Professional Documents

Culture Documents

Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)

Uploaded by

Mayank ShuklaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)

Uploaded by

Mayank ShuklaCopyright:

Available Formats

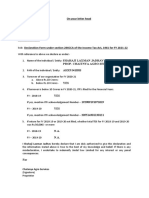

Date:-

DECLARATION

(For Compliance of section 206AB of Income Tax Act 1961)

I Ravada Bharthi proprietor of Hi -Tech Power Systems would like to inform that we have

read and understood the provision of section 206AB of the Act we hereby confirm that;

1) We have / have not filed the income tax return for the below mentioned preceding

Financial Years.

Description Acknowledge No. & Date Remarks YES/NO

Permanent Account AHSPB8357Q YES

Number

Tax Deduction Account NO

Number

ITR Acknowledgement 926065170280819 and date YES

Number and date of filing of filing is 28/08/2019

for FY 2018-19

ITR Acknowledgement 108659420050121 and date YES

Number and date of filing of filing is 05/01/2021

for FY 2019-20

Sale Turnover (2020-21) Greater than Rs 10 Crores No, less than 10 Crores

2) Further, we confirm that we will file the annual Income Tax Return for Financial Year

2020-21 on or before the prescribed due date. In case same is not filed within the

time limit prescribed in section 139(1) od the Act, then we understand it is our

responsibility to intimate Okaya Power Pvt. Ltd. Via email within 15 days from the

expiry of time limit prescribed under section 139(1) of the Act.

Authorised signatory

(With Seal of organisation)

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Jayanata Kumar Hota TDS DECLARATIONDocument1 pageJayanata Kumar Hota TDS DECLARATIONAmit Ranjan SharmaNo ratings yet

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Declaration 206AB and 206CCA For Vendor & CustomerDocument2 pagesDeclaration 206AB and 206CCA For Vendor & CustomerAbhimanyu100% (1)

- NSEIT Declaration For Sec 206ABDocument1 pageNSEIT Declaration For Sec 206ABsam franklinNo ratings yet

- Annexure - Format For DeclarationDocument1 pageAnnexure - Format For DeclarationAhmed SaadNo ratings yet

- ITR AchkonwledgementDocument2 pagesITR AchkonwledgementdanNo ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- A9Rfcwz1g A682zt AqwDocument46 pagesA9Rfcwz1g A682zt AqwSANJAY DUMBRENo ratings yet

- Draft Confirmation - VendorDocument1 pageDraft Confirmation - VendorMahesh VarmaNo ratings yet

- Document Checklist - Sole-ProprietorDocument4 pagesDocument Checklist - Sole-ProprietorKarthik DeshapremiNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- Union GST Audit ReplyDocument2 pagesUnion GST Audit ReplybirmaniNo ratings yet

- Declaration For Customers For Sale of GoodsDocument1 pageDeclaration For Customers For Sale of Goodspramod bathijaNo ratings yet

- Declaration Form For TDSDocument1 pageDeclaration Form For TDSMunna Kumar SinghNo ratings yet

- Form15h GH01389401 PDFDocument3 pagesForm15h GH01389401 PDFNamme KyarakhahaiNo ratings yet

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- Income Tax Payment Challan: PSID #: 47684385Document1 pageIncome Tax Payment Challan: PSID #: 47684385gandapur khanNo ratings yet

- Form12BB FY2122Document3 pagesForm12BB FY2122Anurag pradhanNo ratings yet

- Declaration To SSSSDocument1 pageDeclaration To SSSSedyNo ratings yet

- Annual ReportDocument38 pagesAnnual ReportNeha DenglaNo ratings yet

- Shri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 DocumentDocument8 pagesShri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 Documentbharath289No ratings yet

- Know Your JurisdictionDocument10 pagesKnow Your JurisdictionsamaadhuNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Form PDF 366780401311018Document69 pagesForm PDF 366780401311018rajit kumarNo ratings yet

- PTaxPaymentCertificate '192156969058'Document1 pagePTaxPaymentCertificate '192156969058'skmasudali041No ratings yet

- 10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDODocument2 pages10/05/1979 Guntur Siva Kumari M MEDL/83591 Emp Id:0617221: Name DOB Treasury DDOADNo ratings yet

- Amitsinh Nababha Rana Versus ITO, Ward-1 Morbi - 2022 (8) TMI 188 - ITAT RAJKOTDocument6 pagesAmitsinh Nababha Rana Versus ITO, Ward-1 Morbi - 2022 (8) TMI 188 - ITAT RAJKOTSrichNo ratings yet

- Declaration To Hafele Customers 194QDocument2 pagesDeclaration To Hafele Customers 194QBhavesh PatelNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Income Tax Payment Challan: PSID #: 145879823Document1 pageIncome Tax Payment Challan: PSID #: 145879823farhan aliNo ratings yet

- It 000136606018 2022 00Document1 pageIt 000136606018 2022 00Amazon wall streetNo ratings yet

- It 000126799893 2023 08Document1 pageIt 000126799893 2023 08Anas KhanNo ratings yet

- Form 3CD - Ajesh SoniDocument16 pagesForm 3CD - Ajesh SoniAditya AroraNo ratings yet

- It 000135879998 2023 00Document1 pageIt 000135879998 2023 00Qavi UddinNo ratings yet

- Income Tax Payment Challan: PSID #: 40277624Document1 pageIncome Tax Payment Challan: PSID #: 40277624shoaiba1No ratings yet

- Audit Report Fy 2020 21Document15 pagesAudit Report Fy 2020 21Ankrut VaghasiyaNo ratings yet

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- Ca. Pathik B. Shah: Value Added Tax Act 2003Document36 pagesCa. Pathik B. Shah: Value Added Tax Act 2003SanjayThakkarNo ratings yet

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDocument10 pagesForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuNo ratings yet

- Muhammad Afan Malik-IIDocument1 pageMuhammad Afan Malik-IIBabu AnsariNo ratings yet

- GST and It Ppt. GRP.6Document32 pagesGST and It Ppt. GRP.6BANANI DASNo ratings yet

- Tax Proof Forms PDFDocument1 pageTax Proof Forms PDFAnushyantan NicholasNo ratings yet

- Lic Final Application Form For Empanelment of FirmDocument36 pagesLic Final Application Form For Empanelment of FirmanireethNo ratings yet

- 15/03/1966 East Godavari Janshi Rani Puthineedu MEDL/68694 Emp Id:0202086Document2 pages15/03/1966 East Godavari Janshi Rani Puthineedu MEDL/68694 Emp Id:0202086Siva KumarNo ratings yet

- Income Tax Payment Challan: PSID #: 143186538Document1 pageIncome Tax Payment Challan: PSID #: 143186538talhaNo ratings yet

- 02/08/1980 Sangareddy Dto Vijay Naik R V JUDL/21241 Emp Id:1819158Document2 pages02/08/1980 Sangareddy Dto Vijay Naik R V JUDL/21241 Emp Id:1819158SCJCOURT ZAHEERABADNo ratings yet

- Annexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersDocument1 pageAnnexure 1 With Declaration For Customers of GRIL-To Be Filled by CustomersJhalak JainNo ratings yet

- Muhammad Mehtab Aslam FBR ChallanDocument1 pageMuhammad Mehtab Aslam FBR ChallanKingRafayIINo ratings yet

- FBR FerozabadDocument1 pageFBR Ferozabadferozabad schoolNo ratings yet

- TDS Declaration Format 194 QDocument1 pageTDS Declaration Format 194 QjayamohanNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)