Professional Documents

Culture Documents

SPktTyfOn2q9UeZKwQ1ER8gs PDF

Uploaded by

Avinash KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SPktTyfOn2q9UeZKwQ1ER8gs PDF

Uploaded by

Avinash KumarCopyright:

Available Formats

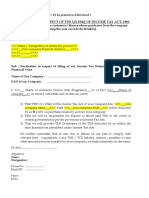

FORM NO.

15D

[See rule 29B]

Application by a person other than a banking company for a certificate under section

195(3)

of the Income-tax Act, 1961, for receipt of sums other than interest and dividends

without deduction of tax

To

The Assessing Officer,

Sir,

I, _________________ , being the principal officer of __________________ we _____________ [name of the

person, firm or company entitled to receive sums other than interest and dividends] do hereby declare :

(a) that I/ _____________ [name of the firm, company, etc.] am/is a non-resident assessee (not being a banking

company) carrying on business/profession in India through a branch(es) by name(s) _____________ having

office(s) at _____________ ;

(b) that my head office/the head office of _________________ [name of the firm, company, etc.] is situated at

[name of the place and country]

(c) that I/ ___________________ [name of the firm, company, etc.] am/is entitled to receive income (other than

dividends and interest) chargeable under the provisions of the Income-tax Act, 1961, during the financial

year;

(d) that I/ _________________________ [name of the firm, company, etc.] fulfil(s) all the conditions laid down

in rule 29B of the Income-tax Rules, 1962.

I, therefore, request that a certificate may be issued authorising me/ ________________________ [name of the

firm, company, etc.] to receive income other than interest or dividends without deduction of tax under sub-

section (1) of section 195 of the Income-tax Act, 1961, during the financial year

I hereby declare that what is stated in this application is correct.

Date ______________

Signature

Address

Printed from www.taxmann.com

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Power of Attorney Subrogation & IndemnityDocument5 pagesPower of Attorney Subrogation & IndemnityJagjeet SinghNo ratings yet

- Investment Alternatives - Negotiable and Non-Negotiable InstrumentsDocument7 pagesInvestment Alternatives - Negotiable and Non-Negotiable InstrumentsAvinash KumarNo ratings yet

- Resolution and NOCDocument3 pagesResolution and NOCNaina Goyal100% (1)

- State Land Investment Corporation v. Cir DigestDocument2 pagesState Land Investment Corporation v. Cir DigestAlan Gultia100% (1)

- Affidavit Non Submission BIR Form 2316Document1 pageAffidavit Non Submission BIR Form 2316Jhoevel CastilloNo ratings yet

- Waiver For Non Submission of BIR For 2316Document1 pageWaiver For Non Submission of BIR For 2316Andrew PanganibanNo ratings yet

- Legal Notice AnimeshDocument7 pagesLegal Notice AnimeshKalyan Dutt100% (1)

- Itr 62 Form 15 CDocument1 pageItr 62 Form 15 Cad2avNo ratings yet

- Form No. 15DDocument1 pageForm No. 15DDeep SanjayNo ratings yet

- 31 thU9V8pZIEoijGbRNn7OXQ0eDocument1 page31 thU9V8pZIEoijGbRNn7OXQ0eAvinash KumarNo ratings yet

- 194C - Non Deduction of TDS For TransporterDocument1 page194C - Non Deduction of TDS For TransporterDINESH MEHTANo ratings yet

- Form 27CDocument2 pagesForm 27CrajdeeppawarNo ratings yet

- TDS Declaration From Transporter For 194CDocument1 pageTDS Declaration From Transporter For 194CASHISH KUMARNo ratings yet

- To Whomsoever It May ConcernDocument1 pageTo Whomsoever It May Concernsharma ramNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Waiver For The Non-Submission of Bir2316Document2 pagesWaiver For The Non-Submission of Bir2316lucNo ratings yet

- Form No. 15G: Signature of The DeclarantDocument2 pagesForm No. 15G: Signature of The DeclarantNineFinancialNo ratings yet

- TDS Declaration From Transporter For 194CDocument1 pageTDS Declaration From Transporter For 194Ckksinghp1987No ratings yet

- Tax Compliance AffidavitDocument1 pageTax Compliance Affidavitluthfi musthofaNo ratings yet

- Tax Affidavit (Make A Copy)Document3 pagesTax Affidavit (Make A Copy)Miles LabadoNo ratings yet

- FSI GST Wavier Undertaking Cum Indeminity 24.08.2021Document2 pagesFSI GST Wavier Undertaking Cum Indeminity 24.08.2021sai nair100% (1)

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- Tax Compliance AffidavitDocument1 pageTax Compliance Affidavitcesc festNo ratings yet

- Form No. 39: Form of Application For Registration As Authorised Income - Tax PractitionerDocument1 pageForm No. 39: Form of Application For Registration As Authorised Income - Tax PractitionerGanesh GollaNo ratings yet

- Template-Of-TDS-Declaration For Transporter Wef 1.6.15Document1 pageTemplate-Of-TDS-Declaration For Transporter Wef 1.6.15Dhananjay KulkarniNo ratings yet

- Declaration Under Section 194C (6) For Non-Deduction of Tax at SourceDocument1 pageDeclaration Under Section 194C (6) For Non-Deduction of Tax at Sourcesai sabari accounting solutionsNo ratings yet

