Professional Documents

Culture Documents

MG Pricing For 2015

Uploaded by

api-191645396Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MG Pricing For 2015

Uploaded by

api-191645396Copyright:

Available Formats

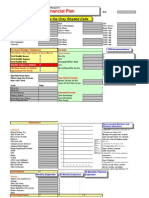

PRICING FOR 2015

Tax situation

Our Price

Basic

Employment Income- one T4

Old Age Security- T4A(OAS)

CPP-T4A(P)

$ 40

Typical

Employment Income- Multiple T4s

EI benefits

Social Assistance &WCB

Pension Income

CPP or QPP Benefits

RRSP Income/ Contributions

Transit Passes

Union Dues

Universal Child Care Benefit

$ 50

Intermediate

Typical Package plus:

Amount for eligible dependant

Carrying charges & interest expenses

Charitable donations

Home Buyers Plan/ Life-long Learning Plan

Investment Income

Support Payments

Scholarships

Student Loan Interest

Tuition & Education Amounts

Complex

Intermediate Package plus:

Medical Expenses (up to ten receipts)

$70

$80

Premium

Complex Package plus:

Capital Gains and Deductions

Business/Commission Income

Pension Income Splitting

Rental Income

RESP Accumulated Income

Caregiver amount/infirm dependent

Child Care Expenses

Clergy Residence Deductions

Disability Amount/Support

Employment Expenses

Foreign Income &FTC

Moving Expenses

AMT Carryovers

GST 370 (Refund)

Loss Carryback

Overseas Tax Credit

Partnership Income or Losses

Deceased Return

Starting $100

(Price is based on complexity of return. Free estimate will be

provided.)

You might also like

- Individual Income Tax Formula ExplainedDocument2 pagesIndividual Income Tax Formula ExplainedHenry ZhuNo ratings yet

- Income Tax Calculator 2012-13Document2 pagesIncome Tax Calculator 2012-13Cool Friend GksNo ratings yet

- Becker Regulation CHPT 1Document3 pagesBecker Regulation CHPT 1kishkiss25No ratings yet

- Income Tax Calculator F.Y. 2016-17 (AY 2017-18Document2 pagesIncome Tax Calculator F.Y. 2016-17 (AY 2017-18Pankaj BatraNo ratings yet

- Income and Expense Statement For: Amount Income Time PeriodDocument1 pageIncome and Expense Statement For: Amount Income Time PeriodKelli StudentNo ratings yet

- Personal Tax Heads of Income and DeductionsDocument3 pagesPersonal Tax Heads of Income and DeductionsHimanshu AroraNo ratings yet

- Budgetworksheet 1Document1 pageBudgetworksheet 1api-313772308No ratings yet

- New Hire Benefits Summary: Medical, PTO, Life Ins & MoreDocument3 pagesNew Hire Benefits Summary: Medical, PTO, Life Ins & MoreRavi Prakash MayreddyNo ratings yet

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- RG146 Pocket GuideDocument30 pagesRG146 Pocket GuideMentor RG146No ratings yet

- 2013 Tax RatesDocument4 pages2013 Tax Ratesapi-241405153No ratings yet

- Chapter 7Document21 pagesChapter 7api-263146371No ratings yet

- Handout 4Q - Philippine Individual Income Tax TableDocument1 pageHandout 4Q - Philippine Individual Income Tax Tablekathy143100% (5)

- Accounting Side of MedicineDocument32 pagesAccounting Side of MedicinelkjdslfjalNo ratings yet

- Notes Chapter 1 REGDocument7 pagesNotes Chapter 1 REGelmotakeover1No ratings yet

- 2010 11HEAP ApplicationDocument4 pages2010 11HEAP ApplicationEnder751No ratings yet

- ChecklistDocument1 pageChecklistdeep patelNo ratings yet

- CTC EstimationDocument3 pagesCTC EstimationVenkata Aneel InugantiNo ratings yet

- CTCDocument30 pagesCTCNilesh MandlikNo ratings yet

- A Guide To Australian Government Payments 2014Document44 pagesA Guide To Australian Government Payments 2014Wing ChuNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocument17 pagesWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownNo ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- Budget SummaryDocument7 pagesBudget Summarypvrpl3No ratings yet

- Application For 16-18 Study Programme Award 2020-21 - Updated v1 InteractiveDocument2 pagesApplication For 16-18 Study Programme Award 2020-21 - Updated v1 InteractiveFaizan AliNo ratings yet

- IHRM - Compensation ManagementDocument36 pagesIHRM - Compensation ManagementVinay Krishna H VNo ratings yet

- Presented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreDocument30 pagesPresented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreshraddhavanjariNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- About Schedule DuesDocument1 pageAbout Schedule DuestitooluwaNo ratings yet

- Occupation GuidelinesDocument160 pagesOccupation Guidelinesjo lamosNo ratings yet

- Your Customized Benefits Plan at HCL America IncDocument2 pagesYour Customized Benefits Plan at HCL America IncShiv RanjanNo ratings yet

- Individual Tax OverviewDocument49 pagesIndividual Tax OverviewMo ZhuNo ratings yet

- Investment ChecklistDocument18 pagesInvestment ChecklistVarun NaharNo ratings yet

- Lesson 14-Budget Planning WorksheetDocument6 pagesLesson 14-Budget Planning Worksheetapi-253889154No ratings yet

- 2013 Tax Ref. Guide RateDocument2 pages2013 Tax Ref. Guide RateeabooksNo ratings yet

- Taxable Income and Tax Payable For Individuals: Lesson 2 Tax Credits ContinuedDocument37 pagesTaxable Income and Tax Payable For Individuals: Lesson 2 Tax Credits ContinuedXi ChenNo ratings yet

- Sun Life FinancialDocument2 pagesSun Life Financialchristine geronimo100% (1)

- 2013 Federal Tax Amounts and LimitsDocument2 pages2013 Federal Tax Amounts and LimitsJane ZuckerNo ratings yet

- Buckner 2 Family BudgetDocument1,774 pagesBuckner 2 Family BudgetEmily Jones BucknerNo ratings yet

- STANDARDISED TEST SCORES AND APPLICATION FOR FINANCIAL AIDDocument6 pagesSTANDARDISED TEST SCORES AND APPLICATION FOR FINANCIAL AIDsuazulianprincessNo ratings yet

- Element Primary ClassificationsDocument3 pagesElement Primary ClassificationsShahariar AsifNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarNo ratings yet

- Surcharge: On Contributi Employee Use Business Proportion - 100% Cost X OperatingDocument4 pagesSurcharge: On Contributi Employee Use Business Proportion - 100% Cost X Operatinglouis_parker_5553No ratings yet

- Budget WorksheetDocument3 pagesBudget Worksheethayleerudy99No ratings yet

- Factsheet: Family Tax BenefitDocument5 pagesFactsheet: Family Tax BenefitdhibuNo ratings yet

- Individual Financial Plan: Complete The Gray Shaded CellsDocument6 pagesIndividual Financial Plan: Complete The Gray Shaded Cellsraven505No ratings yet

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerDocument21 pagesTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerNo ratings yet

- Budget Proposal ScleeDocument3 pagesBudget Proposal Scleeapi-251018730No ratings yet

- Monthly Budget Justine LawrenceDocument6 pagesMonthly Budget Justine Lawrenceapi-277278641No ratings yet

- Employee Compensation and BenefitsDocument28 pagesEmployee Compensation and BenefitsToqeer AhmedNo ratings yet

- College Budget Analysis: Expenses OverviewDocument4 pagesCollege Budget Analysis: Expenses Overviewnonsense45No ratings yet

- CFG Reference GuideDocument38 pagesCFG Reference GuideStefan IonescuNo ratings yet

- College Budget Analysis: Expenses OverviewDocument4 pagesCollege Budget Analysis: Expenses OverviewSanet SteynNo ratings yet

- Us Benefits Summary Ees 2Document2 pagesUs Benefits Summary Ees 2Joel PanganibanNo ratings yet

- Fire Your Over-Priced Financial Advisor and Retire SoonerFrom EverandFire Your Over-Priced Financial Advisor and Retire SoonerRating: 5 out of 5 stars5/5 (1)