ProcurelastuffNo ratings yet

- Summary of Disciplinary Action For Mercer Hicks IIIDocument35 pagesSummary of Disciplinary Action For Mercer Hicks IIIJaymie BaxleyNo ratings yet

- CFPB 2020 Mortgage Market Activity Trends Report 2021 08Document61 pagesCFPB 2020 Mortgage Market Activity Trends Report 2021 08David RedwoodNo ratings yet

- North Texas Tollway Authority ReportDocument103 pagesNorth Texas Tollway Authority ReportTexas WatchdogNo ratings yet

- SC-100 Plaintiff's ClaimDocument6 pagesSC-100 Plaintiff's Claimimnotbncre8iveNo ratings yet

- Philadelphia Business Journal/Feb. 2, 2018Document32 pagesPhiladelphia Business Journal/Feb. 2, 2018Craig EyNo ratings yet

- Perf ReportingDocument19 pagesPerf Reportingjohn labuNo ratings yet

- Buy Vs Rent Analysis For NYC Co-OpDocument9 pagesBuy Vs Rent Analysis For NYC Co-OpJordan BeeberNo ratings yet

- Before The South Mumbai District Consumer Disputes Redressal ForumDocument8 pagesBefore The South Mumbai District Consumer Disputes Redressal ForumPuneeNo ratings yet

- Letter of Mutual CommitmentDocument2 pagesLetter of Mutual CommitmentDaniele StiglitzNo ratings yet

- 2019 Accounting Question Bank - PDF - Accounts Payable - Debits and CreditsDocument72 pages2019 Accounting Question Bank - PDF - Accounts Payable - Debits and CreditsShohan ImonNo ratings yet

- OMB Circular A-133 Compliance Supplement 2009Document1,049 pagesOMB Circular A-133 Compliance Supplement 2009Beverly Tran100% (1)

- Integration Workplan For Core FunctionsDocument51 pagesIntegration Workplan For Core Functionsthe_playerNo ratings yet

- What Is A Financial InstrumentDocument7 pagesWhat Is A Financial InstrumentNozimanga ChiroroNo ratings yet

- Private Equity Transactions: Overview of A Buy-Out: International Investor Series No. 9Document20 pagesPrivate Equity Transactions: Overview of A Buy-Out: International Investor Series No. 9CfhunSaatNo ratings yet

- Sample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotaDocument13 pagesSample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotabruuhhhhNo ratings yet

- Vaxart Class Action Proposed SettlementDocument46 pagesVaxart Class Action Proposed SettlementEric SandersNo ratings yet

- Public Notice 2019 00070Document4 pagesPublic Notice 2019 00070citybizlist11No ratings yet

- MolsonCoorsBrewingCompany 10K 20110222Document349 pagesMolsonCoorsBrewingCompany 10K 20110222Kuanysh KuramyssovaNo ratings yet

- Evms Critical Care Covid-19 Management Protocol: Paul Marik, MDDocument11 pagesEvms Critical Care Covid-19 Management Protocol: Paul Marik, MDPrashanta Barman Palas100% (1)

- Short Guide To BSC Applied Accounting - FinalDocument8 pagesShort Guide To BSC Applied Accounting - Finalasim riazNo ratings yet

- Real Estate Accounting PoliciesDocument11 pagesReal Estate Accounting PoliciessadiksunasaraNo ratings yet

- Us Optimizing Coa and Why It MattersDocument12 pagesUs Optimizing Coa and Why It MattersfsfsdfsdNo ratings yet

- Terms and Conditions For Convertible Bonds PDFDocument27 pagesTerms and Conditions For Convertible Bonds PDFkeroitinhNo ratings yet

- Applecare Fees Hagens BermanDocument164 pagesApplecare Fees Hagens BermanpcwhalenNo ratings yet

- Template ProspectusDocument3 pagesTemplate ProspectusEkkala NarutteyNo ratings yet

- Healthy California Act AnalysisDocument8 pagesHealthy California Act AnalysisDylan MatthewsNo ratings yet

- By Business ProcessDocument2 pagesBy Business ProcesssharmilatripathiNo ratings yet

- 2018 10kDocument119 pages2018 10kXiaoyuan, Penny ZhengNo ratings yet

- Closing Forms Inventory New MillenniumDocument8 pagesClosing Forms Inventory New MillenniumhiranaqiNo ratings yet

- Ceda Loans ReceivablesDocument76 pagesCeda Loans ReceivablesoaklocNo ratings yet

