Professional Documents

Culture Documents

Income Tax Calculator 2012-13

Uploaded by

Cool Friend GksCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Calculator 2012-13

Uploaded by

Cool Friend GksCopyright:

Available Formats

http://www.PankajBatra.

com

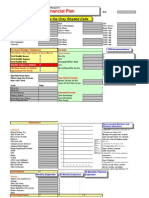

Income Tax Calculator F.Y. 2012-13 (AY 2013-14)

Gender Place of Residence Age Number of children

Salary Breakup

Male Metro City 30 0

April May June July August September October November December January February March Total -

Have a Question? Ask it here: http://www.SocialFinance.in

Basic Salary House Rent Allowance (HRA) Dearness allowance (DA) Transport/Conveyence Allowance Child Education Allowance Grade/Special/Management/Supplemementary Allowance City Compensatory Allowance (CCA) Arrears Gratuity Leave Travel Allowance (LTA) Leave Encashment Performance Incentive/Bonus Medical Reimbursement Food Coupons Periodical Journals Uniform/Dress Allowance Telephone Reimbursements Professional Development Allowance Car Reimbursement Internet Expense Driver Salary Gifts From Non-Relatives Gifts From Relatives Agricultural Income House Rent Income (income from house property) Saving bank account interest Other income (Fixed deposit /NSC/SCSS Interest) Short Term Gains from Share Trading/Equity MFs Long Term Gains from Share Trading/Equity MFs

TOTAL INCOME

Exemptions Actual Rent paid as per rent receipts Availing both HRA and Home loan exemption

HRA Exemption

Non-Taxable Allowances Investment/Bills Details Child Education Allowance Medical Reimbursement receipts submitted Transport/Conv. Allowance LTA receipt submitted Food Coupons Periodical Journals Uniform/Dress Allowance Telephone Reimbursement receipts submitted Prof. Development receipts submitted Car Expenses Reimbursement receipts submitted Internet expense receipts submitted Driver Salary receipts submitted Other Reimbursement receipts submitted Non taxable Gratuity Non taxable leave encashment Non taxable House rent income Balance Salary Professional Tax Net Taxable Salary House and Loan Status On loan and Self Occupied Home Loan Interest Component Gross Total Income Deductions under chapter VIA Life Insurance Premium payment Employee's contribution to PF PPF (Public Provident Fund) Equity Tax saver Mutual Funds - ELSS National Savings Certificate (NSC) deposit National Service Scheme (NSS) deposit Senior Citizen Savings Scheme (SCSS) deposit Post Office/Tax saving Bonds investments New pension scheme (NPS) Deposit 80CCD Children Tution Fees paid Housing Loan Principal repayment Tax saving Fixed Deposit for 5 yrs. or more Stamp Duty/Registration charges for house Other Eligible Investments Total of Section 80C Pension Fund (80 CCC) Total Deduction under Sec. 80C & 80CCC 80D (Medical insurance premium for Self and/or Family) 80D (Medical insurance premium for Parents) 80DD (Maintainence of depandant disabled) 80DDB (Medical treatment for specific diseases) 80E (Interest paid on Higher Education Loan) 80U (Handicapped person/Perm. Disability) Donations - 80G (100 % deductions) Donations - 80G (50 % deductions) Direct Investment in Equity under RGESS Long Term Infra. Bonds (Section 80CCF) Total Taxable Income Taxable Income rounded off Income Tax on Total Income Education Cess @ 3% Income tax including education cess TDS (Tax deducted at source) Pending Tax Payable Monthly Deductions from salary TDS (Tax deducted at source) Professional Tax Employee's PF Contribution Employee's NPS Contribution VPF (Voluntarily Provident Fund) contribution Deduction for company provided transport Deduction towards State Labour welfare Fund (LWF) Deduction towards company provided Group Term insurance Deduction towards Leave availed Deduction towards company provided medical insurance Other Deductions from Employer Employer's NPS Contribution Employer's PF Contribution In Hand Salary In Hand Salary without reimbursments April May June July August September October November December January February March -

With Severe Disability Parents above 60 years With Severe Disability Patient Below 65 years

Total Income in this year

ADVANCE TAX SCHEDULE - NOT APPLICABLE FOR SENIOR CITIZENS Total Tax as per Consolidation Sheet: PARTICULARS Payable upto 15th September, 2012 Payable upto 15th December, 2012 Payable upto 15th March, 2013 % 30% 60% 100% Payable Paid Difference -

Savings for Tax

PPF Investments Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Total -

Long Term infra bonds investment Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Total Post Office/Tax saving Bonds investments Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Total Pension Fund (80 CCC) investments Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Total GROSS TOTAL

Children Tution Fees paid -

You might also like

- J.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything DeductibleNo ratings yet

- Income Tax Calculator F.Y. 2016-17 (AY 2017-18Document2 pagesIncome Tax Calculator F.Y. 2016-17 (AY 2017-18Pankaj BatraNo ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleRating: 3 out of 5 stars3/5 (1)

- Genpact Vs InfosysDocument3 pagesGenpact Vs InfosysNidhi MishraNo ratings yet

- Setting up, operating and maintaining Self-Managed Superannuation FundsFrom EverandSetting up, operating and maintaining Self-Managed Superannuation FundsNo ratings yet

- Corporate Tax Course OutlineDocument82 pagesCorporate Tax Course Outlinejayen0296755No ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleNo ratings yet

- Income Tax Sheet Bmoi 2012 13Document2 pagesIncome Tax Sheet Bmoi 2012 13rincepNo ratings yet

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yNo ratings yet

- Individual Financial Plan: Complete The Gray Shaded CellsDocument6 pagesIndividual Financial Plan: Complete The Gray Shaded Cellsraven505No ratings yet

- Individual Income Tax Formula ExplainedDocument2 pagesIndividual Income Tax Formula ExplainedHenry ZhuNo ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- MG Pricing For 2015Document1 pageMG Pricing For 2015api-191645396No ratings yet

- Investment ChecklistDocument18 pagesInvestment ChecklistVarun NaharNo ratings yet

- Auto Income Tax Calculator Version 5.1 2010-11Document19 pagesAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNo ratings yet

- 56 Incom Tax CalculatorDocument6 pages56 Incom Tax Calculatorspecky123No ratings yet

- Pay Scales For Executives and Non-Executives at RINLDocument1 pagePay Scales For Executives and Non-Executives at RINLbanchodaNo ratings yet

- Monthly Budget Planner Track ExpensesDocument25 pagesMonthly Budget Planner Track Expensesnhar27No ratings yet

- How To Save Tax For FY 2013 14Document42 pagesHow To Save Tax For FY 2013 14duderamNo ratings yet

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- Click Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyDocument24 pagesClick Here To Check Take Home Salary-Once You Have Filled Input Sheet CompletelyHARSHITA JOSHINo ratings yet

- Salary Structure CalculatorDocument6 pagesSalary Structure CalculatorNisha_Yadav_6277No ratings yet

- Guideline On ITDocument19 pagesGuideline On ITmikekikNo ratings yet

- ClassificationsDocument39 pagesClassificationsbalasukNo ratings yet

- Verizon India income tax statementDocument2 pagesVerizon India income tax statementabintmNo ratings yet

- Epsf Form & Guideliness - 2016-17Document8 pagesEpsf Form & Guideliness - 2016-17SumanNo ratings yet

- UNIT 2 Income From SalaryDocument146 pagesUNIT 2 Income From Salaryeasy mailNo ratings yet

- Tax PresentationDocument39 pagesTax Presentationtap4awhileNo ratings yet

- Income tax filing deadline reminderDocument2 pagesIncome tax filing deadline remindermakamkkumarNo ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Declaration For Income TaxDocument1 pageDeclaration For Income TaxjameerahmadNo ratings yet

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiNo ratings yet

- Basic Income Tax StructureDocument69 pagesBasic Income Tax StructureAditya AnandNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- Financial Check Up FormsDocument10 pagesFinancial Check Up FormsJoshelle B. BanciloNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Guidelines For Investment Proof SubmissionDocument6 pagesGuidelines For Investment Proof Submissionzaheer KaziNo ratings yet

- Employee Compensation and BenefitsDocument28 pagesEmployee Compensation and BenefitsToqeer AhmedNo ratings yet

- Personal Tax Heads of Income and DeductionsDocument3 pagesPersonal Tax Heads of Income and DeductionsHimanshu AroraNo ratings yet

- CMA-How To Save Tax 2013-14Document37 pagesCMA-How To Save Tax 2013-14sunilsunny317No ratings yet

- Monthly Budget (Cash Flow) : He MeDocument4 pagesMonthly Budget (Cash Flow) : He MeJacob Chua Yew HongNo ratings yet

- QUESTIONNAIREDocument3 pagesQUESTIONNAIRETRISHAYAN DUTTANo ratings yet

- 2009 Tax Calculator-1Document2 pages2009 Tax Calculator-1Sandip S NagareNo ratings yet

- Sample - Comprehensive Personal Financial Plan - Created in ExcelDocument147 pagesSample - Comprehensive Personal Financial Plan - Created in ExcelSatish Mistry100% (1)

- ANNUAL INCOME TAX STATEMENTDocument4 pagesANNUAL INCOME TAX STATEMENTManoj SankaranarayanaNo ratings yet

- Tax-efficient investment through gifts to relativesDocument7 pagesTax-efficient investment through gifts to relativesAditya YadavNo ratings yet

- Stambaugh Ness, PC 2012-2013 Payroll Processing & Payroll Tax GuideDocument151 pagesStambaugh Ness, PC 2012-2013 Payroll Processing & Payroll Tax GuideSteve Hake0% (1)

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Retirement Planning: by Prof Sameer LakhaniDocument18 pagesRetirement Planning: by Prof Sameer LakhaniPooja DeliwalaNo ratings yet

- Amount Credit Credits Items: 41580 Tax Payable Without Marginal ReliefDocument4 pagesAmount Credit Credits Items: 41580 Tax Payable Without Marginal Reliefaqeelahmed1978No ratings yet

- Auto CTC Salary CalculatorDocument1 pageAuto CTC Salary CalculatorSathvika SaaraNo ratings yet

- Financial QuestionnaireDocument8 pagesFinancial QuestionnaireNishant PokleNo ratings yet

- Arizona, Utah & New Mexico: A Guide to the State & National ParksFrom EverandArizona, Utah & New Mexico: A Guide to the State & National ParksRating: 4 out of 5 stars4/5 (1)

- Japanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensFrom EverandJapanese Gardens Revealed and Explained: Things To Know About The Worlds Most Beautiful GardensNo ratings yet

- South Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptFrom EverandSouth Central Alaska a Guide to the Hiking & Canoeing Trails ExcerptRating: 5 out of 5 stars5/5 (1)

- The Bahamas a Taste of the Islands ExcerptFrom EverandThe Bahamas a Taste of the Islands ExcerptRating: 4 out of 5 stars4/5 (1)

- New York & New Jersey: A Guide to the State & National ParksFrom EverandNew York & New Jersey: A Guide to the State & National ParksNo ratings yet

- Naples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoFrom EverandNaples, Sorrento & the Amalfi Coast Adventure Guide: Capri, Ischia, Pompeii & PositanoRating: 5 out of 5 stars5/5 (1)