Professional Documents

Culture Documents

Affidavit Non Submission BIR Form 2316

Uploaded by

Jhoevel CastilloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Affidavit Non Submission BIR Form 2316

Uploaded by

Jhoevel CastilloCopyright:

Available Formats

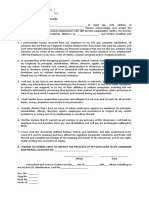

AFFIDAVIT OF NON-SUBMISSION OF

CERTIFICATE OF INCOME TAX WITHHELD

I, _________________________________, hereby certify that I did not furnish my current

employer, CBE Companies PH, Inc., a copy of 2020 Certificate of Income Tax Withheld on

Compensation (BIR Form 2316) from my previous employer ____________________________.

Therefore, CBE Companies PH, Inc. has no basis of combining any personal income from my

previous employer for the taxable year 2020.

In view of omission to submit the required BIR Form 2316, I hereby undertake that I shall be

responsible in computing and paying the appropriate tax to the Bureau of Internal Revenue from

my income from all sources on or before April 15, 2021.

I hereby hold free and harmless and indemnify CBE Companies PH, Inc. its parents, its affiliates

and its successors-in-interest, stockholders, officers, directors, agents or employees, for any

obligations, costs, and other expenses in relation to the non-withholding of the appropriate tax in

relation to my combined income.

__________________________

Signature over Printed Name

Taxpayer

ACKNOWLEDGMENT

Republic of the Philippines)

) S.S.

BEFORE ME, a Notary Public in and for _______________, personally appeared to me

on ________________ , with Government ID and No. _______________ known to me and to me

known to be the same persons who executed the foregoing instrument and who acknowledged to

me that the same is their free and voluntary act and deed.

IN WITNESS WHEREOF, I have hereunto set my hand and seal this ___ day of

_______________ at ______________.

Doc. No. ____;

Page No. ____;

Book No. ____

Series of 2021.

You might also like

- NHA Waiver & Transfer of RightsDocument2 pagesNHA Waiver & Transfer of RightsWilvic Jan GacitaNo ratings yet

- HLF111 CertificateEngagement V05Document1 pageHLF111 CertificateEngagement V05julesniko23No ratings yet

- Waiver & QuitclaimDocument1 pageWaiver & QuitclaimAnonymous uMI5BmNo ratings yet

- Affidavit of Loss: Republic of The Philippines) City of Pasay) S.SDocument1 pageAffidavit of Loss: Republic of The Philippines) City of Pasay) S.SJillene FlororitaNo ratings yet

- Affidavit For OwwaDocument1 pageAffidavit For OwwaAndrew BelgicaNo ratings yet

- Stirling HomexDocument3 pagesStirling HomexAnne cutieNo ratings yet

- Special Power of AttorneyDocument4 pagesSpecial Power of AttorneyMichael San LuisNo ratings yet

- Affidavit of GuaranteeDocument1 pageAffidavit of Guaranteejimmy_barredoNo ratings yet

- Aff of Loss - Marawi SeigeDocument2 pagesAff of Loss - Marawi SeigeSteph BL100% (1)

- Tax Estate TaxDocument13 pagesTax Estate TaxAlbert Baclea-an100% (1)

- letter-RPT ExemptionDocument2 pagesletter-RPT ExemptionRichard GomezNo ratings yet

- Republic of The Philippines) Province of Occidental Mindoro) City/Municipality of Sablayan) S.SDocument2 pagesRepublic of The Philippines) Province of Occidental Mindoro) City/Municipality of Sablayan) S.Sbhem silverioNo ratings yet

- Affidavit of Support and GuaranteeDocument1 pageAffidavit of Support and GuaranteekatjocsonNo ratings yet

- Request Letter For Deactivate Some Banck FacilitiesDocument1 pageRequest Letter For Deactivate Some Banck FacilitiesDileepa Wijerathne0% (1)

- Sample Contract To SellDocument2 pagesSample Contract To SellJM BermudoNo ratings yet

- Cessation of Business OperationDocument2 pagesCessation of Business OperationZsarmaine Lee Prades100% (1)

- Special power attorney pickup NBI clearanceDocument1 pageSpecial power attorney pickup NBI clearanceKarla EspinosaNo ratings yet

- Petition For Reallocation Carlos Gomez Ave PedranoDocument4 pagesPetition For Reallocation Carlos Gomez Ave PedranoCarlo ColumnaNo ratings yet

- Conditional Deed of Sale of Motor VehicleDocument2 pagesConditional Deed of Sale of Motor VehicleMyco MemoNo ratings yet

- ConsentDocument1 pageConsentGn GulanesNo ratings yet

- Proforma Waiver of RightsDocument2 pagesProforma Waiver of Rightsmylannie p minogNo ratings yet

- Sample Affidavit DiscrepancyDocument2 pagesSample Affidavit DiscrepancyFerg100% (1)

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Deed of Absolute SaleDocument2 pagesDeed of Absolute SaleHenna CapaoNo ratings yet

- Affidavit of UndertakingDocument1 pageAffidavit of UndertakingYani DaquisNo ratings yet

