Professional Documents

Culture Documents

Income Tax Complaince Certificate

Uploaded by

Urvashi Tikmani0 ratings0% found this document useful (0 votes)

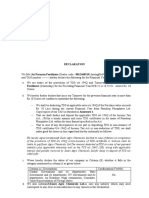

124 views1 pageThis document is a declaration from a vendor for tax deductions under sections 206AB/206AA for the financial year 2021-22. It provides the vendor's permanent account number and details of tax deducted and tax returns filed for the previous two financial years. It also confirms that a similar declaration will be filed once the return for 2020-21 is completed and that the vendor's Aadhar will be linked to their PAN by June 30, 2021 if required by law.

Original Description:

Income Tax Compliance Certificate

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a declaration from a vendor for tax deductions under sections 206AB/206AA for the financial year 2021-22. It provides the vendor's permanent account number and details of tax deducted and tax returns filed for the previous two financial years. It also confirms that a similar declaration will be filed once the return for 2020-21 is completed and that the vendor's Aadhar will be linked to their PAN by June 30, 2021 if required by law.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

124 views1 pageIncome Tax Complaince Certificate

Uploaded by

Urvashi TikmaniThis document is a declaration from a vendor for tax deductions under sections 206AB/206AA for the financial year 2021-22. It provides the vendor's permanent account number and details of tax deducted and tax returns filed for the previous two financial years. It also confirms that a similar declaration will be filed once the return for 2020-21 is completed and that the vendor's Aadhar will be linked to their PAN by June 30, 2021 if required by law.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

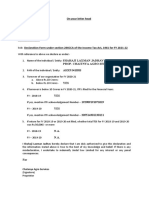

On letterhead of vendors

Declaration for Tax deduction under section 206AB/206AA pertaining to FY 2021-22

Dear Sir/Madam,

In relation to the tax declaration required under Section 206AB/206AA pertaining to the

financial year 2021-22, we submit as under:

Our Permanent Account No. is .

Particulars FY 2018-19(AY 2019-20) FY 2019-20 (AY 2020-21)

Aggregate amount of Yes/No Yes/No

TDS/TCS

deducted/collected

Rs. 50,000 or more

Tax Return Filed Yes/No Yes/No

Date of Filing

Acknowledgement No.

We confirm that we shall furnish the similar declaration for returns filed for FY 2020-21 once

the return for the said period is filed.

I declare and confirm that, if required under law, I have linked / I will be linking (before 30

June 21), Aadhar number with PAN as required under section 139AA(2) read with Rule

114AAA. I/We confirm that the details shared above are correct and accurate and my

organization will be responsible for any error / mis-statement / non-compliance at our end

on the subject.

For .

_____________

Name:

Designation:

Place:

Date:

You might also like

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- Declarartion Us 194QDocument1 pageDeclarartion Us 194QNIKHIL KASATNo ratings yet

- NEw TDS Decleration FormatDocument2 pagesNEw TDS Decleration FormatNITIN PATHAKNo ratings yet

- Date:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Document1 pageDate:-Declaration (For Compliance of Section 206AB of Income Tax Act 1961)Mayank ShuklaNo ratings yet

- Declaration For 206AB 206CCA 4 1 1 2 1 2Document1 pageDeclaration For 206AB 206CCA 4 1 1 2 1 2Khalid ShaikhNo ratings yet

- Babu SinghDocument1 pageBabu SinghRohitNo ratings yet

- 194N Declaration FormDocument2 pages194N Declaration FormShubham MishraNo ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- Tdsincometax (210621)Document3 pagesTdsincometax (210621)Pallavi SharmaNo ratings yet

- Annexure - Format For DeclarationDocument1 pageAnnexure - Format For DeclarationAhmed SaadNo ratings yet

- AnnuxureabDocument2 pagesAnnuxureabDeepak MaliNo ratings yet

- Declaration For Customers For Sale of GoodsDocument1 pageDeclaration For Customers For Sale of Goodspramod bathijaNo ratings yet

- Sec 194 N - Declaration of Filing of Income Tax ReturnDocument2 pagesSec 194 N - Declaration of Filing of Income Tax ReturnSahithyaNo ratings yet

- WD Letter PMITDocument1 pageWD Letter PMITMadhur GuptaNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Declaration FormatDocument2 pagesDeclaration Formatshyam gildaNo ratings yet

- ITR AchkonwledgementDocument2 pagesITR AchkonwledgementdanNo ratings yet

- VENDOR - ID - DECLARATION - FORM ShahiDocument1 pageVENDOR - ID - DECLARATION - FORM ShahiRajnand singhNo ratings yet