- Australian Tax Return: Power of Attorney and Declaration of RepresentativeDocument1 pageAustralian Tax Return: Power of Attorney and Declaration of RepresentativeOmar FuentesNo ratings yet

- Declaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Document2 pagesDeclaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Cma Saurabh AroraNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaNo ratings yet

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- Form 15 GDocument2 pagesForm 15 GAmit BhatiNo ratings yet

- ITR AchkonwledgementDocument2 pagesITR AchkonwledgementdanNo ratings yet

- Taxguru - In-Guide To Approved Gratuity FundDocument12 pagesTaxguru - In-Guide To Approved Gratuity FundnanuNo ratings yet

- 194N Declaration FormDocument2 pages194N Declaration FormShubham MishraNo ratings yet

- The Rigours of TDS - An OverviewDocument31 pagesThe Rigours of TDS - An OverviewShaleenPatniNo ratings yet

- Basic Concepts of TaxDocument6 pagesBasic Concepts of TaxAshutosh Dubey AshuNo ratings yet

- Erll Unit 5Document22 pagesErll Unit 5Himani KhatriNo ratings yet

- 15 G Form (Blank)Document2 pages15 G Form (Blank)nst27No ratings yet

- 16ubi513 - Income Tax Multiple Choice Questions. K1 - LevelDocument41 pages16ubi513 - Income Tax Multiple Choice Questions. K1 - LevelMann MazeNo ratings yet

- Payment of Bonus Act 1965Document38 pagesPayment of Bonus Act 1965Prajapati Kalpesh BhagvandasNo ratings yet

- Bundled BIL BCC Sole Proprietorship LetterDocument3 pagesBundled BIL BCC Sole Proprietorship LetterLovely ReddyNo ratings yet

- Tds Law and Practice: Under Income Tax Act, 1961Document84 pagesTds Law and Practice: Under Income Tax Act, 1961Vaibhav ChauhanNo ratings yet

- Income Tax DeclarationDocument1 pageIncome Tax DeclarationParwinder SinghNo ratings yet

- Annexure - 6 - Non-Resident Tax DeclarationDocument2 pagesAnnexure - 6 - Non-Resident Tax Declarationprateek agrawalNo ratings yet

- FORM No. 26ADocument3 pagesFORM No. 26AKumar KumarNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- Form No. 15-I: VerificationDocument1 pageForm No. 15-I: Verificationtabassumansari0750No ratings yet

- Form No. 15G: (See Rule 29C)Document1 pageForm No. 15G: (See Rule 29C)MKNo ratings yet

- CBDT Notifies Forms For Accumulation of Income by A TrustDocument4 pagesCBDT Notifies Forms For Accumulation of Income by A TrustBibhuChhotrayNo ratings yet

- Module - 1 Basic Concepts.Document11 pagesModule - 1 Basic Concepts.Dimple JainNo ratings yet

- In Re - Dinshaw Maneckjee Petit ... Vs Unknown On 29 November, 1926Document16 pagesIn Re - Dinshaw Maneckjee Petit ... Vs Unknown On 29 November, 1926Ravi RanjanNo ratings yet

- TDS, TCS & Advance Payment of TaxDocument54 pagesTDS, TCS & Advance Payment of TaxFalak GoyalNo ratings yet

- Form F-A Application For Withdrawal of Corporate Insolvency Resolution ProcessDocument2 pagesForm F-A Application For Withdrawal of Corporate Insolvency Resolution ProcessBhava SharmaNo ratings yet

- TDS ElaboratedDocument80 pagesTDS ElaboratedAncyNo ratings yet

- SandipDocument3 pagesSandipRahul GuptaNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- Tally Erp 9.0 Material Tax Collected at Source Tally Erp 9.0Document25 pagesTally Erp 9.0 Material Tax Collected at Source Tally Erp 9.0Raghavendra yadav KMNo ratings yet

- ITC Notes PDFDocument44 pagesITC Notes PDFAvinash KumarNo ratings yet

- rf9RgWUoLMY58namXBIiNpED PDFDocument2 pagesrf9RgWUoLMY58namXBIiNpED PDFAvinash KumarNo ratings yet

- Market PlanDocument1 pageMarket PlanAvinash KumarNo ratings yet

- Bank Account Number Name and Address of The DeductorDocument2 pagesBank Account Number Name and Address of The DeductorAvinash KumarNo ratings yet

- Good Evening To AllDocument2 pagesGood Evening To AllAvinash KumarNo ratings yet

- Market PlanDocument1 pageMarket PlanAvinash KumarNo ratings yet

- Investment Alternatives - Negotiable and Non-Negotiable InstrumentsDocument7 pagesInvestment Alternatives - Negotiable and Non-Negotiable InstrumentsAvinash Kumar100% (1)

- Rural Market Plan: - (Akash Kumar) (Shani Jha)Document1 pageRural Market Plan: - (Akash Kumar) (Shani Jha)Avinash KumarNo ratings yet

- Meaning and Importance of Financial Services 1&2 UNITDocument11 pagesMeaning and Importance of Financial Services 1&2 UNITAvinash KumarNo ratings yet