- Capability StatementDocument1 pageCapability Statementapi-235870025No ratings yet

- Meeting Agenda TemplateDocument1 pageMeeting Agenda Templateapi-643481686No ratings yet

- A Primer On Restructuring Your Company's FinancesDocument9 pagesA Primer On Restructuring Your Company's FinancesLeonardo TeoNo ratings yet

- De Operating AgreementDocument59 pagesDe Operating AgreementAyan RoyNo ratings yet

- Due Diligence ChecklistDocument4 pagesDue Diligence ChecklistLance WeatherbyNo ratings yet

- Executive SummaryDocument6 pagesExecutive SummaryhowellstechNo ratings yet

- Holding CompaniesDocument23 pagesHolding CompaniesSumathi Ganeshan100% (1)

- Fully Executed Agreement - Rfp190164rjdDocument78 pagesFully Executed Agreement - Rfp190164rjdFrederickNo ratings yet

- Ey frd02856 161us 05 27 2020 PDFDocument538 pagesEy frd02856 161us 05 27 2020 PDFSarwar GolamNo ratings yet

- Macro Economics FinalDocument9 pagesMacro Economics FinalDeepa RaghuNo ratings yet

- Non Disclosure AgreementDocument5 pagesNon Disclosure Agreementbigcat2012No ratings yet

- Proposal For Youth Business HubDocument26 pagesProposal For Youth Business Hubfindurvoice100% (1)

- P&L Profits and LostDocument12 pagesP&L Profits and LostMarcelo RodaoNo ratings yet

- Global Investment Returns Yearbook 2017 - SLIDES - Credit Suisse - February 21 2017Document38 pagesGlobal Investment Returns Yearbook 2017 - SLIDES - Credit Suisse - February 21 2017Zerohedge100% (3)

- Reliance CAF SIP Insure ArnDocument8 pagesReliance CAF SIP Insure ArnARVINDNo ratings yet

- Marekting PD Flow ChartDocument1 pageMarekting PD Flow Chartjim8430No ratings yet

- Finance ProDocument84 pagesFinance ProdingjcNo ratings yet

- ProvestDocument14 pagesProvestForeclosure FraudNo ratings yet

- Procurement Manual: Network of Centers For Civic Engagement (Ncce)Document10 pagesProcurement Manual: Network of Centers For Civic Engagement (Ncce)RodasNo ratings yet

- OIG Findings of Noncompliance by LINCOLN HALL BOYS' HAVEN Caring For UACsDocument45 pagesOIG Findings of Noncompliance by LINCOLN HALL BOYS' HAVEN Caring For UACsStephen BoyleNo ratings yet

- Wiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- CMLTI 2006-NC2 Mezz InvestorsDocument4 pagesCMLTI 2006-NC2 Mezz Investorsthe_akinitiNo ratings yet

- Glacier Funding V CDO Term SheetDocument2 pagesGlacier Funding V CDO Term Sheetthe_akinitiNo ratings yet

- Glacier Funding V CDO PitchbookDocument79 pagesGlacier Funding V CDO Pitchbookthe_akinitiNo ratings yet

- Volans 2007-1 CDO Pitch BookDocument55 pagesVolans 2007-1 CDO Pitch Bookthe_akinitiNo ratings yet

- Volans 2007-1 CDO Term SheetDocument4 pagesVolans 2007-1 CDO Term Sheetthe_akinitiNo ratings yet

- Relative Strength Strategies For InvestingDocument22 pagesRelative Strength Strategies For Investingthe_akinitiNo ratings yet

- FCIC Final Report ConclusionsDocument14 pagesFCIC Final Report ConclusionsInvestor ProtectionNo ratings yet

- CMLTI 2006-NC2 Citi Commitment LetterDocument18 pagesCMLTI 2006-NC2 Citi Commitment Letterthe_akinitiNo ratings yet

- Attentus CDO III - Offering CircularDocument227 pagesAttentus CDO III - Offering Circularthe_akinitiNo ratings yet

- CMLTI 2006-NC2 True Sale Letter and Tax OpinionDocument12 pagesCMLTI 2006-NC2 True Sale Letter and Tax Opinionthe_akinitiNo ratings yet

- PSI Wall Street Crisis 041311Document646 pagesPSI Wall Street Crisis 041311feckish2000No ratings yet

- NCUA NGN 2010-R1 - Final Prelim Offering MemorandumDocument72 pagesNCUA NGN 2010-R1 - Final Prelim Offering Memorandumthe_akinitiNo ratings yet