- Draft Confirmation - VendorDocument1 pageDraft Confirmation - VendorMahesh VarmaNo ratings yet

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- Information Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Document3 pagesInformation Regarding Net Income and Savings For The Financial Year 2019-20,2020-21,2021-22Mangesh JoshiNo ratings yet

- Qus - Lower TDS DeductionDocument2 pagesQus - Lower TDS Deductionvinus.dhanankarNo ratings yet

- 194 Q DeclarationDocument1 page194 Q DeclarationAnkit KapoorNo ratings yet

- Declaration From Vendor On Letter Head - Under Section 206AB of IT ActDocument1 pageDeclaration From Vendor On Letter Head - Under Section 206AB of IT ActSiddharth shuklaNo ratings yet

- Narayan TdsDocument2 pagesNarayan TdsAgri MosaramNo ratings yet

- Jayanata Kumar Hota TDS DECLARATIONDocument1 pageJayanata Kumar Hota TDS DECLARATIONAmit Ranjan SharmaNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- Letter To CustomerDocument3 pagesLetter To CustomerAgri MosaramNo ratings yet

- Note On TDS - TCS Changes Applicable Wef 01.07.2021Document2 pagesNote On TDS - TCS Changes Applicable Wef 01.07.2021anand trivediNo ratings yet

- Employee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezDocument2 pagesEmployee's Undertaking For Non-Submission of BIR Form 2316 (Year 2022) - Laurence GomezLaurence Erex GomezNo ratings yet

- How To File Indian Income Tax Updated ReturnDocument6 pagesHow To File Indian Income Tax Updated ReturnpragativistaarNo ratings yet

- TDS Declarartion - 1Document3 pagesTDS Declarartion - 1canamanagrawal11No ratings yet

- Ca. Pathik B. Shah: Value Added Tax Act 2003Document36 pagesCa. Pathik B. Shah: Value Added Tax Act 2003SanjayThakkarNo ratings yet

- Atr 14541220Document2 pagesAtr 14541220camurthykarumuriNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Instructions For Filling ITR-1 SAHAJ A.Y. 2020-21 General InstructionsDocument34 pagesInstructions For Filling ITR-1 SAHAJ A.Y. 2020-21 General InstructionsRavindra PoojaryNo ratings yet

- BIR Forms and Deadlines (STRATAXMAN)Document7 pagesBIR Forms and Deadlines (STRATAXMAN)Juday MarquezNo ratings yet

- OLD Income Tax Performa-2021-22Document13 pagesOLD Income Tax Performa-2021-22Research AccountNo ratings yet

- Recent Development of 194QDocument4 pagesRecent Development of 194QnamanojhaNo ratings yet

- Republic of The Philippines: Quezon CityDocument1 pageRepublic of The Philippines: Quezon CityCharina Marie CaduaNo ratings yet

- Tax Declaration Form 2021Document1 pageTax Declaration Form 2021Jessica SantosNo ratings yet

- Instructions ITR3 AY2020 21 V1Document152 pagesInstructions ITR3 AY2020 21 V1Ravindra PoojaryNo ratings yet

- TFW Application Forms NEW - 20210809102815Document5 pagesTFW Application Forms NEW - 20210809102815doney PhilipNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Pawan Yadav0% (2)

- Circular 10 - 2022 - 194Q FunctionalityDocument3 pagesCircular 10 - 2022 - 194Q Functionalitylegendry007No ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet

- Instruction ITR1 Sahaj 2018Document8 pagesInstruction ITR1 Sahaj 2018MadNo ratings yet

- Waiver For Non Submission of BIR For 2316Document1 pageWaiver For Non Submission of BIR For 2316Andrew PanganibanNo ratings yet

- Tax Planning and Compliances Suggested Answers (Exam Nov-Dec, 2020) Question No.1Document17 pagesTax Planning and Compliances Suggested Answers (Exam Nov-Dec, 2020) Question No.1Tariqul IslamNo ratings yet

- PDF 4Document3 pagesPDF 47ola007No ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- Instructions ITR2 AY2020 21 V1Document103 pagesInstructions ITR2 AY2020 21 V1Ravindra PoojaryNo ratings yet

- Irl MsmeDocument1 pageIrl MsmeMAYUR SHARMANo ratings yet

- Irl MsmeDocument1 pageIrl MsmeMAYUR SHARMANo ratings yet

- Circular No 10 2022Document4 pagesCircular No 10 2022Shobhit ShuklaNo ratings yet

- Bir 2316 Submission Waiver 2022Document1 pageBir 2316 Submission Waiver 2022John Jason Narsico AlbrechtNo ratings yet

- How To Deal With 206AADocument5 pagesHow To Deal With 206AAnamanojhaNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet