Professional Documents

Culture Documents

Form No. 15D

Form No. 15D

Uploaded by

Deep SanjayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 15D

Form No. 15D

Uploaded by

Deep SanjayCopyright:

Available Formats

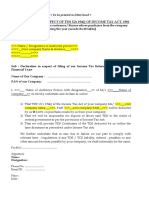

FORM NO.

15D

[See rule 29B]

Application by a person other than a banking company for a certificate under section 195(3) of the Income-tax Act, 1961, for receipt of sums other than interest and dividends without deduction of tax

To The Assessing Officer,

Sir, I, , being the principal officer of we [name of the person, firm or company entitled to receive sums other than interest and dividends] do hereby declare : (a) that I/ [name of the firm, company, etc.] am/is a non-resident assessee (not being a banking company) carrying on business/profession in India through a branch(es) by name(s) having office(s) at ; (b) that my head office/the head office of [name of the firm, company, etc.] is situated at [name of the place and country] (c) that I/ [name of the firm, company, etc.] am/is entitled to receive income (other than dividends and interest) chargeable under the provisions of the Income-tax Act, 1961, during the financial year ; (d) that I/ [name of the firm, company, etc.] fulfil(s) all the conditions laid down in rule 29B of the Income -tax Rules, 1962. I, therefore, request that a certificate may be issued authorising me/ [name of the firm, company, etc.] to receive income other than interest or dividends without deduction of tax under sub-section (1) of section 195 of the Income-tax Act, 1961, during the financial year . I hereby declare that what is stated in this application is correct.

Date

. Signature Address

[ITR62;15D,1]

-tax Rules on CD

Page 1 of 1

You might also like

- Articles of Incorporation TemplateDocument2 pagesArticles of Incorporation TemplatePaola Morales100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- The Rigours of TDS - An OverviewDocument31 pagesThe Rigours of TDS - An OverviewShaleenPatniNo ratings yet

- AGM TemplateDocument4 pagesAGM TemplateJunguang TanNo ratings yet

- Checklist For Closure of Company Under Section 560 Companies Act 1956Document15 pagesChecklist For Closure of Company Under Section 560 Companies Act 1956CA Sai Prasad100% (3)

- SPktTyfOn2q9UeZKwQ1ER8gs PDFDocument1 pageSPktTyfOn2q9UeZKwQ1ER8gs PDFAvinash KumarNo ratings yet

- 31 thU9V8pZIEoijGbRNn7OXQ0eDocument1 page31 thU9V8pZIEoijGbRNn7OXQ0eAvinash KumarNo ratings yet

- Itr 62 Form 15 CDocument1 pageItr 62 Form 15 Cad2avNo ratings yet

- Afcons Notice 2020Document14 pagesAfcons Notice 2020himangptNo ratings yet

- Letter in Case A Foreign Company Does Not Have A "PE" in IndiaDocument2 pagesLetter in Case A Foreign Company Does Not Have A "PE" in IndiaAmit GhangasNo ratings yet

- Annexure - 6 - Non-Resident Tax DeclarationDocument2 pagesAnnexure - 6 - Non-Resident Tax Declarationprateek agrawalNo ratings yet

- TDS, TCS & Advance Payment of TaxDocument54 pagesTDS, TCS & Advance Payment of TaxFalak GoyalNo ratings yet

- Permanent Esta ResearchDocument24 pagesPermanent Esta ResearchNeha PandeyNo ratings yet

- Notice For AGMDocument11 pagesNotice For AGMSakshi GuptaNo ratings yet

- Employee Declaration - GratuityDocument1 pageEmployee Declaration - Gratuitygiri gNo ratings yet

- Articles of Incorporation Template 04Document2 pagesArticles of Incorporation Template 04張 雲No ratings yet

- Sanofi India Limited: Notice of Annual General MeetingDocument24 pagesSanofi India Limited: Notice of Annual General Meetingyamada_842000No ratings yet

- Declaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Document2 pagesDeclaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Cma Saurabh AroraNo ratings yet

- Vision Realcon RejoinderDocument8 pagesVision Realcon RejoinderSonali AggarwalNo ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- 15 G Form (Blank)Document2 pages15 G Form (Blank)nst27No ratings yet

- Godfrey PhillipsDocument114 pagesGodfrey PhillipsvikskukrejaNo ratings yet

- The Of: Executed On Non-Judicial Stamp 100/-)Document4 pagesThe Of: Executed On Non-Judicial Stamp 100/-)Ashok PalakondaNo ratings yet

- Undetaking For Remittance For NRDocument5 pagesUndetaking For Remittance For NRhds1979No ratings yet

- Return of IncomeDocument13 pagesReturn of IncomeParth UpadhyayNo ratings yet

- Gratuity Account Opening FormatDocument9 pagesGratuity Account Opening FormatTikaram ChaudharyNo ratings yet

- Annual Report of Falcon Tyre CompanyDocument41 pagesAnnual Report of Falcon Tyre CompanyRaghavendra GowdaNo ratings yet

- Articles of Incorporation SampleDocument3 pagesArticles of Incorporation SampleLincoln Reserve Group Inc.No ratings yet

- Ficci Sugessions GSTDocument20 pagesFicci Sugessions GSTkapuNo ratings yet

- Airtel 2019Document520 pagesAirtel 2019Ravi BhadauriaNo ratings yet

- Payment of Bonus Act 1965Document38 pagesPayment of Bonus Act 1965Prajapati Kalpesh BhagvandasNo ratings yet

- Annual Report 2009 10 Falcon TyresDocument104 pagesAnnual Report 2009 10 Falcon TyresGaurav AgarwalNo ratings yet

- Taxation Ions B1Document8 pagesTaxation Ions B1Saurabh SanjayNo ratings yet

- Prof Ca S P Desai Important Definitions: Assessee (Section 2 (7) )Document10 pagesProf Ca S P Desai Important Definitions: Assessee (Section 2 (7) )Jay SangoiNo ratings yet

- Annual Report For FY 2018-2019 PDFDocument154 pagesAnnual Report For FY 2018-2019 PDFhukaNo ratings yet

- Erll Unit 5Document22 pagesErll Unit 5Himani KhatriNo ratings yet

- 21 Application Format For Registring As NBFCDocument13 pages21 Application Format For Registring As NBFCDarshak ShahNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Esab Annual Report 2008Document56 pagesEsab Annual Report 2008Viraj SandaruwanNo ratings yet

- Mandm Ar f12Document197 pagesMandm Ar f12Dhruv BhandariNo ratings yet

- BSE SB Cancellation New FormatDocument4 pagesBSE SB Cancellation New FormatabcNo ratings yet

- (Name of The Company) (Address of Registered Office)Document1 page(Name of The Company) (Address of Registered Office)RashmiNo ratings yet

- Annual Report 2018 19 PgcilDocument359 pagesAnnual Report 2018 19 PgcilDeepakyadavNo ratings yet

- 15th Annual ReportDocument102 pages15th Annual ReportChandni PatelNo ratings yet

- Madhya Pradesh Professional Tax Act, 1995Document40 pagesMadhya Pradesh Professional Tax Act, 1995sumitkejriwalNo ratings yet

- HCL Infosystems Limited: NoticeDocument16 pagesHCL Infosystems Limited: NoticeShashikant ThakreNo ratings yet

- $valueDocument1 page$valueBikeworldNo ratings yet

- Income TaxDocument8 pagesIncome TaxAditya KumarNo ratings yet

- Notice AttandanceSlip PDFDocument7 pagesNotice AttandanceSlip PDFHkNo ratings yet

- Voltas: Sub: Annual Report 2018-19Document278 pagesVoltas: Sub: Annual Report 2018-19dharmendraNo ratings yet

- BSL201 Ca3 AnkitaDocument16 pagesBSL201 Ca3 AnkitarishikaNo ratings yet

- 15G FormDocument2 pages15G Formsurendar147No ratings yet

- TDS ElaboratedDocument80 pagesTDS ElaboratedAncyNo ratings yet

- ST STDocument11 pagesST STmanoj kumar JhaNo ratings yet

- Advance Payment of TaxDocument3 pagesAdvance Payment of TaxsadathnooriNo ratings yet

- Tds Law and Practice: Under Income Tax Act, 1961Document84 pagesTds Law and Practice: Under Income Tax Act, 1961Vaibhav ChauhanNo ratings yet

- SRS Annual ReportDocument236 pagesSRS Annual Reportkaushal patelNo ratings yet

- Amendmenzts For Nov 2015cvncvncDocument4 pagesAmendmenzts For Nov 2015cvncvncBhavin ShahNo ratings yet

- SPICeINC9 INC0001218903Document4 pagesSPICeINC9 INC0001218903anant mehraNo ratings yet