Professional Documents

Culture Documents

Optimistic Most Likely Pessimistic

Uploaded by

Debayan GhoshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Optimistic Most Likely Pessimistic

Uploaded by

Debayan GhoshCopyright:

Available Formats

A small project is composed of seven activities whose time estimates are listed in the table as follows: Activity Estimated

duration (weeks)

Optimistic Most likely Pessimistic

1 1 1 2 3 4 5

2 3 4 5 5 6 6

1 1 2 1 2 2 3

1 4 2 1 5 5 6

7 7 8 1 14 8 15

a) Draw the project network b) Find the expected duration and variance of each activity c) Calculate early and late occurrence time for each event. What is the expected project length

The following table gives the activities in a construction project and you are required to a) Draw the project network b) Find the total float and free float for each activity Activity I -- j 1 -- 2 1 -- 3 2 -- 3 2 -- 4 3 -- 4 4 -- 5 4 -- 6 5 -- 7 6 -- 7 Normal time (days) 20 25 10 12 5 10 5 10 8

The following table lists the jobs of a network along with their time estimates Job Duration I 1 1 2 2 3 4 j 2 6 3 4 5 5 Optimistic 3 2 6 2 5 3 Most Likely 6 5 12 5 11 6 Pessimistic 15 14 30 8 17 15

6 5 7

7 8 8

3 1 4

9 4 19

27 7 28

Draw the project network a) Find the expected duration and variance of each activity b) Calculate the variance and the standard deviation of project length c) Calculate early and late occurrence time for each event. What is the expected project length

The following table gives the activities in a construction project and you are required to c) Draw the project network d) Find the total float and free float for each activity Activity I -- j 1 -- 2 1 -- 3 2 -- 3 2 -- 4 3 -- 4 4 -- 5 4 -- 6 5 -- 7 6 -- 7 Normal time (days) 20 25 10 12 5 10 5 10 8

TF= Latest finishing time of the j activity earliest starting time of I activity expected time FF= Earliest starting time of j activity Earliest starting time of i activity expected time

Activity 12 23 24 35 36 46 47 58 68 78

Duration 2 3 5 4 1 6 2 8 7 4

a) Draw the project network b) Calculate total float and free float c) Identify the critical path

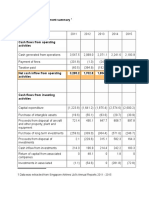

Capital cost of a project Rs. 50,00,000 Operating cost per month Rs. 1,60,00,000 WCR - 3 months Calculate a) total investment b) total cost of the project c) promoters contribution d) total borrowings margin money 25% for both WCF and LTD

X Company is considering investment in either one of the two alternative projects both with life of 5 years & the following information is given: Project A 2,00,000 60,000 60,000 Project B 1,60,000 80,000 70,000

Capital Investment Year 0 Inflow 1 2

3 4 5

60,000 60,000 60,000

60,000 50,000 20,000

Based on Pay Back Period technique, which of the projects would be chosen and why?

Ans: b) total investment = capital cost add: working cap. Requirement (1,60,00,000*3) Rs. 50 crores Rs 4.80 Rs. 54.80 crores a) cost of the project capital cost = add: 25% of Rs. 4.80 = 50 crores 1.20 crores

51.20 crores c) promoters contribution 25% of Rs. 51.2 crores d) total borrowing bank borrowing Term loan 75% of 51.2 = WCF 75% of 4.80 = total investment promoters contribution = Bank borrowing 12.80 crores 42.00 54.80 crores 38.4 crores 3.6 42.0 crores = 12.8 crores

You might also like

- Cash Flow Analysis PresentationDocument44 pagesCash Flow Analysis Presentationkojo2kg100% (1)

- Question PaperDocument2 pagesQuestion PaperSarath ReddyNo ratings yet

- Ass 2Document2 pagesAss 2Ankush Jakhmola50% (2)

