Professional Documents

Culture Documents

NEw TDS Decleration Format

Uploaded by

NITIN PATHAKOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

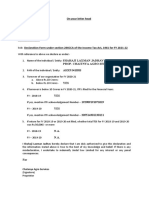

NEw TDS Decleration Format

Uploaded by

NITIN PATHAKCopyright:

Available Formats

Dear Sir/Madam,

I/We ------ and complete address -------, PAN: -------, TAN: ----, referring to the provisions of

206AB of Income-tax Act, 1961(‘the Act’), hereby declare the following to ----------------

(Purchasing Co.)

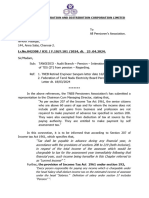

1) That I/We have filed Income-tax return u/s 139 of the Act for the Assessment Year 2019- 200

and Assessment Year 2020-21 or the same will be filed in case due date has not been lapsed.

2) That the aggregate of Tax deducted at Source (‘TDS’) and Tax collected at Source

(‘TCS’) of Assessment Year 2019-20 and Assessment Year 2020-21 has exceeded INR

50,000.

3) That I have linked my PAN with Aadhaar number or will link it before 30 Jun 2021 (or any

further date as may be notified by CBDT)

Note: Above is applicable to all other payments viz. -Section 206AB- notwithstanding anything

contained in any other provisions of this Act, where tax is required to be deducted at source under

the provisions of Chapter XVIIB of the Income Tax Act 1961.

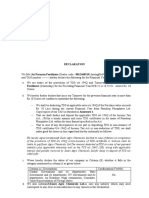

We do here by declare that to the best of my/our knowledge and belief what is stated above is correct,

complete and is truly stated. In case there is tax liability, interest or penal impositions which are

levied by Income Tax Department on account of this representation/ declaration, we

undertake to fully indemnify ------ (Purchasing company) for the same.

Thanks

Name of Authorized Signatory:

Designation:

Signature

You might also like

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- ITR AchkonwledgementDocument2 pagesITR AchkonwledgementdanNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- TDS Declaration Format 194 QDocument1 pageTDS Declaration Format 194 QjayamohanNo ratings yet

- Recent Development of 194QDocument4 pagesRecent Development of 194QnamanojhaNo ratings yet

- How To Deal With 206AADocument5 pagesHow To Deal With 206AAnamanojhaNo ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- Article On Section 194Q and Common Queries TheretoDocument5 pagesArticle On Section 194Q and Common Queries TheretonamanojhaNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- AnnuxureabDocument2 pagesAnnuxureabDeepak MaliNo ratings yet

- Dfletter AllDocument11 pagesDfletter AllelangoNo ratings yet

- Note On Applicability of TDS Under Section 194Q and TCS Under Section 206CDocument15 pagesNote On Applicability of TDS Under Section 194Q and TCS Under Section 206CvamshiNo ratings yet

- Applicable Tax Deduction at Source Tds 2023Document4 pagesApplicable Tax Deduction at Source Tds 2023Hemangi PrabhuNo ratings yet

- Declaration For Customers For Sale of GoodsDocument1 pageDeclaration For Customers For Sale of Goodspramod bathijaNo ratings yet

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- Letter To CustomerDocument3 pagesLetter To CustomerAgri MosaramNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Narayan TdsDocument2 pagesNarayan TdsAgri MosaramNo ratings yet

- Sub.: Circular Regarding Use of Functionality Under Section 206AB and 206CCA of The Income-Tax Act, 1961-RegDocument3 pagesSub.: Circular Regarding Use of Functionality Under Section 206AB and 206CCA of The Income-Tax Act, 1961-RegVsreddy CaNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Draft Confirmation - VendorDocument1 pageDraft Confirmation - VendorMahesh VarmaNo ratings yet

- Declaration FormatDocument2 pagesDeclaration Formatshyam gildaNo ratings yet

- Income Tax Circular No. 17/2014 Dated 10.12.14Document70 pagesIncome Tax Circular No. 17/2014 Dated 10.12.14Elisabeth MuellerNo ratings yet

- Resident Individual Shareholders Valid PanDocument4 pagesResident Individual Shareholders Valid Panharikrishnan176No ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- NSEIT Declaration For Sec 206ABDocument1 pageNSEIT Declaration For Sec 206ABsam franklinNo ratings yet

- Circular 10 - 2022 - 194Q FunctionalityDocument3 pagesCircular 10 - 2022 - 194Q Functionalitylegendry007No ratings yet

- Circular No. 162 - 18 - 2021 - GSTDocument4 pagesCircular No. 162 - 18 - 2021 - GSTRamesh GoddumariNo ratings yet

- 194 Q DeclarationDocument1 page194 Q DeclarationAnkit KapoorNo ratings yet

- b0d9c Reply To 16 4 NoticeDocument7 pagesb0d9c Reply To 16 4 NoticeahemadriandcoNo ratings yet

- Return of Income & AssessmentDocument3 pagesReturn of Income & AssessmentABC 123No ratings yet

- New FORM 15H Applicable PY 2016-17Document2 pagesNew FORM 15H Applicable PY 2016-17addsingh100% (1)

- 31188sm DTL Finalnew-May-Nov14 Cp28Document66 pages31188sm DTL Finalnew-May-Nov14 Cp28gvcNo ratings yet

- Ref: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Document4 pagesRef: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Nikhil JainNo ratings yet

- Dividend IntimationDocument21 pagesDividend IntimationRutuja SNo ratings yet

- Ca. Pathik B. Shah: Value Added Tax Act 2003Document36 pagesCa. Pathik B. Shah: Value Added Tax Act 2003SanjayThakkarNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- Interim-Dividen-2021-22 - TDS-on-dividend-CommunicationDocument4 pagesInterim-Dividen-2021-22 - TDS-on-dividend-CommunicationNimesh PatelNo ratings yet

- Form 15 GDocument2 pagesForm 15 GRahul SahaniNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- Tax Compliance AffidavitDocument1 pageTax Compliance Affidavitluthfi musthofaNo ratings yet

- Annexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersDocument1 pageAnnexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersJhalak JainNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- Tax Compliance AffidavitDocument1 pageTax Compliance Affidavitcesc festNo ratings yet

- Declaration 206AA 206ABDocument2 pagesDeclaration 206AA 206ABskikhtiarNo ratings yet

- Note On TDS - TCS Changes Applicable Wef 01.07.2021Document2 pagesNote On TDS - TCS Changes Applicable Wef 01.07.2021anand trivediNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- TDS Declarartion - 1Document3 pagesTDS Declarartion - 1canamanagrawal11No ratings yet

- Annexure - Format For DeclarationDocument1 pageAnnexure - Format For DeclarationAhmed SaadNo ratings yet

- Circular 17 2020Document4 pagesCircular 17 2020Moneylife FoundationNo ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet