Professional Documents

Culture Documents

Annexure - Format For Declaration

Uploaded by

Ahmed SaadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure - Format For Declaration

Uploaded by

Ahmed SaadCopyright:

Available Formats

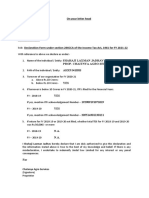

TO : BHARAT PETROLEUM CORPORATION LIMITED

DECLARATION

I/we, the ______________ (Proprietor/Partner/Director) of M/s ____________________________

having Permanent Account Number (PAN) _____________________ hereby declare the

following:

a. I / We are aware of the provisions of TDS and TCS u/s 194Q, 206C(1H), 206AB and

206CCA.

b. My / Our total sales / gross receipts / turnover for the financial year 2020-21 at the PAN

level Exceeds Rs.10 crores. Please tick either “YES” or “NO”:

( YES / NO )

c. If answer to ‘b’ above is “YES”, I / we confirm to timely deposit TDS u/s 194Q with the

government and submit the TDS certificates to BPCL. My / Our TAN* is

_______________________ and copy / copies are attached herewith for verification. (No

need to give TAN if answer to ‘b’ above is “NO”)

d. I / We hereby agree to indemnify BPCL in case of failure on compliance of the provisions of

TDS u/s 194Q or non-issuance of TDS certificate or both, I / We shall be liable to pay BPCL

the TCS u/s 206C (1H), along with applicable interest and penalty incurred by BPCL for

delay in deposit of TCS u/s 206C(1H).

e. I / We give the below declaration with respect to section 206AB / 206CCA:

ITR filed for the financial year 2018-19 Yes/No :

If Yes, mention ITR acknowledgement number

ITR filed for the financial year 2019-20 Yes/No :

If Yes, mention ITR acknowledgement number

Whether total of TDS&TCS of FY 2018-19 was ₹50,000 or more Yes/No :

Whether total of TDS&TCS of FY 2019-20 was ₹50,000 or more Yes/No :

f. I / We also agree to indemnify BPCL in case of any liability which may arise consequent to

any error or non-adherence to any clause in this declaration.

g. I hereby declare that I am duly authorized to submit and sign this declaration.

Yours Faithfully

For Customer’s Name

NAME of Authorised Person

Designation

Sign and Seal

*In case of multiple TANs, please provide only the TAN(s) which you will use for BPCL.

You might also like

- Adm Guidelines Cov 19 LevyDocument12 pagesAdm Guidelines Cov 19 LevyFuaad DodooNo ratings yet

- Kalt Gas Oil Principal Statement Terms and ConditionsDocument2 pagesKalt Gas Oil Principal Statement Terms and ConditionsChandni Singh0% (3)

- Shri Shiddivinayak Tractors - Security AgreementDocument2 pagesShri Shiddivinayak Tractors - Security AgreementshiddivinayakNo ratings yet

- Joint Declaration Under para 26Document1 pageJoint Declaration Under para 26Yashika SalujaNo ratings yet

- A Specimen of A Dealership ContractDocument4 pagesA Specimen of A Dealership ContractAVIP BusinessNo ratings yet

- ABRY Scheme GuidelinesDocument12 pagesABRY Scheme GuidelinesreenaNo ratings yet

- MFAAssessment IDocument10 pagesMFAAssessment IManoj PNo ratings yet

- DT Icai MCQ 3Document5 pagesDT Icai MCQ 3Anshul JainNo ratings yet

- E CircularDocument3 pagesE Circularkethan kumarNo ratings yet

- WPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveDocument29 pagesWPPF and WWF (As Per Labour Law and Rules Amended Upto Sept 2015) Accountants PerspectiveFahim Khan0% (1)

- Practice Test - Financial ManagementDocument6 pagesPractice Test - Financial Managementelongoria278100% (1)

- Bir Ruling 044-10Document4 pagesBir Ruling 044-10Jason CertezaNo ratings yet

- DT MCQs & Case Scenarios Booklet Solutions Yash KhandelwalDocument89 pagesDT MCQs & Case Scenarios Booklet Solutions Yash Khandelwalhtassociates12No ratings yet

- Introduction (2) Accountingtheory ANZDocument6 pagesIntroduction (2) Accountingtheory ANZAakash SharmaNo ratings yet

- MSMS Declaration Cum AgreementDocument1 pageMSMS Declaration Cum Agreementcpbapna44jain100% (1)

- 1a. IR8A (M) - YA 2012 - v1Document1 page1a. IR8A (M) - YA 2012 - v1freepublic9No ratings yet

- On Of: Subject: Review Physical UsageDocument3 pagesOn Of: Subject: Review Physical UsagebhanupalavarapuNo ratings yet

- Leave Rules1Document13 pagesLeave Rules1Bhabani Shankar NaikNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalNo ratings yet

- Section 194C: TDS On ContractDocument5 pagesSection 194C: TDS On ContractwaghuleNo ratings yet

- Wage TypeDocument4 pagesWage TypeFareha RiazNo ratings yet

- MCQS (F. Accounting)Document102 pagesMCQS (F. Accounting)waleedrana786No ratings yet

- Artifact 5 PF Withdrawal Application PDFDocument1 pageArtifact 5 PF Withdrawal Application PDFRamesh BabuNo ratings yet

- Ir8a (M) 2010Document1 pageIr8a (M) 2010gk9f5e6ho1owcldxNo ratings yet

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument12 pagesTest Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionANIL JARWALNo ratings yet

- Sports Management AGREEMENT Made and Entered This - Day ofDocument7 pagesSports Management AGREEMENT Made and Entered This - Day ofNichole John ErnietaNo ratings yet

- Key CH 11 TExt HWprobsDocument3 pagesKey CH 11 TExt HWprobsAshish BhallaNo ratings yet

- Pay Bill GazettedDocument3 pagesPay Bill Gazettedibrahimshahghotki_20No ratings yet

- International Taxation Partial ExamDocument7 pagesInternational Taxation Partial ExamJoan RecasensNo ratings yet

- Beer Duty Return by Keyconsulting UKDocument2 pagesBeer Duty Return by Keyconsulting UKKeyconsulting UKNo ratings yet

- The Citizenship and Immigration Canada's Special Event Code For This Event Is 19PETRDocument2 pagesThe Citizenship and Immigration Canada's Special Event Code For This Event Is 19PETRAmechi OnyenkaNo ratings yet

- Agmt For Overseas TrainingDocument2 pagesAgmt For Overseas TrainingPratik ShahNo ratings yet

- 1702 July 08Document7 pages1702 July 08Jchelle Lustre DeligeroNo ratings yet

- Dsa Invoice - Points To Remember: Don'tsDocument3 pagesDsa Invoice - Points To Remember: Don'tsMadhan Kumar BobbalaNo ratings yet

- Short Fall in Qualifying Service For Pension To Be Taken From GDS ServiceDocument5 pagesShort Fall in Qualifying Service For Pension To Be Taken From GDS ServiceK RAGAVENDRAN67% (3)

- Hra HL DeclarationDocument1 pageHra HL DeclarationShiva PrakashNo ratings yet

- Form of Bank GuaranteeDocument3 pagesForm of Bank Guaranteesherry j thomas100% (1)

- CDAC Contributions - Opt-out-FormDocument1 pageCDAC Contributions - Opt-out-FormDesmond WeeNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- BUS 201 Review For Exam 2Document7 pagesBUS 201 Review For Exam 2Brandilynn WoodsNo ratings yet

- Objective Type Questions and Answers On Central ExciseDocument5 pagesObjective Type Questions and Answers On Central ExciseGayathri Prasad Gayathri0% (2)

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Form A1Document13 pagesForm A1Ben DennisNo ratings yet

- Channel Placement AgreementDocument7 pagesChannel Placement AgreementNDTVNo ratings yet

- DPR FormsDocument16 pagesDPR FormsAdegboyega AdeyemiNo ratings yet

- General Financial Rules 2017 - Chapter 8: Contract ManagementDocument3 pagesGeneral Financial Rules 2017 - Chapter 8: Contract ManagementBijay Keshari100% (1)

- Gar 29Document2 pagesGar 29smvpdy0% (1)

- Pay and AllowancesDocument23 pagesPay and AllowancesRavi KumarNo ratings yet

- MACPS (Modified Oct. 2012)Document86 pagesMACPS (Modified Oct. 2012)Aparajita GhoshNo ratings yet

- Cms OfferDocument7 pagesCms Offerpdp1985yNo ratings yet

- Accounting 202 Notes - David HornungDocument28 pagesAccounting 202 Notes - David HornungAvi Goodstein100% (1)

- Cma-Cgm Container Guarantee FormatDocument1 pageCma-Cgm Container Guarantee Formatelija gwyneth f MartinNo ratings yet

- Marine Proposal FormDocument2 pagesMarine Proposal Formgantasri80% (1)

- DIRECT TAX Finalold p7Document5 pagesDIRECT TAX Finalold p7VIHARI DNo ratings yet

- CS Executive Direct TaxDocument477 pagesCS Executive Direct TaxJanhaviNo ratings yet

- Narayan TdsDocument2 pagesNarayan TdsAgri MosaramNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Income Tax Complaince CertificateDocument1 pageIncome Tax Complaince CertificateUrvashi TikmaniNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- 277-A, Near Gurudwara Sahib, Bakshi Nagar, Jammu Phone:01912950820,9055544447Document1 page277-A, Near Gurudwara Sahib, Bakshi Nagar, Jammu Phone:01912950820,9055544447Ahmed SaadNo ratings yet

- 11 14 2018Document20 pages11 14 2018Ahmed SaadNo ratings yet

- Government of Jammu and Kashmir,: Services Selection Board, Sehkari Bhawan, Panama Chowk, Jammu (WWW - Jkssb.nic - In)Document46 pagesGovernment of Jammu and Kashmir,: Services Selection Board, Sehkari Bhawan, Panama Chowk, Jammu (WWW - Jkssb.nic - In)Ahmed SaadNo ratings yet

- Nfra PDFDocument8 pagesNfra PDFAhmed SaadNo ratings yet

- Power Development Department, J & K Online Payment ReceiptDocument1 pagePower Development Department, J & K Online Payment Receiptabc_1221No ratings yet

- Master Thesis: Improving The City Blueprint Assessment FrameworkDocument102 pagesMaster Thesis: Improving The City Blueprint Assessment FrameworkAhmed SaadNo ratings yet

- 11 14 2018Document20 pages11 14 2018Ahmed SaadNo ratings yet

- UiujkDocument40 pagesUiujkFaerahMazlanNo ratings yet

- Atomic Absorption Spectroscopy Is A Technique Which Studies Absorption ofDocument8 pagesAtomic Absorption Spectroscopy Is A Technique Which Studies Absorption ofAhmed SaadNo ratings yet

- UiujkDocument40 pagesUiujkFaerahMazlanNo ratings yet

- Power Development Department, J & K Online Payment ReceiptDocument1 pagePower Development Department, J & K Online Payment Receiptabc_1221No ratings yet