- CE 352 Lecture 2a - Week 4 Network Diagrams-Critical Path Method (CPM) & Project Evaluation & Review Techniques (PERT)Document48 pagesCE 352 Lecture 2a - Week 4 Network Diagrams-Critical Path Method (CPM) & Project Evaluation & Review Techniques (PERT)Nickson KomsNo ratings yet

- Beginner’S Project Management Handbook: Art of Project DeliveryFrom EverandBeginner’S Project Management Handbook: Art of Project DeliveryNo ratings yet

- FE Old Questions and Answers (Time Management)Document4 pagesFE Old Questions and Answers (Time Management)Khun Aung Paing0% (1)

- Solution-Review Problems of Chapter 17Document11 pagesSolution-Review Problems of Chapter 17Julie Ann CanlasNo ratings yet

- Pert and CPMDocument52 pagesPert and CPMTalha Bin SaeedNo ratings yet

- Congoleum CaseDocument9 pagesCongoleum Casefranco50% (2)

- Project SchedulingDocument15 pagesProject SchedulingVijay JainNo ratings yet

- Control AccountsDocument8 pagesControl AccountsAejaz MohamedNo ratings yet

- Estados Financieros ComcastDocument90 pagesEstados Financieros ComcastGustavo Florez100% (1)

- Credit LineDocument6 pagesCredit LineUday UddantiNo ratings yet

- HB o BR Wire-App0914Document2 pagesHB o BR Wire-App0914Anonymous HH3c17osNo ratings yet

- Accounting SamplesDocument10 pagesAccounting Samplesleviadain100% (2)

- Exercises in PERTCPMDocument4 pagesExercises in PERTCPMvamsy5690% (2)

- Credit Transactions MCQDocument3 pagesCredit Transactions MCQeinsteinspy100% (1)

- Project Management TechniquesDocument53 pagesProject Management Techniquesaditi_apteNo ratings yet

- CpmPert SlideDocument35 pagesCpmPert SlideSiddharth MohanNo ratings yet

- MGT 3121 Chapter 16Document6 pagesMGT 3121 Chapter 16AmandaNo ratings yet

- CISA Exam-Testing Concept-PERT/CPM/Gantt Chart/FPA/EVA/Timebox (Chapter-3)From EverandCISA Exam-Testing Concept-PERT/CPM/Gantt Chart/FPA/EVA/Timebox (Chapter-3)Rating: 1.5 out of 5 stars1.5/5 (3)

- 14 Interest Rate and Currency SwapsDocument45 pages14 Interest Rate and Currency SwapsJogendra BeheraNo ratings yet

- NICMAR Exam Ques Paper - June 2010Document10 pagesNICMAR Exam Ques Paper - June 2010Vithal Katrodiya100% (6)

- Use of Pert and CPM Model in ProjectsDocument26 pagesUse of Pert and CPM Model in ProjectsSheeba ShankariNo ratings yet

- PM A-4Document2 pagesPM A-4abhayavhad51No ratings yet

- Management PricipalDocument7 pagesManagement PricipalmdivyalakshmiNo ratings yet

- 9A01710 Construction Technology and Project ManagementDocument8 pages9A01710 Construction Technology and Project ManagementReddy Kiran KDNo ratings yet

- PertDocument28 pagesPertHarshit BhatiaNo ratings yet

- HW8-Scheduling - NewDocument5 pagesHW8-Scheduling - NewMai Phương AnhNo ratings yet

- S19-20 - Network AnalysisDocument30 pagesS19-20 - Network AnalysisSAKETH ANo ratings yet

- Assignment-II - HU801B - B.Tech (CHE)Document2 pagesAssignment-II - HU801B - B.Tech (CHE)SnehasisDasNo ratings yet

- TYPICAL QUESTIONS FOR CTPM of 7th Sem - 14 (For Minor Exam)Document5 pagesTYPICAL QUESTIONS FOR CTPM of 7th Sem - 14 (For Minor Exam)Jane MooreNo ratings yet

- CE31206 Construction Planning and Management EA 2012Document2 pagesCE31206 Construction Planning and Management EA 2012Suman SahaNo ratings yet

- Tutorial 1.0 - Construction Management and Management TechniquesDocument14 pagesTutorial 1.0 - Construction Management and Management TechniquesPatel MitulkumarNo ratings yet

- M.E. (Civil) Examination Nov-Dec 2011 615 CCM: Scheduling of Construction Projects Time: Three Hours Max. Marks: 100 Min. Pass Marks: 40Document2 pagesM.E. (Civil) Examination Nov-Dec 2011 615 CCM: Scheduling of Construction Projects Time: Three Hours Max. Marks: 100 Min. Pass Marks: 40Sanjay TiwariNo ratings yet

- 9A01710 Construction Technology and Project ManagementDocument8 pages9A01710 Construction Technology and Project ManagementsivabharathamurthyNo ratings yet

- 6 V Unit QuestionsDocument2 pages6 V Unit QuestionsRambabu UndabatlaNo ratings yet

- Quantitative Analysis - Chapter 6 (Project Management)Document18 pagesQuantitative Analysis - Chapter 6 (Project Management)Ash0% (1)

- OrDocument3 pagesOrsatishsaga1990No ratings yet

- Civil - IV I BCEDocument53 pagesCivil - IV I BCEAnonymous 8EYiR2EGQNo ratings yet

- Or Mba FM Bi Be Unit 4Document38 pagesOr Mba FM Bi Be Unit 4Vani GangilNo ratings yet

- List of Project Management ExercisesDocument7 pagesList of Project Management ExercisesKay Chan SothearaNo ratings yet

- CPM & PertDocument3 pagesCPM & Pertहुमागाँई शिशिरNo ratings yet

- Subject: B. Tech (Computer Science & Engineering) Paper Name: Project Management Paper Code: HU801B FM: 70 Time: 3 HoursDocument4 pagesSubject: B. Tech (Computer Science & Engineering) Paper Name: Project Management Paper Code: HU801B FM: 70 Time: 3 HoursVikas Kumar100% (1)

- Chapter12cpm Pert 120130120246 Phpapp01Document38 pagesChapter12cpm Pert 120130120246 Phpapp01Kendi Kejar IralNo ratings yet

- CPM & PertDocument13 pagesCPM & PertRamdayal pandit RamdayalNo ratings yet

- Unit 6 Lecturer Notes of OR - by - DRDocument17 pagesUnit 6 Lecturer Notes of OR - by - DRVikramviki5No ratings yet

- R5321502-Mathematical Modeling & SimulationDocument1 pageR5321502-Mathematical Modeling & SimulationIbmWasuserNo ratings yet

- Project Implementation and ControlDocument14 pagesProject Implementation and ControlMirara SimonNo ratings yet

- Project Management-NotesDocument6 pagesProject Management-NotesJeff EryNo ratings yet

- Take Home Quizz - Exec HMDocument5 pagesTake Home Quizz - Exec HMbeshfrend'z0% (1)

- Project Management Cpm/Pert: Professor AhmadiDocument19 pagesProject Management Cpm/Pert: Professor AhmadiboubkaNo ratings yet

- Sheet 1 - AOA PDFDocument3 pagesSheet 1 - AOA PDFMoustafa AnwarNo ratings yet

- Project SchedulingDocument7 pagesProject SchedulingTanviAgrawalNo ratings yet

- Large Electrical Parts RetailerDocument5 pagesLarge Electrical Parts RetailerCharlotteNo ratings yet

- Assignment 2 SolutionDocument2 pagesAssignment 2 SolutionSyeda Zoya'No ratings yet

- Performance ExamDocument2 pagesPerformance ExamTewodros Tadesse100% (1)

- Ceme 352 Engineering Management Ii (Lecture Series 2)Document48 pagesCeme 352 Engineering Management Ii (Lecture Series 2)Israel PopeNo ratings yet