- Affidavit and Request For DeletionDocument1 pageAffidavit and Request For DeletionPascual Law OfficeNo ratings yet

- Affidavit - ThumbmarkDocument1 pageAffidavit - ThumbmarkManuel Joseph FrancoNo ratings yet

- BIR - Requirement For Renewal of Accreditation1Document1 pageBIR - Requirement For Renewal of Accreditation1Jem Vadil100% (1)

- FishpondDocument8 pagesFishpondPonching Orioste100% (1)

- SSS CONTRIBUTIONSDocument1 pageSSS CONTRIBUTIONSAnid AzertsedNo ratings yet

- Release Waiver QuitclaimDocument1 pageRelease Waiver QuitclaimJericson GalangaNo ratings yet

- Spa. CarloDocument1 pageSpa. CarlogiovanniNo ratings yet

- Affidavit Financial Capacity Kidney Transplant PhilippinesDocument1 pageAffidavit Financial Capacity Kidney Transplant PhilippinesEsther DilleraNo ratings yet

- Affidavit of Undertaking - Tabastabas 3Document1 pageAffidavit of Undertaking - Tabastabas 3Christian J. V. Cojamco100% (1)

- Affidavit attesting business name changeDocument2 pagesAffidavit attesting business name changePaulo VillarinNo ratings yet

- Declaration of Heirship With SPA To Sell The Property AdjudicatedDocument2 pagesDeclaration of Heirship With SPA To Sell The Property AdjudicatedJoemar CalunaNo ratings yet

- SPA Kaye BIRDocument2 pagesSPA Kaye BIRDales BatoctoyNo ratings yet

- Affidavit of ConsentDocument1 pageAffidavit of ConsentRoger L. Salvania100% (1)

- RMO No. 12-2012Document11 pagesRMO No. 12-2012PatOcampo100% (1)

- Affidavit of Lost Corporate DocumentDocument2 pagesAffidavit of Lost Corporate DocumentRocketLawyerNo ratings yet

- (To Be Obtained On Letter Head Along With Stamp - Proprietary /partnership Firm / Company/ LLP) Wherever ApplicableDocument2 pages(To Be Obtained On Letter Head Along With Stamp - Proprietary /partnership Firm / Company/ LLP) Wherever Applicablevinod financeNo ratings yet

- Sample Computation of Capital Gains Tax On Sale of Real PropertyDocument9 pagesSample Computation of Capital Gains Tax On Sale of Real PropertyNardsdel RiveraNo ratings yet

- Registration Statement for Single Proprietorship Real Estate Development ProjectDocument1 pageRegistration Statement for Single Proprietorship Real Estate Development ProjectAllen HidalgoNo ratings yet

- Pab Ibig EcifDocument1 pagePab Ibig EcifPilgrem Rull0% (1)

- Affidavit of Undertaking-2Document2 pagesAffidavit of Undertaking-2adobopinikpikan60% (5)

- Deed of AssignmentDocument2 pagesDeed of Assignmentjohn godinezNo ratings yet

- Retirement of Business Form-FinalDocument1 pageRetirement of Business Form-Finalfrancis helbert magallanesNo ratings yet

- Secretary's Board Resolution Vghoa - Series 2019Document2 pagesSecretary's Board Resolution Vghoa - Series 2019Janeth Villanueva Montorio WaminalNo ratings yet

- Affidavit of Explanation - MeguroDocument1 pageAffidavit of Explanation - MeguroRL BernaldezNo ratings yet

- CMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Document2 pagesCMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Lariyl de VeraNo ratings yet

- Affidavit of Non-Filing of Income Tax ReturnDocument1 pageAffidavit of Non-Filing of Income Tax ReturnSitelba Recin Eiram-AnaNo ratings yet

- Affidavit of Quitclaim and Waiver of RightsDocument2 pagesAffidavit of Quitclaim and Waiver of RightsMeg Guarin100% (1)

- Mgbform13-Application Form As TraderDocument2 pagesMgbform13-Application Form As Traderhannah aileen fernandez100% (1)

- OUT-OF-TOWN-AFFIDAVIT SampleDocument1 pageOUT-OF-TOWN-AFFIDAVIT SamplecathylopezNo ratings yet

- Affidavit of No ImprovementDocument1 pageAffidavit of No ImprovementBobby VillaniaNo ratings yet

- Sworn Statement For Retired UnemployedDocument1 pageSworn Statement For Retired UnemployedNooroddenNo ratings yet

- Release, Waiver and Quitclaim: Know All Men by These PresentsDocument1 pageRelease, Waiver and Quitclaim: Know All Men by These PresentsPj CuarterosNo ratings yet

- Affidavit of Non-Filing of Income Tax ReturnDocument1 pageAffidavit of Non-Filing of Income Tax ReturnSunshine LumbangNo ratings yet

- Employee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezDocument2 pagesEmployee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezLaurence Erex GomezNo ratings yet

- Waiver For The Non-Submission of Bir2316Document2 pagesWaiver For The Non-Submission of Bir2316lucNo ratings yet