- JPMorgan Credit Derivatives Handbook (2006)Document180 pagesJPMorgan Credit Derivatives Handbook (2006)the_akiniti100% (1)

- Goldman Sachs's 1st Response To SEC Wells NoticeDocument49 pagesGoldman Sachs's 1st Response To SEC Wells NoticeDealBookNo ratings yet

- Amc Copy: Enrolment FormDocument4 pagesAmc Copy: Enrolment FormAhmad ZaibNo ratings yet

- Mpesa MombasaDocument5 pagesMpesa MombasaPAUL NJUGUNANo ratings yet

- Dasar Dasar AuditDocument12 pagesDasar Dasar AuditDeasy MarianaNo ratings yet

- Flipkart Phpapp01Document12 pagesFlipkart Phpapp01Gaurav BaruNo ratings yet

- National Agriculture Market (ENAM) and ENWRDocument34 pagesNational Agriculture Market (ENAM) and ENWRsatishchpantNo ratings yet

- Fee Based ServicesDocument2 pagesFee Based ServicesGurwinder SinghNo ratings yet

- Catman 3-0 Introduction FinalDocument3 pagesCatman 3-0 Introduction FinalMuthu PattarNo ratings yet

- Summary of Bank Reconciliation StatementDocument3 pagesSummary of Bank Reconciliation StatementMary Roan CambaNo ratings yet

- Denail Codes PDFDocument16 pagesDenail Codes PDFAnonymous u47CziLINo ratings yet

- Merchant Integration GuideDocument29 pagesMerchant Integration Guideadnan21550% (2)

- Internal Investigations 2014: Nancy Kestenbaum Richard J. Morvillo David B. Bayless Steven S. ScholesDocument17 pagesInternal Investigations 2014: Nancy Kestenbaum Richard J. Morvillo David B. Bayless Steven S. ScholesJulia MNo ratings yet

- SFM by CA Pavan Karmele SirDocument2 pagesSFM by CA Pavan Karmele SirPrerak JainNo ratings yet

- 7692XXXXXXXXX405820 12 2019 PDFDocument4 pages7692XXXXXXXXX405820 12 2019 PDFpawan siyagNo ratings yet

- B) Quote For TrademarkDocument1 pageB) Quote For TrademarkKawrw DgedeaNo ratings yet

- Detailed StatementDocument17 pagesDetailed Statementsanket enterprisesNo ratings yet

- U.S.-Based Wholesale Vehicle Auction Giant, Auto Auction Mall, Establishes Local Presence in Lagos, NigeriaDocument2 pagesU.S.-Based Wholesale Vehicle Auction Giant, Auto Auction Mall, Establishes Local Presence in Lagos, NigeriaPR.com100% (1)

- Accounting For Non-ABM - Accounting and Its Environment - Module 1 AsynchronousDocument25 pagesAccounting For Non-ABM - Accounting and Its Environment - Module 1 AsynchronousPamela PerezNo ratings yet

- Comprehensive ProblemDocument2 pagesComprehensive ProblemCeline Floranza100% (1)

- Introduction To Networks - Reliable NetworksDocument4 pagesIntroduction To Networks - Reliable NetworksFaical BitamNo ratings yet

- Ibs Balik Pulau 1 31/12/22Document4 pagesIbs Balik Pulau 1 31/12/22Farah AuliaNo ratings yet

- Jio Fiber InvoiceDocument1 pageJio Fiber InvoicePiyush Kumar PandeyNo ratings yet

- Statements 5013Document6 pagesStatements 5013ytprem agu100% (1)

- MT 103Document9 pagesMT 103roshan_x115027No ratings yet

- Mindtext: para Transit System in India-A Case Study of ChennaiDocument3 pagesMindtext: para Transit System in India-A Case Study of ChennaiAnirudh KalliNo ratings yet

- Career Feb2019 PDFDocument6 pagesCareer Feb2019 PDFleo mateoNo ratings yet

- SyslogDocument4 pagesSyslogBasma SalahNo ratings yet

- Security and Control in The CloudDocument12 pagesSecurity and Control in The CloudvadavadaNo ratings yet

- F2015L00182ESDocument15 pagesF2015L00182ESDaveNo ratings yet

- Beat Data Sales No: Sales Nameyusuf Beat Name: b3 Vtopup Mob NoDocument12 pagesBeat Data Sales No: Sales Nameyusuf Beat Name: b3 Vtopup Mob NoAmbigai DhandayuthamNo ratings yet