- Path AnalysisDocument3 pagesPath AnalysisRakesh bhukyaNo ratings yet

- Project Scheduling PertCPMDocument77 pagesProject Scheduling PertCPMmyraNo ratings yet

- IT543 - Tran Nguyen Quynh Tram - Project 6.1Document5 pagesIT543 - Tran Nguyen Quynh Tram - Project 6.1tramtran20% (1)

- Assignment PDFDocument26 pagesAssignment PDFMohamed Saad100% (1)

- Project Planning NotesDocument13 pagesProject Planning NotesEljah NjoraNo ratings yet

- Pertandcpm 140523111749 Phpapp01Document32 pagesPertandcpm 140523111749 Phpapp01NitinNo ratings yet

- An Interrelated Set of Activities With Definite Starting and Ending Points, Which Results in A Unique Outcome For A Specific Allocation of ResourcesDocument47 pagesAn Interrelated Set of Activities With Definite Starting and Ending Points, Which Results in A Unique Outcome For A Specific Allocation of Resourcesgeegostral chhabraNo ratings yet

- Problems On PERT1Document9 pagesProblems On PERT1sarvesh.bagad25No ratings yet

- Foreign Direct InvestmentDocument2 pagesForeign Direct InvestmentMustakkima Afreen Mouly100% (2)

- Accountants Formulae BookDocument47 pagesAccountants Formulae BookVpln SarmaNo ratings yet

- Project Ginning FactoryDocument28 pagesProject Ginning FactoryGirish Agarwal0% (1)

- QUIZ Marathon 1:: Master Budget (Set ADocument7 pagesQUIZ Marathon 1:: Master Budget (Set AImelda leeNo ratings yet

- Unit 4. Accruals and DeferralsDocument21 pagesUnit 4. Accruals and Deferralszynab123No ratings yet

- Cement Industry in SwedenDocument1 pageCement Industry in Swedenemad sabriNo ratings yet

- Chapter 2Document27 pagesChapter 2yewjie100% (1)

- Expenditure Switching PoliciesDocument5 pagesExpenditure Switching PoliciesAkashdeep GhummanNo ratings yet

- Macroeconomics Assignment 2Document4 pagesMacroeconomics Assignment 2reddygaru1No ratings yet

- Motion To Dismiss-Fleury Chapter 7 BankruptcyDocument5 pagesMotion To Dismiss-Fleury Chapter 7 Bankruptcyarsmith718No ratings yet

- Difference Between Expense and AllowanceDocument3 pagesDifference Between Expense and AllowancenishavinodNo ratings yet

- C&ma RWQDocument5 pagesC&ma RWQPrabhakar RaoNo ratings yet

- Depreciation, 5Document36 pagesDepreciation, 5SDW7No ratings yet

- PZ Financial AnalysisDocument2 pagesPZ Financial Analysisdewanibipin100% (1)

- Table 4.4 Common Size Balance Sheet Statement: 45 Source ComputedDocument1 pageTable 4.4 Common Size Balance Sheet Statement: 45 Source ComputedManoj KumarNo ratings yet

- Foreign Exchange Spot MarketsDocument41 pagesForeign Exchange Spot MarketsVikku AgarwalNo ratings yet

- Principles of Option PricingDocument30 pagesPrinciples of Option PricingVaidyanathan Ravichandran100% (1)

- 5 Year Cash FlowDocument5 pages5 Year Cash FlowRith TryNo ratings yet

- Accounting June 2011 Unit 1Document9 pagesAccounting June 2011 Unit 1nymazeeNo ratings yet

- Format of Bond RefundingDocument9 pagesFormat of Bond RefundingvanvunNo ratings yet

- BUSANA1 Chapter2 - Compound InterestDocument101 pagesBUSANA1 Chapter2 - Compound InterestIzzeah RamosNo ratings yet